Ground hog day? Will SPY continue yesterday's rally? My plan for Wed Mar 6.

How I planned two 10x+ trades yesterday. SMCI dip buy at 980, predicted and delivered.

Good morning traders.

How did you do yesterday? Are you using the levels I provide? If not, you are missing out on trades that can double your account while risking no more than 5% of it.

Yesterday we got the flush, I wasn’t sure if it was going to come, but being process oriented, as soon as it showed itself, I used the process and was able to plan a 10 bagger trade to the downside and a 20 bagger trader to the upside. I’ll get into how shortly.

Fear and Greed Index dipped to 74 after yesterday’s selling.

Will SPY continue its behavior for last 3 months with yesterday’s dip and reversal being a trigger for new highs? Do we get a groundhog day?

Read on for my review of Tuesday’s action and my plan for today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Mar 5 - SPX 5070c Entry $0.50 - High after $10.75 ($500 → $10750 potential)

** alerted 0.30 entry wanted. dipped to 0.40. entered at 0.50Mar 5 - SPX 5070p Entry $1 - High after $13.50 ($1000 → $13500 potential)

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Tuesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY / SPX

As I wrote before I wanted SPY to back test 510 before a move higher, and so I was watching for a bounce or a break to develop and I got whipsawed in 30 minutes.

Given the gap down, I wanted a gap fill before going short so when I a saw a new low and then a rally back over vwap, I though failed breakdown go for gap fill, and was good with the idea and ok with my original short getting stopped.

But then it did something it wasn’t suppose to. It broke back below the 510.30 line. If bids were going to show up and rip it that shouldn’t have happened. Another thing is that we pierced 510 earlier, so if it does it again we can plan for 1 to 2 levels down to come. that put 508 and 505 into striking range. So upon moving under vwap I jumped back in on my original plan with more size at $6. targeting 10-16 for the exit.

This played out and recovered the losses from the whipsaw and nicely green. the 5100p actually went to $40 from a low of $3 where some members jumped in before I did! :)

This is what the 5100p did after the failed push at 10am. ran to $18! That was good enough for my first 2 hours of the day.

I then came back after lunch and started looking to position for the next leg.

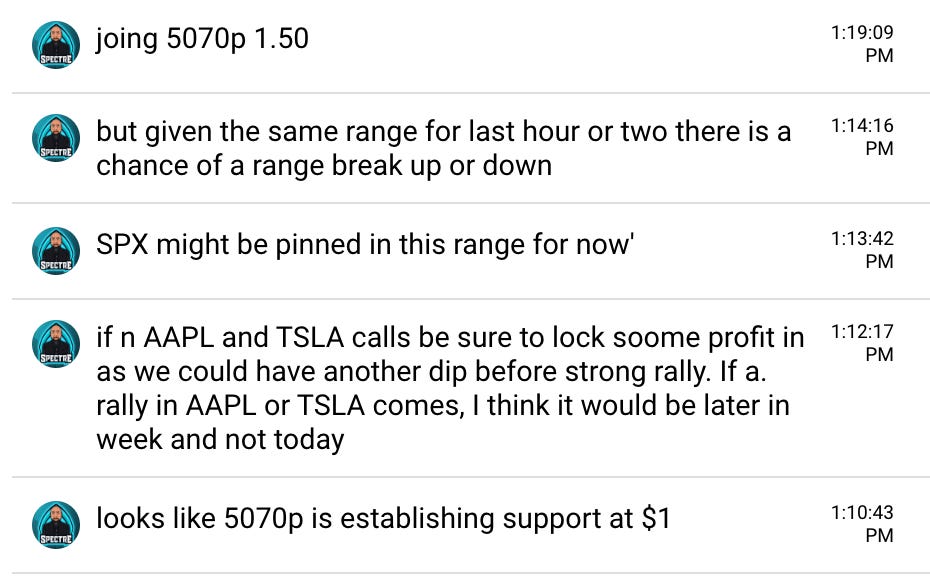

I noticed how as SPY was pushing 5070p was holding $1. I was late to place order so scooped at 1.50 because if right it is going to $12. It then dipped back to $1 for an letting me bring my average down.

Using the levels and Edge Trade Planner, I knew the target was $12. I sold per process along the way with final sell at 11 as it got close enough to the target level and I was diverting my energy to looking for a reversal bounce of of SPY 505 level. I was targeting 504.80 and we got to 504.91!!! How is that for precision?

I then thought we are going to do the same thing as on Monday and do a strong reversal during last 30 minutes.

So I targeted vwap at 507.50 which would make SPX 5083 ish as my target.

I alerted I wanted 5070c for 0.30 (gut estimate, but was comfortable buying at 0.50). 5070c dipped to to 0.40. wasn’t going lower so I took it at $0.50.

And that is what happened!. I sold more my normal process. and was down to 10% size for 10x at $5. and let the last bits ride into close. ending at 8.65.

What a monster day! Sure i got chopped early, but I have faith in my abilities and that the market wants to pay me and pay me she did.

That is the key. Don’t let a loss change your beliefs. You have to keep following your process. sometimes that will trigger a loss, but if your system is right, when it pays, it pays your very well and well beyond your losses.

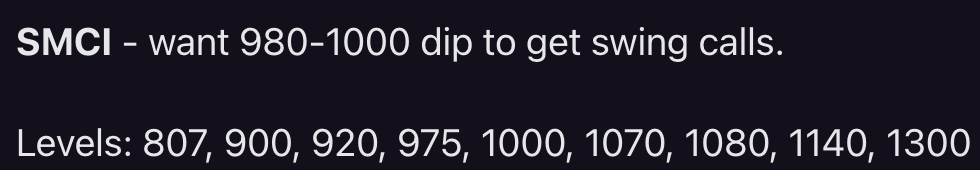

SMCI

I expected some panic selling and as I wrote in yesterday’s blog, we got just that.

SMCI dipped to 980. We got the 1100c for $16

What a perfect swing plan. the $1100 calls were $16ish when it came into the swing entry zone. Hit $58 at close yesterday at 1060 and this morning SMCI is gapping up to $1130. These contracts should be $70+ this morning.

Summary Review of Market Price Action

Market broke 9ma and flushed but then did what it loves to do, reverse! Based on the price action if it stay true to previous patterns we should be gapping up this morning and possibly running to new highs by Friday.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

Use /plan in Edge Trade Planner to quickly create trade plans.

Use Edge Trade Planner’s scanner to find trades.

Set alerts on levels based on the ideas I write about in the blog

Trade Ideas - Plan for Wed Mar 6

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Overall SPY has had difficulty creating 3 red days in a row all year so, I will have a long bias but will be watching for possible double top fails for a short.

SPY, SMCI and NVDA are gapping up and there should be a lot of opportunity again.

Reminder Powell starts testimony at 10am today and Jobs numbers come out. I don’t plan to open any positions in first hour today unless it is a push and fail at major resistance in first 10minutes for a scalp short.

Read on for my thoughts/plan for today.