Monster November Rally, December kicked-off green, SPY Gap down while COIN and MSTR rally

Also, UBER joins SPY index.

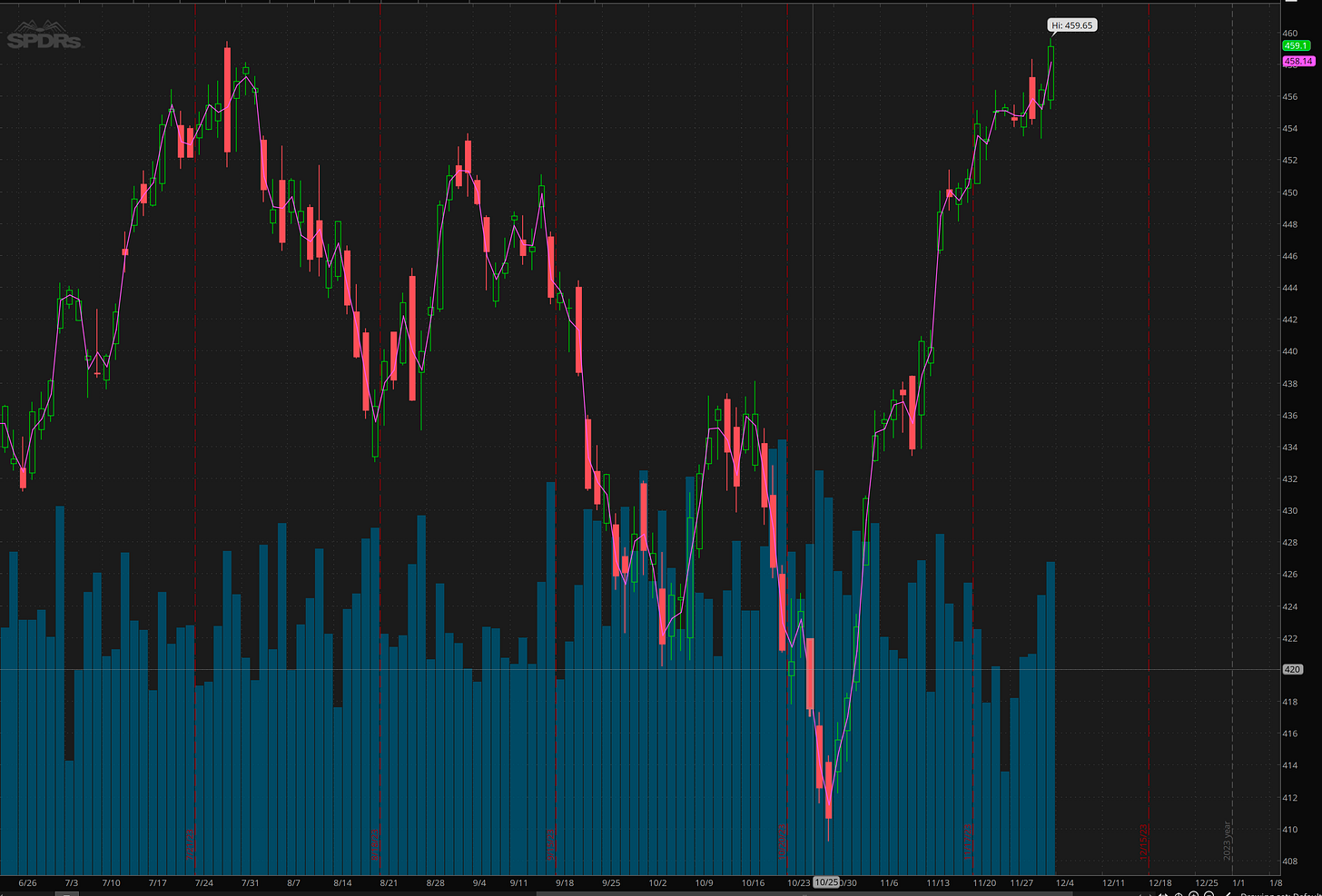

It’s amazing how markets can flip so suddenly. As we headed into end of October, market sentiment was strongly bearish and then after one month sentiment has shifted clearly bullish.

On Friday SPY closed at a new 52week high.

Let’s take a look at the trade plans for Friday.

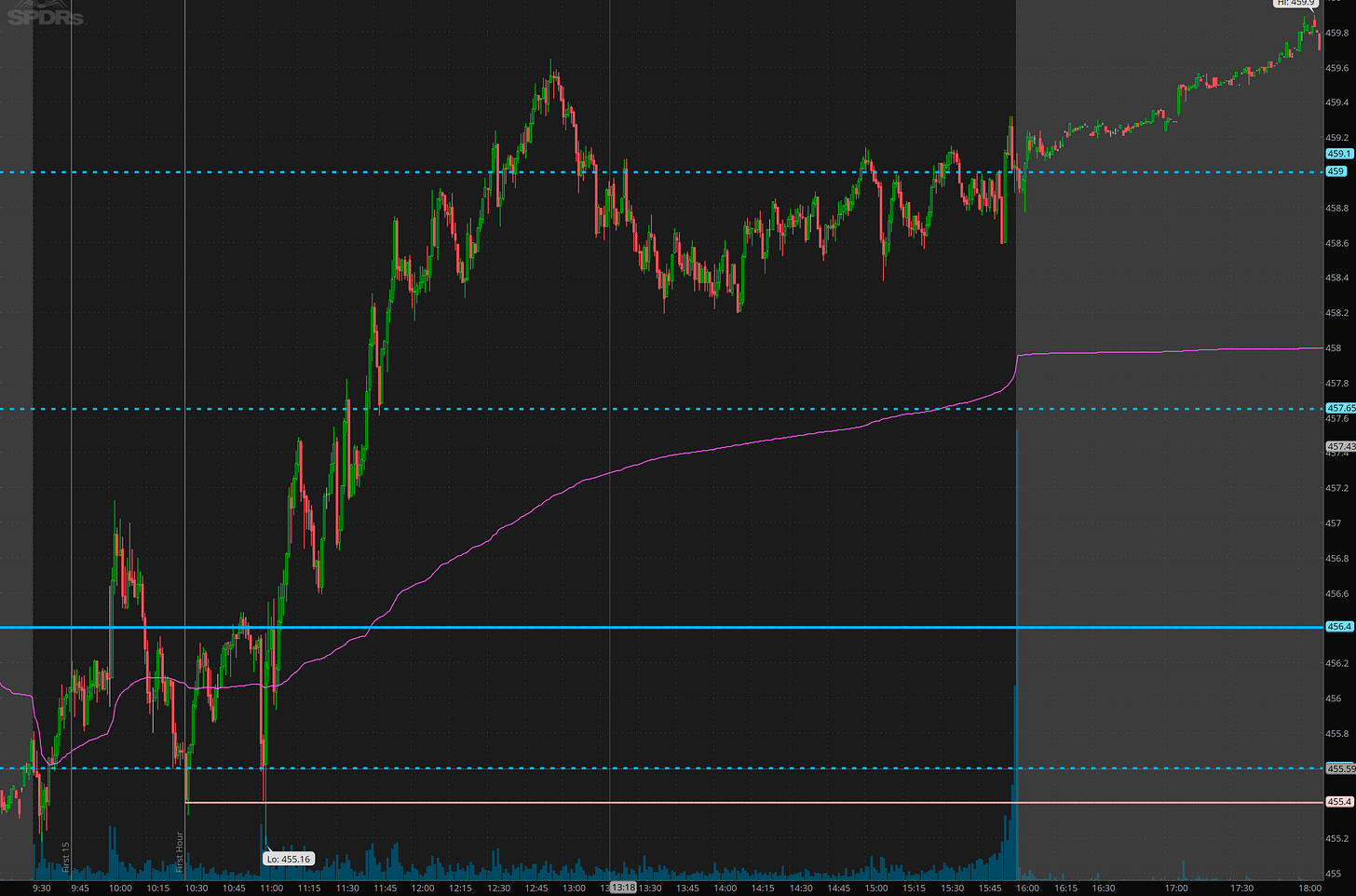

My latest scanner for premium selling indicated around 10:00am for a bearish move, and sure enough we went red and tested support. This had me wondering if the short squeeze on Thursday was just a squeeze into the close vs real buying.

Then we had a failed break down reversal at 11 after Powell’s comments. Notice the new low that was then bought up. 30minutes later we clear high of day. I had commented that we should be looking range break. Once we got the failed breakdown combined with a range break, it was time to get long.

I alerted members that I was taking SPX 4590c for $4 target sell 8-12. Absolutely nailed it. Notice, I waited for confirmation on the 457 range break and then entered on the back test.

During last hour I tried to position for a dip into vwap as well as s squeeze back on the highs.

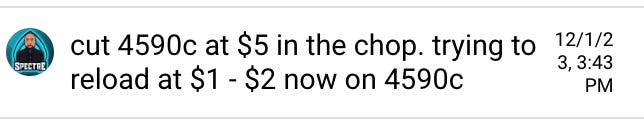

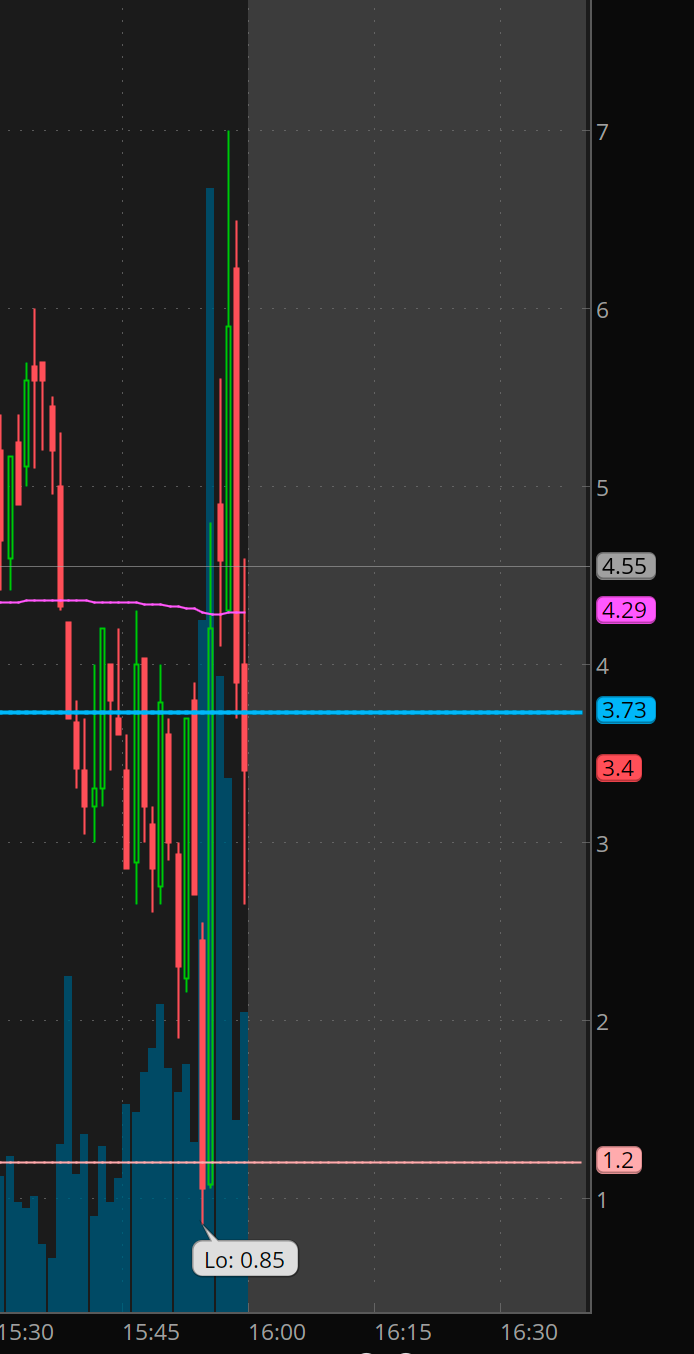

Took 4590c at 5 average but it wasn’t getting any follow through after dippng into 3.50 a couple of times. So when we started running out of time, it was time to cut and reposition for a cheaper entry.

And sure enough we got a dip into $0.80 and then ripping into 7 before closing at around 3.40. What an exciting close. This is why I stress on planning and discount shopping., placing orders in advance get let you get filled at great risk/reward prices.

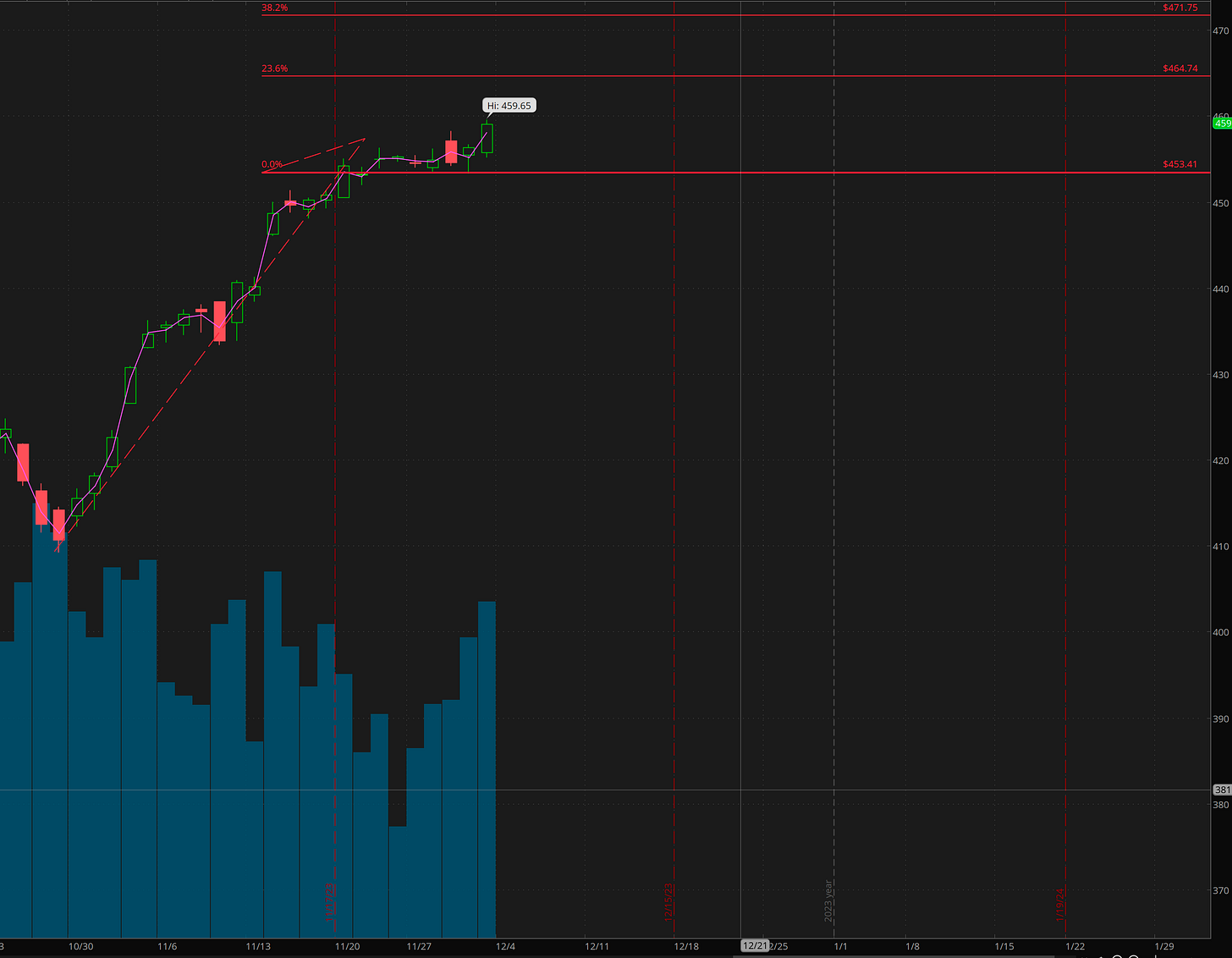

SPY 0.00%↑ is gapping down this morning, but if the rally continues into a Santa rally, and SPY 453.50 hold, this is my projection/targets for the month of December.

In theory 470-472 for next couple of weeks, and 480-483 is possibly by end of year.

I may be wrong about not hitting new all time highs this year. That is the great thing about day trading. I know my trade setups and levels and process, and I don’t stress about overnight fluctuations. Overnights moves create opportunity.

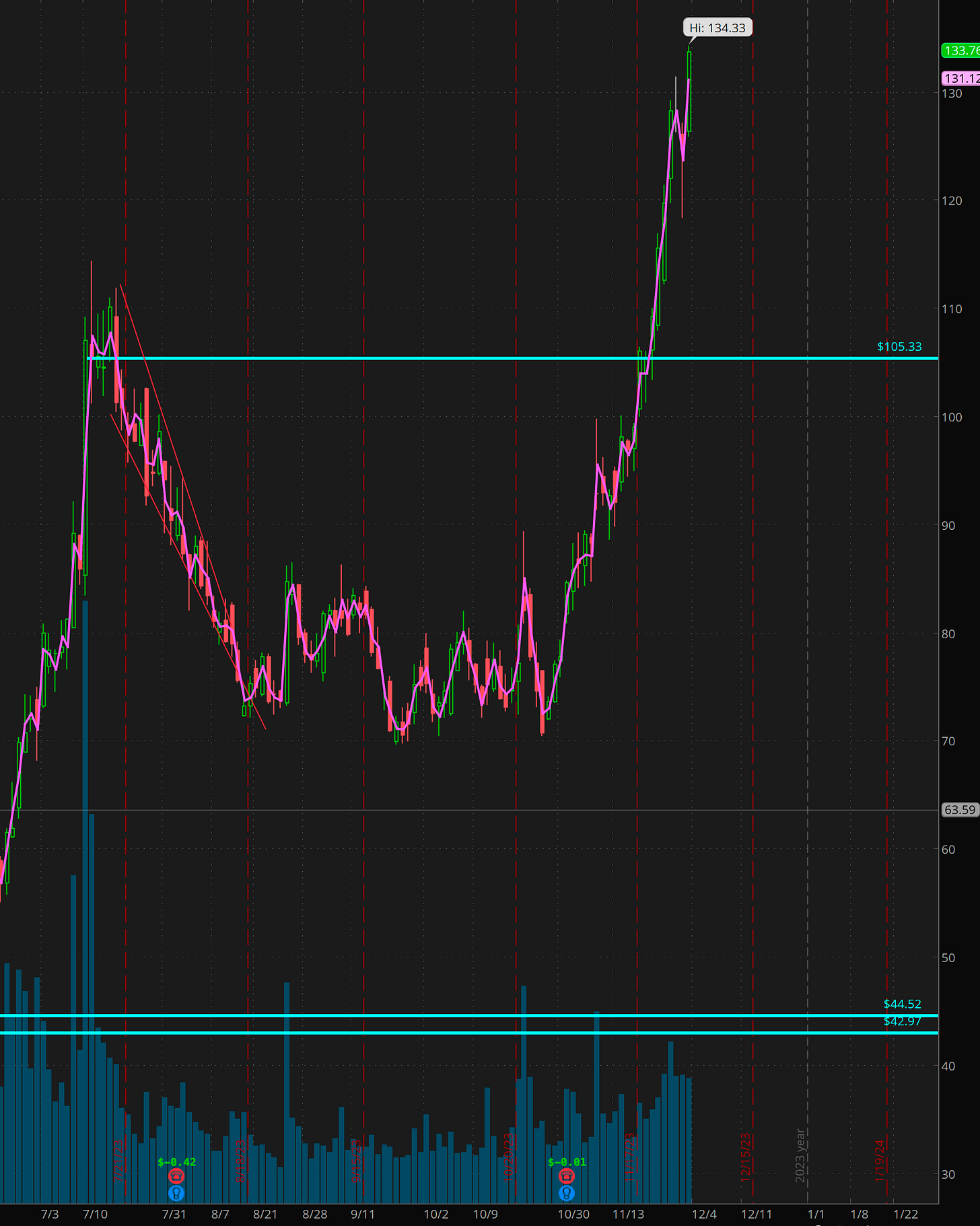

Bitcoin Rally and its effects on COIN and MSTR

Back when COIN was around 108 I had mentioned I liked COIN and MSTR for swing long. This morning we are gapping up over 140. Bitcoin had based for last 5 or 6 months and was breaking out. I really wanted one more dip, but it never developed on it and now FOMO buyers should start showing up.

COIN makes money on volume/transactions, when FOMO kicks in, revenue should get a boost which will translate to more profits and a higher valuation. COIN will like hit 200+ next year.

MSTR invests in bitcoin and has been acquiring BTC. If right, I think we see 600+ this month.

This morning COIN is gapping up. I’m targeting 155-165 for an exit on calls this week.

Plan for Mon Dec 4

We are gapping down this morning, and that means opportunity! The bigger picture for now continues to tell the same story until it stops. That story is BTFD. Buy The F***ing Dip.

I will keep doing the same thing over and over again. Be patient, wait for A+ setups, ideally failed breakdown reversal to capture that dip buy and trend until that stops working. I’ll also keep targeting resistance levels since we are near top of the range for possible exhaustions to get short.

Overall we are building toward more upside, but at some point this month we should get at least a 3 day profit taking and reset move. I will stay on bull side until supports break and it becomes evident that a sell program is back on.

So ideally SPY dips into 457 on the open and then we get rally back toward 460. Overall looking for 461-464 this week to to come.

COIN 0.00%↑ I’ll be watching dips after this gap up to add. I’ll also look for a possible gap up reversal scalp trade, but overall I think dips will get bought up until 155-165 area comes then maybe some chop. Bigger picture, Imho, if and when BTC reaches 100k+ in 2024 or 2025, COIN should be over $400.

It’s time to pay attention to beat down names that will likely get bidders if market rally continues.