SPY Gapping up again, New All Time Highs on Deck. How I plan to make 100-300% today

Also, yesterday's 5000% opportunity following the plan I shared. NVDA, TSLA, AAPL price action

Yesterday’s plan was spot on and if you bought and rode into the close provided insane 5000% opportunity! If you haven’t already, please like and share this blog with friends. Let’s grow to 100k+ profitable readers!

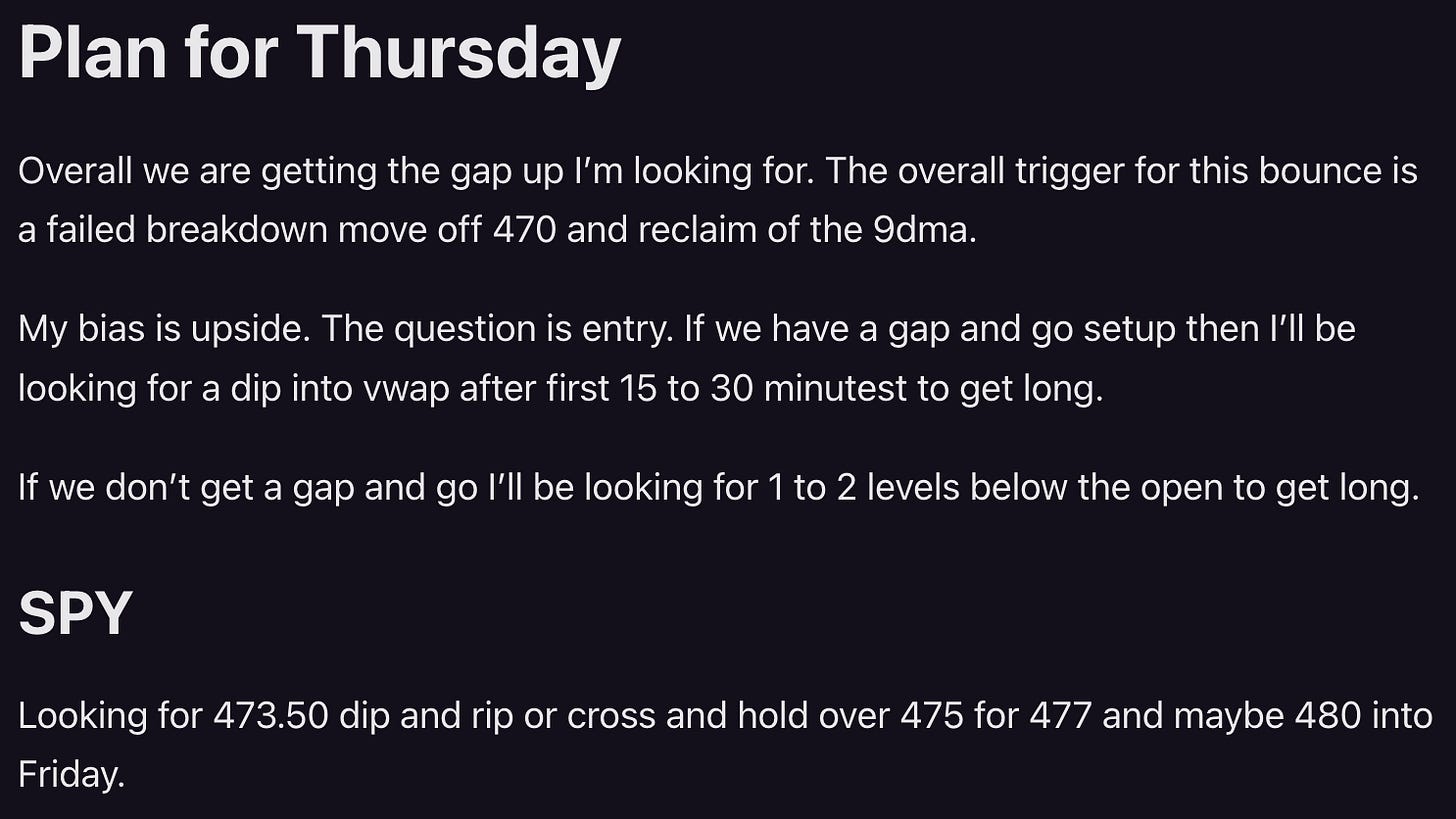

Let’s go over the price action. Overall, we didn’t get the gap and go, so we then target 2 levels below the open which also aligned with a gap fill.

There were 2 trade setups here. The first is to watch for the fail/exhaustion since we didn’t get a strong gap and go move. that happened right at the 475 level. once can target 473.50 and 472.50.

SPX 4750p went from 2-3 at the lower high on the fail to $12+ for a 300% gain move at 472.50 and 200% gain at 473.50.

I didn’t take the short as I wanted to get some sleep/take a nap and be ready for the after lunch move I was expecting.

Unfortunately I woke up late, and that 30 minutes of extra sleep cost me 5x extra gains.

However even then we were able to get 10-15x on the sub vwap entry and 4x on the 475 back test.

SPX 4770c I was trying to fill for 0.20-0.40 for size and took a chase size at $1. Notice how even though the 473.50 level was reclaimed, the acceleration didn’t come until VWAP was crossed.

473.50 reclaim is your indicator for a failed breakdown reversal — THE CONFIRMATION to get long

These ran to $15 when SPY 477 hit. There was no hesitation to exit there when we got that spike as members saw in the chat. I wasn’t trying to get more out of it. I got the planned move I wanted EXACTLY. You will see me do that repeatedly and miss out on extra profits, but I also secure profits regularly.

As we broke over 475 I sold into the $8 spike and told members I wanted to reload at 475 and was targeting $1.80 on the contracts. Well when it hit 475 it was 2.50 and I grabbed some at 2.80.

Ok. So this is round 2 and an entry after the back test. sold 50%-75% at $9 and left the rest for $18. When 477 hit, I changed order to $15 and called it the top and then scalped 4780p from $0.50 to $2 for a fast 300% gain in less than 5 minutes.

Key Takeaways from the price action

The market is in full BTFD still and VERY likely we see new all time highs next week.

Using the levels I update each morning as a guide and the price action to your advantage can yield over 1000% gains in this market and 100-300% with consistency.

Wait for dips into key levels to enter and IT IS OK to scalp short given the range we are getting.

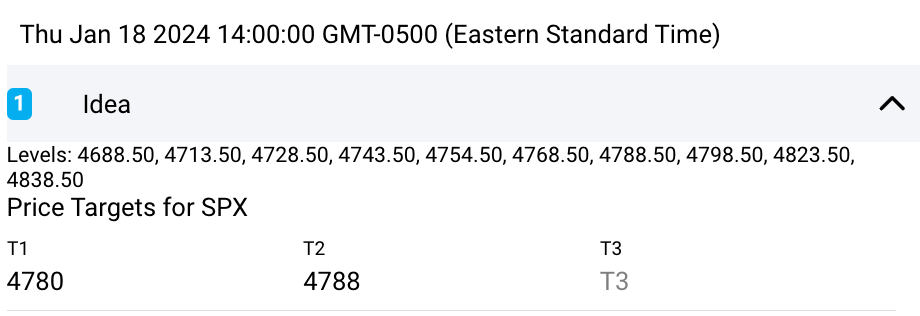

How to use Edge Trade Planner for targeting

So given the big run, I wanted to target 4780-4788. I chose 4780 as it was a round number under 4788 and roughly half way between 4768 and 4788.

I plugged in the targets into Edge around 2pm. And it gave me the following plan.

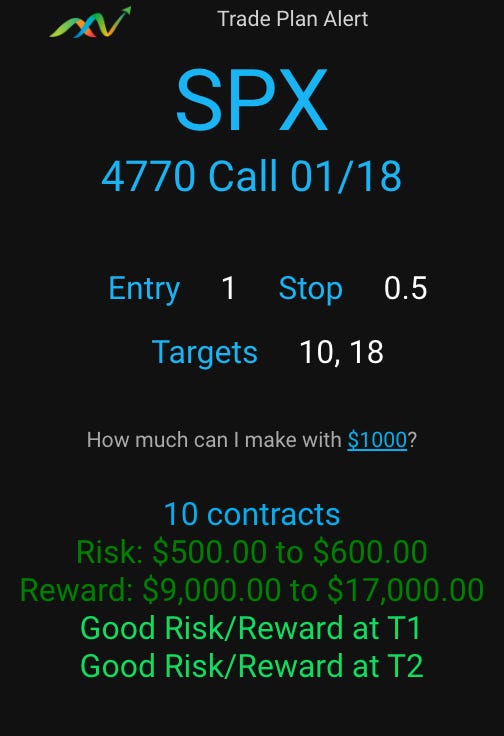

The price was around 0.80 when generated. So I will need to go back and look at the logic and see how to add a “chase” entry plan. I designed Edge based on plan generation is looking for dip/discount buys.

That said we got the $10 target and almost got to $18 (hitting $16).

Not bad to make a judgement call on whether or not to buy at $1. Here is the revised plan after plugging in $1 for entry and $0.50 for the stop.

If you missed out on these gains, don’t fret, there will be more, but read over this blog and review the logic and learn the process.

Want the exact levels and access to Edge Trade Planner, message me and I’ll send you a link.

Price action for other names

NVDA

gave a great dip. I was off on timing, but th 565p gave a great opportunity from $3 to $9 and bounced perfectly off 562.50 level. Now gapping up over 580 this morning.

TSLA

With market ripping near all time highs, TSLA can’t seem to find any love. I took TSLA short betting on 209 coming and that worked. Notice how it could not reclaim 212.50 with market being strong. That tells me there are sellers. dipped into 208 this morning. There is a chance we see 205 or less today. I’m hoping for a dip sub 200 to trigger stops and then scoop long for a swing. WHY IS TSLA not getting bids? Would you buy if the CEO of the company is saying he doesn’t want grow the business in AI/Robots unless he gets 25% stake? until this matter is settled or discount shopping bidders show up, TSLA stock growth is benched

AAPL

Wow! buying the 200d man was spot on. Earlier this week I took 185 calls round 0.50 targeting 190 as a swing. Why? 181 is 200dma, and if bounce we should see a fast move above 185.

Yesterday we got a monster gap up and I told members that AAPL is hold the gap up well. The price action was all bid even with SPY dipping. That is a major clue for why I had confidence of upside coming.

This morning we are gapping up over 190.

Plan for Friday Jan 19

Today is OpEx day and so I have special rules for it.

Trade smaller or skip trading today

Trade for Chop/Reversals

Focus on Credit Selling Trades

DO NOT CHASE the odds are against you.

When wanting to get in immediately place order at 30% discount and size for 100% loss.

Today is much harder get a gauge for what will happen. We have a gap up, we have new all time highs on SPY in striking range and we today as OpEX day after a 100pt run in 3 days. More can come but I’m sure there are a lot of emotions running high on this gap up. Smart money will take advantage of dumb money.

Unless we get a trade setup that is A+ there is no trading for me today. So How do I plan to make 100-300% today? I don’t. I plan to protect my account.

SPY

I’m looking to go short for a gap up reversal play. We are near all time highs. In theory the first test should reject and we get some gap fill. Once that comes, I’ll look for a bounce for a long. Roughly looking at SPY 480.50 and 477 as the key levels.

I am shooting to make 50-150% on contracts today as oppose to normal 100-300%. Why? Because of expected chop.

Remember we just had a huge move with multiple gap ups and back tests over last few days and OpEx days has a history of trapping and burning premium.

I may even take the day off and work on the online courses I’m developing. Leave comments on what you would like to learn.

NVDA

Watching dips to swing 600c for next week. Also will look at scalping short for profit taking after seeing toppy action.

TSLA

If 212.50 reclaims, I’ll consider 215c/220c for next week

If 212.50 rejects, I’ll consider 210p and maybe 207.50p

210p for 0.25 or less and 207.50p for 0.10 or less are entry targets

How do I get the Edge Trader? New to this but you were my favorite on black box!

Thanks for kind compliment! I'm still working on the landing page and content, but you can sign up for THT Pro which will give you access to the Beta version. https://edumomo.com/cart?add-to-cart=27884. If you want to talk before signing up, DM me on twitter. I'd love to hear about your goals and trading experience.