Rally Edge: Lock In Gains Today on Gap Ups! Trade Ideas for Thu Sep 18

SPY looks poised for upside breakout, but resistance looms—protect capital or miss the surge?

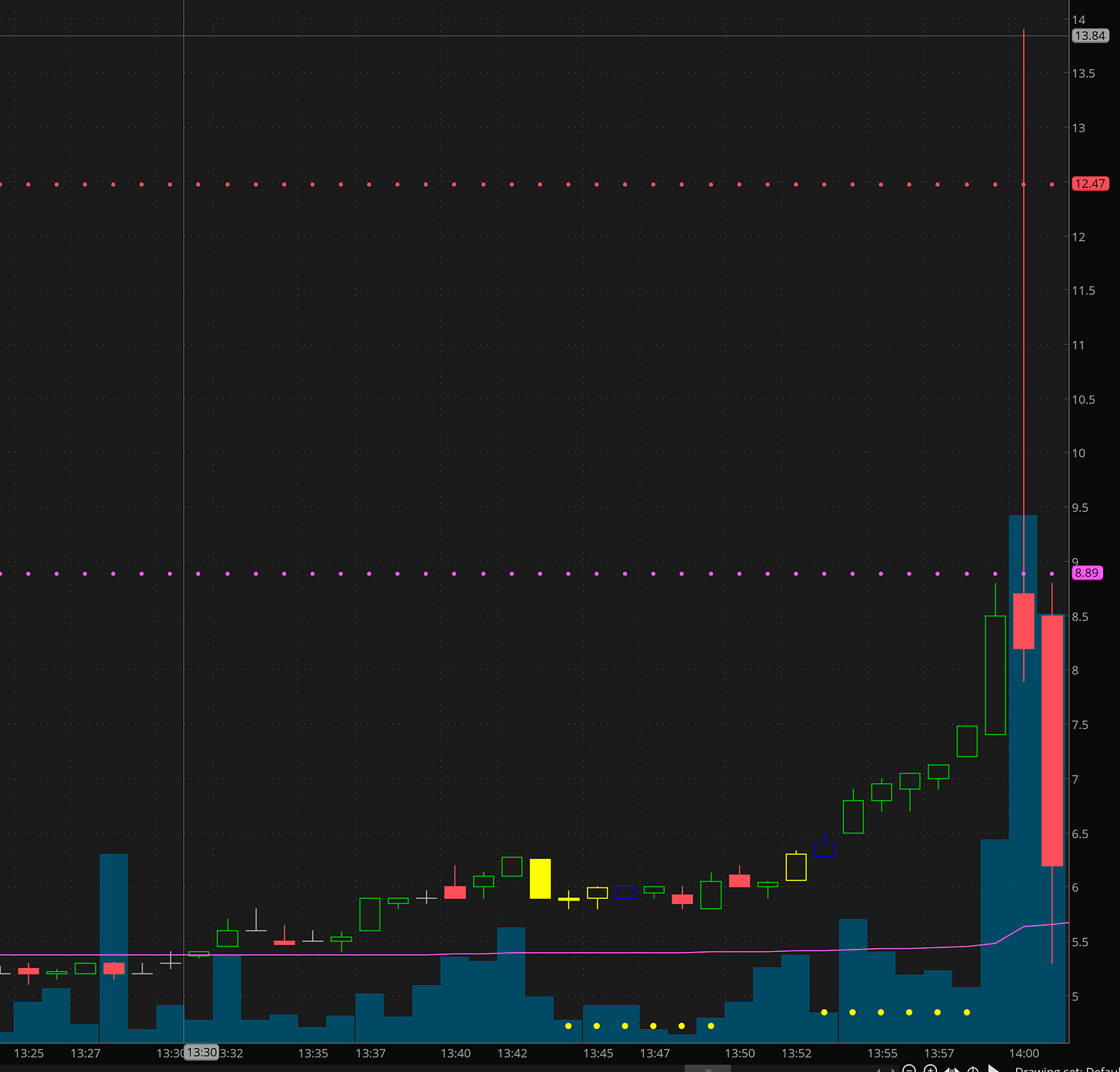

BOOM! The high probaility trade idea scored again with a 2 level move!

80% chance of working, and work it did! The problem Contracts were juiced. The score:

This was risky ahead of FOMC news. but it worked out.sell most at 5→8 to cover risk. and then we got the gorgeous spike to 12 for 100%+

Overall lots of great opportunity and wild action! This morning we are getting a gap up off yesterday’s failed breakdown reversal.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Plan for Thu Sep 18

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Market Context

SPY closed premarket at 664.1, trading above the pivot at 659.75 and nearing resistance at 665.19, suggesting bullish bias with potential for failed breakout reversals if rejected. Recent data shows consolidation around multi-day highs with volume spikes at supports, indicating possible upward momentum toward 667.95 if key levels hold. Bias leans bullish, but monitor for reversals near resistances.

Key Events Today

08:30 - Initial Jobless Claims - Weekly measure of new unemployment claims, expected at 230K.

Key Levels and Their Significance

676.15: Potential for failed breakout reversal if approached

667.95: Projected resistance

665.19 - High Priority: Key resistance near premarket price; clear rejection on 1-minute chart with 2x volume, 75% probability for day traders, active early session.

659.75 - High Priority: Pivot level below premarket close; frequent support holds with volume >2x average, 70% probability for reversals, relevant mid-day.

656.99 - High Priority: Support with multi-day low alignment; volume spike on bounce, 65% probability for scalpers if tested post-open.

651.55: Deeper support from price action; historical hold with Fibonacci alignment, 60% probability for swing traders in extended moves.

643.35: Lowest support in range; strong reversal point with high volume, 55% probability if major breakdown occurs, late session relevance.

Tips for Recognizing When a Trade Idea Is in Play

Volume Confirmation: Look for spikes >2x average at key levels to signal valid entry.

Candle Rejection: Watch for doji or pin bar candles rejecting the level on 1-minute chart.

Price Action Speed: Rapid approach to level followed by slowdown indicates potential reversal.

Event Timing: Monitor setups post-FOMC for increased volatility confirming the bias.

Support/Resistance Test: Multiple touches without break strengthen the failed reversal signal.

Risk Check: Ensure stop loss is outside recent highs/lows before entering.