Spotted... Bear Market Rally after FOMC, Earnings review, and my plan for Thursday Nov 3

$TSLA $MSFT $NVDA $ELF $QCOM $ROKU $SPY $SPX

If you are not a blog subscriber, be sure to do that now.

Yesterday thanks to the many likes, I blogged about how I was looking for 3 scenarios to play out after FOMC with a bullish bias. I didn’t get the deep dip I really wanted to get long, but I did get the failed breakdown setup to get long and the swing long trades from earlier this week are being rewarded.

Let’s review some of the swing ideas I shared, then go over FOMC comments, earnings, and finally my game plan for Thursday

Planning ahead and swing trades

Earlier this week I talked about how I was looking for a bounce at SPY 410, and how I liked a handful of earnings winners for swing longs. We had FOMC risk, but after 3 months of selling, the technical scenario for a long swing was the right thing to do.

It’s important to then have scenarios in place, we don’t expect FOMC to raise, so if it stands pat, how will market likely react? Identifying these situations is where great reward opportunity comes.

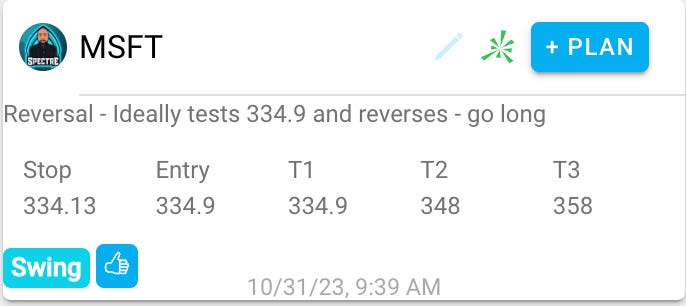

MSFT 0.00%↑ 335c. has been on fire. back when they made their AI investment announcement I made a rare multi-year swing call. at 220 I called for this titan’s market cap to double within 3 years at the latest. They haven’t disappointed since.

Tuesday, we took MSFT 335 calls for 4.50 risking $1. Hit $12 yesterday and could see $20+. 7 profit/1 risk= 7R. Solid trade so far.

I also discussed doing SPX 4200/4250 call vertical for Friday for $10 which are roughly $37 as I’m writing this.

I definitely wasn’t convinced of a move over 4200, but the risk/reward was there and I had high conviction of a 420 back test on SPY.

I found that I struggle with conviction trades for overnight holds, but there are a handful of situations where I’m more comfortable. it’s scooping after exhausted lows where short squeeze opportunity develops and when I’m buying during max fear.

FOMC comments/price action

Not anything new to report really. That is the key, the comments imho were mostly inline with expectations. This is a win for a relief bounce. Then the technical price action confirmed it. This is why I planned to do nothing until 2:45pm. Imagine loading up long on the hod break out only to get smacked, stop, bled, and then proven right! Skip the pain by showing up “late”.

Now here is the deal, if you think about how bearish people were at the beginning of the week, a move and hold over 423.30 could lead to that squeeze / rally into 431 I mentioned in yesterdays blog by next week (maybe by tomorrow). Over 431 should lead to a monster squeeze.

Today will be the day to get a feel for what market wants to do going into next week. more on that later.

Earnings review

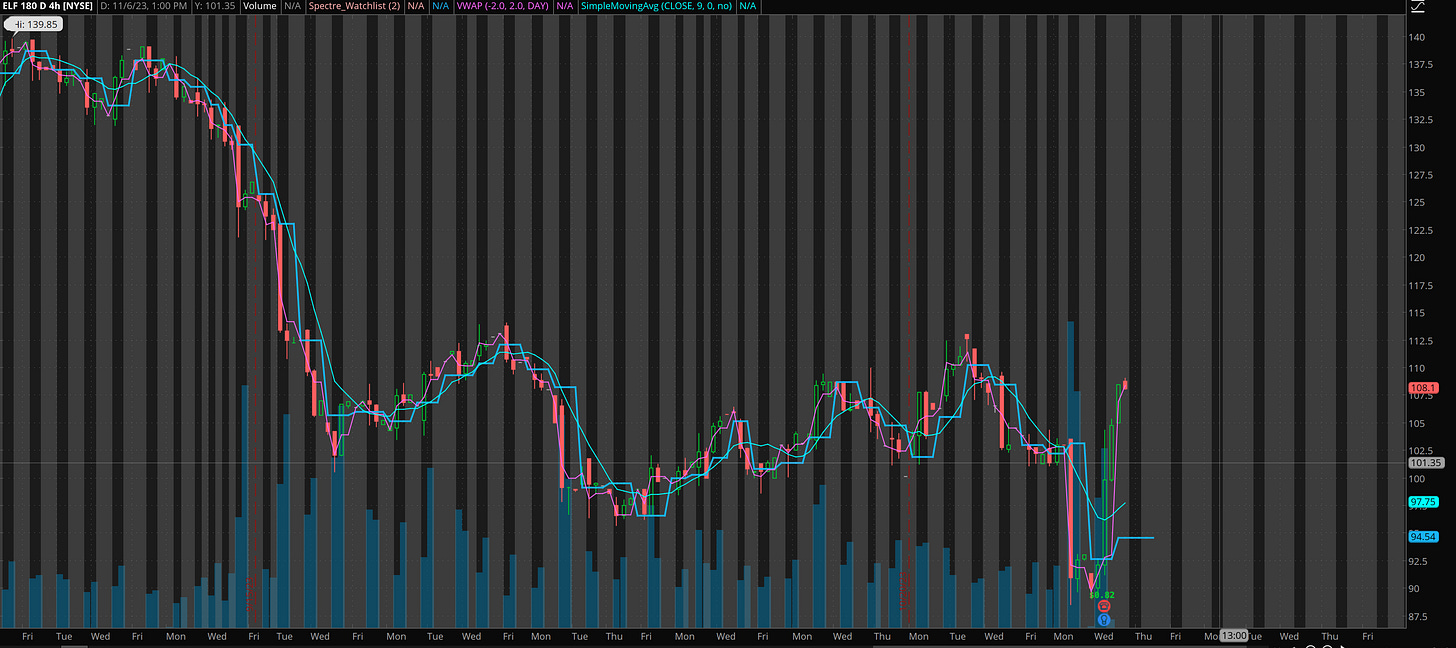

ELF 0.00%↑ Beat and raise - watching dips. Looks like a failed breakdown reversal

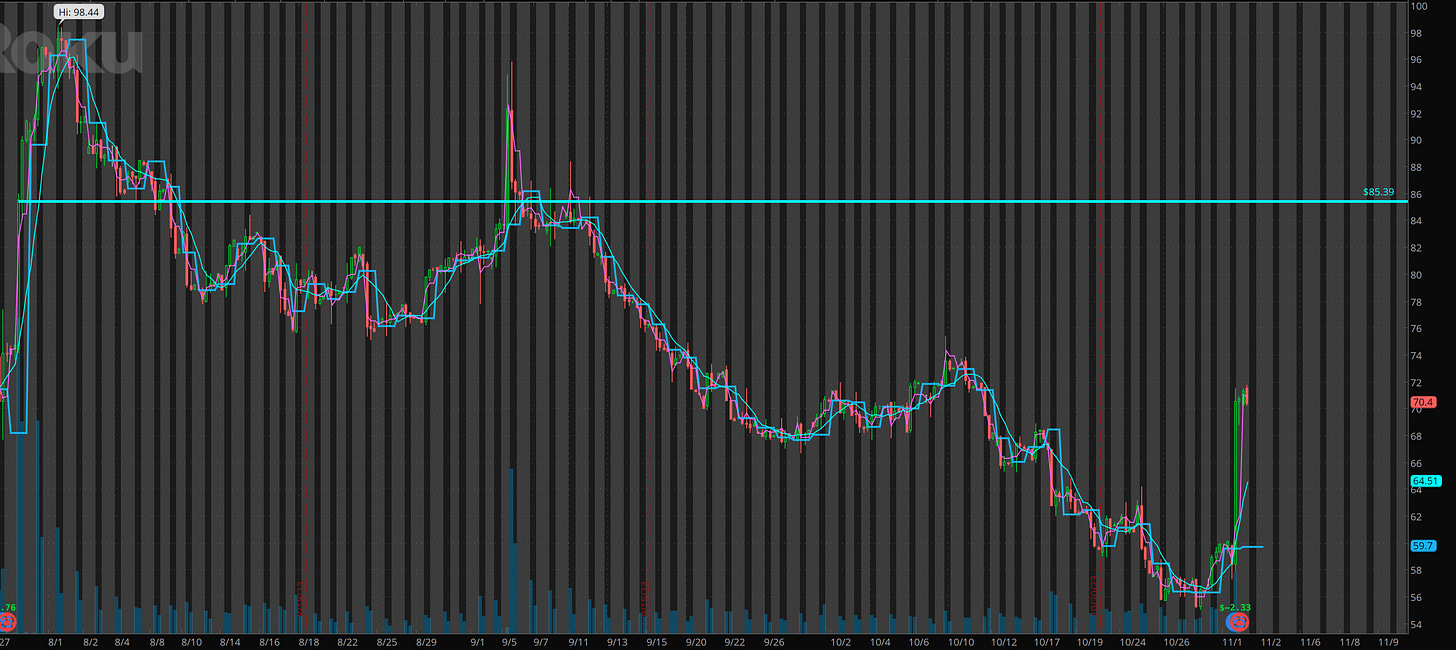

ROKU 0.00%↑ surprise results. a beat down name. Is it time to go long? I’m looking for profit taking today and then possible more squeeze

QCOM 0.00%↑ Nice results. Can it break out of this 2-3 month range?

My plan for Thursday

I plan to short the open for profit taking on this gap up and then I really want to see how the market develops after the first hour or two and may then take an afternoon trade. Typically I’d be looking for a gap up reversal, but we gapped up more than I expected so now will need to see what market wants to do.

Won’t be surprised if after the initial price action we end up consolidating and choppy for a bit.

SPY 0.00%↑ 426 and 430 are key levels I’m watching for a possible short

If we back test 423.30 and hold, I’m game to go long.

MSFT 0.00%↑ rolled into 350c for next week. News out on soft launch of AI driven Office which they expect to add $10B of revenue eventually.

NVDA 0.00%↑ 436 and 444 I’m hawking

Sorry I’m out of time.

Shifting gears and working on watchlist and levels so we can plan. We should be able to plan a few 5-10R trades today.