FREE Education - How I shorted $SPY and $TSLA, Powell on deck tomorrow, and how I plan to bank on Tuesday.

Planning and trade reviews

Typically I hate consolidation days, because I want to get paid in the first couple of hours of the day and be done. But as day traders we have to learn to adapt. Yesterday we nailed the short on TSLA 0.00%↑ after it him my 226 level and rejected and we got SPX 4250 short at $2 targeting $7. it got to 6.75. Finally It happened too quickly for me to share the exact trade, but I noticed that we may get a squeeze into the close.

Let’s break down the trades/planning — I hope this helps you in your trading.

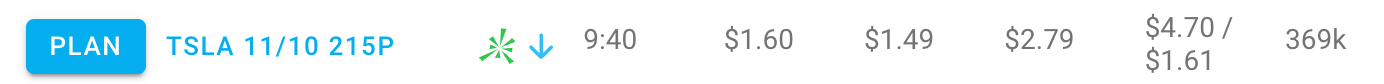

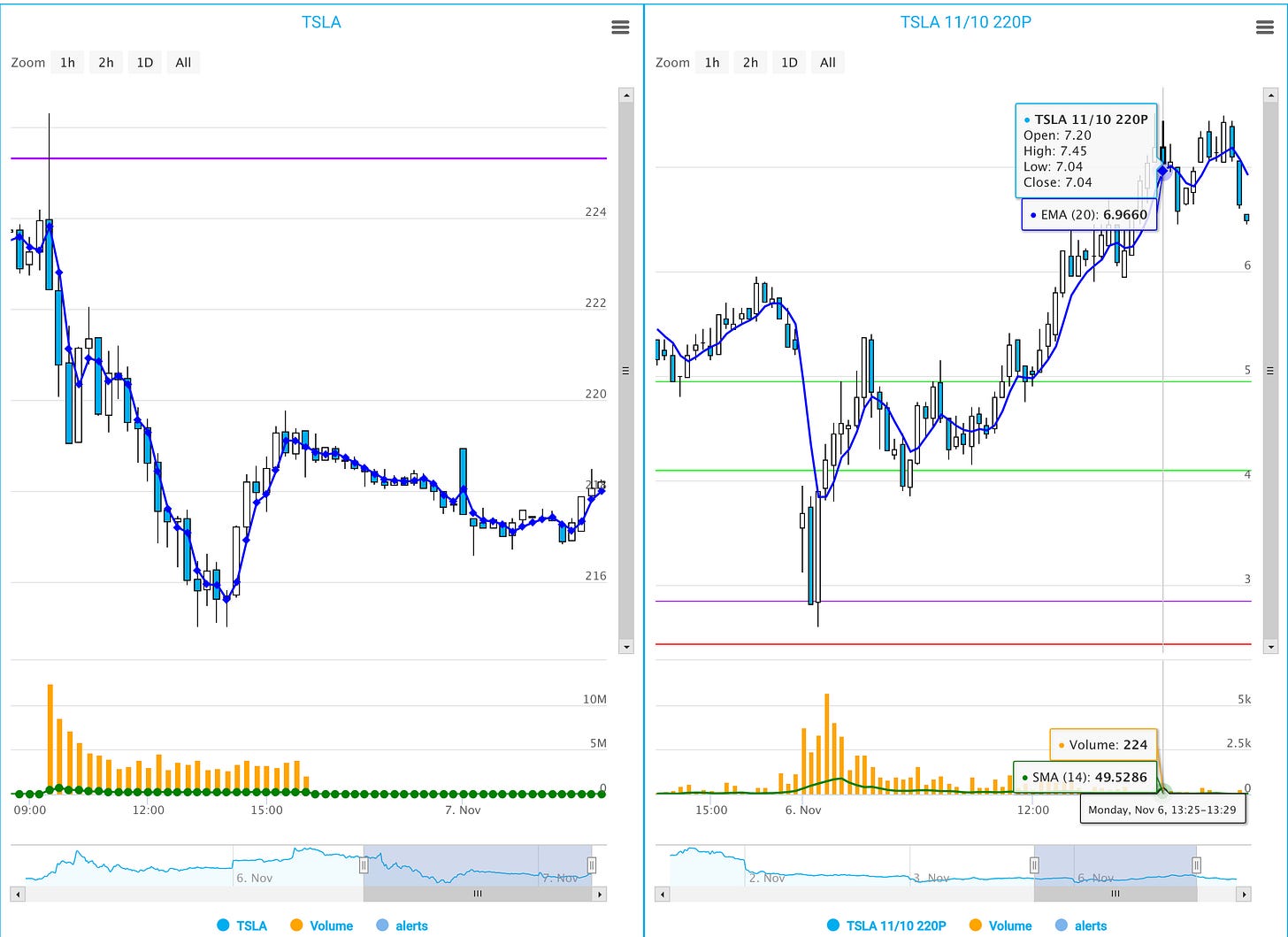

TSLA 0.00%↑ One of the goto setups I have is a gap up reversal for a gap fill. as we pushed into 226 and quickly rejected… I saw this alert in Edge and clicked PLAN and entered 221.50, 219, and 215 for my targets. based on the levels and the alert strike.

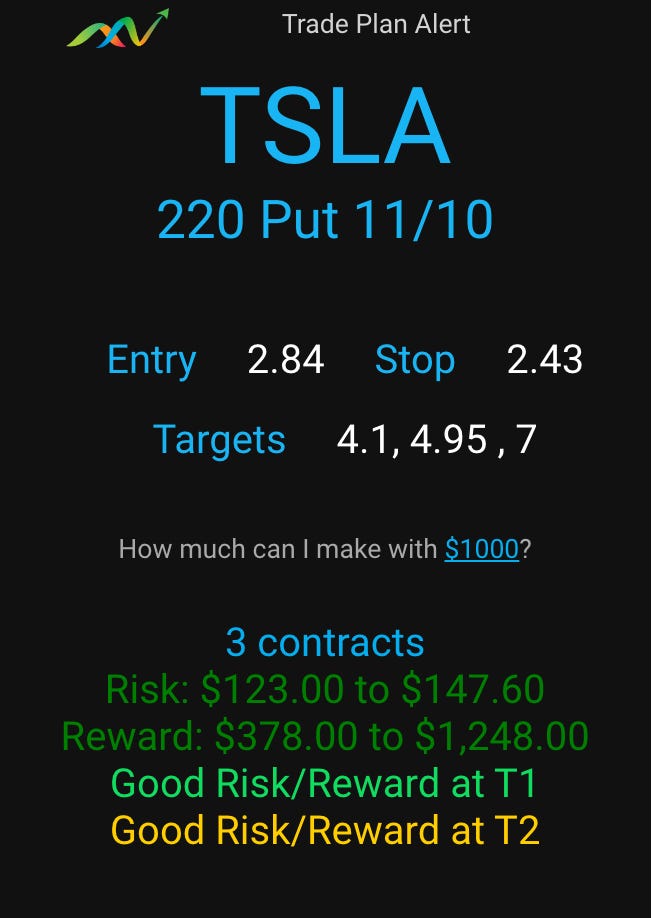

It generated a 4 plans. I like this one:

And sure enough on hitting 219 the $4.95 sell target filled and the by end of day we hit $7!

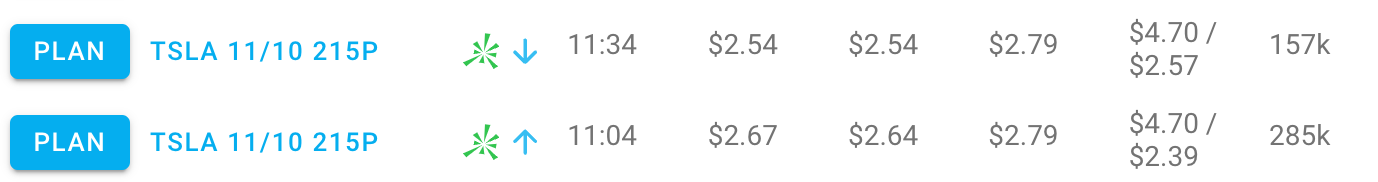

When we hit 219 I locked in the majority. The super interesting thing is if you slept in and came after the first hour, you can see how TSLA rejected the 221.50 level. and around 11am it kept rejecting the peach line and we got additionally buying on 215 puts. This would be where one can reload and/or start another short.

SPY 0.00%↑ Let’s move to discuss the afternoon short/longs. Given the consolidation action and my bias that we would test 438-440 before a big drop, I decided to go long off support and short off resistance (after 5 green days, day 6 is often red) and then let market show me what it wants to do and I’ll load up once it is clear.

Here is how to recognize and plan for the flush.

I wanted more but given the way we dropped and you can see the heavy volume as soon as we hit my 433.80 level, I locked in majority. I assumed there would be a backtest 434.70 before more downside would come. Instead. 434.70 reclaimed after making a double bottom on 433.80. That where my first warning bell went off on the market may squeeze / rip into close and the rally may not be done.

I had sold some credit spreads (4365/4370 SPX calls) so was hawking 4360, 4365, and 4370 calls. the contract and nicely come down 0.10 but this consolidation over vwap and just under the peach line had me nervous so I went ahead and locked in.

Unfortunately I was too slow to enter the order and watched how in the last 5 minutes as soon at the peach line crossed the 4365 calls went from 0.10 to $2.50! a $1000 bet would have hit $25k! I hate letting that opportunity slip by me, but will get the next one. I was juggling a another credit trade I had in a test baby account on a credit selling strategy. (I’m going to turn $5k into $1m in 3 months if I’m right on this strategy). I hate the PDT rule, so the debate of do I burn a day trade or not was in play. One of the neat things with SPX is that it is cash settled, and so you can place a trade and if you hold into the close, it doesn’t cost you a day trade. The trade is settled after close and you are either credited or debited base on the trade result.

Any way I digress. The key point here is, seeing the consolidation above vwap and then that candle at 3:40pm and strong bounce off the solid blue line (previous day close) is where one should start planning for a possible squeeze and if contracts are cheap enough, why not allocate 10% of profits for a possible 10x+ reward trade if a squeeze comes as it crosses back over vwap and the peach line?

Let’s move on…

Fed Speakers

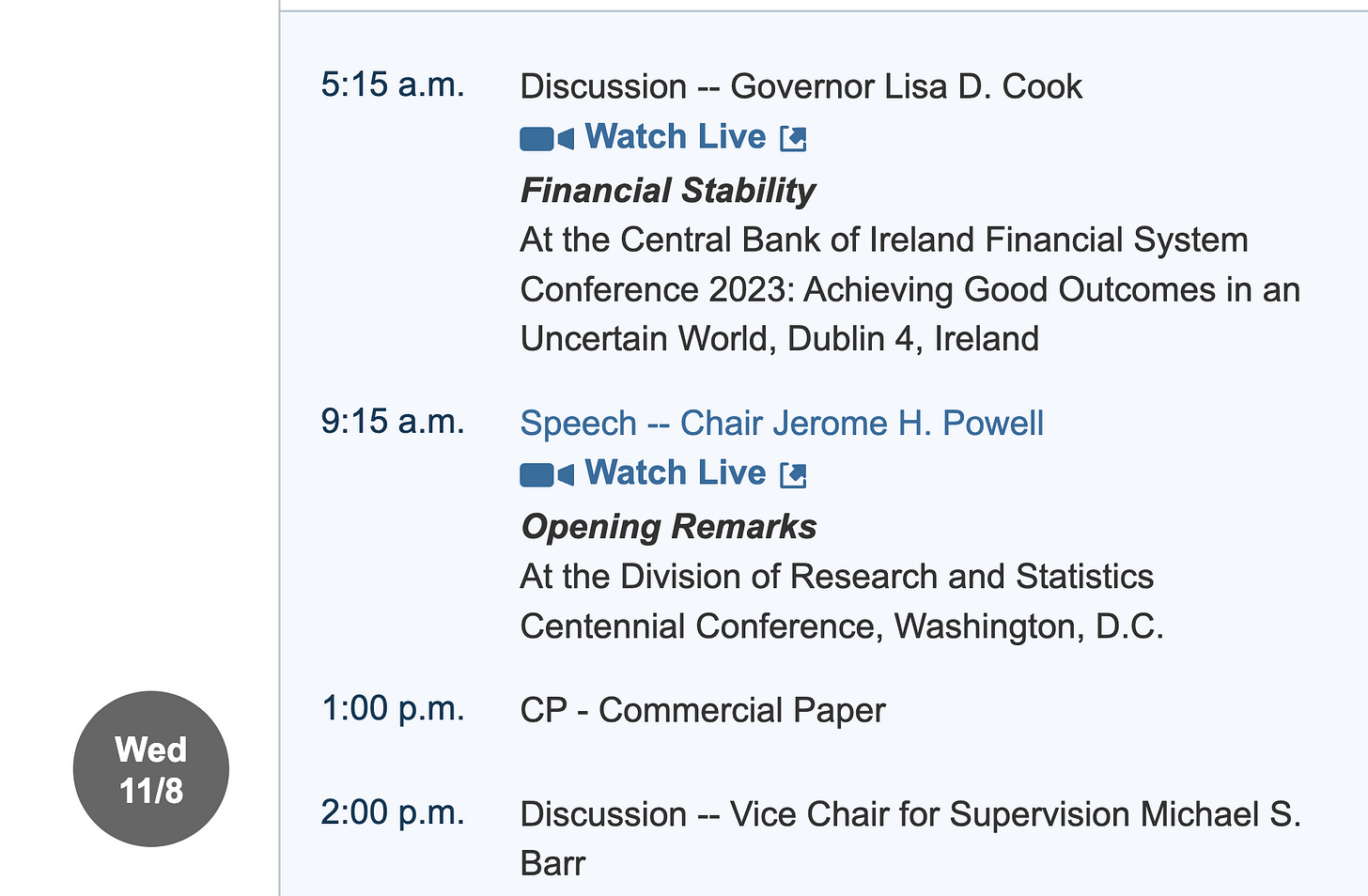

Today we have 2 fed speakers on deck (from federalreserve.gov)

and tomorrow we have 2 more including Powell.

I won’t be surprised if we have more chop / consolidation today.

My plan for Tuesday Nov 7

I will likely do the same as yesterday. Look for my 3 Killer Trade Setups which I more or less do on autopilot now, and let market establish range over first hour or two and then see what we get.

If range bound action, I will likely position short at resistance and long at support. Overall I have a bullish bias.

IF SPY breaks yestrday’s highs I’m looking for 437.50/438 to be tested and if over that 440.

MSFT 0.00%↑ continues to rally, last week’s roll-up of 350c for this week is working nicely and we should get 5 to 10x on these.

NVDA 0.00%↑ is also setting up to benefit if tech rally continues. I’d like to take $360 or 365c if I can get then on the cheap

TSLA 0.00%↑ has been a weird one. Overall it is a laggard in the tech rally, but I think it will eventually rip over 230 again.

Members, remember to use the Scanner in Edge to supplement your ideas, and click PLAN to well plan your trades and let me know how it is or isn’t working for you. Still very much in beta, but I can say I am using it to automate my trading processes and it is definitely help me plan profitable trades, I hope it does the same for you.