Does SPY gives us another RED day? Plan for Tuesday Feb 27

How far will ARM squeeze?

Good morning traders.

Yesterday was a mixed bag. A handful of stocks ripped right out of the gate including the one I wanted to bank on that I wrote about in yesterday’s blog.

TSLA was the surprise ripper for running in sympathy to China EV names.

COIN swing idea from last week worked like a charm! And ripped in sympathy to btc rally.

I hate chasing, and there wasn’t a buyable dip. So what do you do?

I’ll talk about this and how I plan to trade today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

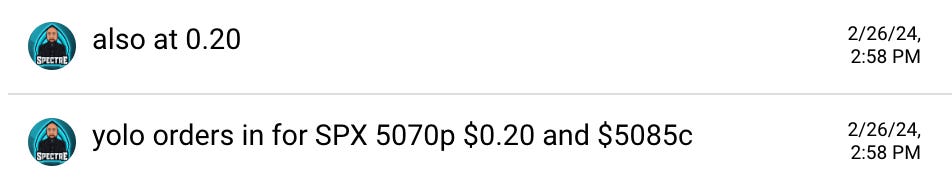

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Friday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

ARM

From premarket action and last week’s wind up, this is the one I wanted to bank on. Unfortunately it started ripping before I could get positioned for a day time scalp.

I bought some 150c into the the vwap dip, but the contracts were so juiced that there was barely anything to be made unless one bought right at the open.

I’m thinking 150+ maybe 170 can come this week, but I don’t love the risk/reward at $6.50 average. So I made a plan that if the contracts dip back to back test 138-140 later in day or this week and I can get the 150c for $2-3 I will get in, otherwise, it will have to run without me. There will be other great paying trades coming.

After the initial run ARM more or less consolidated all day. Let’s see what tomorrow brings. I’m not completely convinced this joins the rest of the AI stocks in wild rallies, so if I’m going to hold overnight, I need a great risk/reward!

That is the key lesson here, It’s not about being right and being in it, it’s about being in when the reward is worth taking the risk. If not let it go. I know I will find 5 or 10x trades so why do I need this one to pay me.

I don’t! That has been the game changer in my trading! My biggest challenge today is impatience, but when I’m patient, magic will come my way. I’ve had 1 red day in all of February and my account is up a whopping 345.7% at end of day this month!

TSLA

Hats off to SJ, one my long time students and trader friends. He called out he thought TSLA was going to 200 in premarket yesterday.

TSLA started ripping right out of the gate. My guess is sympathy to LI. I missed the entry for the long so I waited for 200 for a scalp short. I got 50% off a small gain and stopped at breakeven on the other half. TSLA was too strong! Usually it gives a deeper dip, but this time it didn’t.

I considered a swing late it day for 205c but decided to hold off and evaluate the next trading day.

At this point between the ARM and TSLA scalps, I’m up about 5% on the day not counting the COIN swing I mentioned last week around 162.

COIN

Totally took off yesterday with btc ripping. With the way it is going 220+ is coming.

I sold some swing calls on this rally and just let the rest ride so didn’t pay too much attention to it since contracts were so juiced. The double bottom on the peach line and hod break was a tradeable long entry but I was too focused on wanting to catch a dip on ARM and missed it.

SPY

So you see that I missed a bunch of trade opportunities. All day yesterday I was mentioning that contracts are juiced and I just don’t love the risk/reward. I detest making 25 to 50% on the face value of a contract. I’ve done, but I want big gains while spending minimal effort. So after the morning action, I made a plan.

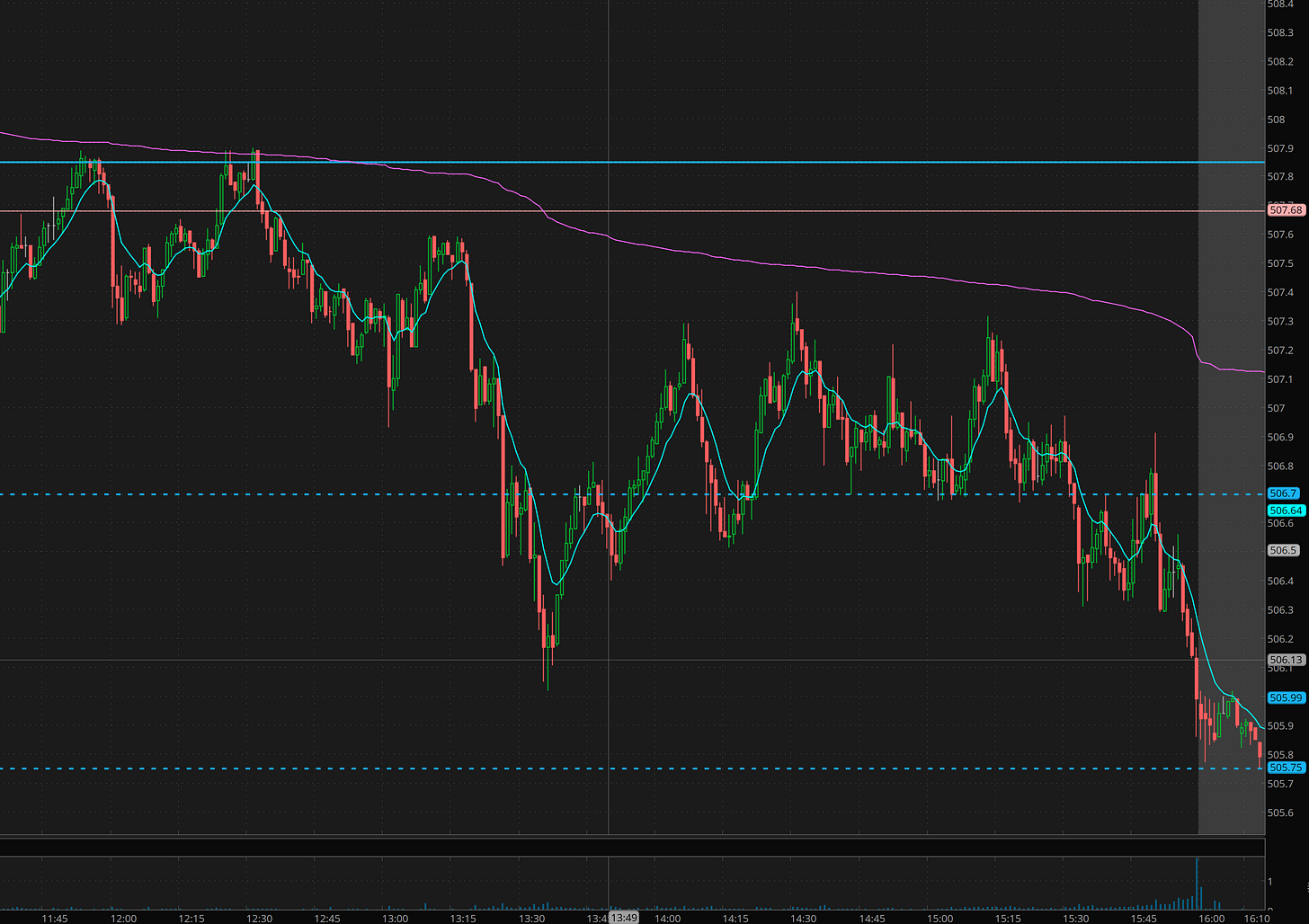

The afteroon developed and gave us a short setup.

I developed a short bias after seeing vwap, the red to green line(solid blue line) and the peach line rejected twice. At this point process takes over. I’m shooting for 505.75 to come into the close. I actually wanted a quick dip there and then hard reversal to close above vwap. So I made multiple bull and bear plans. The bull dip gave me a 100% gain while the bear entry on a pop gave me 150% gain quickly.

I made these plans:

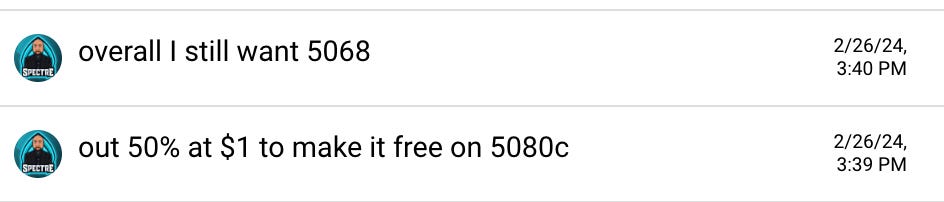

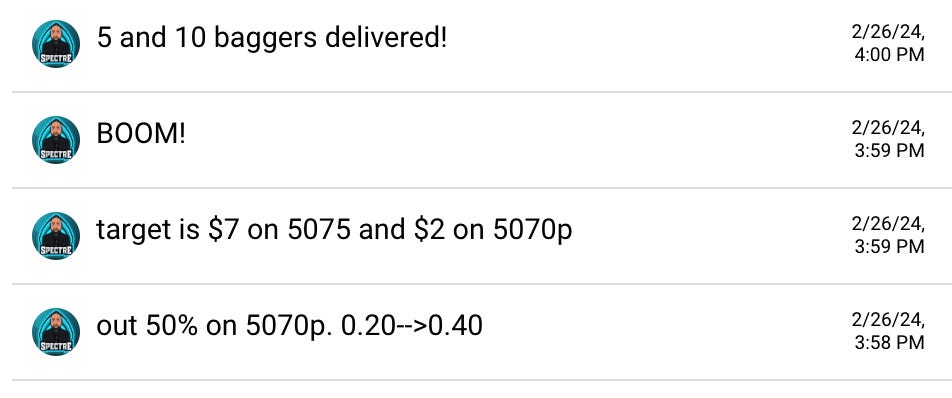

The above messages show how I was trading both calls and puts at the same time taking advantage of the chop, selling 50% at a double to make the yolos free for possible 5 to 10x payouts into the close.

5070p was beautiful! it gave @0.20 —> $2 all in the last minute of the trading day!

This is the power of planning and process!!! Would you risk $200 to make $1200? (I sold 50% at 0.40 to make it risk free)

So I missed all those great runners but what was the gain on the contracts and how long did it take for the payout to develop? Look at what I got in last hour! mutliple 100-200% payout trades and a 6x and 9x trade!

Knowing you can identify and plan great trades and the next one is around the corner even if you don’t know exactly when helps slay the FOMO beast!

Summary Review of Market Price Action

Mixed action with some names picking up bids while other names sold off. SPY is in consolidation mode ahead of PCE on Thursday, but there is a chance it rips today.

TSLA, COIN, ARM all look to being setting for gap ups and more highs.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

If names rip out of gain, wait for first hour to join entry

It’s ok to not chase runners, there will be great plannable trades

Not all of your great ideas have to pay you (ARM for example, nailed the idea, didn’t get the entry)

Slaying the FOMO beast will change your trading life and journey

Trade Ideas - Plan for Tuesday Feb 27

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Will today be a third red day for SPY? In the last month there hasn’t been 3 red days, so unless we break SPY 505.50, I’ll be looking to buy dips for a green day to come.

The primary stocks I’m watching: SPY, COIN, TSLA, VKTX

Read on for my thoughts/plan for today.