SPY Gapping up after 3 red days. My plan for Tuesday March 26

What to do as a day trader when the moves happen overnight

Good morning traders!

The last few days trading SPY/SPX has required a world of patience. For the last 3 days we have had limited range during the day and have got multi point moves overnight. And that happened again last night with a gap up this morning.

So what is a day trader to do? Do you need to change how you trade, what you trade? You might be asking yourself this. IMHO you don’t. You can consider adding new instruments or processes to take advantage of overnight moves, such as adding futures as a trading vehicle, but you have also have to ask yourself do you want to change your lifestyle, test and develop other trading procedures to figure out your edge?

If your trading process works, and the environment isn’t producing the trades you normally get, you might just need to work on your patience, change your perspective, and/or add additional instruments to day trade.

I assume 20-30% of the trading days of the year are going to be crap and sometimes they come in clusters. How I’ve learned to deal with it is that I know my momo trading techniques work not just on SPY but on any name with volume and range. It’s why I don’t just give you ideas on SPY but also on other stocks. There is almost always opportunity.

Be sure to read the education section today to learn how I planned profited from AMD, NVDA, and SPY yesterday.

As for today, I’ve got 3 ideas that should pay us if they setup.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Mar 22 - LULU 390p Entry $1.25 - High after $5.7 ($1125 → $5700 potential)

Mar 21 - SMCI 1000c Entry $4.80 - High after $22.60 ($480 → $2260 potential)

Mar 21 - SMCI 1000c Entry $4.80 - High after $22.60 ($480 → $2260 potential)

Mar 20 - SPX 4200c Entry $7.50 - High after $27.12 ($750 → $2710 potential)

Mar 19 - SPX 4170c Entry $1.10 - High after $11.30 ($1100 → $11300 potential)

Mar 18 - GOOGL 147p Entry $0.65 - High after $1.71 ($650 → $1700 potential)

*runner reached $2Mar 18 - SMCI 900p Entry $10 - High after $30 ($1000 → $3000 potenital)

*runner reached $60!Mar 14 - SPX 5150c Entry $3 - High after $10.50 ($3000 → $10500 potential)

Mar 12 - SPX 5150c Entry $4 - High after $27.50 ($4000 → $27500 potential)

Mar 11 - SPX 5120c Entry $3 - High after 7.50 ($3000 → $7500 potential)

Mar 8 - SMCI 1150p Entry $5 - High after $56.20 ($500 → $5620 potential)

Mar 8 - AMD 220c Entry $0.50 - High after $7.65 ($500 → $7650 potential)

Mar 7 - SPX 5175c Entry $0.50 - High after $2.40 ($500→ $2400 potential)

Mar 6 - SPX 5120c Entry $3.50 - High after $12+ ($3500→ $12000 potential)

Mar 5 - SPX 5070c Entry $0.50 - High after $10.75 ($500 → $10750 potential)

** alerted 0.30 entry wanted. dipped to 0.40. entered at 0.50Mar 5 - SPX 5070p Entry $1 - High after $13.50 ($1000 → $13500 potential)

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Monday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

Most of the easy money came during first hour or two, but not in SPY. That said we got a banger into the close!

SPY/SPX

Yesterday wanting to trade SPY was frustrating for sure. I followed process and lot twice / broke even because SPY didn’t give follow through. After the first hour we got a failed breakout/lower high and so I went short, but vwap held and so I got stopped.

I really wanted a dumped into 518.70-519 and that is where I wanted to start a swing long. But we didn’t get it. So I decided to leave SPY/SPX alone until last hour and see if something sets up.

I came back at 2:30/3pm to see another setup. I’ve shown how I read the price action. I was frustrated by SPY’s tight range, and I didn’t want to open another trade on it because I thought I was going to lose again. But I did take the trade anyways. So why did I take it? Because I was following process. The setup was there, and the risk/reward had a 10-30x potential payout.

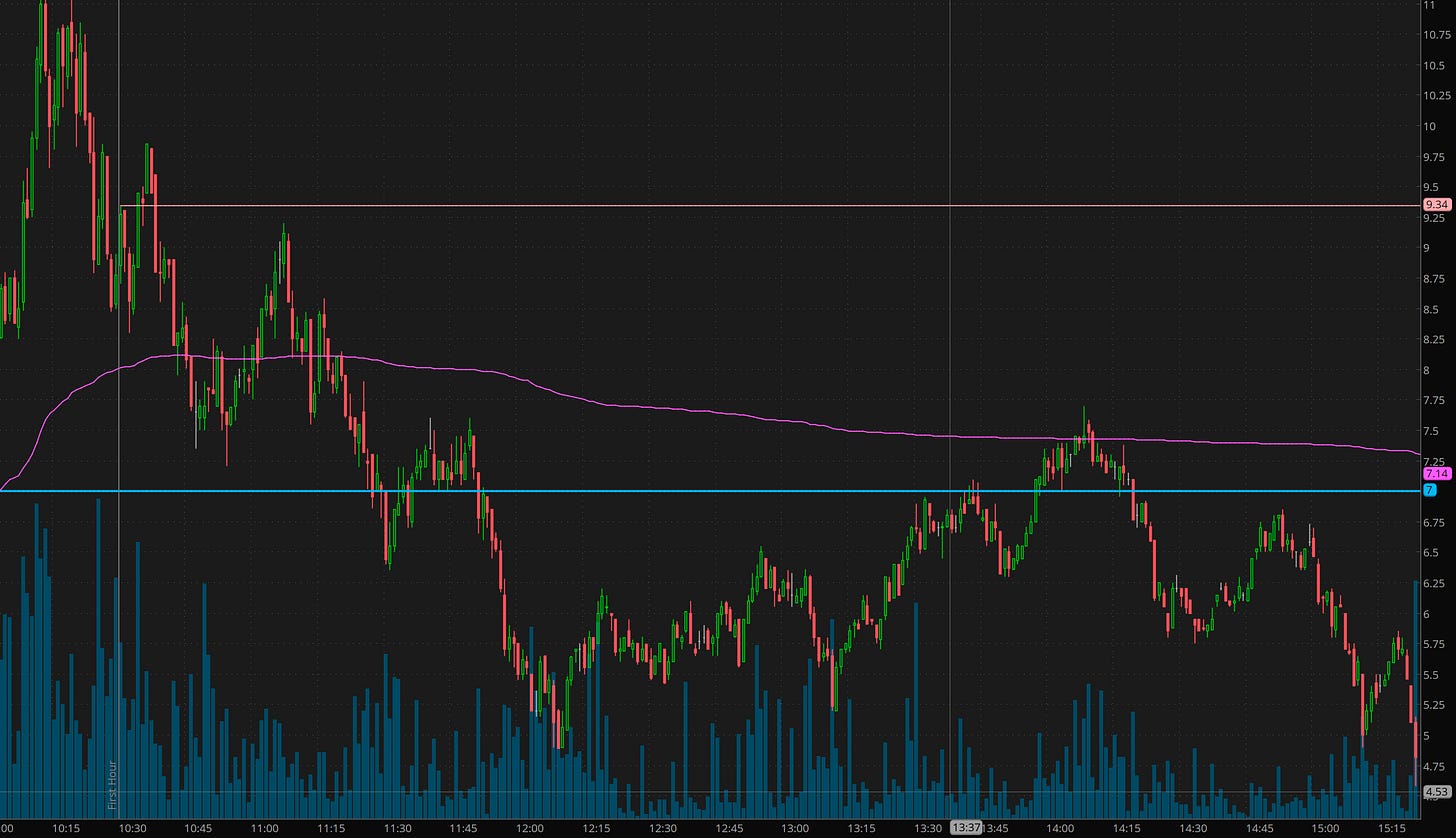

Though I was off on my entry, I took SPX 5220p for 0.50. however I could have filled for 0.20. I had given myself a 0.20 stop, but decided to just let it play out plus I had profits from credit sells to pay for the risk.

I was targeting $5-15 for the exit. We hit a a high of $4! Following take profit rules I set orders to lock some in at $2, $4, $5, $10. The contracts closed at $1.78.

Though SPY didn’t give the range I wanted, I still made over 4x!. This is asymmetrical trading risk/reward betting and why it is important to stick to process.

One final note on SPY / SPX. After recognizing the tight range and being convinced that a dip was coming I also did a credit sell trade. I alerted

And sure enough this was headache free and when to 0 by end of day. I also alerted I was adding more size to the bear calls at 1.20 when I started hawking for the dump during last hour.

Overall not a bad day trading day on SPY!

The key is to arm yourself with multiple techniques to take advantage of the environment. Tight consolidation day? Consider credit sells, strong trend, use the levels, look for a retracement, and take OTM calls or puts.

AMD

The china news and gap down was a gift. Yesterday I wrote I wanted a dip and rip off 172.50. And that is exactly what we got.

The AI story hasn’t changed. Every Dip Buy range I’ve provided on AI names has been right and this was no different!

Quick Recap:

SMCI 1070 high - buy on dip to 700-750

SMCI 1224 high - buy on dip to 850-900

AMD 226 high - buy on dip to 170-172.50, (but there is a room for a dip to 160)

I alerted I was taking 177.50c. I didn’t generate a plan as I wanted to let people know as fast I could.

I then shared that my plan was to sell 50% at $5 and ride the rest. I ended up sizing down to 10% after it 182. Essentially a free swing trade now.

So this trade matches one of my core setups. The GAP Reversal. It has a 78% win rate.

Entry Signals:

172.50 reversal candle and push over 173.50, target 2 levels above 175

Backtest of vwap and 9:45am and cross of 175, target 2 levels above

Swing entry, look for vwap after lunch.

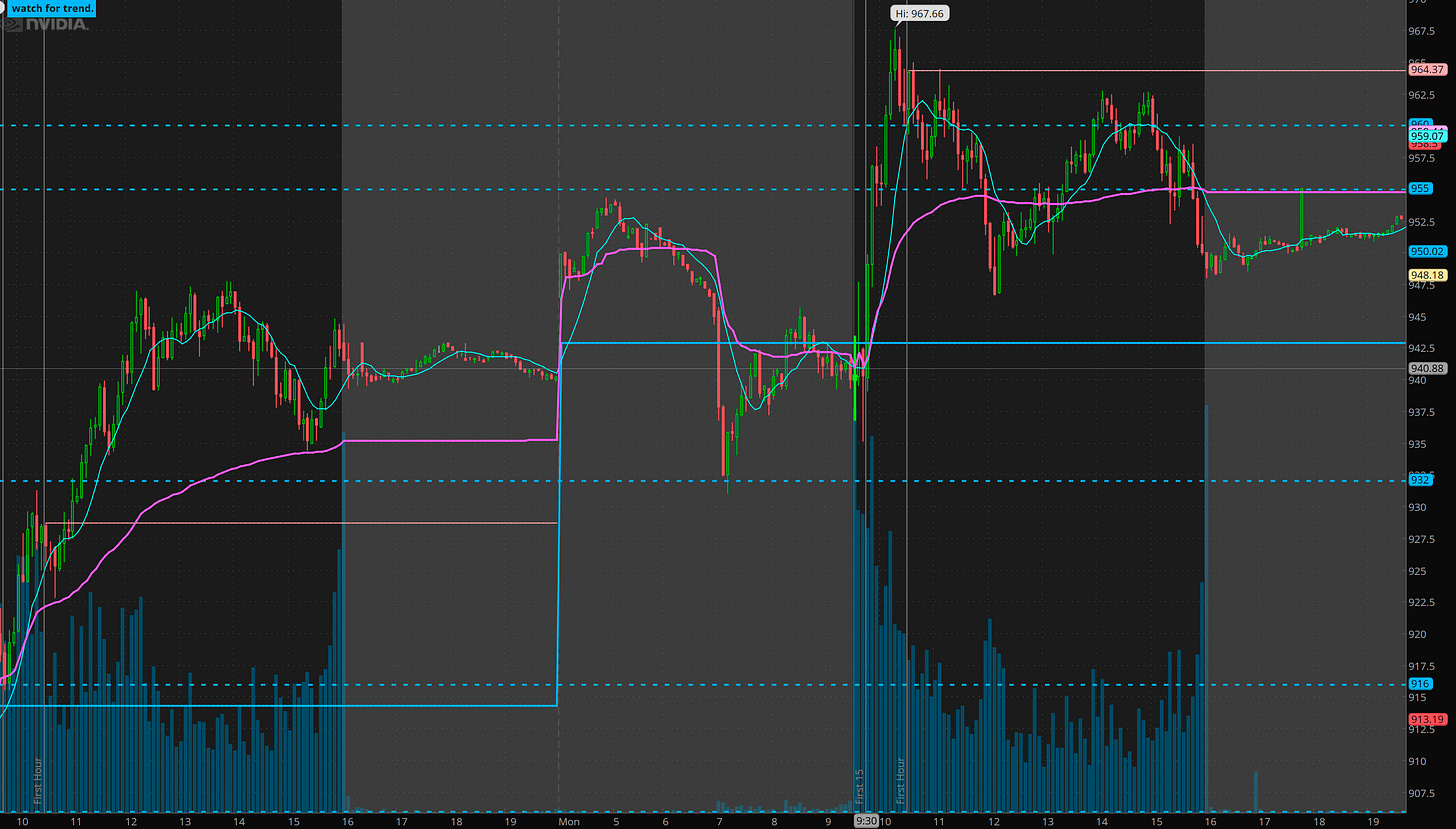

NVDA

I missed the breakout in morning so I had to wait. This time I chose to wait for 947 instead of vwap for a long because it had a big move over last 2 days.

How did I identify 947? Look left. That was the previous day’s triple top and also the open range high for the morning.

This gave a nice $5 entry 0.50 risk for a 5R gain at 7.50/vwap. or 50% on face value.

Summary Review of Market Price Action

Overall nice consolidation over last 2 days with red day dips, In theory this should lead to a green day today and tomorrow as long as SPY lows from yesterday hold.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

Use triple tops to define an intermediate level if a key level isn’t reached.

Be patient. Let trades come to your entry prices (i had to wait over an hour to get filled)

Use /plan in Edge Trade Planner to quickly create trade plans.

Learn how to recognize failed breakout reversals at key levels.

Use credit sells when SPY doesn’t provide range

Trade Ideas - Plan for Tuesday Mar 26

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

I’m not seeing much in the way of news for obvious trades. Overall, I’m looking to join trend today operating under the assumption we do get a trend to develop. Given the gap ups I will need to wait for dips / support for entry.

I’m hawking watching AAPL, NVDA, SPY, and TSLA for trades

BONUS: DJT