Merry Christmas Traders! Will SPY give gift us new all time highs today? -- Plan for Wed Dec 24

Our Bull Puts paid! AlphaOS is making Credit Selling and directional bets easy. Holiday trading = extra attention to avoid over trading.

AlphaOS Charts made it super easy to get long as I alerted/discussed in the room yesterday.

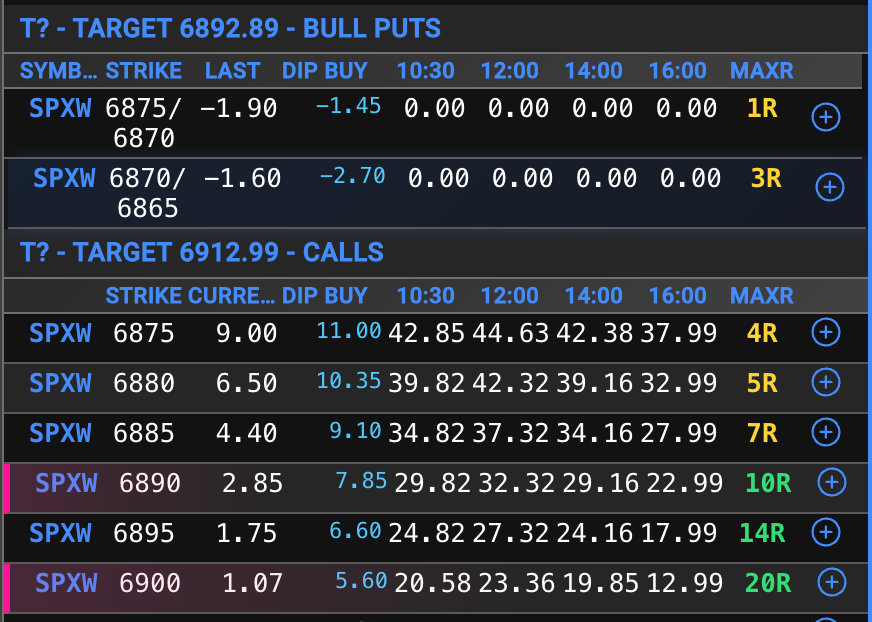

at 10:05 am I saw they were loading up 6890c and 6900c! and I was more aggressive and alerted take SPX 6880/75 bull puts.

Using the ideas and contracts on watch it was easy to know which bull puts to take and to take some SPX 6850c give the love it got at the open. (pink bar)

Process = Profits

Lately I’ve been doing the following:

Premarket establish where we likely wont reach. Sell premium for 0.8-0.60 on open.

After 11: second positioning of credit sells.

After 3:30: start hawking/planning for a Spectre Special

What’s a Spectre Special? A yolo trade that goes 300-1000% in under 30 min.

Credit Selling

SPX 6880/75 bull put - WON

NAKED Direction

SPX 6890c - WON 2.80→18. (Thank you Santa!)

Spectre Special

WON 6910c 0.20 sold 1.20 and 1.50

VIDEO RECAP SPY/SPX on Dec 23

None

If you are tired of overtrading, not knowing how to plan trades, and want to make more in less time, come join us.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Plan for Wed Dec 24

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

SPY Clings to Support Before Holiday Break

Hold the Line: Navigate Low-Volume Risks for Quick Gains

Market Context

SPY wrapped up last week on a resilient note, closing around 687.91 after a choppy session that saw it dip to 687.66 before rebounding. Over the past five days, the ETF has shown a bullish bias with higher lows, bouncing from multi-day support near 676.59 and testing resistance around 689.39, but premarket action today is flat around 687.50 amid thin holiday trading. Chart patterns indicate a potential flag formation after the recent volatility spike, with price action respecting the pivot at 686.35—holding above it keeps the upside open, but a break below could signal a failed breakout reversal. Overall bias leans cautiously optimistic for momentum plays, as volume remains subdued heading into Christmas, but watch for any pre-holiday positioning before the close.