Post CPI market dump and recovery. What's Next? My plan for Friday Jan 12.

TSLA, NVDA, and COIN gapping down

Wow what a Thursday! So much to discuss.

Price Action Review

SPY

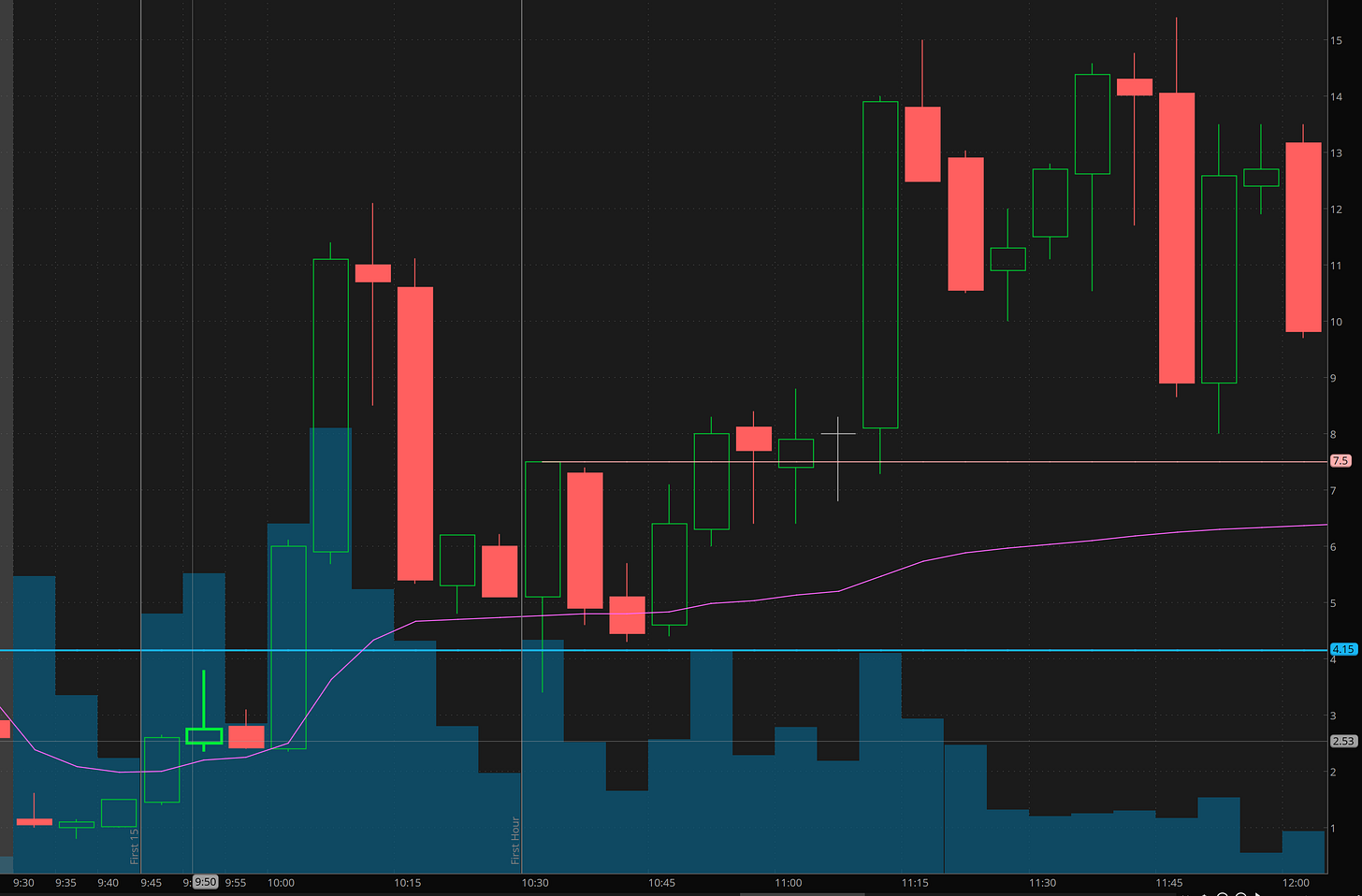

On the premise of the first move is the wrong move, on the opening double bottom, I went long on SPX 4800c at 5 and took some profit at 8 and 9 into the premarket resistance and then got stopped at 5.50 on the rest.

My overall thought was, that as long as we stay over 477.20 and vwap I’ll give the long a short, but as soon as we got the close under vwap after the first 15minutes, I had to follow process and hawk shorts.

CPI numbers were bearish and meant Fed might have to be more hawkish. “Let’s put a hold on that expected rate cut in Q1" is likely the sentiment. Given the previous weeks flush the big question, is will sellers show up.

In my blog yesterday I had sad if 475 breaks will go short for 470 to 472. Unfortunately we only got to 472.25. But that is good enough to make solid gains.

I ended up scooping some 4750p and 4730p for that goal.

The nice thing about 0DTE is it doesn’t have to get to your targets to make money. You can see here that there was a 15min window between 9:45 and 10:00am to get positioned short and then again around 10:30 am after the first hour was up.

Eventually these contracts got to $15 from a 2.50 to 3.50 entry on first opportunity and $4 at the 10:30 dip opportunity.

The price action turned very bearish quickly yesterday morning across the board.

But then something strange happened. If you recall from previous weeks there was a large volume zone around 472-472.50 area, so I definitely wanted to lock in gains as that level was approached and expected some bounce. We nailed the exits on our puts across the board into that dip. The strange thing for me was I expected a rally into VWAP, I did not expect the rally to test the morning open/highs. This translated to no more trades for me. Why - market isn’t moving the way I planned/expected doesn’t fit into a risk/reward trade setup and we already had a 5 bagger. One account was up 10% and another 25%. Mission accomplished!

If this level is rejected again, we could see a break of 472 in coming days. For now I’m expecting a bit of chop. if 477.50 clears a massive short squeeze likely triggers.

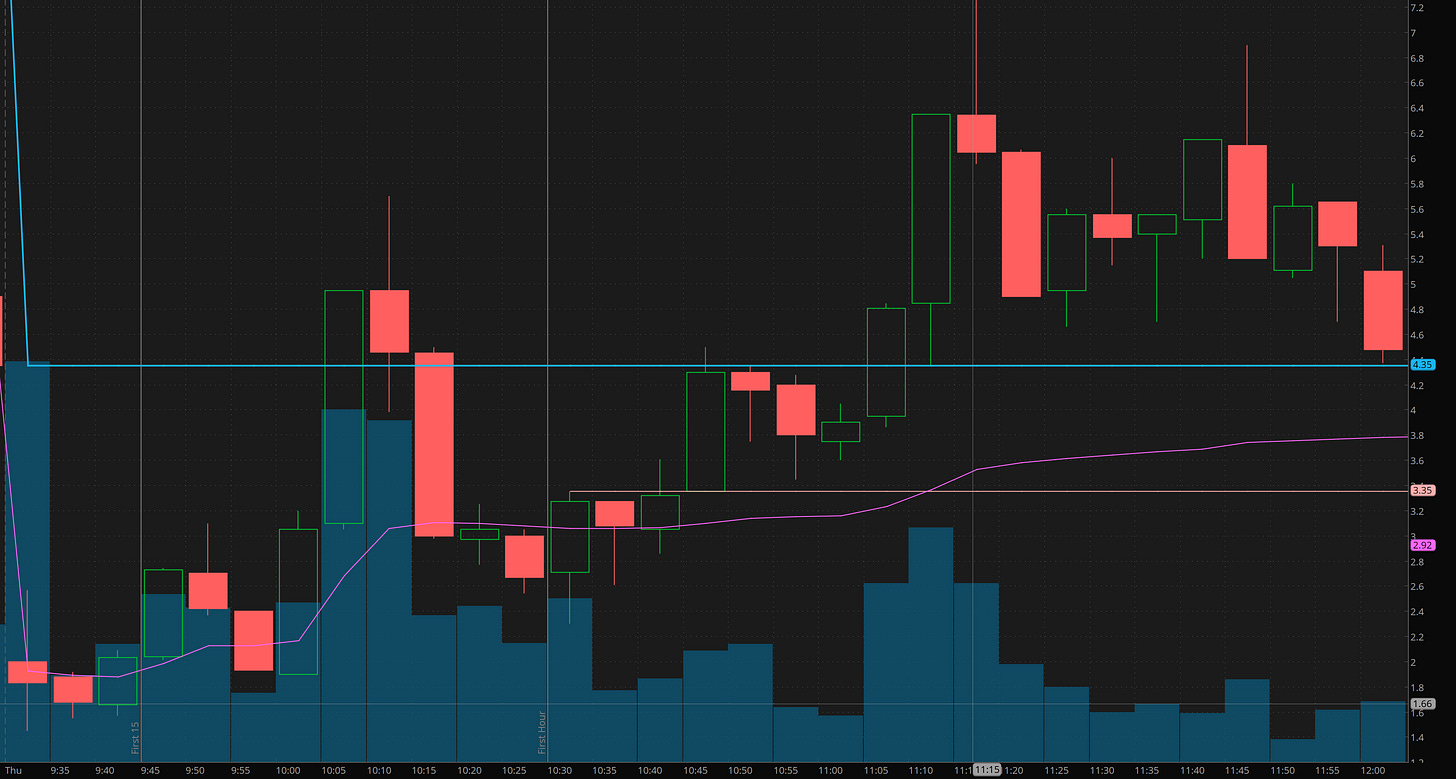

NFLX

NFLX loves to give back gaps and so when it broke vwap, I targeted 488 to come and so 490p was the game. we got those for $2. HOD was over $7! 200% gainer at $6. This was one my biggest payout trades. checked so many boxes.

COIN

the btc etf approval came out and COIN gapped up hard, which I was semi surprised about and wondering if since everyone was expecting a sell off, do they squeeze it… So what does one do? We wait. Once I saw the price action, I was convinced the sell the news event was going to materialize and too the 145p with a 135 target in mind. We hit 135 in premarket today.

The levels are magic! You can see in the action that we had a failed push on 160. I couldn’t watch so many tickers at once, so I got into this trade later than I wanted but its high conviction.

The trigger is the close under vwap after thest 160 and the confirmation was the break of 152.

I got in around $3 and it ran to $7 and should hit $10 this morning.

NVDA

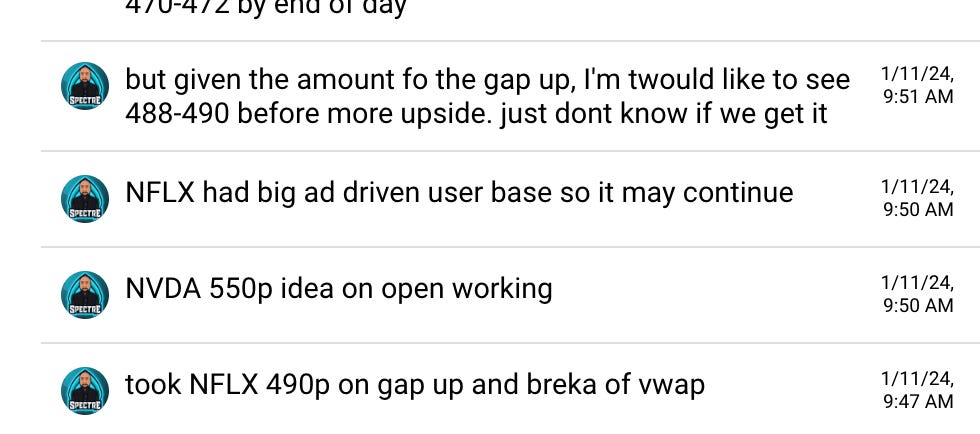

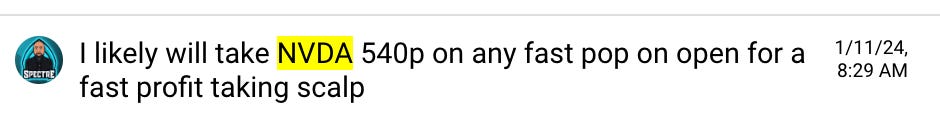

I posted this in edge in premarket. Why? 550 was my target for NVDA and so I was looking for profit taking.

Here is what happened on the NVDA 540p. Nailed the idea! and NVDA dipped right to 540! $2→7 for another 200% banger!

TSLA

Unfortunately I missed the short entry on this. TOO MUCH going on at the same time. Earlier in the week I had mention 232 was major support and 230 is the 200d ma. so what happens when 232 breaks and 230 breaks? where do you get short and where will it go? My target 215-220.

The big clue is that TSLA has been unable to participate in market rally.

This morning we are seeing 220.

Plan for Friday Jan12

I think today is going to be tricky, but I am net bearish given the selling and gap down on tech names I’m seeing.

SPY - If 475 476 area rejects, I’ll consider a short for 472.50. on 472 break I will also consider a short targeting 469. Over 477.50, I will look for a dip and likely take size long for a short squeeze

TSLA - gapping down on price cuts. Looking for a push on 225-227 to get short for 220 break target 216. If 216 breaks, we could see 205-210 next week. We may have a choppy time getting there.

NVDA - looking at pops to get short, thinking we could start a pull back toward 520 into next week.

BA - finally under 220. don’t you hate it when your thoughts are ahead of the market’s realization? I should have swung this short, but the BTFD action kept showing up. If we can get a fast pop into 223-225 I’d like to take 220p targeting 217 and if that breaks 210-213.

Reminder. Earning season starts next week, so I’ll be hawking dips into major support for possible swing longs for earning run up plays.

Be sure to like and comment to let me know you are finding the content helpful. It would also help others find this blog. Your support is super appreciated.