New Highs Again, but market gapping down. FDX wrecked after earnings. Plan for Wed Dec 20.

Trade Reviews

Overall I trade short a couple of times, looking for gap fill and then wanted to go long, but we got a tight range all day and finally a squeeze into the close.

It was very difficult to get a read on if we would breakdown or get a squeeze into the close. So the best thing one can do is no trade/walk away or wait for last 30 minutes and play both sides of the range when contracts get cheap.

To get paid one has to wait for contracts to get cheap and effectively target the close. I was thinking we would get a close either around 4758-4761 or 4767-4770. Using these SPX targets these were potential trades.

SPX 4760p for 0.5 get a 3-4x opportunity

SPX 4765c for 0.3 get a 10x opportunity.

SPX 4765o for 1 get a 3-7x opportunity. (This only dipped to $1.50) so no trade.

Overall Its hard for me to get long now without any major pull back. These slow grinders are one of the most difficult trades for me as I worry about a sudden yank.

I need to get a BTFD dip entry and preferrable triggered on via a failed breakdown. Otherwise my goal is to not trade and preserve capital.

COIN I thought was going to be done, but made a monster recovery and run. Took an extra 2 weeks to get to the 162 target.

When markets get slow I go back to old roots and look for other opportunities.

Saw news on MULN and liked the short at 0.099-0.1 thinking this could see 0.05 to .08 on the 100 to 1 reverse split announcement. hit .08 for 20% gain overnight.

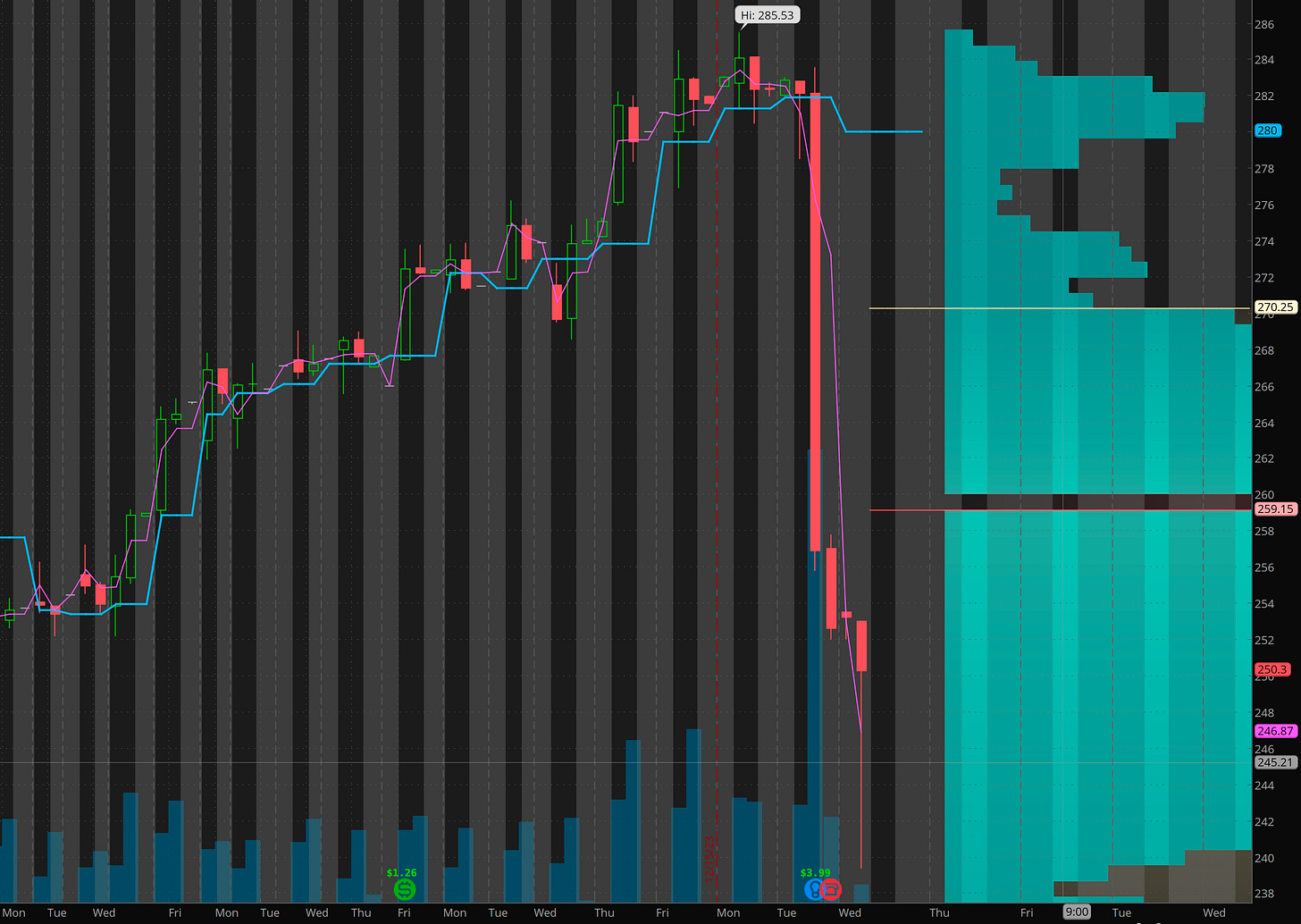

FDX wrecked after e/r

FDX dumped after guiding lower and expect soft 2024. This is indicative of a slow down in economy. IMHO, the gap down in SPY could be attributed to this.

Plan for trading Wed Dec 20

Given the move in FDX, I’m going to take that as the first signal for market to take a breather.

I’ll be looking for pops to get short vs yesterday’s close on SPY. That said, I don’t see this alone killing the momentum and BTFD trade into January.

I’d like to get short targeting 469-471 to come and then relong there for a rally/swing into next week. I have no idea if I’ll get the short play. over 475 and SPY could squeeze into 476-477.

So overall I’m expecting more of the same, lots of chop and tight range during consolidation with fast small range moves with limited follow through.

I'm going to focus on NVDA, NFLX, and TSLA today and maybe keep an eye on AFRM/UPST for possible exhaustion for a short.

Remember once the first round of selling comes, there will be plenty of opportunity so don’t worry about catching the top. For now wait for dips to get long, or short parabolic exhaustion moves.