NVDA reports another great quarter, SPY backtests breakout and is gapping up. The plan for Wednesday Nov 22 with Thanksgiving holiday on Thursday.

FREE Lesson on Credit Selling and Directional buying

Lesson on Credit Sells vs Directional Buys

Another solid trading day. Lately you may have wondered, why am I doing credit sells?

Answer:

I don’t have to nail the dip entry

Theta decay works in my favor

On consolidation days, I can still get paid.

Here is a good example from yesterday. I was thinking we would dip and then work our way back up to fill the gap. and possible go higher.

So at the lows I took 4540c for $2-2.50 targeting 8-20 for the exit.

Round 1 I got some off at 3.50 and stopped 2.50

Round 2 I got back in around 11:30 for 2.20 and out most at 6. I had gone to get lunch and had noticed the spike. It was lucky timing. because at 1pm, it got slammed.

Eventually these went to 0 and I didn’t get the upside move. Still solid gains.

Meanwhile I also did a credit sell for 4530/4525.

Yes the risk was high compared to the reward, $1 risk for $2.50 gain, but I won over 95% of my credit sell trades, so its a high probability win as long as we don’t close under 5427.50. I’m also more comfortable sizing larger on these because time typically works in my favor and I can buy and hold all day with stops in place.

WAIT.. You are probably wondering well, one gave you $4 Reward for $1 risk so isn’t the calls better? here is the issue, I was wrong about reaching 8+. If I didn’t come back when I did and lock in gains on the $6 spike (because of experience and the way the price action was moving) I would have lost on the trade. I also need to spend a lot of time watching and debating to sell or not.

Conclusion. It doesn’t have to be an either or thing. I like doing both credit sells and directional buying. One lets you make money if we get consolidation action and the other if you are directionally right.

In the current environment where we are pushing higher but also price action is acting toppy, consider taking profits more aggressively (earlier) vs going for the big gain. At least that is my plan for OTM contracts: Round 1 take 80-100% of at 20-50% gains. Round 2 take 80% off at 3R.

Yesterday’s Price action

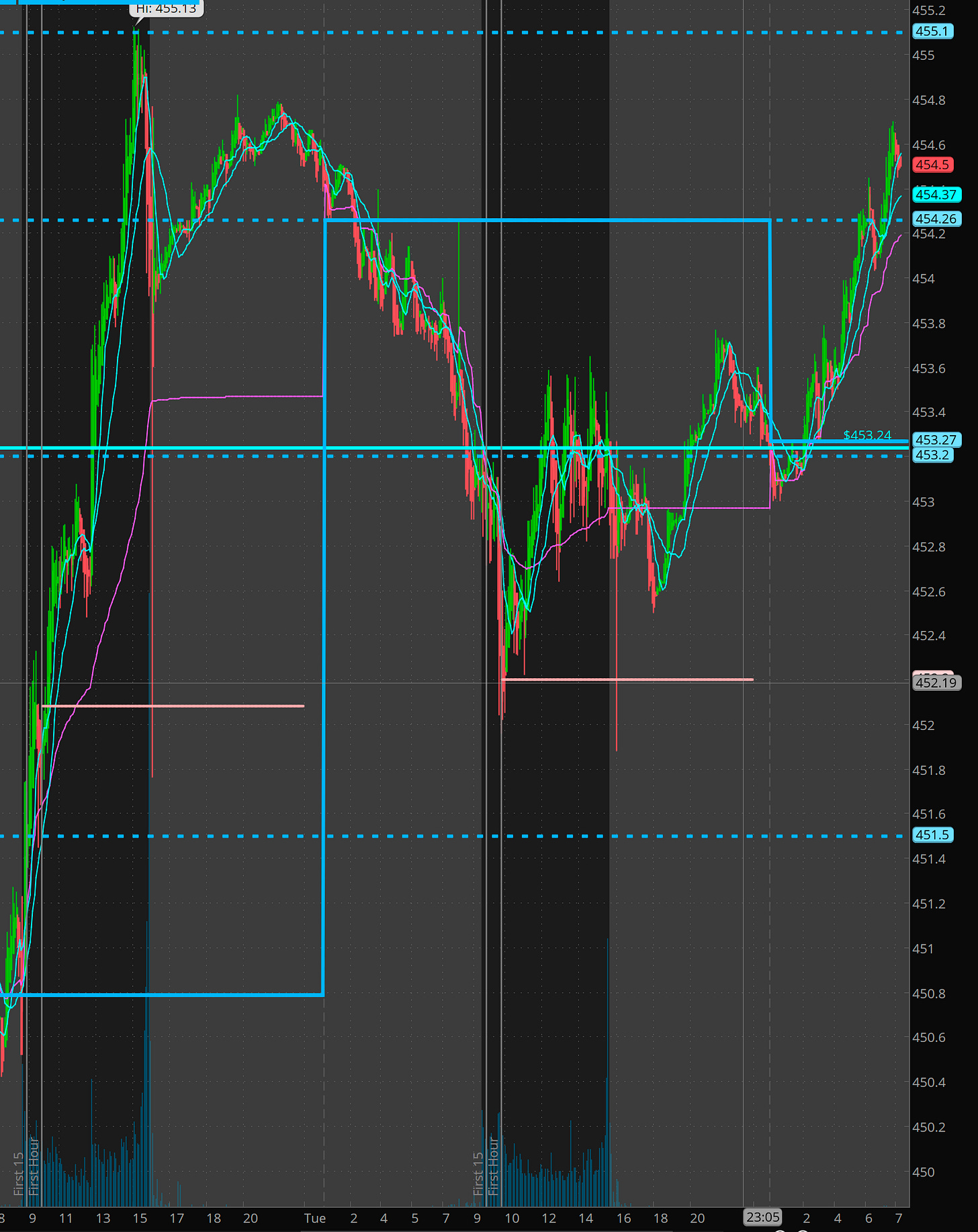

SPY backtested the break out at 452 and in theory is positioned to test 456 now. Range was pretty tight overall all day but once morning selling was done. All dips on vwap were bought. Implies an upside move coming and we are gapping up in premarket.

NVDA earnings results/reaction

NVDA had a strange panic yank/candle down into 470 that was quickly bought up. Overall the results were impressive but then why the dip? Likely lopsided positioning or not as impressive as many hoped and when demand didn’t show up, selling triggered. That said the dip into 490-492 was bought and NVDA got back over 500 in premarket.

My take for take, lets range get defined and the join trend. we could get some profit taking, but I think downside could be limited unless 490 breaks for some strange reason. Multiple price target upgrades into 600 to 650+

600 leaps for Jan 2025 may not be a bad swing trade so I will be digging into that. If support can be established at 506-508 by end of day, we could see 520-540 next week.

Plan for Wed Nov 22

Rinse and repeat. I’ll be looking for range to be set and then joining trend. I may not even trade today depending on volume and price action unless its a quick scalp.

With tomorrow being a holiday, the volume today can be very light. However that can also sometime mean exaggerated moves. So if opportunity presents, I will take advantage, but 90% of my time will be focused on app development for Option alerts/plans right to your phone.

So SPY bull scenario, dip and rip off 453.50 targeting 455-456.

SPY breaks 452, and gets heavy will start bear plans.

META over 339, could start get toward 350 into next week.

NVDA dips on 492 vs 490 break like long or basing over 506 like long.