Perfect planning leads to 20 to 40x gains on Friday. My game plan for Monday Nov 13

SPY reach 441 target level after trapping shorts. Moody downgrades US to negative outlook. CPI numbers on deck this week

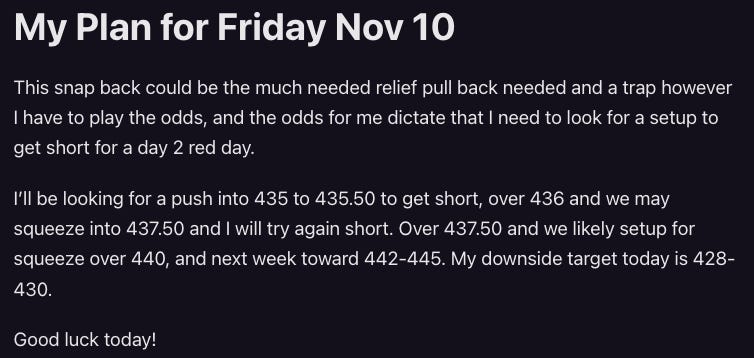

What what read / plan for Friday!

By the open, we had already crossed 436.50, invalidating the short plan, (though I still took a pot shot at while getting positioned for the long). We got the dip we wanted and were able to fill SPX 4390c for $0.50 to $1 targeting 4420 for the exit per the levels.

Super exciting day and one where getting positioned and doing nothing more paid!

Friday was the kind of day one turns $2k into 20 to 50k by planning!

So what happened and why the rally and why was it predictable. I didn’t know if this was going to play out, but it was 1 of the 2 scenarios I prepared for. The recent rally had been savage on shorts, and if market was going to be weak and sellers in control price action should not have gotten over 435-435.50. Over 436 signalled demand.

Once we gapped higher and crossed 437 everyone who got short on thursday and loaded up at the close looking for a day 2 red day got trapped. THAT is the key! traps are what help create strong trend trades. Anyone who tried to short after 10:30 pretty much got smoked! Adding fuel to the rally.

Moody’s Downgrade to Negative

After the close Moody’s kept US at aaa credit rating but issued a negative outlook which lets the market know the US may get it’s credit rating lowered can trigger a spike in rates.

In early premarket we were gapping down but as I’m writing most that has been recovered.

CPI / PPI on deck this week

CPI comes on Tuesday morning and PPI on Wednesday.

Market may decide to hedge/profit take head of these numbers or it might be priced in. Overall, once the numbers come out, I think we will get a couple of trap moves during the day and then nice trend

Plan for Monday Nov 13

After a monster Friday, I’m probably going to take it easy today. I sometimes overdo it after a big winning day so today may trade light or skip.

Overall I’m thinking we get a pop on open and then some profit taking to test premarket lows. If we then take out Friday highs, I would expect more squeezing to come. The question is really how does big money want to position ahead of the CPI numbers tomorrow and can we take advantage of it.

Market looks positioned for a rally into 448-450. I’m not sure we get new highs this year. It was definitely not my expectation for us to get here so fast but here we hard. Until some sort of negative catalyst comes in market appears to be back in BTFD mode.

If Market break 437.50, I will start to look for a short and move back toward 430-433 as a consolidation leg to develop