SPY closes at new high. Was the short program invalidated or is it positioning ahead of FOMC? My plan for Wed March 20

Will FOMC today support or break the market rally?

Good morning traders.

If you aren’t part of the live alerts and commentary, consider joining THT PRO. Yesterday was a bit of a challenge considering I got the chose SMCI for a rally vs NVDA. I also missed the long entry on SPY off 411.30 by being overly focused on SMCI. That said, I left for lunch and told members I’ll be back during last hour for a possible 10 bagger setup, and sure enough we got it.

That is what is so important — Being process focused. Being wrong but instead of losing It was ok for me to more or less been flat after morning trades and then having a trade end of day go ballistic.

With SPY closing at highs and FOMC today coming the big question is how will market reaction to JP’s comments. I suggest waiting until 2:30 before considering joining a trend. FOMC action can be wild and trappy and many people get wrecked. so be careful on sizing and consider letting the traps happen and then get in on a trend for the close.

Let’s get into yesterday’s trades and my plan for Wednesday. I’m booked on a flight at noon and wifi on the plane isn’t definite so I’m planning to miss FOMC action.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Mar 19 - SPX 4170c Entry $1.10 - High after $11.30 ($1100 → $11300 potential)

Mar 18 - GOOGL 147p Entry $0.65 - High after $1.71 ($650 → $1700 potential)

*runner reached $2Mar 18 - SMCI 900p Entry $10 - High after $30 ($1000 → $3000 potenital)

*runner reached $60!Mar 14 - SPX 5150c Entry $3 - High after $10.50 ($3000 → $10500 potential)

Mar 12 - SPX 5150c Entry $4 - High after $27.50 ($4000 → $27500 potential)

Mar 11 - SPX 5120c Entry $3 - High after 7.50 ($3000 → $7500 potential)

Mar 8 - SMCI 1150p Entry $5 - High after $56.20 ($500 → $5620 potential)

Mar 8 - AMD 220c Entry $0.50 - High after $7.65 ($500 → $7650 potential)

Mar 7 - SPX 5175c Entry $0.50 - High after $2.40 ($500→ $2400 potential)

Mar 6 - SPX 5120c Entry $3.50 - High after $12+ ($3500→ $12000 potential)

Mar 5 - SPX 5070c Entry $0.50 - High after $10.75 ($500 → $10750 potential)

** alerted 0.30 entry wanted. dipped to 0.40. entered at 0.50Mar 5 - SPX 5070p Entry $1 - High after $13.50 ($1000 → $13500 potential)

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

Overall my ideas the ideas I wrote about yesterday didn’t play out at all. Unfortunately not having power/internet made it difficult to give good ideas. NVDA was close but I was off. on 875 break we got a 25pt drop but not the 35-55 I was looking for.

That said if you pay attention to the lessons I share here and how I read price action, you can still use the levels to make bank, even without my alerts.

SPY/SPX

There is a lot that happened with SPY yesterday.

Once the first hour range was established, members asked if the SPY bull plan that was shared was still valid. I had said as long as 511.30 holds, it is. You can see how we had an openning range break and a move past 512. The next would be to target a 1 to 2 level move up, that would make 513.50 and 516.50 the targets. As you can see those levels were met.

I was so focused on SMCI/NVDA I missed this trade, but RJ nailed it and all hit targets were met. Great risk/reward!

If using the SPX levels from watchlist, SPX 5160c targeting 5168 would be the way to go. Entering on 512 breakout on SPY would give a $2 entry with a $1 stops. When SPX reach 5168, the 5160c hit $12. That is $10 gain on $1 risk! Though I missed it, I want you to learn how to plan these trades so if I don’t alert it you can bank on it!.

During the last hour I was watching the price action closely. I was in puts but the problem was the puts weren’t gaining much value as it moved lower.

Review my comments on the chart to see how I traded it. The key is in recognizing the reversals. I alerted the SPX 5170c for 1.10. These hit 11.30 into the close. How do you like 1000% in less than 30minutes? Forecasted, planned, and delivered!

NVDA

So I got short on the opening push fail, taking 820p, The contract popped $2-3 and then started to fail so I exited. NVDA almost reached the 847 target level, but it quickly bounced at the 15minute mark. One more attempt short came into plan on the double top rejection of vwap, but there wasn’t follow through after 10:30 am. In fact that turned into support. At that point I went long on SMCI which turned into a nightmare of consolidation with the 1100c contracts bouncing between 6 and 10 all day. If I took NVDA 920c instead these went from $5-6 to $14. That would have been a bunch better trade.

The mistake I made was not checking SMCI’s contract IV of almost 100%. that could imply a need for a huge move and without large moves decay on contracts will be a big negative factor.

Summary Review of Market Price Action

After a few sell days NVDA and SMCI essentially based and may have put into a new bottom. SPY ripped into the close squeezing the heavy shorts anticipating negative news/reaction from FOMC.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

How to target which contracts on a Monday

Be patient. Let trades come to you. Make it OK to take only 1 trade a day.

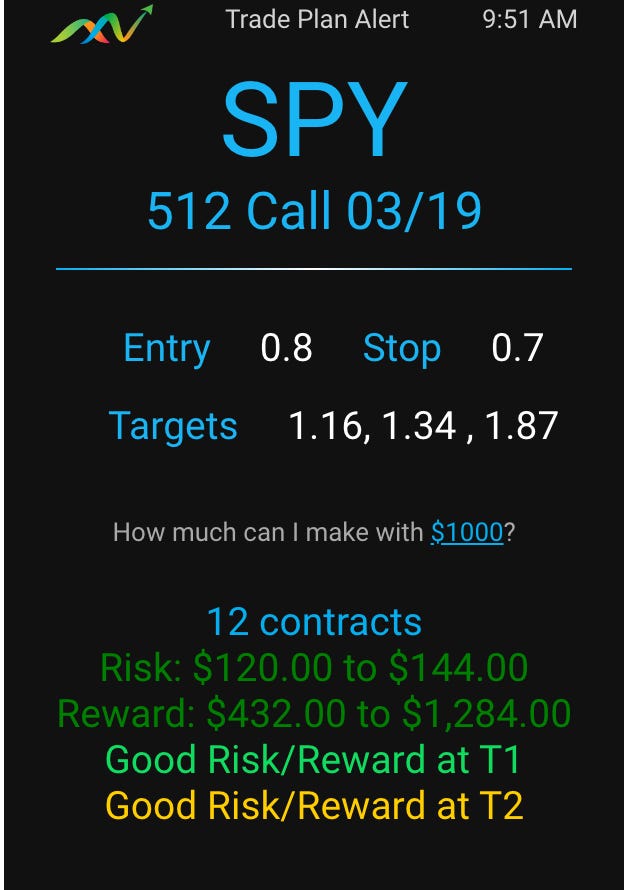

Use /plan in Edge Trade Planner to quickly create trade plans.

Learn how to recognize failed breakdown reversals at key levels.

Trade Ideas - Plan for Wed Mar 20

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Yesterday’s rally seems to have priced in the expected negative news from FOMC today. In theory, after 2 weeks of selling do we return to the grind?

Watch your size today, it could be choppy or we could trend ahead of FOMC at 2pm.