NVDA fears squashed SPY makes new highs!- Daily SPY Review for 2025-08-28

Here is a breakdown of Today's SPY action. Great lessons today and I talk about 4 ways to profit from SPY.

Daily SPY Review - 2025-08-28

Hey traders what a day! SPY plunged to 645.34 early on before rallying like it chugged an energy drink, hitting a high of 649.48 and closing at 648.89. Overall, it was choppy in the morning with volatile swings around the pivot, then trended bullish in the afternoon on decent volume—think a rollercoaster that finally decides to climb. No massive volatility spikes, but that early flush below supports kept things spicy, aligning with the GDP revision buzz without major fireworks.

People were fearful after NVDA’s drop but price action and failed breakdown reversal tell you the story and let you position for great risk/rewards. I missed the scoops at lows on second round but nailed the long in afternoon after hod break. IT WAS ALL DRIVEN BY KNOWING THE SETUPS AND HOW THEY PLAY OUT

Key Levels Performance

Only reviewing levels hit within the day's range (645.34 low to 649.48 high)—we skipped the outliers like 650.14 (just missed!) and 643.66 (never tested).

648.15 (High Priority Resistance): Broken decisively in the afternoon after multiple tests. Tested ~5 times (e.g., 12:28 high 648.41 with volume spike to 294k, then brief dip before pushing through). Acted as resistance initially with rejections (e.g., 12:30 close 647.85 on fading volume), but volume surged >2x average on the breakout around 13:30, invalidating it as a ceiling. Held briefly but ultimately failed to cap the upside.

645.65 (High Priority Pivot): Tested heavily in the morning (~4 times, e.g., 9:56 low 645.37, 9:57 low 645.34 with volume ~300k). Broke below temporarily with high volume dips, but rebounded strongly—acted more as porous support than ironclad, with quick volume-backed bounces signaling failed breakdowns -- Great for us because we get high probability winning trades!

Want the trade ideas and key levels delivered to your inbox each morning? Click here for 7 day free trial.

Trade Ideas Review

Let's dissect these like a post-game replay—some winners, some benchwarmers. Remember, we're judging based on exact setups from the morning blog.

Trade Name: Failed Breakout Reversal Short at 648.15

Setup Triggered: Partially (price tested and briefly rejected below after 12:28 push to 648.41, but no sustained failure as it broke higher later).

Entry Executed: No (partial doesn't count per rules—needed clear rejection without breakout).

Stop Loss Hit: N/A.

Targets Reached: N/A.

Final Outcome: No Entry.

Lessons Learned: The initial rejection looked tasty, but afternoon momentum steamrolled it—like a fakeout that faked us out. Waiting for volume confirmation on the fade could've avoided chasing; tighten criteria for "failure" in trending sessions.Trade Name: Failed Breakdown Reversal Long at 645.65

Setup Triggered: Yes (dipped below to 645.34 at 9:57, then bounced above by 9:59).

Entry Executed: Yes, at ~645.66 (post-bounce above at 9:59 open 645.55, but entry on confirmation above).

Stop Loss Hit: No (low held above 645.15).

Targets Reached: First target 648.15 at ~12:28; second 650.14 not reached (high 649.48).

Final Outcome: Profit of ~2.5 points (to first target; full ride to close could've netted more).

Lessons Learned: Nailed the bounce like a trampoline—volume spikes on the reversal were the hero. What worked: Proximity to premarket made it quick; improve by scaling out at first target in chop to lock gains, Easy peasy, like grabbing the low-hanging fruit.

Four ways to Profit from SPY

Let’s review the potential trades based the the SPY 645.55 failed breakdown reversal

Four Ways to Profit from SPY

Based on the successful Failed Breakdown Reversal Long at 645.65 (dip to 645.34, bounce and entry ~645.66, here is how you can make money on the idea.

SPY Shares

Strategy: Buy SPY shares outright on the reversal confirmation (e.g., close above 645.65 with volume spike).

Execution Example: Enter 100 shares at 645.66; stop at 645.15 (risk $51/share lot). Target partial sell at 648.15 ($249 profit) and trail the rest to 650.14 or close.

Profit Potential: Direct 1:1 exposure to SPY's move; ~$250 profit on 100 shares for 2.5-point gain. Low commissions, no leverage—ideal for conservative accounts. What worked in review: Quick bounce captured easy gains like low-hanging fruit; improve by adding shares on pullbacks in trend.

PROS/CONS: Requires lots of capital. about $65000 to make $250 and risking $50. I don’t love the return on capital so I dont do this.

SPX Options (Calls)

Strategy: Buy SPX call options (European-style, cash-settled) for leveraged upside on the reversal (e.g., near-term expiry, ATM or slightly OTM strikes).

Execution Example: Buy 2SPX 6480 calls at ~$7 premium ($700/contract); stop if SPY hits 645.15 (option decay risk). Estimate $2 risk. Target sell at SPY 648.15 (SPX 6598) (option ~$18, $2400 profit on 2 contracts) or hold to 650.14 for more. Required $1400 capital. Risking $400. for $2200-$3200 profit

Profit Potential: Amplified returns—~165% ROI on 2.5-point move vs. shares' 0.4%; theta decay minimized in quick trades. What worked: Volume hero on bounce signaled conviction; improve by using weeklies in chop to lock gains faster. This is how I like to trade!

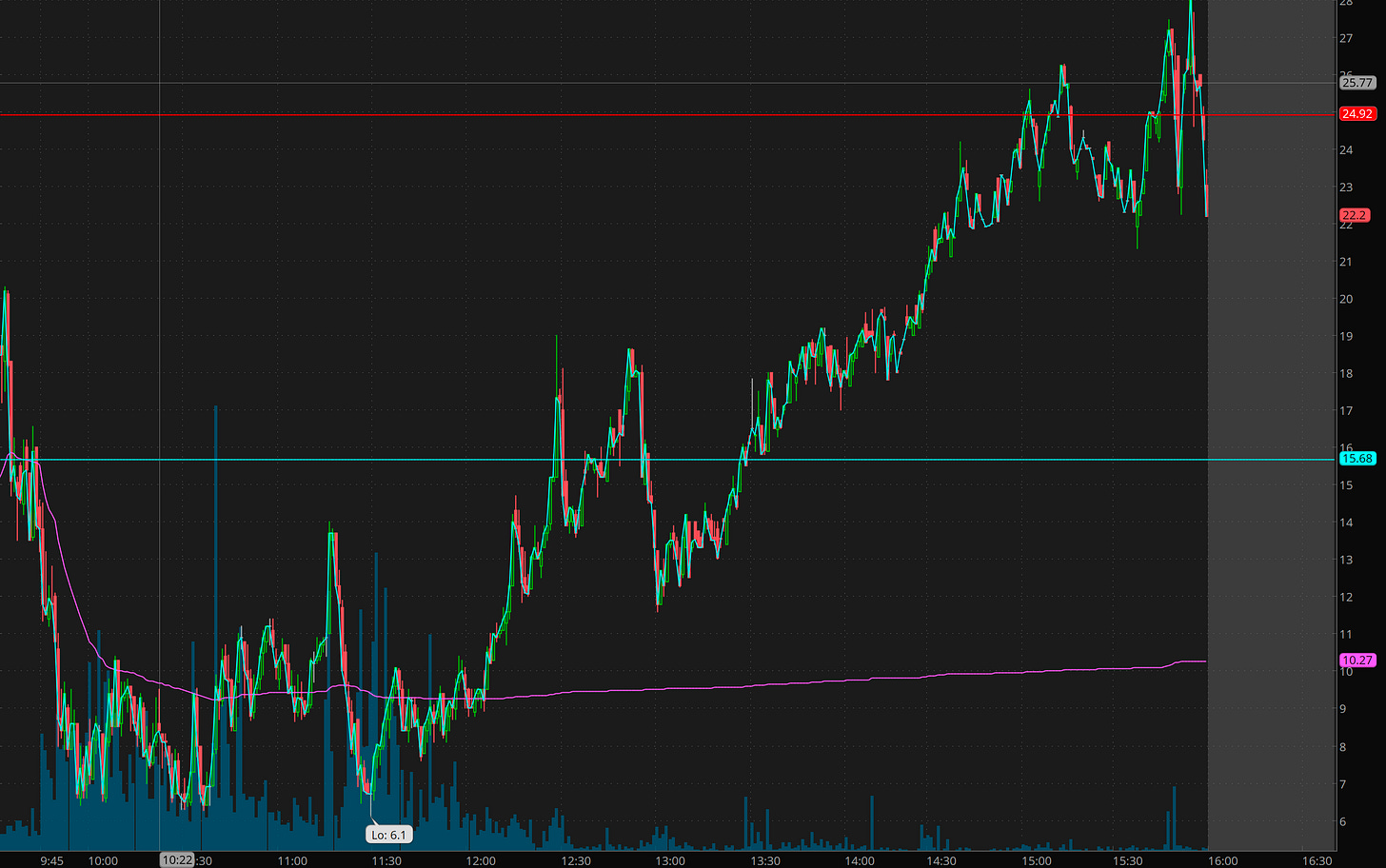

Here is how the SPX 6480c moved. If patient for the consolidation and chop, and scoop on the $7 area, nice gains by end of day!

SPX Options (Credit Sell Bull Puts)

Strategy: Sell a bull put credit spread (bearish put vertical) below the reversal level for income. Most people like betting SPY stays above support. I like betting SPY will close above a level.

Execution Example: Sell SPX 6490/6485 put spread (credit ~$3.50, $350 received); max risk $150 if SPX <6490. Hold for the close. I like this structure. use 10 contracts. requires $5000 capital risking $1500 to collect $3500 premium. If wrong likely able to exit for $500 loss early in the day.

Profit Potential: Collect premium (~70% ROI on margin) as time decays if reversal holds; limited downside. What worked: Stop not hit, allowing full profit ride; improve by rolling up in strong bounces to capture more credit.

SPY Futures (/ES)

Strategy: Buy /ES contracts (50x SPY multiplier) on the reversal for leveraged exposure, similar to shares but with futures margin.

Execution Example: Buy 1 /ES at 6483 equivalent (SPY 645.66); stop at 6478 (risk ~$50/point, $250/contract). Target partial exit at 6509 ride the rest for 6529+

Profit Potential: Scaled gains—$1300 per contract to target 1 and $2300 per contract to target 2. This my new most favorite why to trade when I don’t want to worry about decay!

Performance Summary

Total Trades Triggered: 1 (out of 4—only the long reversal fired fully).

Winning Trades: 1 (100%).

Losing Trades: 0 (0%).

Average Win: 2.5-3.5 points.

Average Loss: N/A.

Largest Win: 2.5-3.5 points.

Largest Loss: N/A.

Win Rate: 100% (small sample, but hey, a win's a win—not bragging, but in my last 5 reviews, we've caught 4 like this by sticking to data... lessons from my own "oops" days!).

Key Insights for Tomorrow

Reversal longs at pivots crushed it when volume backed the bounce—lean into these on bullish biases for easy wins.

Short setups failed due to late-day momentum; avoid them in trending afternoons unless volume drops off a cliff.

Improve entry timing by waiting 1-2 candles post-test—like not jumping the gun on a green light—to filter fakes.

Risk management shone: Tight stops prevented losses; scale rewards in chop to protect gains.

Watch premarket proximity—ideas near open prices triggered best, saving you from waiting games.

Market Patterns Observed

Time-based: Morning volatility with a sharp dip below pivot by 10 AM (classic open flush), lunch lull around 12-1 PM with tighter ranges, and end-of-day push above resistance post-2 PM on rising volume.

Volume patterns: Spikes >2x average (e.g., 1.2M at 9:52, 2.3M at close) signaled reversals and breakouts; low-volume tests led to failures.

Price action: Bullish engulfing patterns after dips (e.g., 10:05 bounce), with wicks rejecting lows like rubber bands—recurring failed breakdowns fueled the uptrend.

Support/resistance: Pivots acted bouncy but breakable; resistances held early but crumbled on sustained volume, hinting at bullish exhaustion if no follow-through. --3rd day in a row where dips got bought leading to an afternoon rally!

Risk Management Lessons

Position Sizing: Spot-on with 0.5-point risks—kept things bite-sized, like portion control for your portfolio, avoiding big bites for scared novices.

Stop Loss Placement: Perfectly tight (e.g., 645.15 never hit), but consider loosening slightly in volatile opens to weather whipsaws without getting stopped out prematurely.

Target Setting: Realistic and hit partially—first targets were gold, but stretching to seconds like 650.14 felt ambitious; adjust based on momentum for more consistent exits, motivating you busy parents to trade smarter, not harder.

Whew, what a day—markets can be brutal, but reviews like this turn losses into laughs and wins into wisdom. I spent most of the day doing nothing. Just got positioned and took a nap.

What's your biggest takeaway today? Spill in the comments—let's keep the adventure going! 🚀

Want the trade ideas and key levels? Click here for 7 day free trial.

Want access to live commentary and trade with us?