SPY continues to trade in a tight range, How to Profit when the market goes nowhere, and my plan for Tuesday Nov 28

Being systematic is essential

For those that have traded with me over the years, you may have seen a shift in my trading. I started off wanting to catch every move, and as my trading matured it has moved toward being much more systematic and looking for much fewer trades. I’ve also added credit selling to my tool kit to address the issue of when markets don’t trend on a day.

Let’s get in to yesterday’s price action and trades.

I suggested for a swing trade last week when it was sub $106. It’s now 120+. I’ll be watching how btc moves , but overall I’m looking to sell / lock in profits on a gap up reversal/spike day. Today could be that day. In theory the daily appears to show a rally into 130 to 150 in coming weeks as being very possible. Yesterday, COIN broke over 116.50, a multi-month resistance level. Let’s see if this continues or fails.

Yesterday we took the 120c for $2 to 2.50 and it hit 5.10. Also loaded up on the dip back into $3 after it tagged $4. Let’s see if I get my $7-10 sell targets this week.

I was prepared for yesterday to be chop or range bound and into the double bottom. We did a credit sell on SPX 4545/4540 at 0.80 and added at 1.60 which bled to 0. We have had a 100% win rate on the credit sells since I started sharing at the beginning of the month! I’ll start tracking a posting those here in the blog.

In the afternoon after i saw the failed breakout I alerted SPX 4555 puts around $2. These spiked to 8.50!!!

How to profit from consolidation days?

I’ve discovered that once one realizes the day could be without strong trend, I like to do credit selling. As long as we close above or below the credit sell level, I win. Sometimes it can get scary or wonky. The overall key is nailing the entry on a momentum spike and using the levels as a your guide.

I didn’t alert this, but I did also take a credit sell on SPX 4560/4565c on the spike in the afternoon/failed breakout. Let me show you the trade

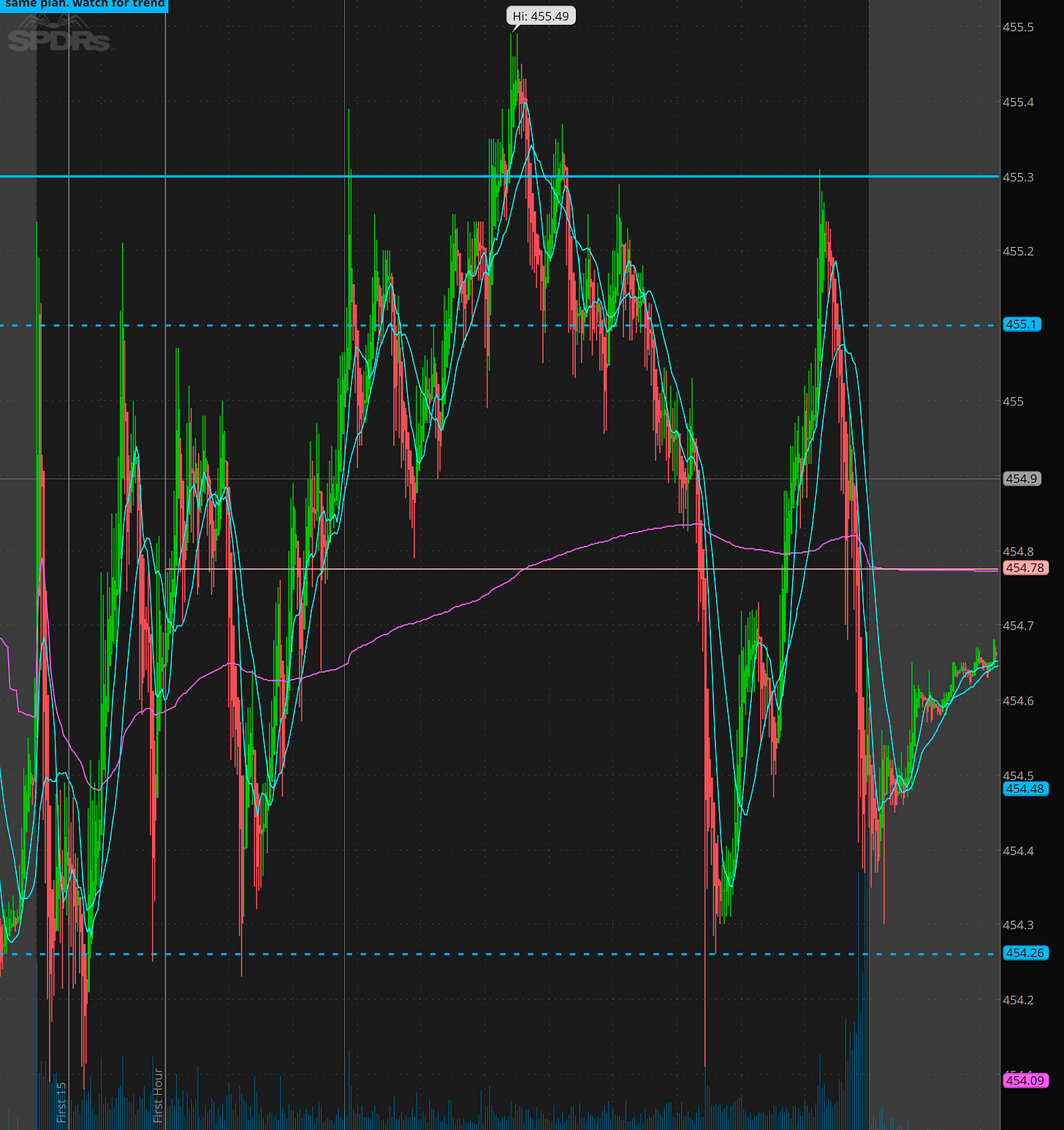

Here you can see how SPX cossed the solid blue line and failed, and then back tested it and failed around 4559.34.

Look at how how the value decayed after that push and fail into the close. Entering after the spike and after the backtest around 2.50 to 3 gave a stress free trade.

One could also take have taken SPX 4560p but look at the difference.

The puts would have gotten stopped if you held into close. However they also did spike to $12. But you had to nail/guess where to sell.

So there are definitely pros and cons to both methods.

One additional key point, Another aspect of making profit in range bound action is to wait for after 1 or 2pm. Let the contracts bleed out and let a level be tested to give you an entry and then set your stops and take profit orders and walk away. Either it works or it doesnt. Dont get caught up looking at the choppy candles.

Plan for Nov 28

Overall Yesterday was first red day. I’m looking for today to developing into more selling. Its about sticking to process. last 2 first red days in November DID NOT develop into follow through selling on day 2. But being systematic is crucial. So I will focus on getting short again for a day 2 sell off to develop. If it works great. If it doesn’t great as well. The key point is building and following a repeatable system in trading. I know I might lose 2 or 3 times in a row, but the winning trade will easily cover the losses by a far margin.

Ideally get a back test into SPY 454.50 and fail/flush into 448 to 451 ahead of PCE and jobs numbers on Thursday. Basically profit taking/derisking ahead of news.

If we flush into 448 to 451, today or tomorrow, I’ll consider scooping long.

To subscribe to alerts and trade plans be sure to DM me on twitter. or send me a comment here.