Multiple 10x and 200x opportunities yesterday as well as multiple 100% gainer trades. Selling in Tech while SPY continues to hold support. Plan for Fri Dec 1.

What an exhausting day yesterday with an exciting close.

I started of getting short out of the gate yesterday given the premarket action after PCE numbers. I was spot on regarding seeing 465.50 rejected. We then dipped into the 453-454 zone.

One of the key principles in my trading is the moment I decide on a direction does not translate to an immediate entry. I want to look for the best price I can for a trade.

The morning gave SPX 4550p at $5-6 for an entry at got to $10+ 3 times in the morning. It was definitely frustrating because I wanted 453 to break and give the big pay out. We also got another win for the premium selling and my algo signaled sell 4555/4560c at 2.60 that went to .05 for the exits before after noon squeeze took it to 5.

The key here is that once the contracts doubled I would sell 50% and then raise stops. I knew 453-454 has had significant buying for the last week so I didn’t expect the break to come on the first attempt.

Not bad work to double your money 3 times.

We’ll come back to the after SPY action in a minute. Let’s talk about the tech sector which experience some decent selling.

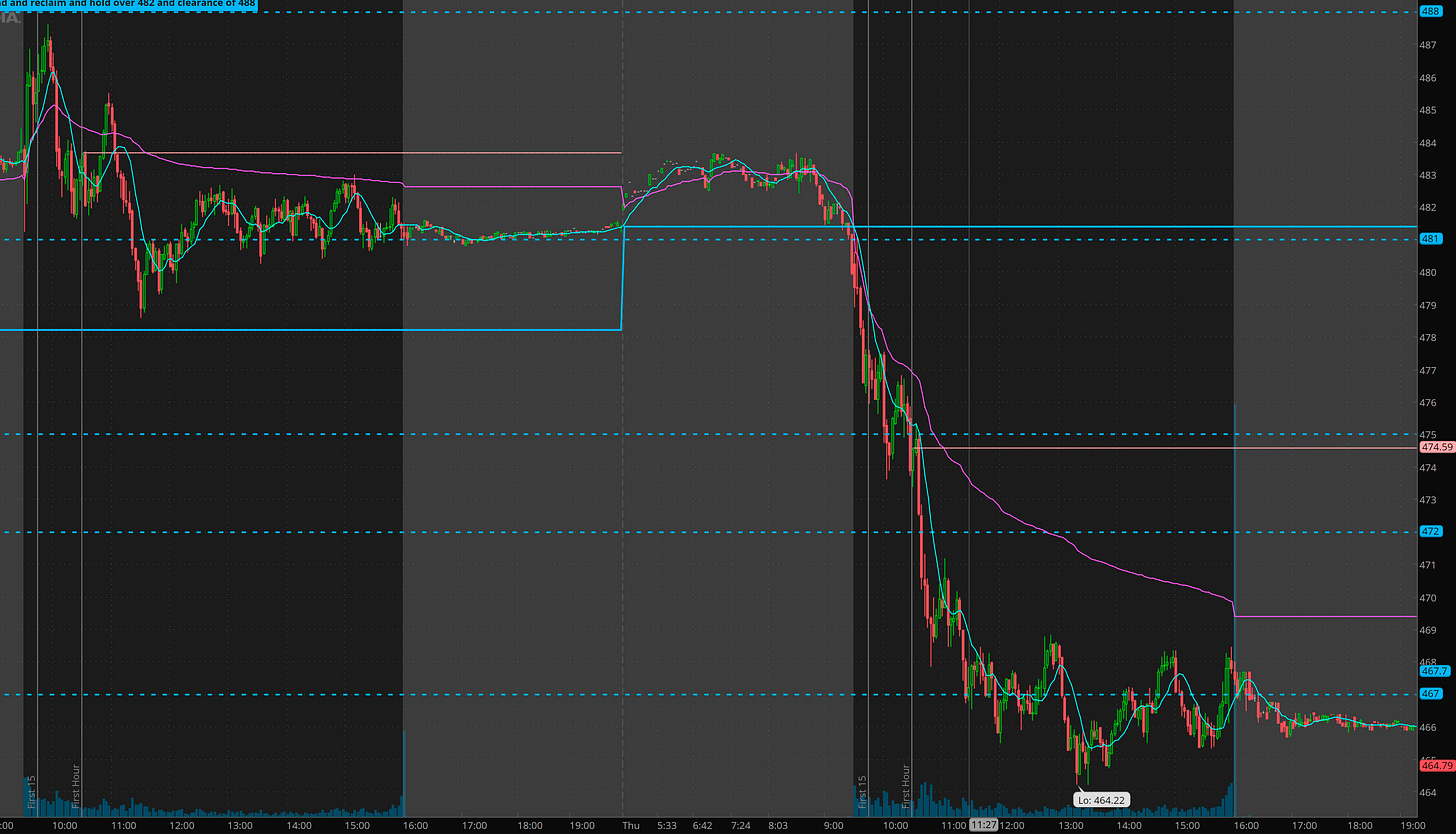

$NVDA

NVDA I had mentioned that 482-483 needs to hold for upside otherwise if 475 breaks we dump. That played out perfectly. I was wanting 481 dip and then clearance of 484, but for a long trade, but I also started a swing short on Wednesday once 487 rejected and 488 could not be reclaimed. That short paid off nicely. If you notice, I make bull and bear plans. I don’t care which direction, I just want great risk/reward. Sometimes I will short the top end of a range, and long the bottom end of a range and let market decide which side breaks.

As you can see once 475 broke straight selling. Following my rulles and plans, once we get got to 467 I was all out.

SPY 0.00%↑ afternoon

After seeing the lunchtime and first hour price action, I started anticipating that we would get a squeeze in the last hour. Why? We had a failed break down reversal candle and 453.50 was strong support. I also used edge and noticed what appeared to be premium selling instead of directional buying.

Given that action, I was able to snake some 4560c for 0.50-0.80 and flipped and sold 4550p/4535p for credit.

I unfortunately didn’t monitor 4560c until after we started the move higher. If you watched these contracts after I mentioned to hawk for a squeeze it did an incredible 200x opportunity going from 0.05 to $10! unfortunately I only got 12x+

What does yesterday’s Price Action tell us?

SPY held the 9ma on the daily. Overall it’s still grinding and we are back into the consolidation zone. Some short loaded up and we got a squeeze into the close and some gap up premarket. Overall today will tell us if the buying is real, or if that is just a faker move/squeeze. Tech broke the 9ma but strongly bounce back over.

Overall i expect a dip on the open to test r/g level or maybe one level below and then upside OR range based consolidation. If market breaks yesterday’s lows, then I’ll expect some additional selling to come.

Bottom line, we don’t have clear directional bias. Its OK to stay out and not trade.

Plan for Friday Dec 1

I’ll be watching price action for first hour to see range get set and see if we get any range breaks and/or trend. If not I’m making it ok to stay out today. Yesterday was an amazing day, why push it?

SPY 0.00%↑

So if SPY breaks 453, I will consider a 5-10% account size short position on a backtest entry. If SPY clear 457 and dips 456 and starts grinding, I will start small long and then add size if 458 clears.

In between 457 and 454 I expect to be a nasty chop zone.

TSLA 0.00%↑

Had delivery event and sell the news action. looking to get short on pops and scoop long around 224 to 228

I’m looking to start a swing long, however ideally i would like to get long closer to 440

For a scalp trade, if NVDA clears 470, I like it long to test at least 474-475, and may get to 480+ next week. If 465 breaks, I’m expecting more downside.

Good luck today. Keep an eye out for commentay in Edge. Consider trading smaller today, I think it will be a wild/screwy one today.