SPY dumps after PPI numbers today. Will the dip get bought or will bears take control? Trade Ideas for Thu Aug 14

Wow! Perfect gap fill short and then go long from yesterday's blog! SPY followed it to the letter!

Good morning!

Yesterday I wrote… “I like 632.50 to 633 for a long on SPY”. I also wanted an ideal short from over 645 What happened? SPY ran past 645.60 and then created a failed breakout reversal and then faded to 633!

It today’s blog Im going to teach you how I read the price action to take that short and where to get long from 633!

SPY/SPX

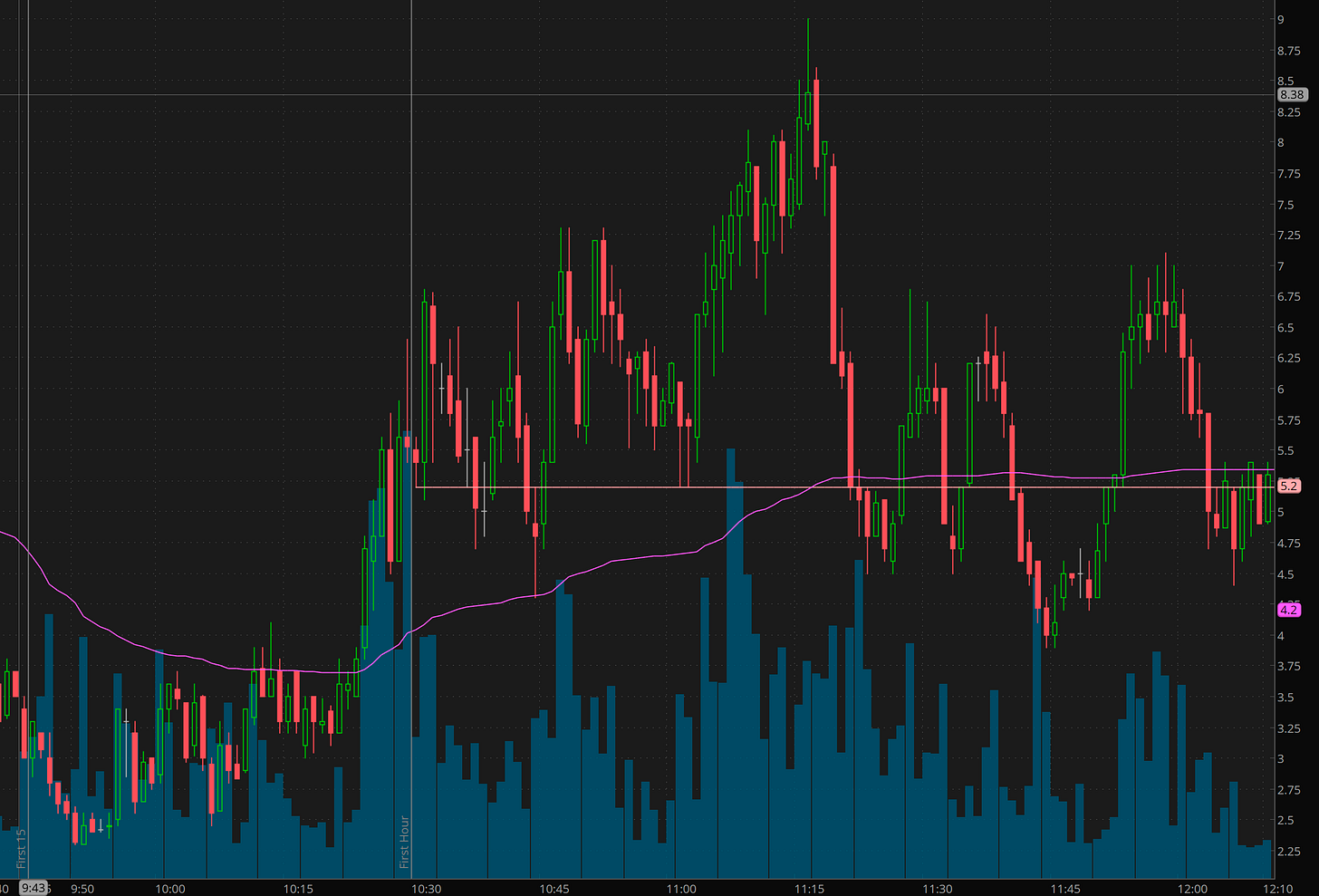

Morning Setup: Failed breakout Reversal on 2 level gap up!

Notice the weakness signal… and then the back test of the 645.60 level and reject, then the vwap break… That was the IDEAL pattern.

Then scale up short.

Here is what the SPX 6450p did.

Entry from $3-4 with size and peaked at 9. High probability trade!

I great thing is no one in the THT PRO group took a short and fought the trend!

Unfortunately unless one neiled the 2.50 entry it was only a 100-200% payer. That is the “sad” part of the moves that happen before 11am that only do 2 levels.

I got spoiled with 500% gainers. But after spending some time with a friend who makes between 300-500k a month it changed my perspective. It’s all about consistency. vs the big score. That is why many of you see me take 70-80% off at 100-300% gains depending on the trade.

More on his philosophy another time.

Afternoon Setup: SPY 643 long after higher low

In the afternoon I wanted to see 643 tested and then a higher low to come, I then saw it but missed the entry and decided to not chase it. My idea was perfectly right, but botched the execution. I want 6455c for 1-1.50 unfortunately it only dipped to 2.05 and then ran to 13 by end of day.

Here is how I read the price action.

After the double bottom, given the recent action, I expected a pop and one more did to come. and it did exactly that… why did I expect that? because of the recent chop.

Here is what the SPX 6455c did!

There is massive opportunity in this market. Are you taking advantage? Literally have planned and alerted trades that pay over 300-1000%! You will need patience to wait for entries and the exits. But if you have self discipline or trust bracket orders, my process can help you get the results you want.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education

How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows or failed breakdown reversal at key level

Join at VWAP mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Securing Profits on Options overnight

Sometimes you get this massive paper gains overnight on options but you can’t secure it right? Well if you have a big enough account and a margin account if you have calls you can. What you need to do is buy or sell the stock overnight. and the option turns into a hedge against that position essentially securing your profits.

Trade Ideas - Plan for Thu Aug 14

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

PPI numbers were bad. But this market is relentless. Will we continue the dump started in premarket is the question.

Here is what I’m looking for.