Everyone gets a 10 bagger! Is this the beginning of the end for TSLA? My plan for Thursday Jan 25.

Looking for another 500-1000% trade today. Can we get it?

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading. Additionally, you will have access to the top scanner results for ideas in Edge Trade Planner (Beta), a powerful tool to enhance your trading decisions.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day with a goal of earning 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22k potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Wednesday’s Price Action

Given the previous 2 days of monster support and market reaction to NFLX’s earnings, sentiment was very bullish and many names gapped up.

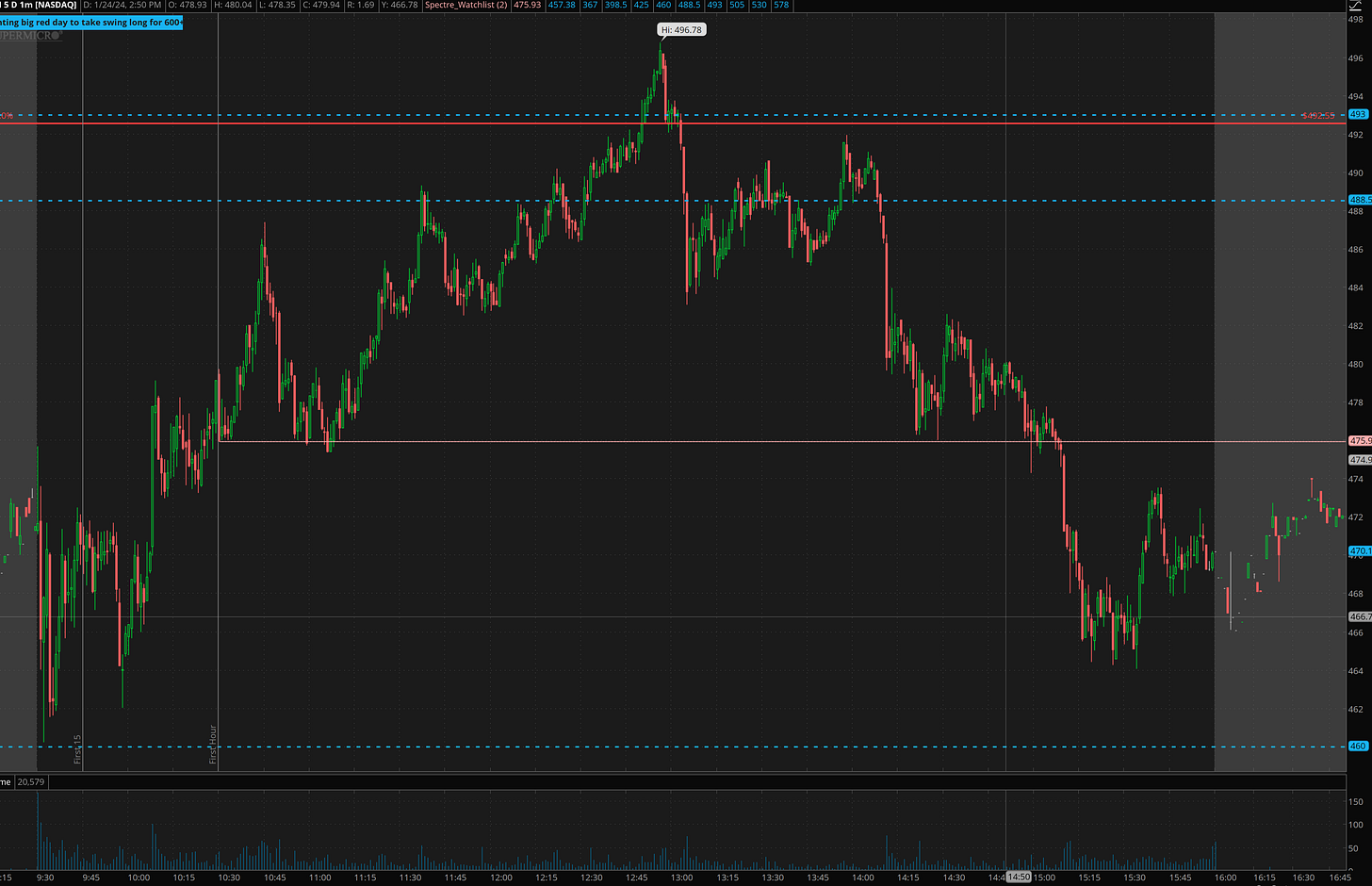

SPY - gap up reversal trade for 20x

The gap up was no surprise. I made a plan to get long at 486 but we didn’t dip enough so no trade and I didn’t like the risk/reward and potential for chop over 487 to get long. Instead I made a plan to look for a triple top and failed breakout and dump after lunch for gap fill. My prediction and timing couldn’t have been more right.

First lets look at morning action.

We got a nice early dip and then after first hour 488.30 was tested and failed. Normally I would have got short. But this is where experience comes in. I wanted a double or triple top to drain the bidders. I’ve seen this setup over the years and planned for it to develop exactly how it did.

45 minutes before the failed breakout happened I shared with everyone exactly what I was looking for plus a credit sell trade to risk 0.50 to make $4.50. almost a 10x gain. The credit sell at time of alert was around $3, but planning and patience was perfect. The 4.50 filled! I love credit sells when 0.50 risk and 90% chance of 4.50 gain.

I shared the 10-20x alert entry with THT pro and elite members. I wanted 4880p for 0.40 but it only dipped to 0.50 which was good enough. And I took the 4890p for $1.50 using $1.30 as a stop. Here is why.

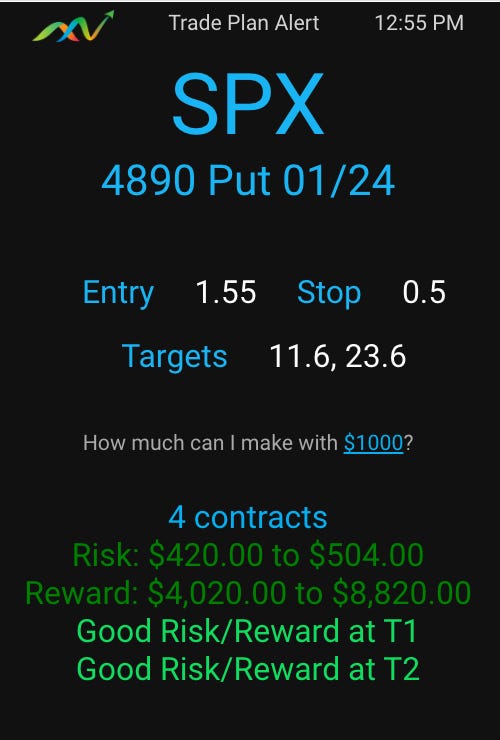

First I planning on a new high coming but instead of a grind, the new high was flat topping. and I figured why not for short. only .20 risk. around 12:55 here is what Edge’s Plan generator came up with:

On the 4880p I was 95% confident that if this is the failed breakout I will be able to sell for $6+. That is 10x baby. Take that bet! + profits from 4890 will pay for the risk so I can be patient on that.

Here is how one can do the capital allocation and risk management. $2k bet. Goal 6k-20k gain. 10 contracts for $1500 on 4890 at 1.50 and 10 contracts for $500 on 4880p. Selling 5 contacts at $5 = $2500-4.50 cost so $1500 profit with $1500 unrealized. that more covers the 4880p as yolo to ride into the levels below.

I wasn’t sure how much chop and so my plan was to first get the risk off. I sold 50% into the first leg down at $5 and more at 4.50 because there is usually a backtest and wanted to reload at 2. unfortunately it only for to 2.50. I was trying to fill for less but it moved quickly and I chased and added back at 5.20 and established my 12, 15, and 20 sell targets. And that was pretty much the work to be done. from 12:45pm to 1:30pm. That is the positioning. The rest is letting bracket orders do the work for you.

SPY essentially filled the gap by end of day. Perfect Gap up Reversal Trade! Textbook. If you want to learn or get alerts send me a message.

NFLX - dip and rip?

This was harder for me, I was the dip into my level and started pushing so took calls, I wanted to sell at 470 but 460 was the stall out and had to lock in. the put contracts were juiced so it was hard to get short with size, so I took a small scalp targeting 445-448. and started planning a long there.

Basically the pull back to 445 into the close was no surprise given market action. I was really wanting 470-480 so we could get a much better short pay out.

Let’s see what happens and if we get a day 2 move to more highs.

NVDA - simply magnificent long and short

I saw this buying on the scanner ad joined it. Given the levels, the target was 625-630 and we got there! In yesterday’s blog, I wrote:

NVDA more or less did both! dip and rip off 599, and as soon as 603 clear it was on it’s way to 628!

Here is the Trade Idea I shared in Edge. Looks like I misread the level and took 615 instead of 612.

we hit 612! the 620p from $4.50 hit $12. My target was $9+ for the 100% gainer.

TSLA - earnings report explains why it hasn’t participated in market rally

Musk and team did little to provide hope and excitement in the near term for TSLA’s future. Per my comments earlier in the weak, break of 200 opens the door to 180 and after the e/r call, I would even say if bulls don’t step in, it could be headed to 150 or less in 2024.

SMCI

For the sake of brevity. WE NAILED IT. Gave us 460 double bottom for long to add to swings. ran right to the 488 and 493 targets and then a failed move triggering profit taking back into 460s. May be range bound now ahead of e/r next week.

Summary Review of Market Price Action

Overall the market is in full BTFD mode and yesterday’s dip at the close was market filling the gap. Today is where we should learn if more downside or if bulls remain in control.

Educational Lessons

From the price action review you should have learned the following:

Patience and planning is the hard work in trading. Use Edge to plan your trades and bracket orders to maximize gains and step away from the computer. Trust in your plan.

Use the levels and the reaction to the levels I share each day to guide your trades

Making 1000%+ trades trading SPX is very achievable.

Making 100-300% on non 0DTE trades is also very possible.

Gap up Reversal Trade setups have an 88% win rate for me when properly recognized and executed.

Choose multiple strikes on high confidence trades so the closer strike pays for the risk on the further strike and let the further strike run to get you 10-20x gains!

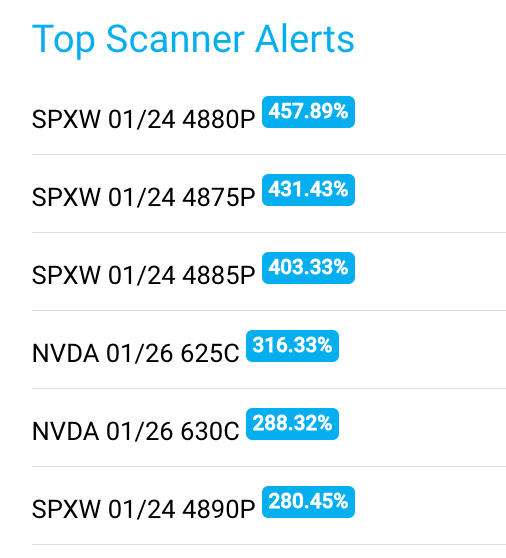

Edge Trade Planner - Top Scan Alerts

No surprises here that the gains were only 100-200% given the consolidation day.

The results above are wrong. The system had a data collection issue and so its missing the time sales data for the 4880p and 4890p contracts and unable to calculate the actual move. the 4880p was 2000% and 4890p was $1400% from our entries.

Trade Ideas - Plan for Thursday Jan 25

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again to. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

After yesterday’s action and moves emotions could be running a bit high. I’m going to play both sides like yesterday but have a small bearish bias into strength.

SPY - Reaction to 487-487.50 is key. 485 is key support.

TSLA - Wrecked. In theory may see sub 180 tomorrow. I’d love 195-198 push to load up on 190p. and yolo 182.50p for 0.50 or less. This will be my primary focus today.

NVDA - gapping up if dips 612/615 again and hold may consider 625c. If pops and rejects 625-628 area will consider puts for consolidation action.

SNOW - failed breakout and off radar. it was unable to get over 211.50.

I will likely look for 1 or 2 trades is morning, but could end up waiting for afternoon to provide a trade. I have to be careful. after yesterday’s big wins, I have a habit of wanting that everyday.

Don't forget to like and share this post to spread the knowledge and help your fellow traders!

Disclaimer: All content provided is for educational and entertainment purposes only. It should not considered financial advise or a recommendation to buy or sell a security. The content is the author’s opinion only and may or may not be accurate. Author may or may not have positions in securities and may or may not open a position in next 48 hours.