Gap Up Reversal Setup, Did SPY give the bears a nod to go short? My plan for Thursday Nov 30.

I keep saying it and I hope you’re paying attention. Be systematic. Be process orientated. Gap up Reversals trade setups have an 88.7% win rate for me. I wrote this as my plan for yesterday.

Let’s review the action above. We had a 3 level gap up yesterday. Once we made that double top at 458.20 and started breaking back below 458, it was time to load up short. Guess what, I wasn’t the only one.

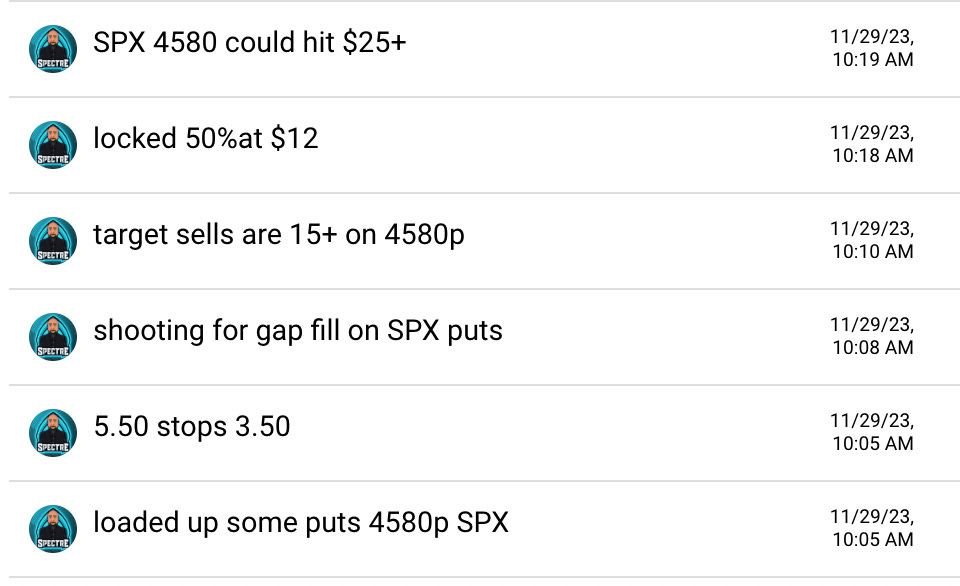

Look at that. There was $5m+ in volume on puts that went almost 10x. On top of that you see those calls being bought…. That was premium selling. I finally got by system setup again for coding so I should have a way to flag premium sell trades next week in Edge. That premium trade was so low risk for the reward it was a no brainer. Basically collecting $4+ in premium for under $1 of risk!!!! Imagine sell 100 contracts for 40k, risking 10k with an over 90% chance winning!

Yesterday I finally got the short payout I was looking for.

The plan worked, we got exactly what I was looking for regrading that gap fill! Hitting $25 from $5.50.

Notice the large volume at 455 on SPY around 11:30 and then a strong candle bar back over the 9ma. That was the signal to go long. We got a nice grind back toward vwap, but SPY could not get over vwap. Then around 1pm we got a rejection move agains the peach line.

We then got a round 2 play. We took the SPX 4560p for around $2 which hit $12. The wild thing is that the 4560p came down to $1 and could have been a 10 bagger but I missed that. I was positioning my self for both the short and and a short squeeze, because my original thought was that we would reclaim vwap and rally back to the highs.

I’m also back on the win streak on credit sells. so 1 loss out 20+ trades!

Do you want credit sell alerts? LMK.

Ok so that is a review of the action on SPY yesterday. I’m on the fence on what it means. SPY should have broke lower but it got bought up again so I’m not convinced that we have selling ahead. Overall market seems to be waiting for a catalyst to push higher or go lower. Once SPY breaks 453, I expect some choppy downtrend.

COIN 0.00%↑ got to the 131 target for exits and for a short. If you took the swing long congrats! $2.50→ 7-10 for the exits plan worked out nicely

TSLA 0.00%↑ also had a nice gap up and short. Cybertuck delivery event starts at 3pm ET today and will be broadcast on X.

Did the bears get a nod to load up?

Possibly, but I am not convinced. Considering how SPY 454 held I wouldn’t be surprised if SPY 458 is cleared today or tomorrow and bears get squeezed again. If we break 454 and 453, I would use that as the first shot for a back test into 445 to 448 being on deck.

Plan for Thursday Nov 30.

Jobless claims and PCE will be released at 8:30am ET.

Based on how market reacts to that news I will position. Ahead of this news my rough plan is to watch if 456.50 rejects to get short and add if 454/453 breaks.

If we clear 457 back test 456/456.50 and start grind higher, will get long.

regarding TSLA I will wait for market reaction after delivery event. Watch for comments in Edge.

Remember you don’t need to win every trade, you do need to make worthwhile plans and let plans playout for the win or the loss. Don’t second guess yourself. I’ve see way too many traders live in should have could have. Progress as a trader will come from planning, taking action, and then letting your plans play out! If you lose, that doesn’t mean you suck, it means it didn’t work. analyze what you did, was it the right plan? Was there anything you should have done differently? If not, then that is the sweet spot. You have got to the point where you can accept that actions you took for the play / setup / strategy you had. test it, validate it, update it. Remember your goal to be a successful trader doesn’t come from winning every trade, but from developing a repeatable process that can systematically take profits out of the market.

— Spectre