FOMC today, will Powell crush the market again? My plan for trading Wed Nov 1.

Edge Update

More bug fixes done yesterday. Today will be focused on testing. Let’s review the key components and their purpose:

What is Big Money betting on and what direction?

This is the question that the scanner hopes to answer and then takes it a step further my providing possible targets and the ability to plan trades. The next major upgrade is probably a confidence indicator of if the scanner’s alert is indicating premium selling action or a directional bet.

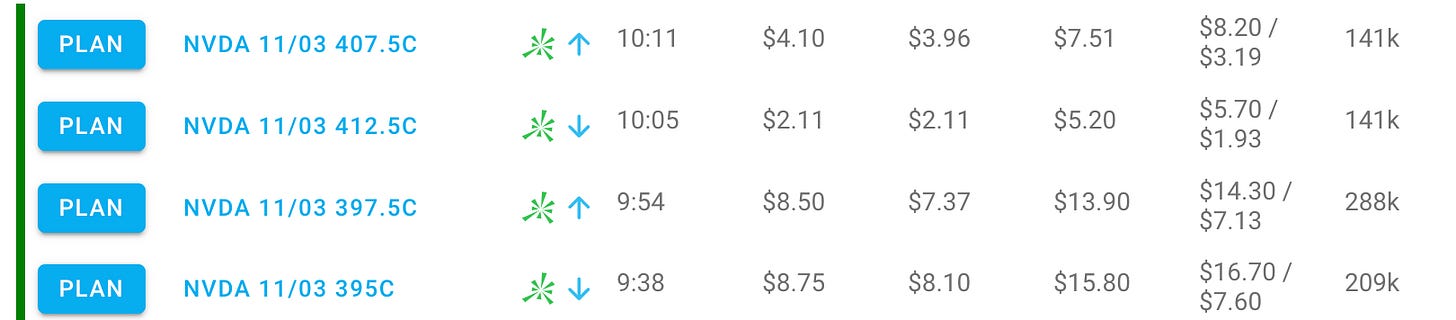

Notice how most of the alerts from 11 to 1 yesterday was put side, however after a little pop in price most of them expired worthless. I have a hard time believing these transactions were actually betting for more lows, I strongly believe they were collecting premium! So I’m trying to figure out the logic or some way of reliably predicting the intent.

That sole 4190c buyer caught my eye. Also I liked 4200c yesterday because I thought we had a decent chance to squeeze 4205 to 4215. I was wrong. The interesting thing….

Which contracts should I take for my price target?

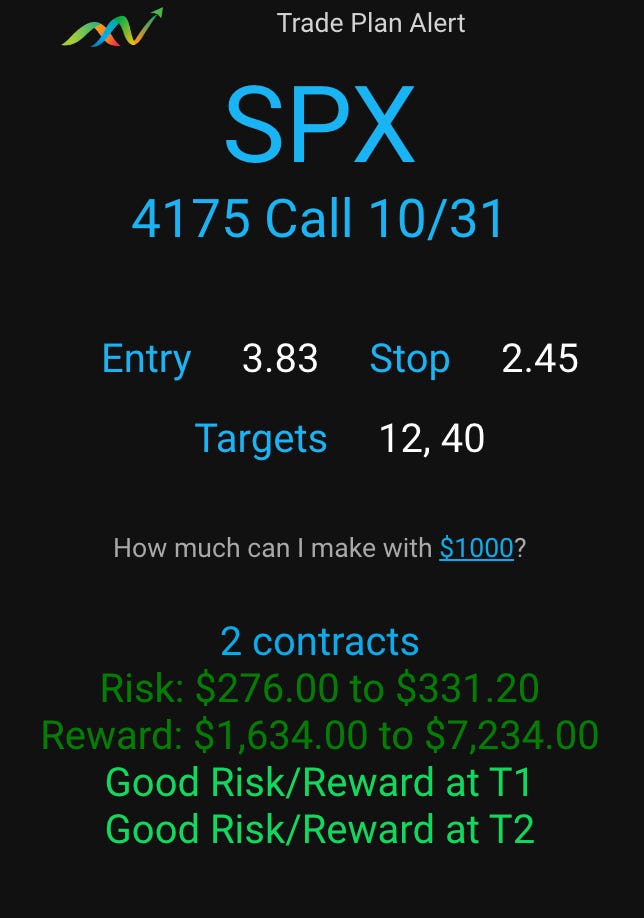

So I used Edge’s what if more to simulate generating a plan around 12 when that 4190c came out. To see what it would suggest for my targets.

While it did not get to T2, it nailed the entry…. The option price was around $7 when the plan was made. Edge suggest a 3.83 entry and a 2.45 stop. Result — $12 T1 hit a high of $20. That is 5x the Entry Price! I was wrong on target for day, but still right on getting paid.

How do I be more systematic / where should I sell?

One of the features in the planning component is you can choose sell targets based on estimated move or based on risk/reward multiples or manually edit the targets to use a blend of both! Edge also will use your capital allocation and risk rules to calculate the number of contracts you should use to be systematic across trades!

No more over or undersizing…

That’s it for updates on Edge for now. I hope you like where it is going.

Price Action for Tuesday

Basically we had a handful of tech names flush and then rally NVDA & TSLA and SPY gave us the day 2 rally I was expecting.

The neat thing… NVDA dipped right to my 394 target level and… scanner caught..

Nice results for joining that option contracts at the level. the 412.50 almost tripled.

My plan for Wednesday

Overall I’m expecting today to be rangy and have multiple faker moves. so I will only enter if key levels are tested / extreme ranges with a faker move.

Otherwise my plan is…. DO NOTHING until after FOMC meeting. I probably won’t trade until 2:30 to 3pm today.

I’m gong to set alerts at major levels on stocks / indexes and if those hit look at screen otherwise, I want t wait till last hour and nail a 5 to 10 bagger. I want to be mentally fresh for a potential trade then and I want to avoid getting trapped.

Overall I think market is setup for a major squeeze higher today or tomorrow, but if SPY breaks 414 again, I’m just as happy to look to get short again on pops.