FOMC Pays Again! Time to BTFD (Buy the dip)? Plan for trading SPY on Feb 1

Can we find a 500%+ trade again?

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading. Additionally, I’ll share the top day trade results for ideas from Edge Trade Planner (Beta), a powerful tool to enhance your trading decisions.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Jan 29 - SPX 5910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22k potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Wednesday’s Price Action

We got more or less exactly what we were looking for. Some trend early with opportunity on the after earnings plays followed by waiting for FOMC. As I wrote yesterday that my plan was to take quick trades in morning and then wait for 2:45pm. It was perfect. That is how you bank spending less than 2 hours!

Let’s get into the action…

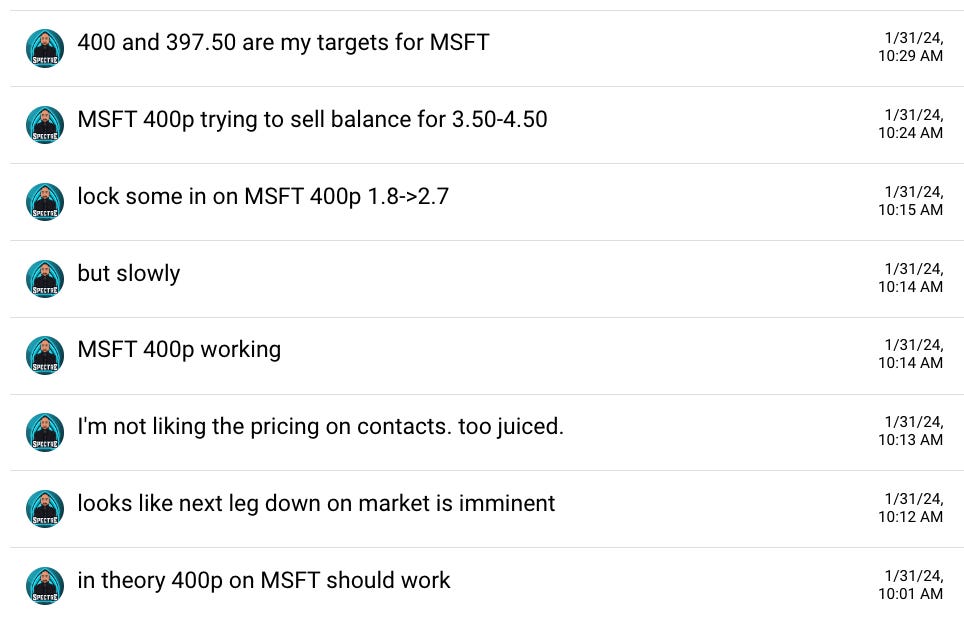

MSFT - pop and drops.

I was hoping for fast dip to get long, but the action started off with a pop and drop setup.

MSFT had an early dip into 396, and I want to buy that dip! but by the open it had gone green. I took a quick long on the vwap dip at the open and sold as it spike over 413 toward 416 for a quick 30% gain. I had to watch if this was going to hold vwap and bounce or break.

It went red (breaking solid blue line) and backtested, this is where we follow process and target the 397.50 level. so we take 400p anticipating being able to sell for 3.50 and 4.50.

Be sure to study how the options prices moved.

I missed the entry at vwap around 1.30, but entering at 1.80 was still OK! why? because if there is all day selling, it isn’t coming back to $1.30!

It then flushed to 2.70 - Why do we sell? I was risking 0.30 so that gives me 3R. I raised stops to 2.60 and quickly got stopped. I placed an order to reload at 1.80 (original entry) with a 0.45 stop (risking 50% of profit) and forgot about it.

When an e/r name goes red, and rejects like this did, it usually means longs got trapped and it will turn into an all day seller. And that is exactly what happened.

It barely popped and couldn’t even get over vwap with the rally after FOMC.

By end of day the predicted $4.50 sell target came for 100%+ gain:)

SPY / SPX - FOMC action

No point going over the morning action, I had wanted to go short if we filled the gap but we didn’t and I didn’t want to chase this short on a gap down as I was unclear where we would bounce.

KEY LESSON HERE - Doesn’t match levels or trade setup with good risk/reward - skip it!

Contracts are also juiced given FOMC so the yield on capital use is crap!

So we wait.

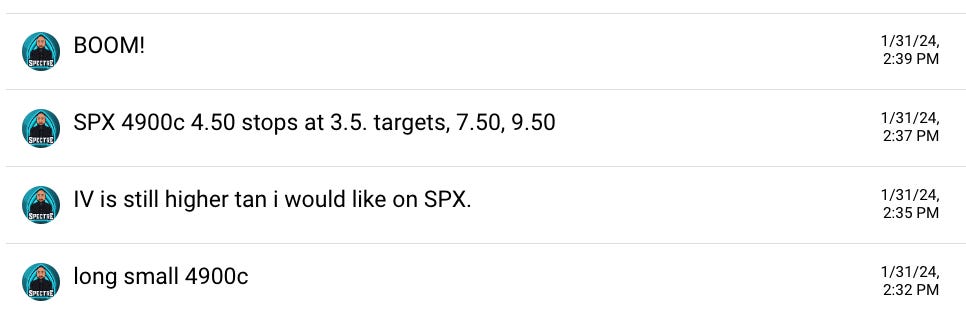

I was comfortable taking a risk long, at 4875 after FOMC minutes came out. First entry gave 2 points. and I stopped and hawked. and then got back in on 4900c.

You can see how the contracts based around $4 for the 30 minutes. Then dip a pop, faker dip and reversed around 2:35pm

I took a starter around 2:32 and then once I saw the fake dip, the risk reward at 4.50 with $1 risk was too good to pass up. Sell at 7.50 and 9.50 to give me 4x my risk and 100% on face value. eventually it pushed to 13 and my trailing stop on runners hit at $10. Great work!

What about 500%?

This is where learning the trade setups are so essential. Let’s break this down on SPX as powell spoke.

Initial reaction was the rally from 2:30 to 3pm. But where did it rally to?

It rallied to high of day BUT a lower high. That is caution warning. At the moment I was starting to scoop AMD and was focused on that because even with SPY dump, AMD was grinding and so I wanted to position for a possible end of week squeezer into 180+.

As soon as I saw SPX breaking back under 4890, that turned this into a fake out breakout, and we have seen this many times in past FOMC days. So we have to target the level below on support break which means we target 4844! Guess what low of day was. 4845! Not bad of target from 50 points away!

After this initial dump, when SPX 4860p was at $12 I called out that I wanted it at 1.50 and ride into the close. My target for entry was off by $1, but we got a s double bottom at 2.50 so enter at $3 and by end of day $15. that is 500%! Technically only a 400% gainer, but I’ll take it!

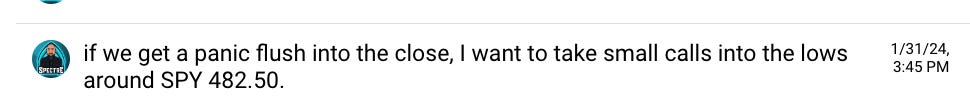

Swing long idea at the lows

15 minutes later we got 482.69. good enough. And we are gapping up almost 3 points from here!!

Summary Review of Market Price Action

Yesterday’s selling could be the first shot for profit taking into February and providing a corrective leg. This aligns with my thoughts from late December, however my model/target was for SPY 495 before real selling begins. So I expect next couple of weeks to provide lots of opportunity.

So Is it time to Buy the dip? I plan to wait for a gap down reversal which may come tomorrow if SPY sticks to its previous patterns.

Educational Lessons

From the price action review you should have learned the following:

On FOMC days, you can wait until after 2:45pm to avoid traps and trade for less an hour and bank!

Failed breakouts on e/r names ca turn into all day sellers.

Be prepared for traps in both directions on FOMC days.

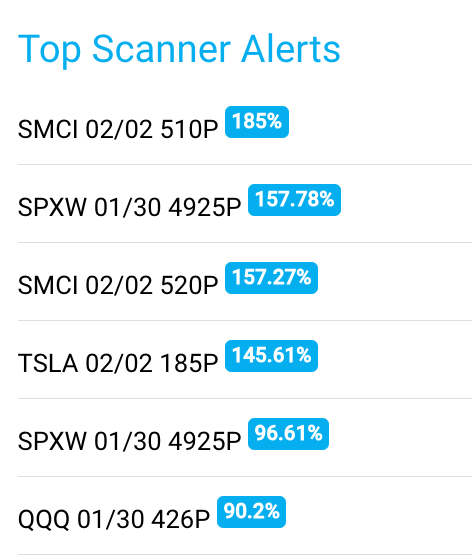

Edge Trade Planner - Top Scan Alerts

Even the scanner had a hard time finding great same day trades! I want 200%+ gainers.

Key Events this week

Thursday - 8:30am ET - Initial Jobless claims

Friday - 8:30am ET - nonfarm payrolls and unemployment rate

Key Earnings Reports this week

Tuesday after close: AMD 0.00%↑ EA 0.00%↑ GOOGL 0.00%↑ MSFT 0.00%↑

Wednesday after close: QCOM 0.00%↑

Thursday after close: AMZN 0.00%↑ AAPL 0.00%↑ $MEA TEAM 0.00%↑ SKX 0.00%↑

Trade Ideas - Plan for Thursday Feb 1

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Read on for the game plan for SPY SPX ALGN.