SPY Back to 420, What's next? My plan for Monday Oct 23 and updates on Edge.

Market volatility is here, make sure you are prepare to take advantage of it

SPY 0.00%↑ moved very close to what I had planned. if it wasn’t for it being OpEx day, we likely would have had 20R+ trades instead of just 5-10R.

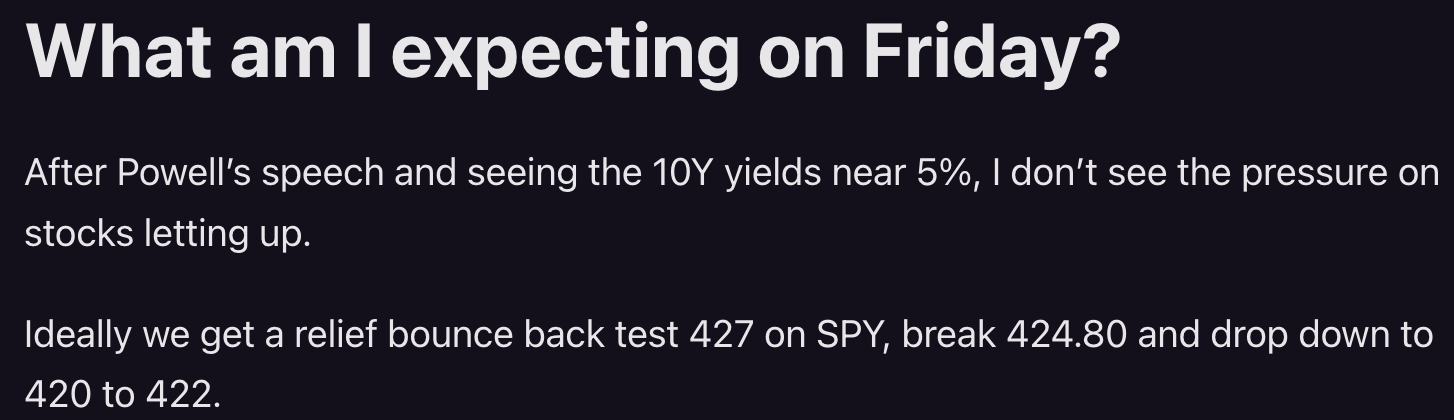

Here are my thoughts from Friday….

Here is what happened on Friday.

On open we got a push to 426.50 (couldn’t even get to 427). then dipped to 422 within 2 hours. It then consolidated/did a relief bounce until about 1 to 2pm. The action in afternoon was messy and slow choppy fade. My least favorite. I ended up exiting my puts early to secure the profits in case OpEx pinned us above 422.

Overall the price action imho is bidless, and I’m expecting market to break the 200dma and continue lower this week.

Keep reading to see how I am planning to trade it. First let’s review the trades we planned.

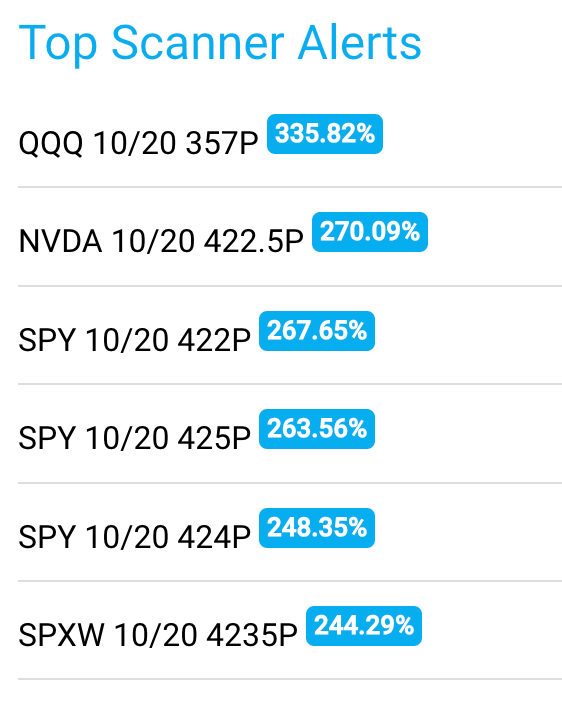

Volume on big money bets on the scanner was 1/3 it was on previous days, and that was reflected in the alerts results. NOT BAD but all week we were finding multiple 1000%+ trades. Less volume often means less range and thus less performance.

Trades Review

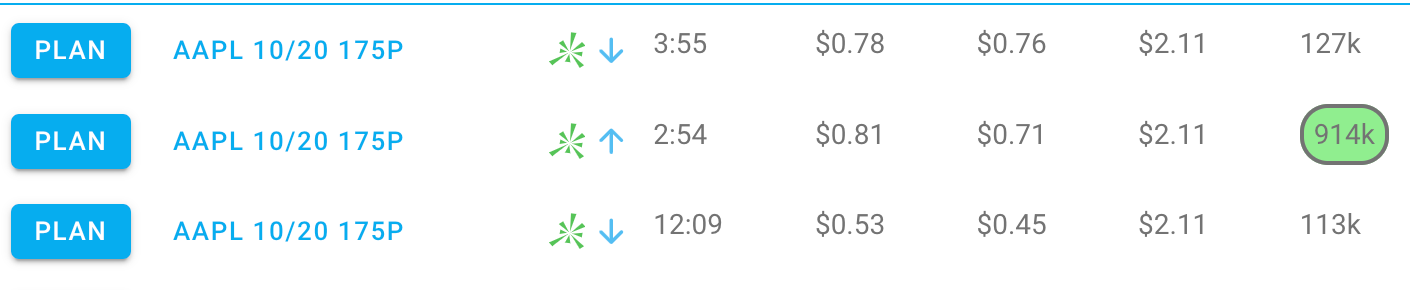

AAPL 0.00%↑ Swing 175p from 0.25. target 2.50. I had keept an eye on this idea once we broke 180. Saw this on the scanner… and placed orders at 0.25 because I wanted a deep discount and I thought I could get 10x out of it. Unfortunately it only got to $2.30. Not quite the 10x face value but solid plan!

Tip: when SPY reaches a key level, consider locking i gains in your other contracts if they also spiked in price, even if they haven’t hit target. In this case SPY hit 422 at 11am, and these contracts peaked at 2.30 around the same time.

Overall, the best trades were the shorts on the opening push into levels. Things moved much faster on Friday morning and then things got choppy and overall not worth the effort imho.

That scanner was fantastic for helping time and plan trades. I took QQQ short on this:

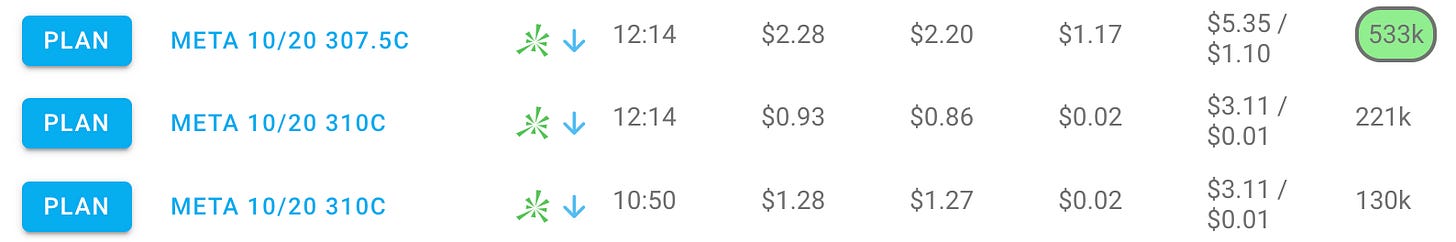

The more fascinating trade for me was on META 0.00%↑ . It’s important to remember key levels for breakouts/ breakdowns. often the first test will bounce.

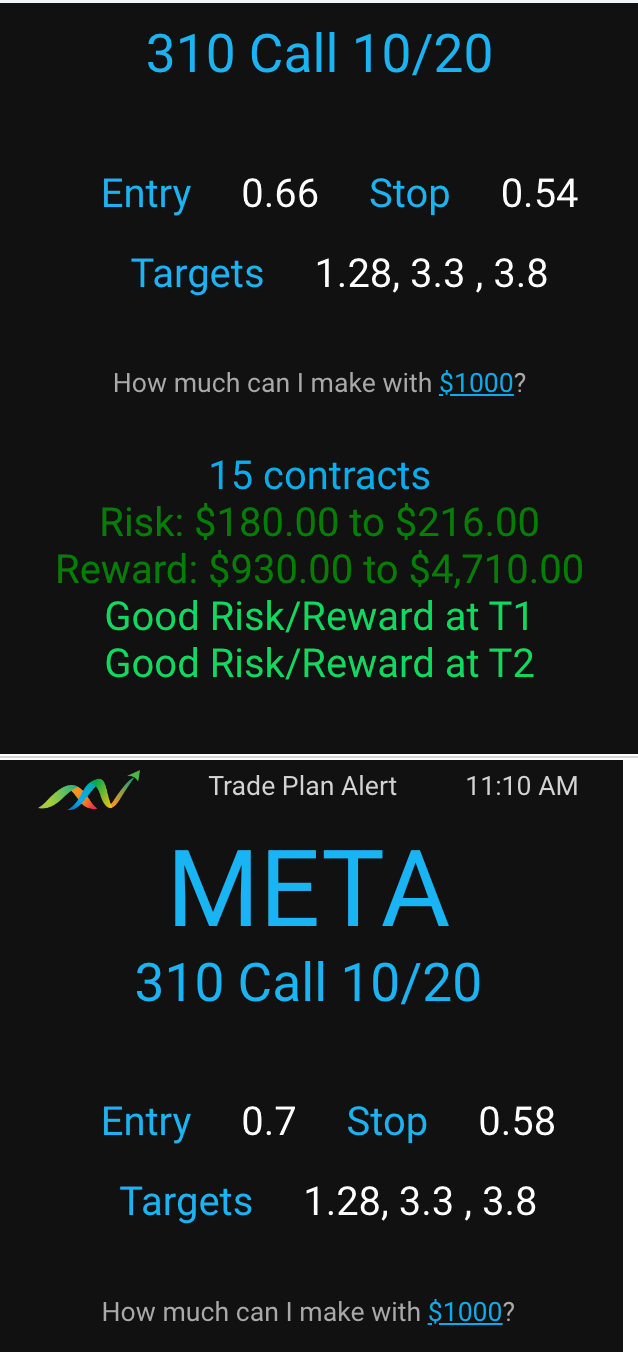

Seeing this caught my eye and given the levels I created it was a high probable sell for 2.50-3 trades on the $310c. Trade for a bounce from the 308 level to back test 312.80. And that is exactly what we got.

New feature in edge - What If Mode

In the course of testing, I ended up adding a What If Mode which for training purposes, one can go back in time and generate and modify trade plans.

So in this case what if one saw the 11:00am low put in on market and around 11:10 said, I think we may backtest the open r/g line before going lower.

By using what If mode I set the time to 11:10 and click generate plans, here it what it created.

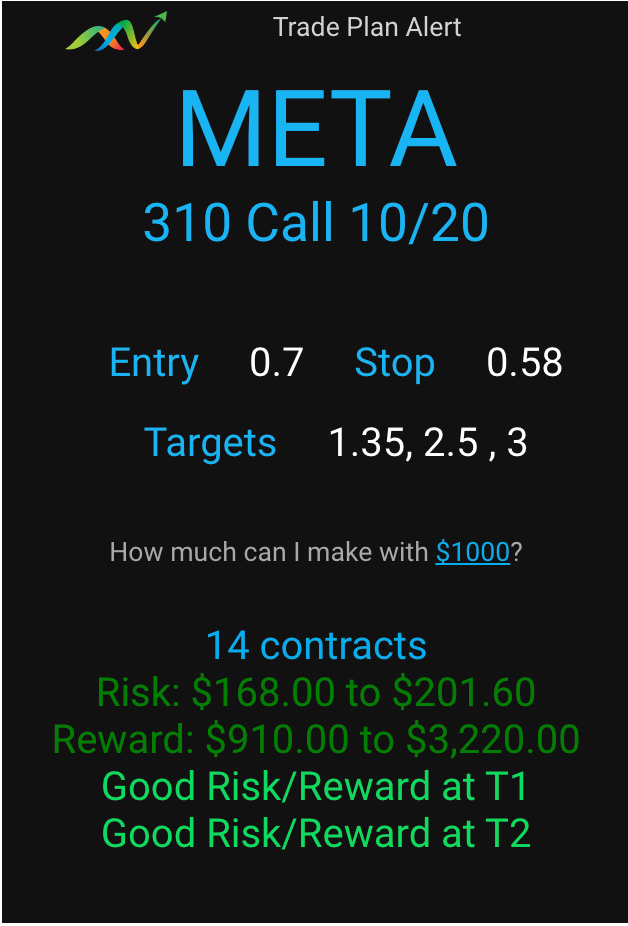

So I select a plan. Next step revise the targets because I thought the targets might be off. I chose EXIT BY MOVE. Here is the updated targets/plan after doing a human sanity check.

Here is how it played out.

I’m super excited to plan trades this week with the latest updates.

What I’m looking for on Monday Oct 23

SPY 0.00%↑ should break 420, ideally back test 421-422 and then start a leg lower. That said, I’ll be hawking for a gap down reversal/relief bounce to come soon. I don’t want to chase short into these lows and might have to skip trades.

I’ll be hawking TSLA, NVDA, AAPL, SPY and QQQ for moves.

I’m flying to California for the week today so short trading day. Be sure to use the scanner and tools provided in Edge to support your trade planning!.

For those that are interested in the exact levels and plans I’m creating, I’m still working through the details and website updates.

I’d love to hear from you if trade planning vs trade plan alerts is what you want the most. What if you only got 5-10 plans a week but the plans all had 5R+ potential, and 10-30 minutes to get positioned?