How will SPY react to Jobs Data today? -- Plan for Tue Dec 16

Our Bear Calls paid! Broke Rules. Greed cost me thousands in profit. AlphaOS blue line nails it again!

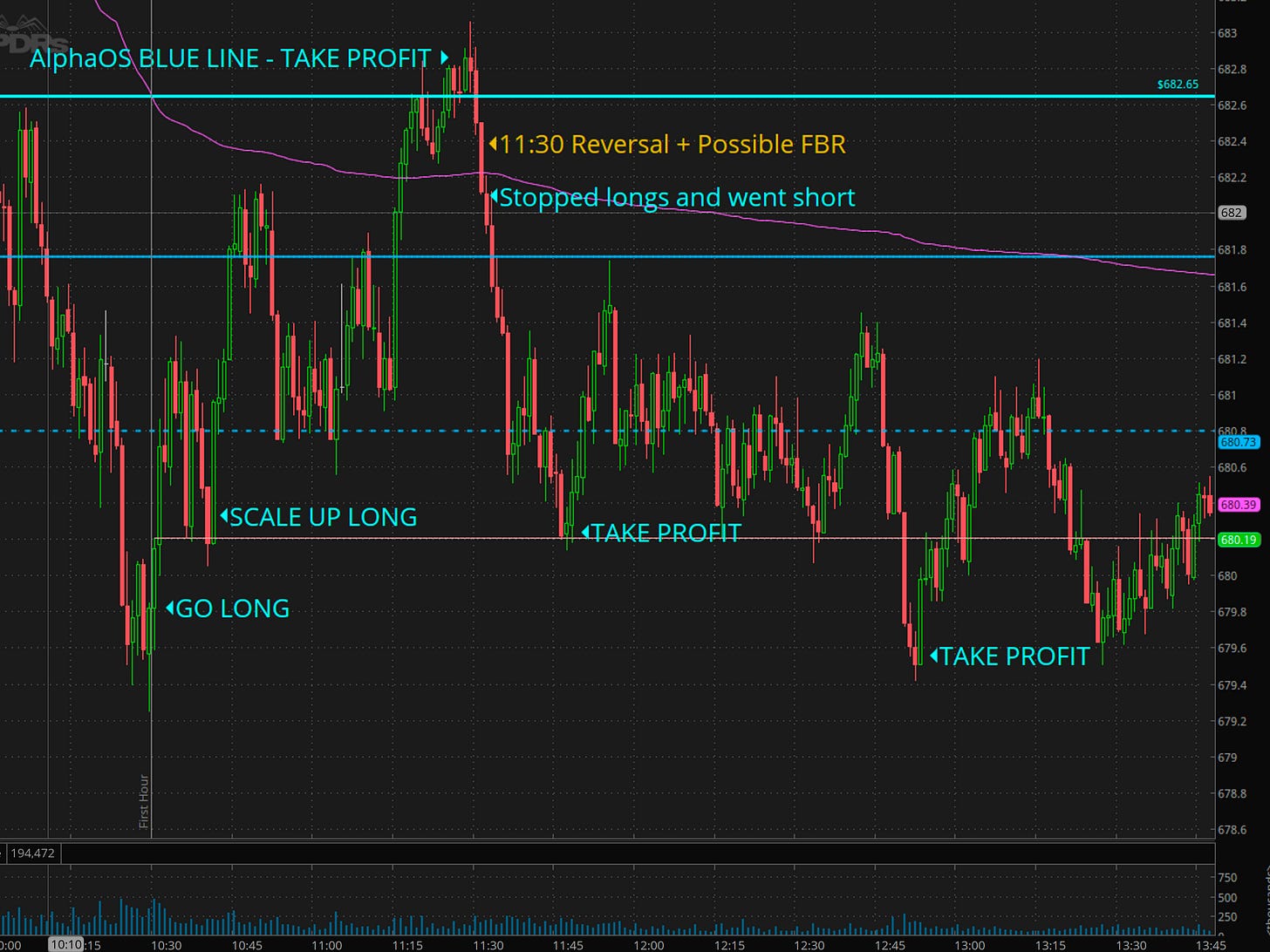

I missed the morning short, but we got long at 10:30 for a nice 3 point rally into the AlphaOS blue trend line. Its a custom trend line I have as part of the AlphaOS platform. (Rebranding Edge to AlphaOS) since it is geared to help traders extract Alpha systematically.

Here are the longs from 10:30

Per process locked into blue line but then got stopped on runnders on vwap break and flipped short. Perfect systematic process.

Process = Profits

Lately I’ve been doing the following:

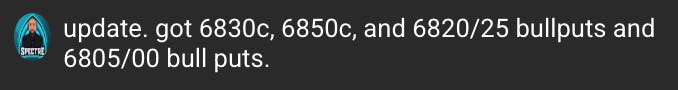

Premarket establish where we likely wont reach. Sell premium for 0.8-0.60 on open.

After 11: second positioning of credit sells.

After 3:30: start hawking/planning for a Spectre Special

What’s a Spectre Special? One of my yolo trades that goes 300-1000% in under 30min.

Credit Selling

SPX 6800/05 - WON

SPX 6820/25 - WON (had to exit early but great collection)

VIDEO RECAP SPY/SPX on Dec 13

none today

If you are tired of overtrading, not knowing how to plan trades, and want to make more in less time, come join us.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Plan for Tue Dec 15

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

SPY Survival Guide: Dodge the Breakdown Trap

Pinpoint failed breakout shorts to protect your portfolio amid jobs data chaos.

Market Context

SPY’s been a rollercoaster lately, bouncing between 677 and 691 over the past week with sharp intraday swings that scream indecision. The index closed Friday at around 680, down from recent highs, forming a potential descending triangle pattern on the 1-hour chart—classic setup for a breakdown if support cracks. Bias leans bearish short-term, with momentum fading after failed pushes above 688; volume’s been erratic, suggesting retail exhaustion. Watch for continuation lower if jobs data disappoints, but a surprise beat could spark a relief bounce. Overall, stay nimble—I’m not chasing this mess without clear failure signals.

Key Events Today

8:30 am ET: U.S. employment report (delayed Nov. data) – Forecast: 45,000 jobs added (vs. prior 108,000). Unemployment rate at 4.5% (prior 4.4%). Hourly wages +0.3% MoM (prior +0.4%). This could jolt markets; weak numbers fuel recession fears and Fed cut bets, pressuring SPY lower.

8:30 am ET: U.S. retail sales (delayed Oct. data) – Forecast: +0.1% MoM (prior +0.1%). Core retail sales +0.2% (prior +0.1%). Consumer spending insights amid holiday season—soft data might amplify downside.

9:45 am ET: S&P flash U.S. services PMI (Dec.) – Forecast: 54.0 (prior 54.1). Manufacturing PMI at 52.5 (prior 52.2). Early economic pulse; sub-50 readings could trigger risk-off moves.

10:00 am ET: Business inventories (Sept.) – Forecast: +0.1% (prior 0.0%). Mild impact, but ties into broader growth narrative.

No major Fed speakers today, but the jobs print sets the tone—trade around it, not through it.