SPY breaks 582 again overnight leading to 573 as predicted on May 19. Where will market go next? Trade Ideas for Fri May 23

Will SPY hold 573 and bounce? Will BTFD regime activate?

SPY / SPX

Let’s get the big picture idea out of the way and then talk about yesterday. On Monday I wrote the following:

This morning SPY broke 582 again and dump to 573! Triggered by Trumps speech but the play started setting up last week!

Idea: SPX 5750/5600p $10 target $40-100

Trigger: reject 595 on Friday and expected 596 failure.

You can see how we had low volume pushes higher on overnight weakness. The with the Bond auction triggering selling on Wed. Thursday was about backtesting the support break, and then Trump triggered the break in premarket like a jerk! The swing paid, but I didn’t get the trade I wanted on 0DTE with size.

Plan is to take profit on 80% today and leave the rest a free trade with stops at $20. If 573 breaks then 565 should come.

Yesterday….

I wanted to see what happened overnight happen yesterday and the market punished me and chopped me. I had to wait until the last hour to get the next setup.

Lost 30% on the trade. Don’t recall the numbers.

So then I had to wait….

Next trade Idea…

Idea: SPX 5850p $0.9 target $6-16. (target 582-583)

Trigger: Failed breakout, back test reject confirmation

I saw the reject and volume on 5870p, but I hadn’t done the math yet. IT rapidly hit 3-4 and I wasn’t sure yet if the dump was coming. so I ended reframing to 5850.

These dipped at low as 0.50 and hit $12!!! nice 10 bagger in 15 minutes. Spectre Special Delivered!

What I could have done better. Preplanned the math on 5870p with a 5844 target. Anything under $2.50 would have been a great risk reward and under $5 a good risk/reward.

CRWV monster rally

I was looking for 119 for the short entry. Unfortunately i didn’t devote much energy to this. I had placed an order for 105p for 0.50 but it only dipped to 1.75 given the high iv.

Right idea, poor execution.

What I could have done better. Paid attention to the backtest reject and entered 95p for 0.50. These hit over $2 end of day and probably 3+ this morning.

Guys, even though I missed this trade. notice how I am reviewing and looking for insights for improvement in execution. This is what you need to make as a habit day in day out.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education

How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows or failed breakdown reversal at key level

Join at VWAP mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Trade Ideas - Plan for Fri May 23

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Overnight:

SPY broke 582 and flushed to 573s

CRWV dumped close to 95 target

AAPL dipped to 194. (second punch… OpenAI has hired Johnny Ives)

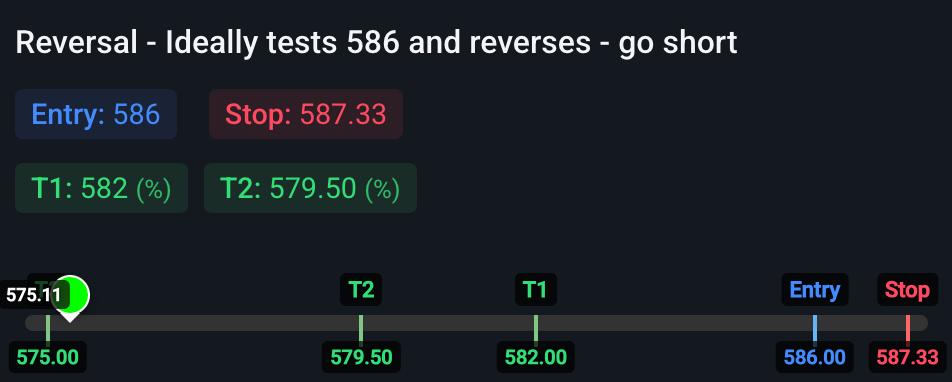

Here is the billion dollar question. Does market consolidation today, break 573 for another leg down, or make a bounce attempt to fill the gap. Is this the 200dma backtest I was looking for before more highs come? Will fear take over and we get another leg of selling?