Holiday Trading Week - Plan for Dec 26-Dec 29

Friday Price Action Review

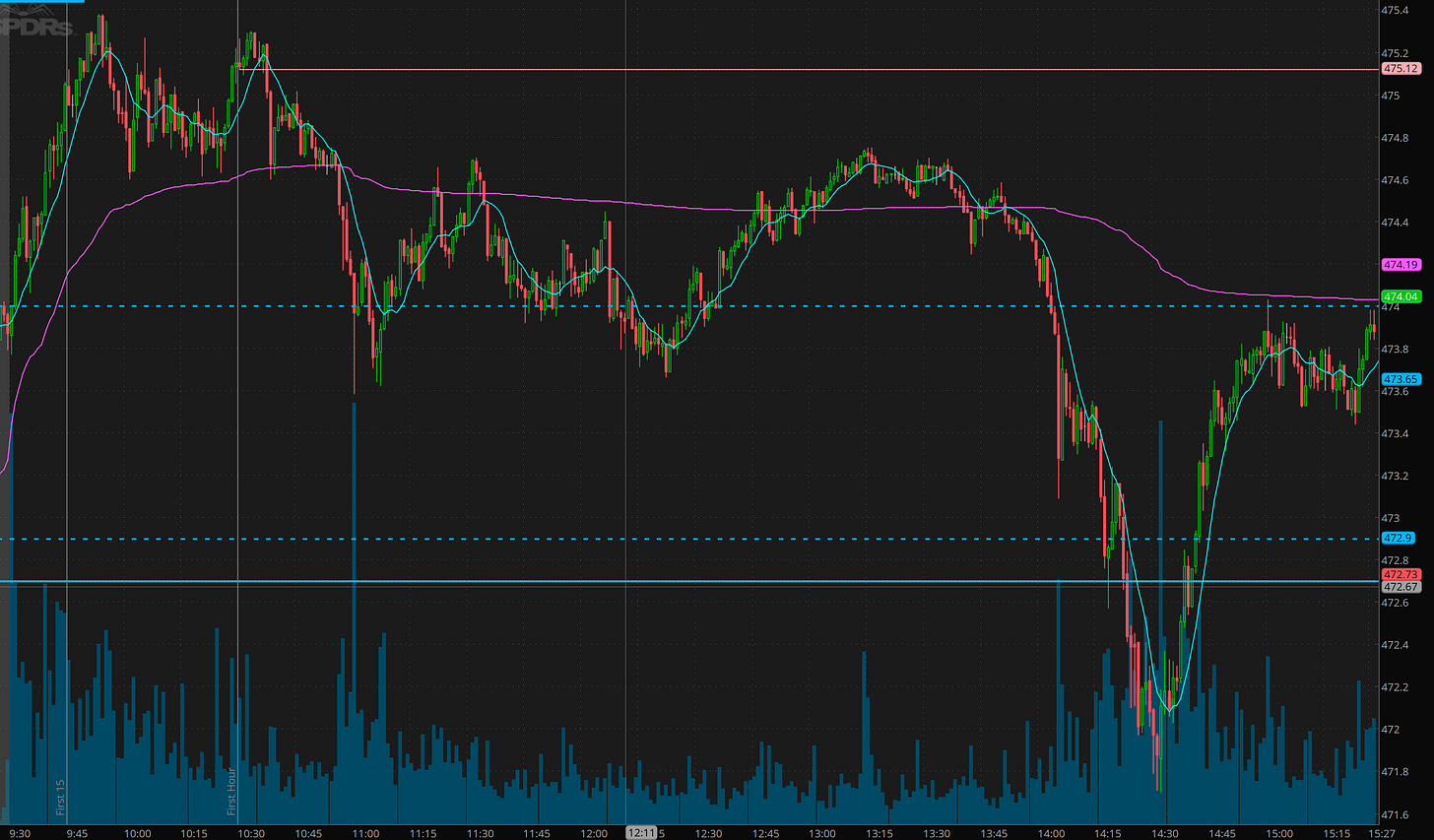

SPY

SPY gapped up Friday and push, forming a double top/lower high under Wednesday’s peak. From here I was looking tor the open or gap fill to come for a bounce and possible squeeze higher.

Instead we got a volume dip/failed breakdown at the 474 level, which had me thinking long, but then vwap double topped and failed. Translation - Chop, and better to stay away till after lunch.

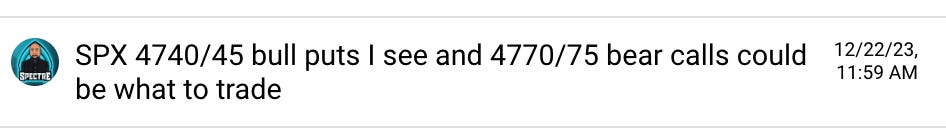

BUT we can take advantage of that… I suggest this trade

The 70/75s went to 0 quickly. the 40/45 spike but ended the day at 0. Credit selling during range bound action can make trading life so much easier.

A little bit after lunch, SPY started getting weaker and as I was typing letting members know I think we are about to flush, the flush started.

I thought I was looking at SPX 4760p when I shared my trade plan, but I was actually on 4750p in my broker and ended up chasing the short at 2.5 for a spike into $14-$17. I tried holding for 25-30 target but raised stops to $11 and got stopped out. Turns out I was wrong on the downside targeting. One of the things I do after each trading day is analyze, why was I wrong, why did a turn happen where it did. Turned out on Friday, SPY found support at 472 (premarket lows)

Overall Friday was a difficult day to trade due to low volume and chop. I spent a good portion of the day red with the after lunch getting me green and then late afternoon chop giving up half my profits in an effort to capture another short squeeze.

The best, easiest and profitable trade in the environment imho turned out to be the credit spreads. Yes the 4750p puts gave 5R+ but it was way too tricky for the exit.

COIN

I spent a fair amount of time on scalping coin. I took 180c for 0.20 and sold 1/3 at 0.60-0.80. and got stopped on the rest at 0.3 when market flushed.

This name looks like it wants 200+ in January.

Plan for Week of Dec 26-29

I will likely keep trading light this week and will consider even taking days off. For members, I will continue to prepare watchlist each morning but will plan to spend time with family versus trading. I’m currently in Oregon for the first time in 3 or 4 years.

Remember, to focus on why you trade vs trading for the sake of trading. It will give you better perspective and let you trade less.

I will set alerts at key levels, and then if and when alerts trigger, will come to my laptop to see if a trade opportunity has developed. Otherwise, I’m going to do what big money and most traders do. Take the week off.

SPY 0.00%↑ - dips into 471-472s I will consider scooping long. 476-477 I will watch for profit taking /selling for chop. I do there there is a chance we make a run at 480-482 this week on low volume.

if 470 breaks, I will be looking to get short for 460 to be tested.

Overall my thoughts, are to look for names that are near the 9ma on the daily for BTFD trades. Consider doing credit selling on SPX in anticipation of rangy chop.