Happy New Year! Is it time for locking in profits? My game plan for trading day of 2024 (Jan 2)

Friday’s price action showed some selling into the close of 2023 and the start of uptrend failure on a number of names breaking the 9ma on the daily including:TSLA 0.00%↑ NFLX 0.00%↑ AAPL 0.00%↑

This red action comes on the heal of 8 to 9 weeks of daily greens with only a handful of red days. An incredible rally and end of year move after a rocky 2023 start.

My overall thesis is that we will have a correction/back test move develop within the first 2-4 weeks of January. My short term “bearish” thinking is why take profits in 2023 when you can take profits in January and defer taxes on profits for a year? So anyone who wanted to take profits, but didn’t due to tax reasons, might be open to it i January.

I’m also. a big believer of sequences and waves to moves. If you believe in sequences, we could be in for a 3 week decline once it gets going.

One of the most exciting things about corrective moves is how fast the rallies on dips can be as well as the range expansion. The last 2 weeks of December saw overall range be somewhat limited and that could change to kick off 2024 with monster gains in both longs and shorts.

Friday Price Action

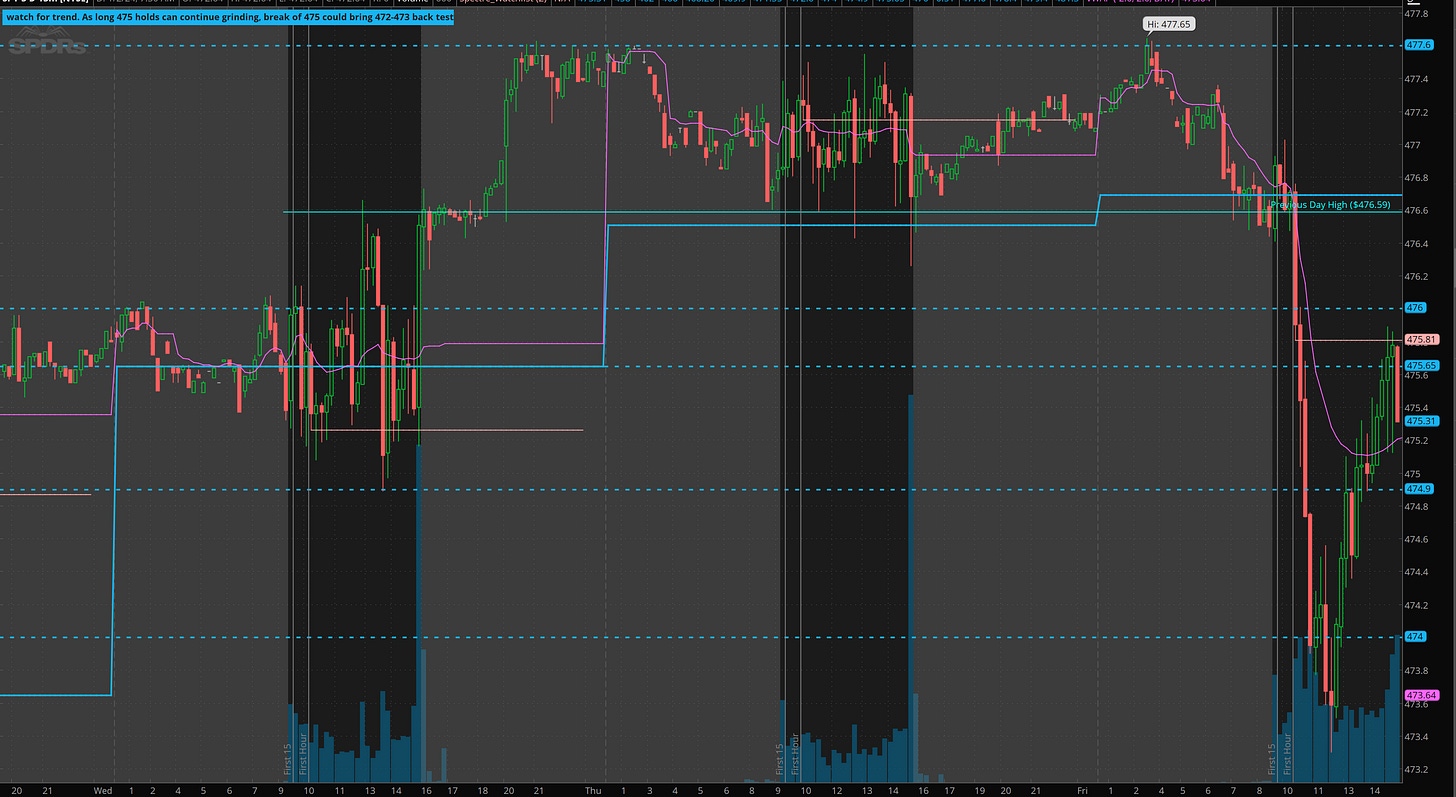

On Friday, in premarket we made a new high, but then broke thursday support and 475 triggering a fast flush toward 473. By the close a rally back into 475s came but that is not a full recovery. For upside to continue, we need to see 476+ reclaimed.

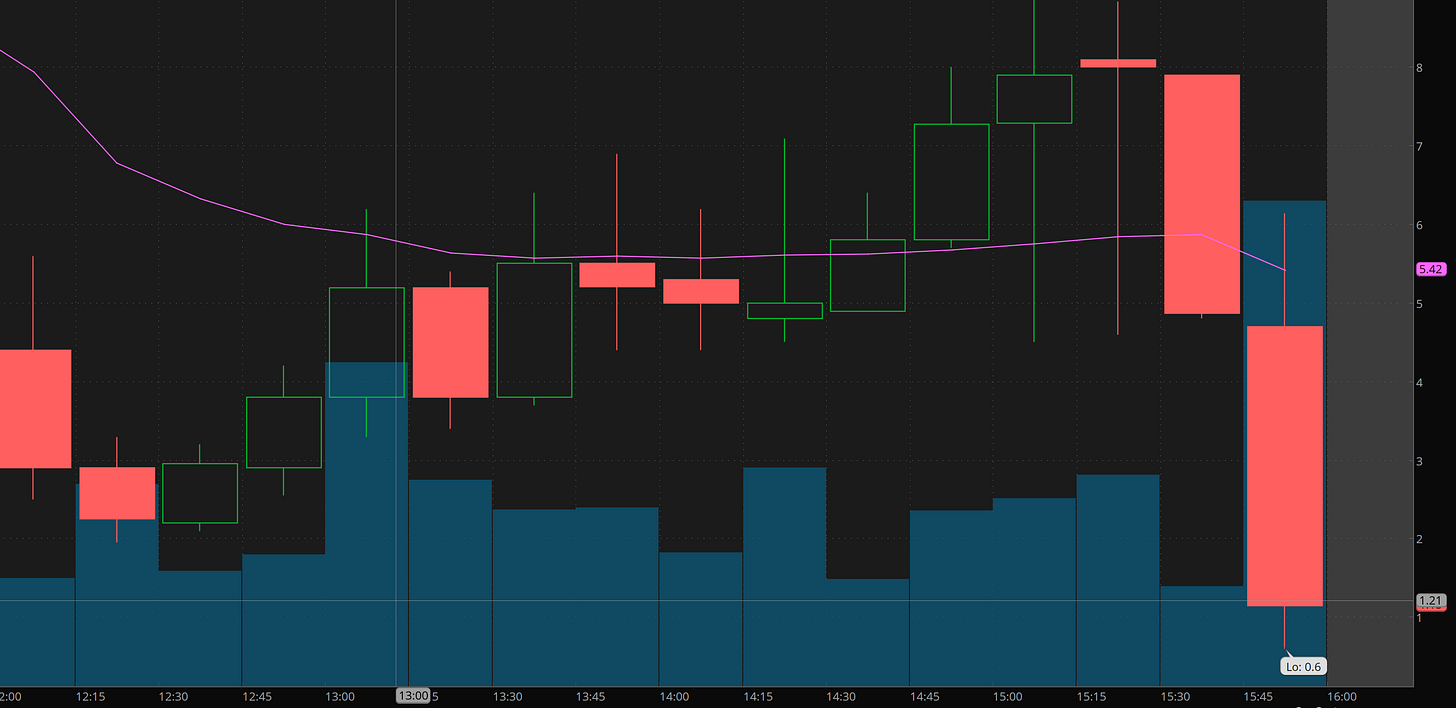

Using the levels as a guide, once 474 was reclaimed developed into the classic failed breakdown reversal move I am always talking about. Taking SPX 4770c would have yielded a 100% gainer from $4 to $8+.

Using the levels make this so easy. Take profits at the first level / vwap and be out 80 to 100% on a 2 level move. 474.85, push gave the $8 exit. No need to guess, no need to trade on “hope”. I like to look for 2 level moves to capture a majority of my profits. Everything else is a bonus. Selling into the price spike on option contracts into levels can generate consistent gains.

Plan for Tuesday Jan 2

Premarket we saw 476 backtested and failed. the 475 broke. I was able to take a quick chase short using SPX 4730p from 4 to 6.50 in premarket thanks to Interactive Brokers.

In an ideal world, I’d like to see a failed breakdown reversal on 472.50 trigger a BTFD squeeze into 474-475 area during early morning session to let me get short for for 472.50 break and dump into 470.

If during early session we reject 473.20 nd break 472.50 again, I’ll take a chase size short and try to grab SPX 4710p for $1 or less with a target exit of $3-10.

If market flushes fast out of the gate into SPY 469-470, I’ll look to take a scalp long targeting 472-473 for a back test of the breakdown.

I will also be keeping an eye on high fliers for profit taking action including NFLX, NVDA, AAPL, and MSFT.

CVNA, UPST, and AFRM will also be on watch for short entry.

Good luck today!