Is the BTFD train done? Bearish engulfing candles on SPY and NFLX. My plan for Thurs Dec 7.

Also... AMD and GOOGL news

Price Action and Trade Reviews

Sell Credit Strategy

So 2nd loss on Sell Credit strategy algo strategy, but mostly because I was biased and ignored the opposing signal. If I had and used 0.50 stop on both, would have come out ahead. Overall 23/25 wins. I’ll take it.

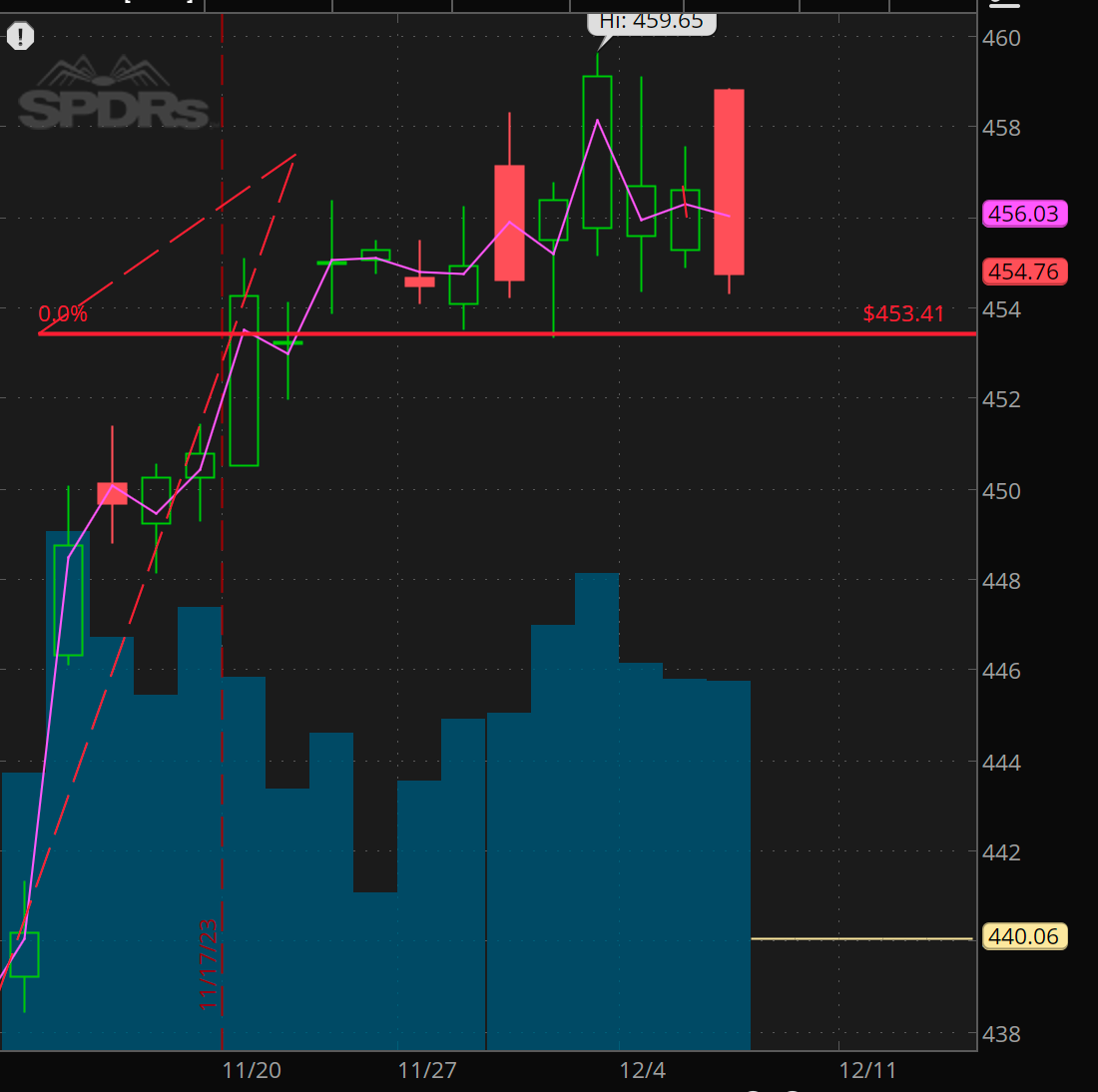

SPY Price Action Review

The gap up reversal and fail off 459, was a no brainer short. and it paid quickly. The major question in my mind, and where I went wrong was I was expecting SPY 457.20 to hold and start a grind higher. We had what appeared to be a failed breakdown under 457.20 and then a reclaim over after the first hour. So took starter long and plan was to add once over vwap. That didn’t develop.

I was then long biased on not interested in a short until we broke 456.60. At this point I started a small short targeting SPY 455 to come to get paid. I was red most of the day, until we got the afternoon flush into 455. I tried small call yolos in case a dip and rip would come, but the sellers overwhelmed the bidders.

The best trade for me yesterday was the short on rejection of 456.60, but it took 2 to 3 hours to play out. At 1pm we got what looked like a reversal candle., but the reject on 456.60 again and being a lower high was the signal to get short.

Using the levels I share is essential to my trade planning. I like to trade SPX so I had a target of SPX 4520 and 4545 so taking SPX 4560 for under $2 was a no brainer. at 4552 it would be $8 and at 4545 it would be $15. That is 300% and 500% gainers by using the levels to plan! This is why I don’t care about losing on my starter calls. with tight stops. lose $1-2 bucks but then win $4 to 10.

Or if using SPY, taking SPY 456p for 0.30 ran to $1.50 when it got to the 455 target.

So is BTFD dead? It might be for now. Overall market seams to be waiting on next week’s economic data. The key is to use key support levels, and honor stops. Don’t sweat losing and give up on a strategy when it loses. But if you don’t honor stops and price action it can get nasty.

Bearish Engulfing

Here is what a Bearish engulfing candle is and often can be an indicator of a reversal.

SPY - That isn’t a great look and we now have a triple top on 459 and a close below the previous 4 day opens. $453.50 break, can lead to a corrective move into 450, 445, and 441. Will the last 2 weeks of basing lead to a dump?

NFLX - Also, I was planning to get long, for another leg up in market, but the price action proved not great when 448 could not hold. We were able to get short on 451-452 back test intraday

Plan for Dec 7

$AMD - is gapping up on AI chip launch news. I think the AI trade for now is tired. Looking for a gap up reversal unless market as a whole rallies hard.

$GOOG - gapping up on launch of Gemini product and deal with McDonalds for AI in service industry. I’m also looking for a gap up reversal

$SPY - Will watch for a back test of 456 to 456.50. If that rejects, will take starter short. I’m still not 100% convinced market is shifting into sell mode until I see 453.50 break. The only reason I’m considering the short is the bearish engulfing candle. I would not be surprised to see another 454 dip and rip back into 459 over the next 2-4 days as we continue to consolidate ahead of CPI next week. BOTTOM LINE: we are still in chop zone.