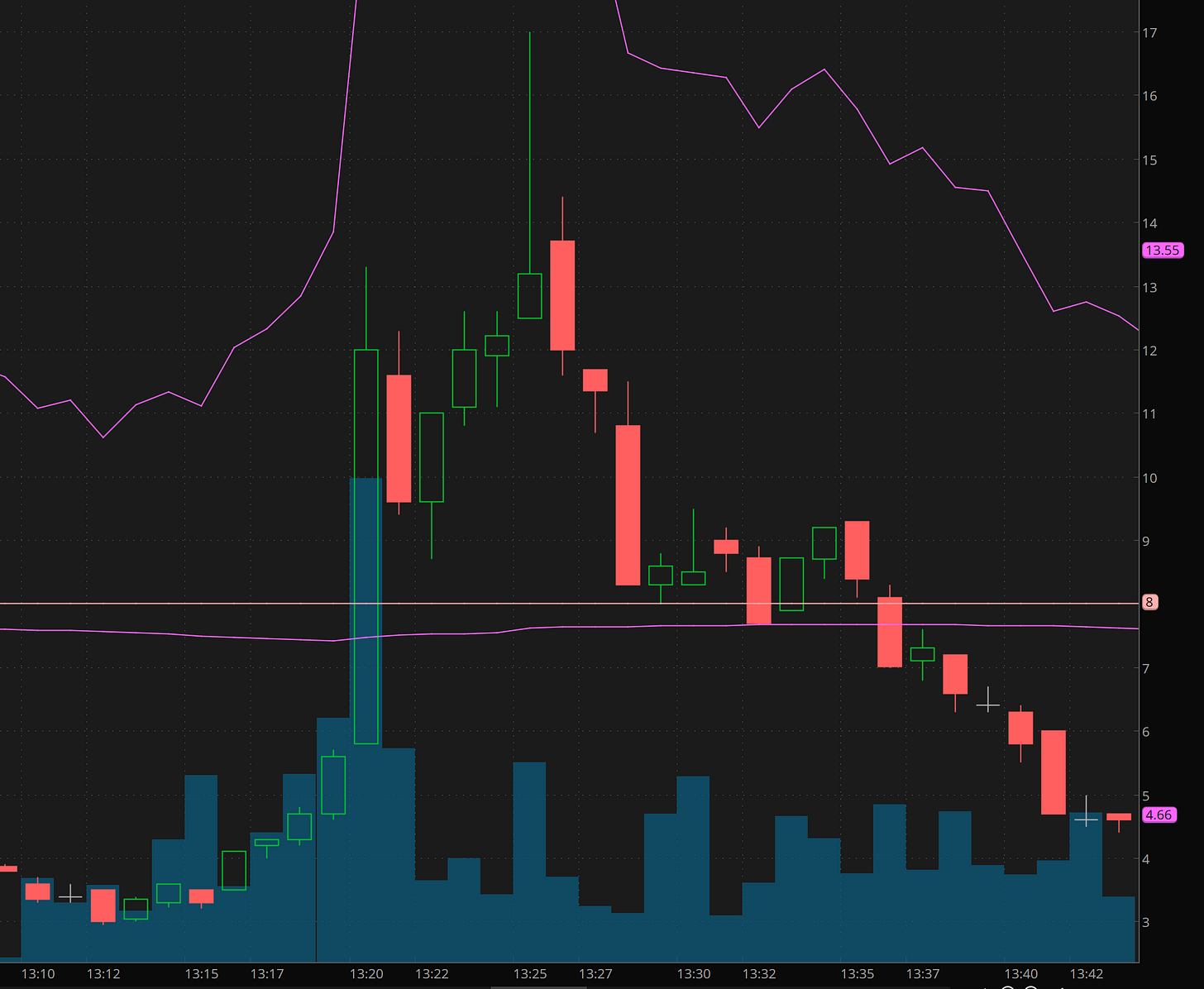

Nice Recovery Monday vs Friday Selling, what's next for Tuesday Oct 17.

On Friday, I said I said 430-431 was seeing buyers, and yesterday they got a gap and go play into 437. I needed a dip to get long and while there was a tradable play after first hour to go long, I chose to skip it, I didn’t like the risk/reward. Overall the action respected the levels I shared.

That said, if you recall in yesterday’s blog I said I expect bulls and bears to get smacked around. The action yesterday was exactly that but on a smaller scale.

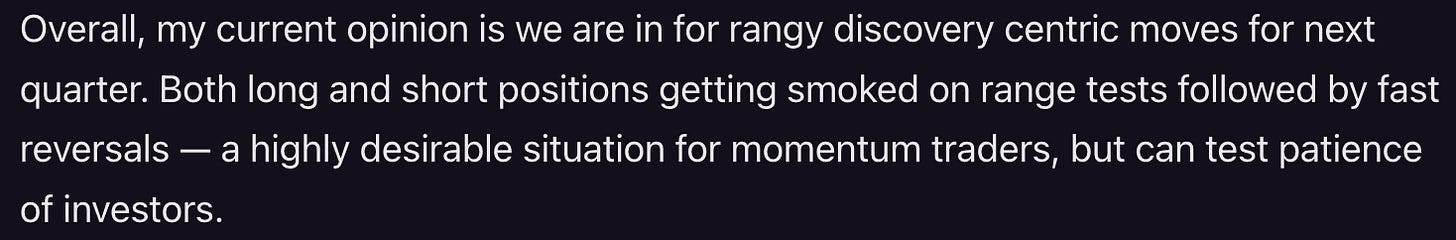

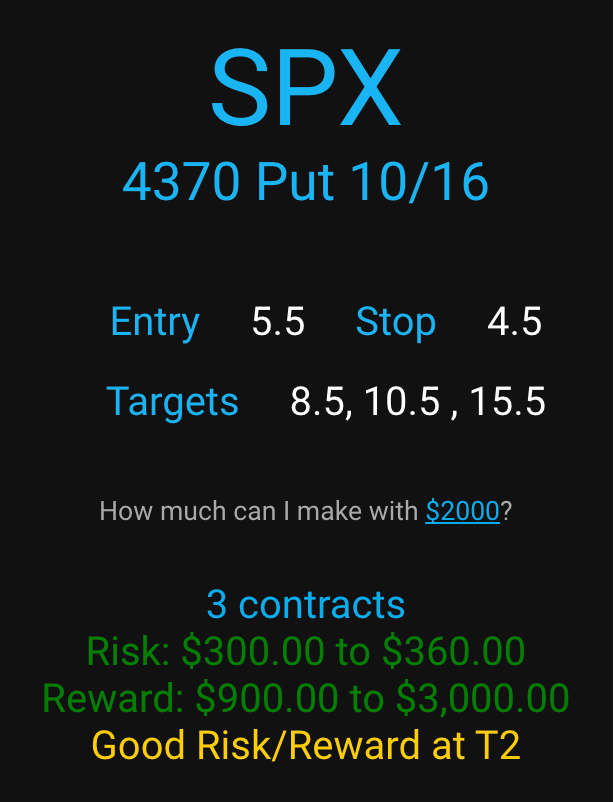

You can see the market bounce and trap bulls after lunch looking for high of day to get taken out only to quickly get a reversal and break of vwap and drop right the the 434.30 leve. This was quickly followed by fast buying. So shorts trapped. that said, market couldn’t take out highs in afternoon. 436.50 to 438 appears to be a sell zone until we have a catalyst to clear.

If you were super bullish, Edge Trade Planner identified an interesting 500k bet at $2 on SPX 4385c that hit $9.

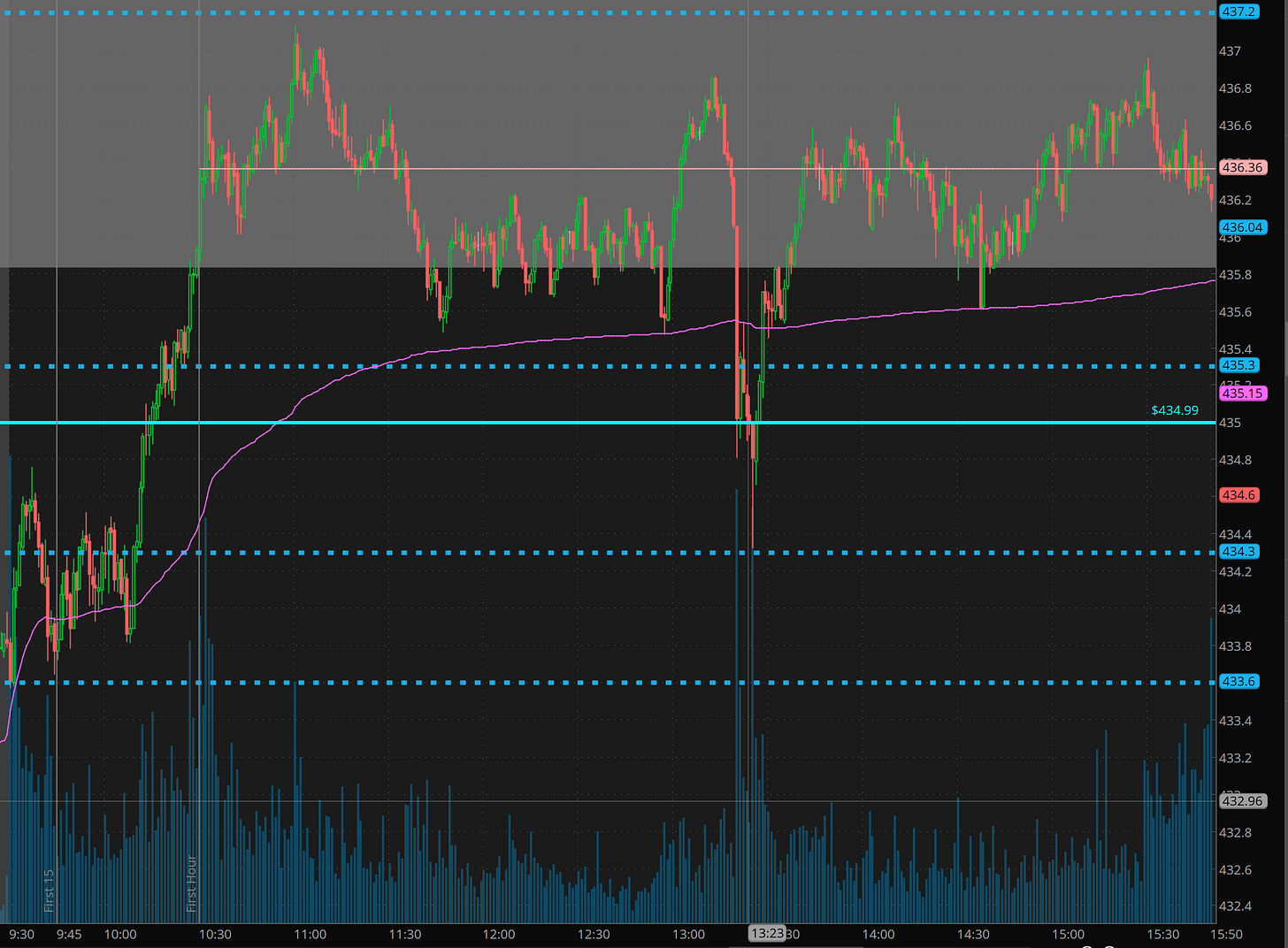

I preferred to wait. Ended up shorting the double top near 437.

This was my tradeplan. Now here is the trickiness. nailed the entry, and sold some at first target and I got stopped on the rest for smaller gains. I was frustrated to not get my $10+ exit. Edge nailed the T3 sell target!

I started mentally prepare for a long entry for a short squeeze, but we got a failed move over the peach line from the Custom Study Code I provide in thinkorswim. I love failed breakout reversals, and that led me to rerun the plan above. I went full size shouting it on voice for the mentoring students. On the second round I skipped the 8.5 sells, sold small at 10.50 and the rest at 15.50 . Why? Because it was a fast move right to one of my levels. One of the many rules I share/teach. This worked out to the best trade of the day for me

Using Edge Trade planner to help me target my sells has been a game changer for me. I hope Edge will be for you too… How many times did you have great gains, didn’t lock it in, only to sell for much less than you could have? When you look at trades systematically, it become less about maximizing gains on each trade and more about collecting profits regularly.

Outside of this, there were a handful of other trade opportunities, but as expected small trades and choppy action. After reviewing my trades, I determined I gave back about 1/3 of my profits on the day due to the chop.

What I’m looking for on Tuesday

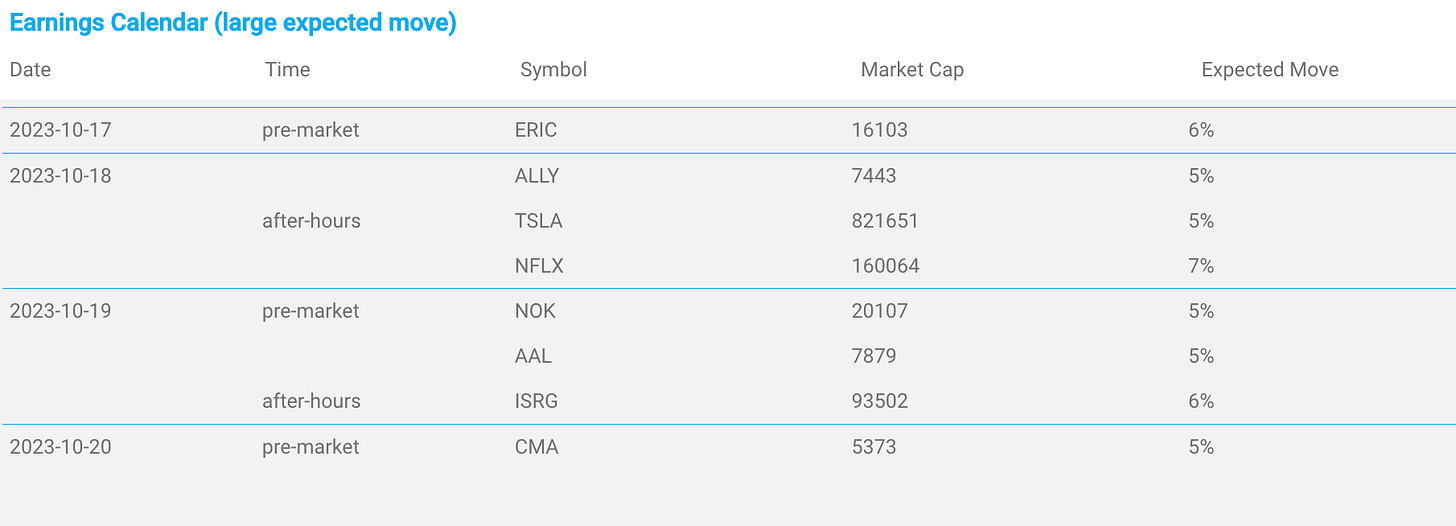

I’ll see if ERIC gives a tradable opportunity.

SPY 0.00%↑ I’ll be looking for more chop and consolidation action. Overall I want to wait with the market for some earning results. probably 433 to 437 range. If we break 434.30 I’ll start to hawk for a downside play if 434.30 turns into a ceiling.

TSLA 0.00%↑ and NFLX 0.00%↑ report this week and contracts are juiced. I will wait for after reports to trade.

Overall I am open to not trading today or focus strictly on range trading setups. Look for a fast buck for reversals toward vwap vs a multi-level trending pay day.

AAPL 0.00%↑ had non stop put buying on 177.50s so I will keep an eye on those or if AAPL starts to break down targeting 174.80-175.50

I’m not worried about making money today because I know there will be high probable/high reward trades coming Wednesday and Thursday.

Changing your mindset from must make money today to, I will only take A+ trade setups, will shift the dynamics of your trading results.