We did it again! 10-20x play in less than 2 hours! Did you get it? Can we get 3x-5x today?

$SMCI rips after e/r, $TSLA and $COIN bounces off lows.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading. Additionally, I’ll share the top day trade results for ideas from Edge Trade Planner (Beta), a powerful tool to enhance your trading decisions.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Jan 29 - SPX 5910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22k potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Monday’s Price Action

I had planned for more of a dip and a consolidation day but the morning action established that dips were being bought and that an afternoon rally could come.

I had wrote that COIN And TSLA are likely to bounce off oversold conditions and they did!

I have one mission every day. Make 1 to 3 trades using 2 hours of my time. For that I want to make 100-300% on the money I risk. Let’s see what happened.

SPY

I was expecting more consolidation or chop today so planned a short following process. My goal was to sell for $10 making almost 100%. But it dipped, popped, rejected vwap again, and started making a new low. Great right?

Nope. When it started making a new low, what do we do? Raise the stops, because if it reverse, we get stopped and don’t lose money and if it works, great.

As you can see it quickly bounced back over the solid blue line. Time to get out making an exciting 20-30% return! (yawn). Time spent about an hour.

NFLX - dip buy oppotunrity

While this was going on, I saw alert from the scanner on NFLX and shared it. a 300k bet $20 out of the money.

This looked like a decent trade setup. It ran to $6.30 for an almost 100% gain.

TSLA - missed dip target but gave a chance later

Yesterday I wrote that I wanted at 183 dip to get long on TSLA. It only dipped to 183.70 and I missed the entry i wanted. So at this point, what do i do?

I hate chasing breakouts, and could have taken it on the hod break, but I was busy with SPY. My thesis was if 187.50 clears, TSLA should hit 195-197 and maybe 205 as a swing trade.

Well that is aggravating isn’t it? I’m sure you’ve been there. and the it clears 189 and in your mind you are like it is going to to 195, I have to get in now right? Nope. bad risk/reward. this is where we plan. I told members I wanted 1.50-2.20 area for he dip buy and to look for a failed break down on vwap. I placed my orders and moved on. got filled at 2.25 stopped at 2.05 and then reloaded around $2 once I saw the failed move.

TIP: Set alerts near vwap so you don’t have to babysit charts

once we tested 189 dipped and cleared it again I doubled my size at 2.70. If right we should be able to sell these for $6.50-12 by Friday. I sold the adds at 3.20 o the stalling and to reduce overnight exposure. This also gave me a 0.50 buffer in case overnight gap down :)

Premarket we are sitting at 195 :).

Time spent: 30 minutes

SPY - afternoon session

As many of you know I’ll come back around 1 or 2pm. As I commented on yesterday’s blog I didn’t think a big move would develop until afternoon. And boy did it!

I wrote that I wanted 4890 for $2, but that was assuming we got the dip I wanted, so I shifted focus to 4900c thinking if we get a mini pop and test of 4905 iI’ll be able to sell for 8-10. Well 4900c wouldn’t drop to $2 and barely to 2.60. That was my big clue.

So I did the math quickly using the levels.

Let me hawk 4910c. Target 4924. If I’m right I can sell for $14, So I made this alert to THT PRO/ELITE members (20 minutes before the move happened!)

4910c for $1 and 4905p for 0.50. in case it is a failed breakout. Either way get paid.

10 minutes later we get the $1 or less fills! and 10 minutes after that the fireworks begin!

I gave an additional heads up about the squeeze triggering and that I was loading up at $2 followed by sharing my targets.

$14 came and we got a rip to $20!!!!

How is that for a trade!! 1400% on the the $1 entry and 500%+ on the size up at $2!

Time in planning and placing orders for the trade: 45 minutes.

Summary Review of Market Price Action

Overall the market continues to be BTFD mode as we approach FOMC on Wednesday.

Educational Lessons

From the price action review you should have learned the following:

Patience and planning is the hard work in trading.

Use alerts and time of day to reduce how much time you are at screens.

Placing bracket orders and sell orders in advance lets you step away, letting trades pay you or not pay you. But you aren’t stressing and aren’t spending more time on screen!

Use the levels and the reaction to the levels I share each day to guide your trades

Making 1000%+ trades trading SPX is very achievable.

Make your goal to spend less than 2 hours a day. use alerts to help you.

Sometimes you will spend more than 2 hours, but if you do make sure its worth it. Honestly I almost called it a day, until I saw the magic setting up around 2:30pm.

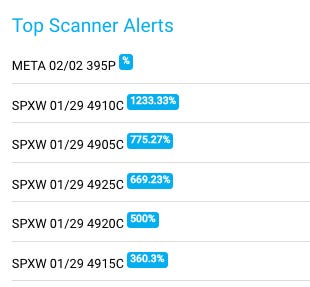

Edge Trade Planner - Top Scan Alerts

Nice finds by scanner:

Our entry on 4910c beat the scanner!!! Planning and intuition can be amazing!

We have a big week ahead between earnings reports and FOMC. I will continue to focus on SPY / SPX and any names with significant momentum or news

Key Events this week

Tuesday - 10am ET - Consumer confidence

Wednesday - 2pm ET - FOMC rate decision

Thursday - 8:30am ET - Initial Jobless claims

Friday - 8:30am ET - nonfarm payrolls and unemployment rate

Key Earnings Reports this week

Tuesday after close: AMD 0.00%↑ EA 0.00%↑ GOOGL 0.00%↑ MSFT 0.00%↑

Wednesday after close: QCOM 0.00%↑

Thursday after close: AMZN 0.00%↑ AAPL 0.00%↑ $MEA TEAM 0.00%↑ SKX 0.00%↑

Trade Ideas - Plan for Tuesday Jan 29

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Yesterday gave a big payout. Hard to plan for that so I won’t shoot for 1700%.

I’m shooting for 500% gainer today! can we get it?

Read on for the game plan.