INTC Ignites Premarket Fireworks with NVDA's $5B Power Play – Chip Titans Collide as AMD, ASML, and BABA Ride the Wave

Trade ideas in the Chip Chaos

Traders, buckle up – the premarket just turned into a semiconductor slaughterhouse, and Intel ($INTC) is the undisputed champ swinging the axe. We're talking a blistering +30% surge to $32.40 in early hours, fueled by Nvidia's ($NVDA) bombshell $5 billion equity stake and a multi-gen collab on custom chips for data centers and PCs. This isn't just a lifeline for the battered chip giant; it's a seismic shift in the AI hardware wars that could ripple through $AMD, $ASML, and even $BABA's orbit. Yesterday's Fed whispers and China's AI push set the table, but today's feast is all about Big Tech's unholy alliance.

We've scoured the wires, X chatter, and premarket tapes from Sept 17-18 to break it down. If you're long semis, this is your green light. Short? Time to cover. Let's dissect the action, news, and what it means for your book.

The NVDA-INTC Megadeal: From Rivals to Bedfellows Overnight

Forget the headlines – this is straight-up symbiosis. Nvidia's dropping $5B to scoop up INTC shares at $23.28 a pop, locking in custom x86 CPUs for their AI stacks and RTX-integrated SOCs for next-gen PCs. Intel's been bleeding market share to NVDA and AMD, but this flips the script: Intel fabs the silicon, Nvidia brands the magic. Premarket volume's exploding, with INTC flipping from yesterday's $24.90 close to a moonshot that erases months of pain.

Quick Tape Read: INTC 0.00%↑ NVDA 0.00%↑

X is lit with bulls calling this INTC's "redemption arc" – one trader quipped it's like NVDA handing Intel a "get out of foundry hell free" card. But whispers of regulatory scrutiny (hello, antitrust ghosts) could cap the rally. Still, if you're swinging calls, $INTC's weekly 200ma at $32.xx is your first resistance – breach it, and we're eyeing $34 monthly.

THT PRO MEMBERS ONLY - Easy Money Premarket Trade

TRADE IDEAS:

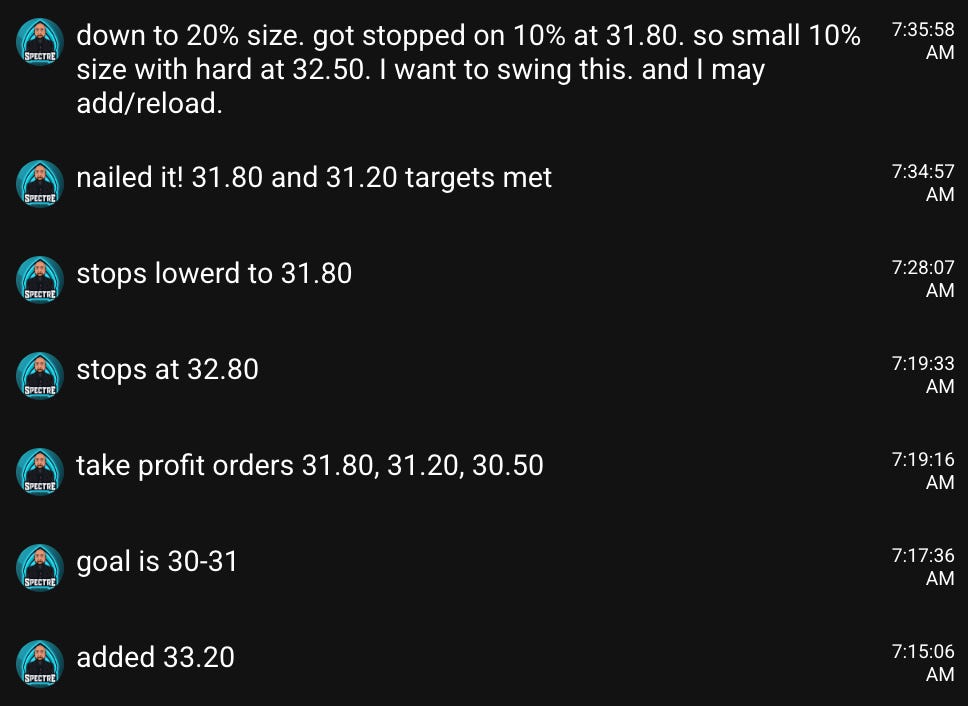

Short 32+ target 30-31 and 28-29 (Profit taking)

Long 30-31 if support comes in for possible short squeeze over 33

Wait for dips sub 29, ideally 26-28s for long term swing if you believe in game change, long term momentum develops.

NVDA Holds Steady Amid the Frenzy – But Is the Throne Shaking?

The GPU kingpin's dipping a toe (or $5B wallet) into Intel's pond, but premarket's shrugging it off with a mild -1% trim to $117. Yesterday's close held firm despite broader semi rotation, buoyed by endless AI tailwinds. News flow's mixed: MediaTek's nod to TSMC's 2nm tech screams "NVDA's moat is ironclad," but China's clampdown on U.S. chip exports has some eyeing Beijing's homegrown push.

Sentiment Check: X traders are split – some dumping NVDA for $AMD at $151 pre, betting AMD's MI300X steals share in the data center scrum. Outlook? NVDA's $185 breakout looms if Q4 guidance crushes – but watch for profit-taking if INTC's glow-up dilutes the narrative.

AMD: The Underdog Barks Louder in the Shadow of the Deal

Advanced Micro's no slouch, but today's INTC fireworks have it nursing a -2% premarket yawn to $151 amid rotation chatter. Zacks pegs AMD's 2025 sales exploding 26.9% vs. Intel's 1.7% whimper, thanks to AI accelerators outpacing the pack. Yesterday's vs. INTC comparison lit up feeds: "AMD's the real AI bet," one analyst hammered.

Yet, X bulls are piling in: "BTFD $AMD – this NVDA-INTC hug won't last." Tape's coiling for a $200 sprint in 6 months if EPYC chips keep winning hyperscaler bids. Risk? If the deal spawns more U.S.-China friction, AMD's Taiwan ties could sting.

TRADE IDEAS:

I’m not seeing any direct news for why this gap down. so I’m looking for calls

Look for volume into support 147.50 and 150. looking at 150 and 152.50c for tomorrow as yolol

March 180 calls are interesting for a swing

ASML: EUV Empire Strikes Back Amid AI Gold Rush

The lithography lord's humming along +0.5% pre to $920 (est.), capping a 16% monthly tear on unrelenting AI demand. No direct NVDA splash here, but the ripple's real: Intel's custom fab push means more EUV orders down the pipe. Yesterday's "buy vs. hold" debates on Finviz crowned ASML the steady eddy in a volatile semi sea.

Pro Tip: If you're charting, that head-and-shoulders flirtation on the daily? Ignore it – volume's building for a $950 test. Geopolitical noise (export curbs) is the only buzzkill.

BABA: Alibaba's AI Chip Coup Fuels Premarket Jitters

Stepping outside pure semis, Alibaba's riding high off yesterday's heroics but pulling back -2% pre to $162.83 from a $166.17 close. The spark? A game-changing AI chip pact with China Unicom ($390M data center tie-up) and a $3.2B convertible note raise, smashing 2021 highs with a 7% three-day rip. It's Beijing's middle finger to NVDA bans – Alibaba's Yunfeng chip is now "enterprise-ready," per reports.

X sentiment's frothy: "BABA's the China AI play while U.S. semis bicker." But profit-taking's real – watch $160 support for a bounce. Long-term? This cements BABA as the Eastern NVDA foil.

I alerted swing long on BABA when it was sub 100 and all in on the chip news at 130.

TRADE IDEAS:

It’s been on a strong run. Waiting for some dips and bullis flow

If Dips on 155 like 160c for next week.

Yesterday's Echoes: Fed Cuts and China Clamps Set the Stage

Sept 17 was all prelude: Fed's anticipated rate trim juiced risk assets, but Nvidia's Beijing woes (chip sale curbs) handed Chinese plays like BABA the baton. AMD-INTC face-off dominated wires, with AMD's growth edge shining. ASML's monthly surge? Pure EUV dominance in a TSMC 2nm world.

Summary

The chip wars just got personal, folks. NVDA's olive branch to INTC could redefine the stack, but AMD and ASML aren't sleeping, and BABA's proving East isn't just catching up – it's lapping. Stay nimble, trade smart, and hit reply if you're in the trenches. What's your move today?

I primarily focus on SPY/SPX/ES but would you like more of these kind of posts? Let me know in the comments..

152.50c on AMD perfect!! nonstop grind since open!