How will the market react to CPI numbers today? My plan for trading SPY and more for Tuesday March 12

ARM IPO lockup expires today freeing up 90% of supply.

Good morning traders.

I hope the warning I shared on X yesterday helped save you from overtrading or chasing breakout/breakdowns. One of the essential skills traders need to develop is knowing when not to trade. If you are struggling with that, consider changing your goals to be centered on weekly/monthly gains instead of daily.

I wanted a 9R+ trade but only got a 3R on one and 30$ gain on another that I stopped out flat on (I was shooting for more profit). And that was it. There was no point or god risk/reward trade that I saw during the trading windows I focus on. It’s annoying, but if you make 1 good trade a day, that is good enough. That is a worthwhile goal. I want 1 to 3 good trades a day and expect to find 3-5 great trades per week. The trades will come, but you have to be patient and let them come on their schedule not on ours.

Off the soapbox and on to today. Yesterday we more or less consolidated after Friday’s sell program and market is gapping up overnight ahead of CPI. I am expecting volatility and faker moves after CPI comes out. Often waiting 15 to 45 minutes to let it shake out can let you join a trend with less chance of chop getting you. I plan to set some extreme move trade orders on SPX to fill for reversals in premarket and then wait 15 to 60 minutes after market opens before opening new trades.

I’ll also be watching ARM today to see if a sell trend or short squeeze develops.

Let’s review yesterdays’ action and talk then I’ll go 3 trade ideas for today…

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

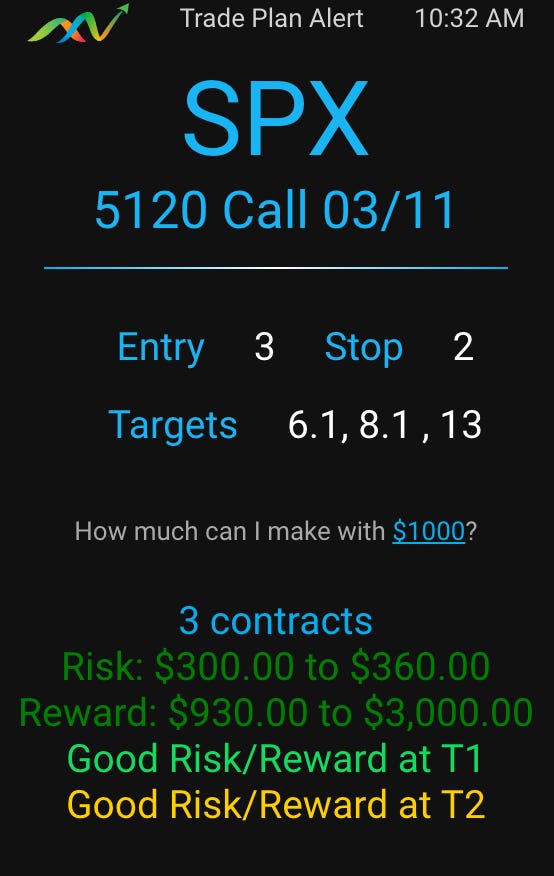

Mar 9 - SPX 5120c Entry $3 - High after 7.50 ($3000 → $7500 potential)

Mar 8 - SMCI 1150p Entry $5 - High after $56.20 ($500 → $5620 potential)

Mar 8 - AMD 220c Entry $0.50 - High after $7.65 ($500 → $7650 potential)

Mar 7 - SPX 5175c Entry $0.50 - High after $2.40 ($500→ $2400 potential)

Mar 6 - SPX 5120c Entry $3.50 - High after $12+ ($3500→ $12000 potential)

Mar 5 - SPX 5070c Entry $0.50 - High after $10.75 ($500 → $10750 potential)

** alerted 0.30 entry wanted. dipped to 0.40. entered at 0.50Mar 5 - SPX 5070p Entry $1 - High after $13.50 ($1000 → $13500 potential)

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Monday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

I expected a bit more range to develop but after the morning range was set it was essentially chop within the range all day. Luckily we got the early action and then called it a day.

SPY/SPX

Yesterday I wrote I wanted 508.50 to 509.50 area for a dip to get long. We dipped right to 508.50 during the first hour. That is when I alerted

The contracts dipped to 2.25 and then ripped to 7 as it tested high of day. In Edge Trade Planner chat I wrote I would sell 80% at T1 targets because I expected the day to be choppy. And that plan worked out nice. I missed the T2 target by 0.60 and stopped on runners at 5.50. That was a solid trade and more or less my mission for the day was accomplished. Did I want another trade and big payer? YES. Did I think it was likely to develop given the action I saw, no. So my bias turns toward NO more trades.

Master one or two good setups and get one good trade a day, you will grow your account massively. Learn to scale up with appropriate risk. If you are nervous and feel like you need to catch everything you will eventually blow up your account.

Now something. to learn, notice how we eventually got to the solid blue line target. If I held for that target level I could have sold for 7.50, but was it worth the risk to hold all day? After all my goal was gap fill during first hour or two and then go short for support retest / chop. That trade didn’t develop.

There was an opportunity when 5123 was hit on SPY to take 5120p for $2 that ripped to $8 but I chose to be patient and wait for today’s volatility.

NVDA

I was looking for day 2 selling similar to what we had on SMCI after its blow off pop. We got initial selling with NVDA testing 850 and then coming back to 870s. After seeing the triple top and 875 reject and break vwap I decide to go short. Sharing this plan with group.

Notice how Edge says, that for using $1000, for a trade, this plan does not qualify. That means skip the trade, it doesn’t meet your capital management rules. (I wanted to show that example). I was allocating up to 2k so I took 1 contract. NVDA dipped almost to 850, and hit 14.50 a contract where I raised my stop to 11.50 and got stopped at 11. Once a direction starts moving, I will usually raise my stops to above entry especially on a day where I think there will be chop. Upon review, would I take the trade again? YES. Did it work. No. But the opportunity was definitely there and if we got the drop to the 810 or even 840, the $18+ sell targets would have been met.

COIN

With a nice big gap up I wanted to get short but after a pop into 275+. COIN respected the levels very well! After the gap fill COIN popped back to 270 and kept rejecting providing a short opportunity. I unfortunately was looking away when vwap broke and my cheapie order wasn’t filled so I didn’t get a trade on this.

notice the 5 rejections of 275, and the peach line and vwap holding all day. Once range broke in either direction, trend would form and did. Learn this pattern. Tight consolidation over 2 hours in making often leads to a directional move.

Summary Review of Market Price Action

Overall nothing surprising. After Friday’s action, today was expected to be choppy and consolidation while market waits for CPI numbers.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

Be patient. Let trades come to you. Make it OK to take only 1 trade a day.

Use /plan in Edge Trade Planner to quickly create trade plans.

How consolidation over 2 hours leads to moves

Raise stops on choppy days to avoid losses.

Edge Planner will let you know to take 0 contracts if a plan doesn’t fit your budget.

To review your trades and ask if you would take the trade again, especially if the trade didn’t win. If you would, then that affirms your growth as a trader.

Trade Ideas - Plan for Monday Mar 12

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

With CPI today, we could see some choppy rangy action initially and then a trend form. I am concerned that today could turn into a bull bear fight though, but for know I will be on the bull’s side until we break support or cleanly failed breakout resistance above.

I’m watching the following today: SPY, NVDA, ARM