Lead Generation – Identifying Trade Opportunities

Part 1 of 7 in the 7 Systems You Need to Trade the Lazy Way

In the world of business, lead generation is the lifeblood of growth. Without it, a company can’t move forward. The same applies to trading—if you’re not constantly finding and identifying profitable trade opportunities, your trading journey will stall. But finding these opportunities isn’t just about looking for any trade—it's about finding the right ones. In this post, we’ll explore how identifying the right trades is the first step in the “lazy way” of trading.

What is Lead Generation in Trading?

Just like a business looks for leads that could become customers, as a trader, you need to identify setups that have the highest potential for success. Lead generation in trading is about scanning the market for opportunities that align with your strategy, risk tolerance, and goals. Without a clear strategy for identifying trade opportunities, you're just gambling.

How to Identify Trade Opportunities?

The process of identifying opportunities in the market isn’t much different from looking for promising leads in business. Here’s how to do it effectively:

Use Market Scanners and Tools:

Leverage technical indicators like RSI, MACD, and moving averages. These tools can help you quickly spot overbought or oversold conditions, and other setups that might signal an opportunity.Look for Unusual Volume or Volatility:

Stocks that experience a spike in volume or volatility are often indicating potential movement. You want to catch trades when there's a good chance of significant price action.Monitor News and Earnings Reports:

Fundamental catalysts, like earnings reports or significant news events, can provide excellent trading opportunities. These are often times when stocks move in predictable ways.Follow Your Strategy:

Stick to your criteria. Whether you’re swing trading, day trading, or investing long-term, your lead-generation process should always filter out noise and keep you focused on setups that fit your defined strategy.

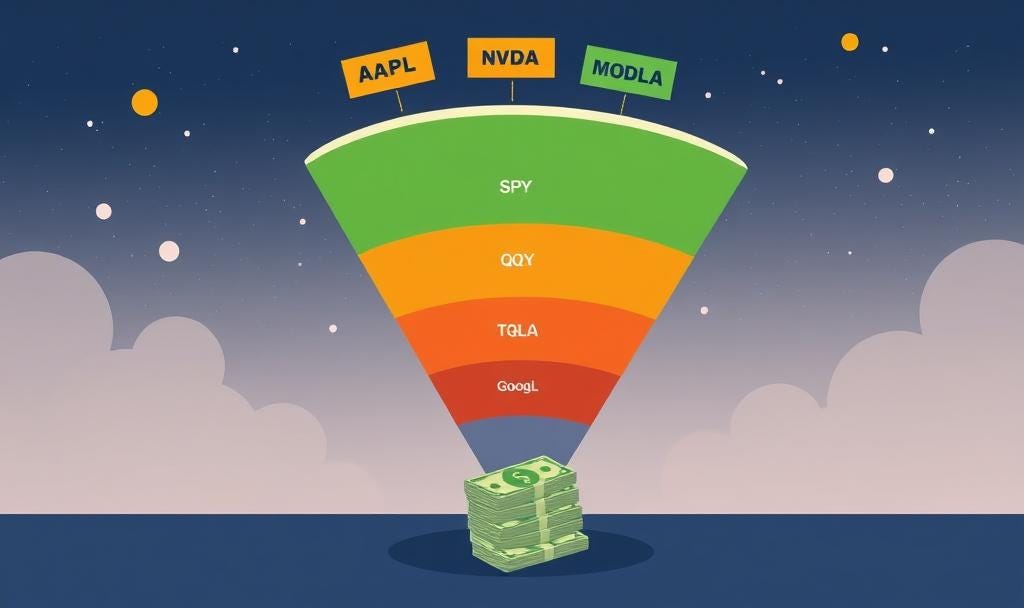

Develop a Trade Opportunity Funnel

Just like in business, not every lead is worth pursuing. The market is full of opportunities, but not all of them meet your standards. You need a system to filter through all of them and find the best candidates for your trades.

Create a “trade opportunity funnel” by:

Filtering out low-quality setups based on your predefined criteria.

Focusing on high-probability trades that fit your risk/reward profile.

Scanning daily for fresh opportunities and adjusting your funnel as market conditions evolve.

Conclusion: Start with the Right Opportunities

Lead generation is the foundation of a successful trading business. Without it, you're simply reacting to the market instead of being proactive. By setting up a systematic approach to identifying trade opportunities, you’ll be able to position yourself to capture the best trades with confidence. Remember, success in trading—just like in business—is all about finding the right leads.

Edge Trade Planner – The Tool Purpose Built to help me be “lazy”

Speaking of systems, Edge Trade Planner is the tool I personally built to support my trading process. My goal? To spend just 2 hours a week trading, with everything running on autopilot. It’s not there yet, but we’re getting close. With Edge Trade Planner, I’ve designed a system that helps identify the best opportunities, automate the planning, and track the performance—all with minimal effort on my part.

Want to know how here is a small glimpse of what it can do now:

Option Scanner - Identifies patterns in option volume that match my special mix of criteria that identifies what big money is doing

Playbook Scanner - Imagine if you had access to generated trade ideas and plans based on my playbooks. I’ve got my #1 playbook added and my goal is to add one playbook per month to catch outlier plays… The plays that help me identify 500-1000% gainers. I’m tired of watching screens, but I’m not tired of trading profits ;)

Level based Ideas - A section where I, or other trader share ideas based on what levels we are watching for a reaction t or what level we believe a stock will reach. It’s a powerful way to narrow down what to focus on.

Chat - Where experience traders share ideas and trades in real time.

If you want to be a part of this journey, come join the community! You’ll get early access to the tool as I continue to refine it. Together, we’re building something that will help make trading more accessible, “lazy”, and (hopefully) profitable.

Stay tuned for the next post in this series, where we’ll dive into how to qualify those opportunities and decide which trades are really worth your time and effort. You don’t want to miss it!

Ready to trade the lazy way? Let’s keep the systems rolling. Stay tuned for Part 2 of the 7 Systems You Need to Trade the Lazy Way.