NFLX reports triggering market gap up. $SMCI back in beast mode? Let's plan 300%+ gainer trades today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading. Additionally, you will have access to the top scanner results for ideas in Edge Trade Planner (Beta), a powerful tool to enhance your trading decisions.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day with a goal of earning 100-300% on the capital I risk. A few key benefits of limited-effort trading:

Higher Quality trades with better reward/risk

Avoiding Overtrading and losses from it

Not selling too soon

(more info to come )

Tuesday’s Price Action

SPY - consolidates and forms strong base

I wanted a second read day with more dip to get long for a gap and go day. Unfortunately we got a limited dip and I didn’t get the dip I wanted to scale in for swing trade or same day scalp.

I tried 4840p wanting 482 in a great feat 480 to backtest the breakout. We only got 483 before establishing support and reversing.

I alerted filling at 2.50 and selling at 4 and 4.50. got stopped on the runners. I was so frustrated because I had 0 doubt a rally in latter part of week is coming, but I wasn’t getting the dip I wanted to load up for a 10x trade.

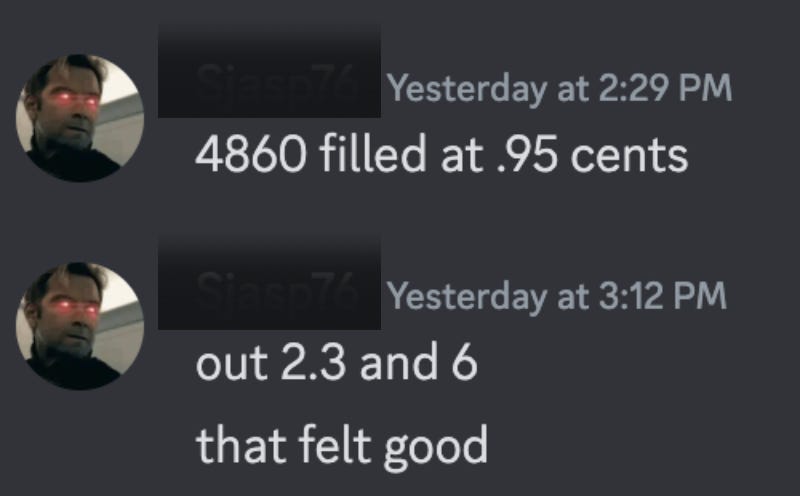

Once support got established I attempted longs on 4860c target 4-6 for exit but got stopped flat. I was feeling super impatient and I had spent the 2 hours I planned on for trades and decided to call it a day and save my energy for today.

It was a frustrating day but then I checked messages…

I got a message from one of students who nailed the entry for SPX 4840c earning 100% and 500% gains! This really made my day.

The Overall price action was that as long as 482.50 held, upside rally was coming. and this morning we are gapping up strong. SPY 495 imho is on deck into Feb.

NFLX reported and rallied after hours, taking SPY over 485 at which point, I took SPX calls overnight. Note: IB let’s one trade SPX contracts after hours. Did you know you can trade SPY/QQQ options until 4:15pm at most brokers?

COIN - gapped down is it smoked?

That is the thought I had when I saw bitcoin under 39k and I was anticipating a 38k break.

in case of fast flush I took chase size puts near the open and again later at 125. Both trades started to work but I essentially got stopped out flat or small losses.

Again I was emotionally being impatient and too short biased. This added another reason to call it a day.

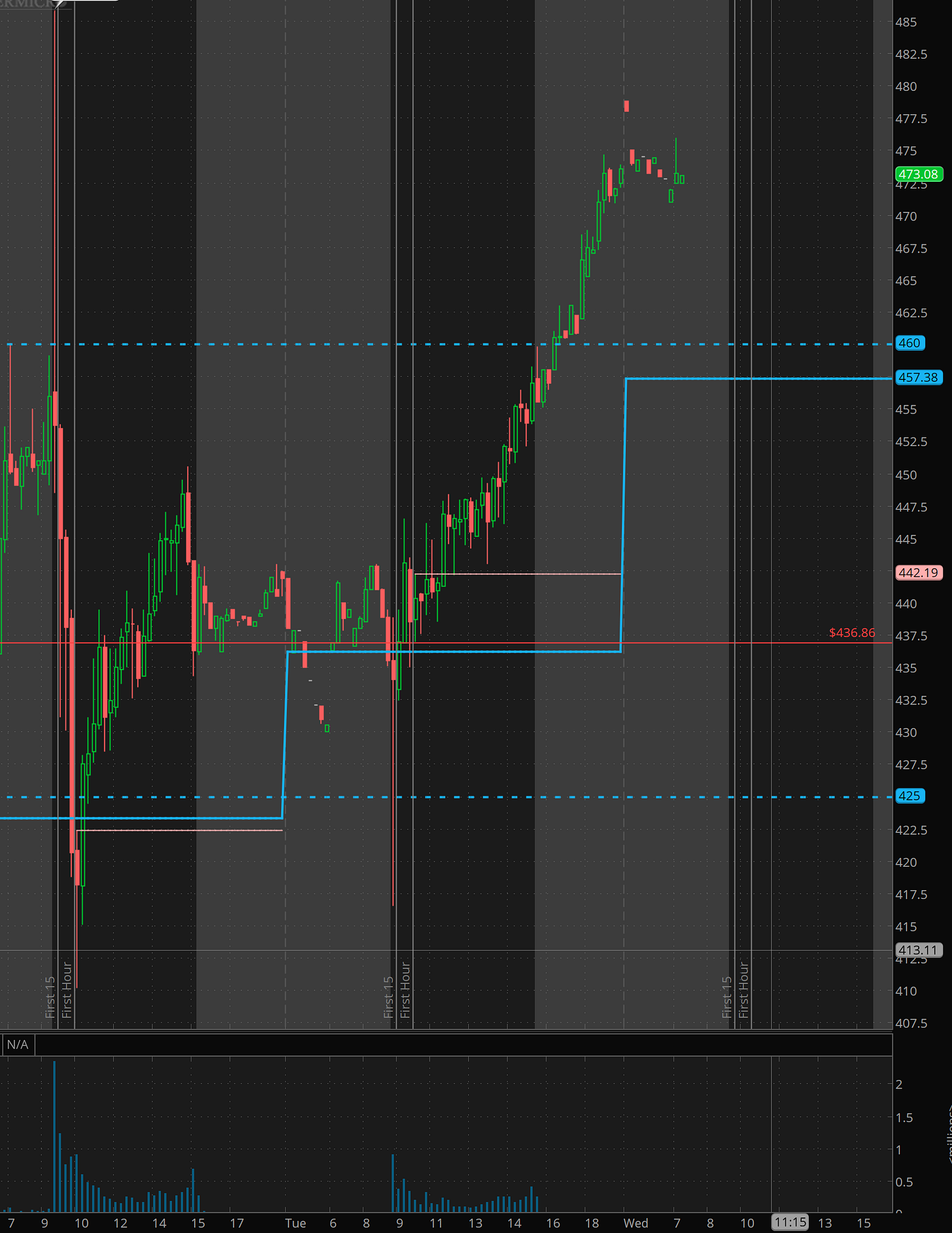

SMCI - double bottom and ready for next leg

yesterday I wrote I wanted a dip into 390-410 in an ideal world targeting 460-480+ as a swing. we dipped into 415 and quickly reversed and are gapping near 480 this morning.

Just like the day before fast opening flush and then bids all day.

The scanner caught lots of call buy all day yesterday and they are being rewarded this morning.

SMCI reports next week.

If you took 450c for around $10 these should be 30-40 by the open.

TSLA - failed push again

Yesterday I wrote that TSLA could be pinned around 209. We got a fast push into 215 and then faded and was pinned around 209. TSLA reports tonight.

Summary Review of Market Price Action

Overall the market based yesterday and was waiting on e/r for a direction. Given the reaction to NFLX looks like upside has been picked but market is extended.

Overall Ill be eyeing BTFD trades and scalping gap up reversals/exhaustion moves. We are moving into an area where we can see large whipsaws.

Educational Lessons

From the price action review you should have learned the following:

Don’t have to catch every trade

Making 100%+ trades is on a consolidation day is still very achievable.

On day 2 consolidation day, scalping short into resistance for fast profits can work.

Even with the experience one can make mistakes/get impatient, when that happens, better to walk away and avoid emotional trading. Remember this is a marathon and you don’t need one trading day to ruin future days.

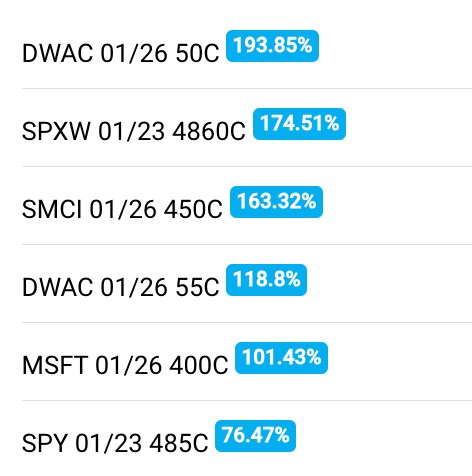

Edge Trade Planner - Top Scan Alerts

No surprises here that the gains were only 100-200% given the consolidation day.

Below is the timing and the alerts using the criteria I like. As you can see there were only 3 before lunch. There will be days like this. Recognizing this had me stop for day trades and just let swing trades work.

Trade Ideas - Plan for Wed Jan 24

NFLX triggered the market gap up. Fear and Greed index is almost to Extreme Greed. This makes me think we are could see more upside, sometimes the candles triggering extreme greed can be huge.

For anyone that is more inclined to swing, I’m also considering a small start for 4-8 weeks out swing put starting at 488 but prefer to get positioned short in 495-500 area.

Stick to process. I’ll be looking for some names that are laggards to possibly gap and go while others we need to look for possible gap up reversal scalps for some gap fill.

SPY - looking for double top around 488-488.50 to scalp short. or dips into 486 for a long.

TSLA - Let’s see what news comes out and how market react after e/r. Overall given the environment we are in if they say anything positive about the sub 25k model and address Musk recent comments about ownership ai and robotics, TSLA could start to run toward 250 again. if not 180 can come. I plan to wait until tomorrow to trade.

NVDA - like 625-630 area for a short if it gets there, otherwise dips on 595-598 for a scalp long.

SMCI - reaction to 485-488 is key. over 488, may look at dips for 500c. Reports next week. dips on 460 will consider longs.

NFLX - I don’t understand how this name keeps ripping, but overall I think it could see 560-580. I’ll be hawking for momo trades

SNOW - possible multi-month breakout. could see 220-225 this week, then back test, then 250+ later in coming months.

Don't forget to like and share this post to spread the knowledge and help your fellow traders!

Disclaimer: All content provided is for educational and entertainment purposes only. It should not considered financial advise or a recommendation to buy or sell a security. The content is the author’s opinion only and may or may not be accurate. Author may or may not have positions in securities and may or may not open a position in next 48 hours.