First Green Day, does a rally start? Plans for Tuesday Oct 24.

First let’s review yesterday’s action. I had kept the option of a gap down reversal play being in the making and that is exactly what we got. SPY 0.00%↑ gave 6 pt rally right to my levels, and a failed breakout trade setup for a short into the close.

Members saw my comment to watch tech names dip into vwap at the close to scoop long. So far in premarket names are getting a nice gap up.

Given I was traveling, I was unable to trade the afternoon action, but it was very textbook.

Here is how I would have traded the afternoon. Definitely tricky. The trick you need to do is anticipate the entry price on the pops after the confirmed failed breakout signal.

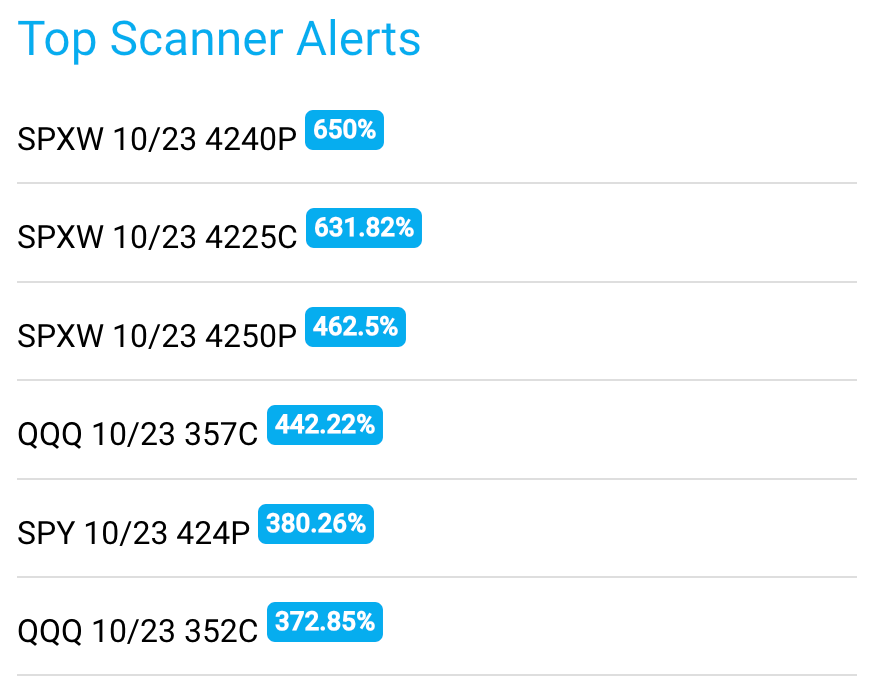

As for trades, getting long on tech names was great. Scanner caught some great longs!

Here are top performing alerts from yesterday:

One interesting note, was TSLA made a clean failed breakdown reversal move, but call actions didn’t hit radar until late into the move.

Let’s get into today

What I am planning for today

Overall I’m looking to short the open for quick profit taking/fill some gap if it develops and then scoop long off the lows for more upside.

NFLX 0.00%↑ may squeeze over 410

TSLA 0.00%↑ dips into 212.50-214 like 217.50c

SPY 0.00%↑ should struggle to cross 424.60-426.area, but if it does, it could lead to a back test of 431.50 this week before we head lower.

Remember I can have a bullish or a. bearish stance at open, but once price action develops, I will takes trade that give great risk/reward over a 1 to 2 level move. I don’t care if it is long side or put side. Stay flexible. Don’t let stubborn beliefs override risk/management rules.

Members I’m working on the watchlist and it will be out soon and we will start Premarket Prep just after 9am.

PS. I’m LA for the week if anyone wants to meet send me a message.