SPY blows away OpEx Credit Sellers on Friday. More highs or profit taking?

I was wrong on SPY but still got 100%+ gains on it and 300% on TSLA and 200%+ on COIN. Keep reading to learn how and why!

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading. Additionally, you will have access to the top scanner results for ideas in Edge Trade Planner, a powerful tool to enhance your trading decisions.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day with a goal of earning 100-300% on the capital I risk. A few key benefits of limited-effort trading:

Higher Quality trades with better reward/risk

Avoiding Overtrading and losses from it

Not selling too soon

(more info to come later)

Friday’s Price Action

SPY Rips OpEx Credit Sellers a New One!

Last OpEx I recall chop city and selling credit was the way to go. This time selling bull puts was sound, but also buying directional could have paid over 2000%. I totally missed it and am find with it because I didn’t want to take the risk, and the trade developed outside of my key timeframes. I value being consistent and systematic over catching very trade with size.

That said, we took SPX 4800c for $5 which ran to 40+. However I sold at 8-10 on round one off the morning move. And then decided to wait for after lunch to look for another trade on it.

My algo signaled bull puts on 4795/4800p would payout and it sure enough did. That was good enough for me. It does annoy me that it started the run and breakout around 12:30 but I was away from desk and couldn’t analyze. Also one can see the failed breakout around 11am. So I wanted to be more careful being too bullish and sided OpEx chop could be in the works.

Hopefully I’ll have the mobile analysis tools done and ready in edge in the next month or two. They key point is, I’m happy to miss the breakout and move because 9/10 times lunch can be traps and chop. Basically I’ve lost more from trying to participate in that hour than I’ve made. So its a numbers game. I skip/avoid. Now if market behavior changes I start seeing moves initiate during lunch 4/5 days, then I will adjust my trade timing. But until then I generally try to avoid opening new trades to join trend between 11:45 and 1pm.

Overall the price action destroyed any call sellers and SPY broke out and ran to new highs reaching exactly the levels and targets I was looking for.

You can see how the levels were respected for both where to buy and where to target. 477 to 482 for a 5pt range move!

After 1pm, given the levels and the range, I determined that the risk/reward wasn’t there to get long so I started to hawk for a short, but the options pricing didn’t align to make it make sense. I’m super proud of avoiding overtrading/getting into that chop!

We are at a pivotal spot now, today/tomorrow should define if we get a failed breakout or if we back test and then continue higher toward my 495 target I talked about in December.

COIN

So. I was worried about OpEx on SPY. Guess what I wasn’t worried about? The short in COIN as well as the possible gap down reversal play on it.

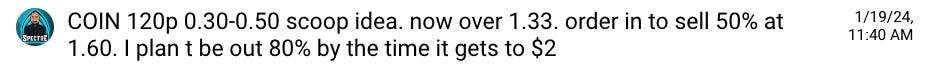

I had confidence in the short on COIN because it broke 127 AND bitcoin broke 42k. Early Friday morning I alerted members that I wanted to fill 120p for 0.30-0.50 when it was around $1. And if 117 broke we could see 112-113 for possible exits as high as 8.

But wait, I just said 8 why am I selling 80% at $2? because I also remembered that 118-119 area was where COIN violently reversed when it was on it’s grind up. 120 is also 65 point drop. so if I can sell 180p from 0.5 at $2. that is a 300% gain!

Here is what the 120p contracts did. Dipped to 0.35 and hit $2.45! Great planning.

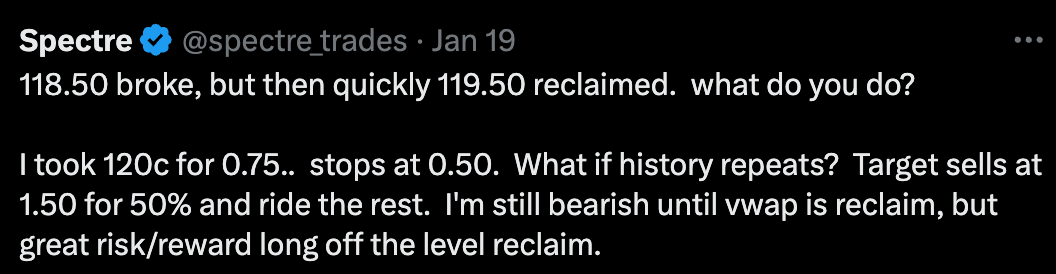

Now here is the kicker. I shared on twitter that I was going to go long…. What!!! WHY?

Failed breakdown reversal and I knew there was a decent chance of shorts getting trapped.

So you see that blue line at 118.74. and how 119 turned into support… That is where I mentally planned if we go over 119.50 I have to get long and plan for 125-130 to come.

I was able to scoop the 120c for 0.75 with 0.50 as the stop. with 0.25 risk, almost $3+ of gains. that is over 10R!!! (10 times reward vs the risk). But being systematic. started locking in gains at $2 for 5R. This trade also made more than satisfied and didn’t feel the need to force a trade in SPY after 1pm.

Notice how, even though I’m emotionally bearish, systematically, I had to go long. The risk/reward was too good.

As for where does COIN go from here, I think it will depend on if bitcoin breaks under 40k. The next catalyst is the bitcoin halving in April, and volume has dried up. so it can go either way.

TSLA

The magnificent stocks are at highs or near highs except for TSLA. I took it long following process on a move over 212.50 and got stopped for small loss. Was able to flip short after for 100%+ gainer.

We then planned a trade in afternoon on 212.50c. for 0.20. It dipped and gave us the perfect fill and then started to run. I was feeling ballsy after all the other wins, so I decided to risk 10% of profits on the day and added a bunch at 0.50. Was looking great as it pushed over 0.60 and I raised my stops. Minutes later TSLA dumped and I got stopped. I was feeling vengeful, very vengeful which is when it became time to call it a day and enjoy the gains.

Overall if TSLA can get over 212.50 and reclaim 217, it may begin a grind back toward 250-260. My bias is that it will be net sideways for awhile.

Summary Review of Market Price Action

Bottomline things are looking very bullish, and laggards might be the way to go this week, unless the breakout turns into a failed breakout. I’d like to see a back test of the breakout to confirm/validate but there could be a chance of another gap and go day it act like the breakout we had at 450.

Educational Lessons

From the price action review you should have learned the following:

Don’t have to catch every trade

Making 3 100%+ trades is spectacular so who cares about what was missed

Don’t measure success by how much you made, but by how well you executed to your plan. Were you able to plan profitable trades?

Failed break down reversal at major levels WORKS! Learn it, trust it, bet on it! Even when emotionally you don’t agree with it.

You don’t need to trade all day. Most of the trades involved positioning between 10:00 and 12:00 and then doing nothing more. Use bracket orders.

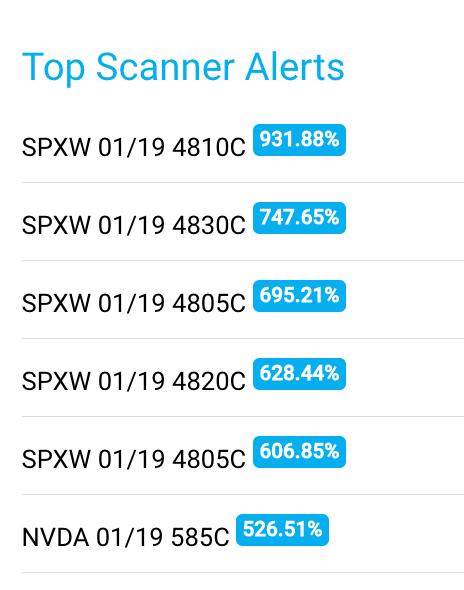

Edge Trade Planner - Top Scan Alerts

Nice job/finds by the Scanner! The cool thing with the scanner is that you can click on Plan on the alert, and it may even suggest different contracts and plan that will give you even better results.

Plan for Mon Jan 22 - Trade Ideas

We are gapping up this morning so I will be looking for a gap up reversal trade to fill the gap and ideally begin a move to backtest the breakout from Friday.

SPY - Eyeing 485 to get short or break of 483.30 targeting 480 and 482. If we hold 482 as support into the close or 483, I might take SPX 4880c overnight.

TSLA - like 215/220c bull call vertical for $1-1.50. Alerted swing on Friday. Let’s see if this pans out

COIN - not touching unless breaks 118 and/or btc breaks 38k. on 118 break likely take 110p and sell most for 50% gain. (I think it could be choppy)

NVDA - likely take 590p out of the gate for a quick profit taking scalp.

SMCI - will be looking for a trade, adding to watchlist and working on levels. It can go either way.

CVNA - eyeing dips on 44.50 to 45 for possible long/squeeze or breakout over 46.50

GS and JPM - are reclaiming 9ma after initial positive reaction on earning reports. May grind higher if SPY can hold gains.