Does SPY breakout over 475? Can NVDA see 550? Scoring over 6 100%+ gainer trades in a day. My plan for trading Wed Jan 10.

Good morning all. My sleep schedule is still messed up. (couldn’t sleep most of the night) so being process centric,I will trade less and lighter today to avoid mistakes from lack of sleep.

Price action review and scoring over 6 100%+ trades

I know I harp on this over and over, but when expecting rangebound consolidation, I will take profits faster and take gains at 100-200% and not wait for a 500% gain. Why? because when being systematic those gains add up quick and if a choppy day forms those gains can evaporate quickly and you may not get the move for the BIg payout. One way to get a bit of both is to sell 70-80% and leave 20-30% as runners for the high conviction moves.

So how do I catch so many? It has to do with 0DTE on SPX and us getting large moves in NFLX and NVDA.

Let’s review.

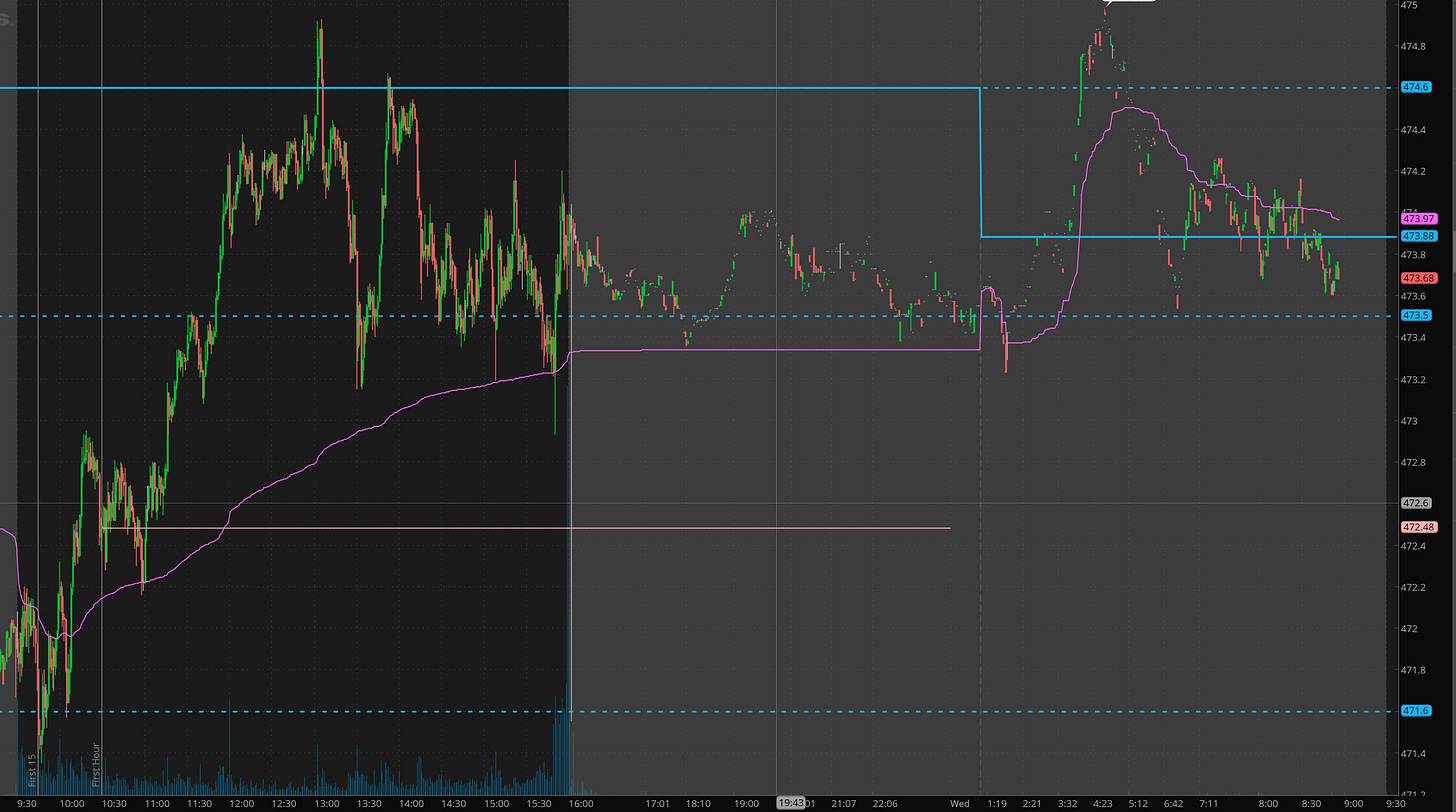

SPY / SPX

I made a plan for the dip and rip off 471.60. You can’t get any more beautiful than that.

For this we took SPX 4750c around $3 targeting $14+, with profit taking at 6 and 12. Hod was 15. 100 to 300% gainer!

I also was hawking the rejection after lunch — came as a textbook move. SPX 4750p up again, this time going from $2 to $6. I was away from desk so missed the $1.15 entry (had a $1 entry order in but it was just shy). 200% gainer!

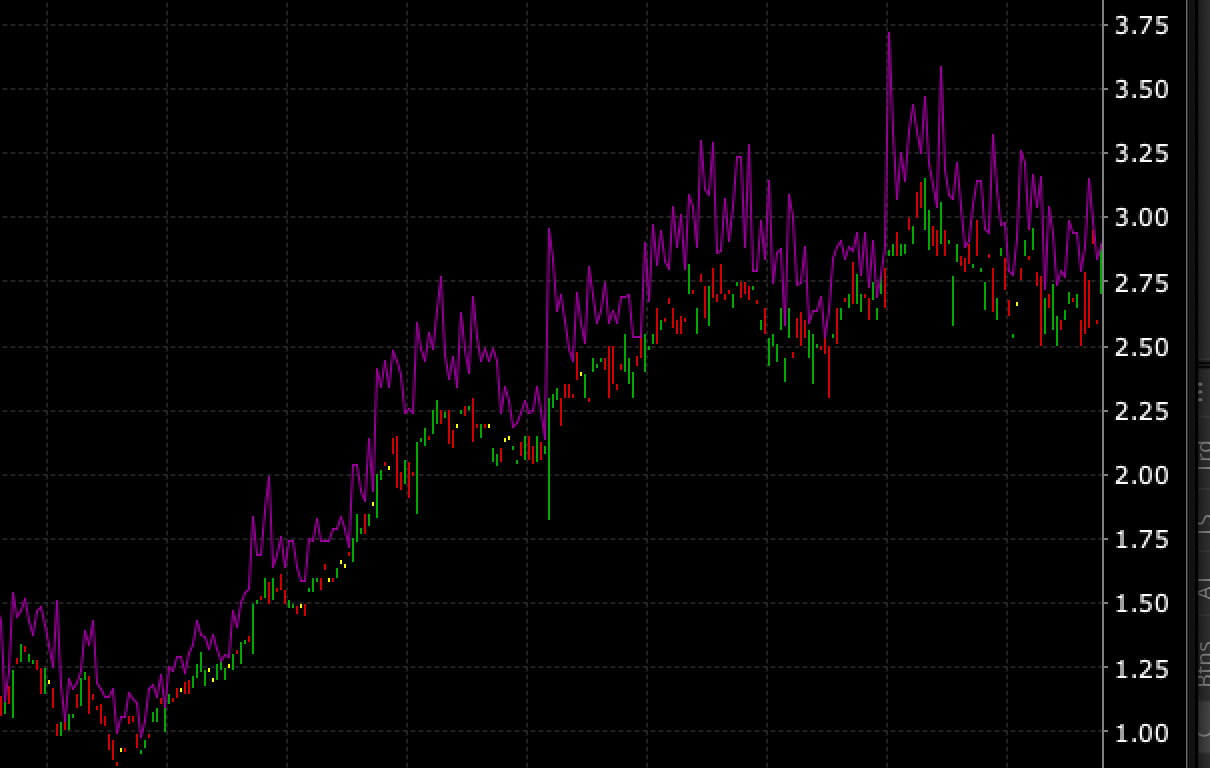

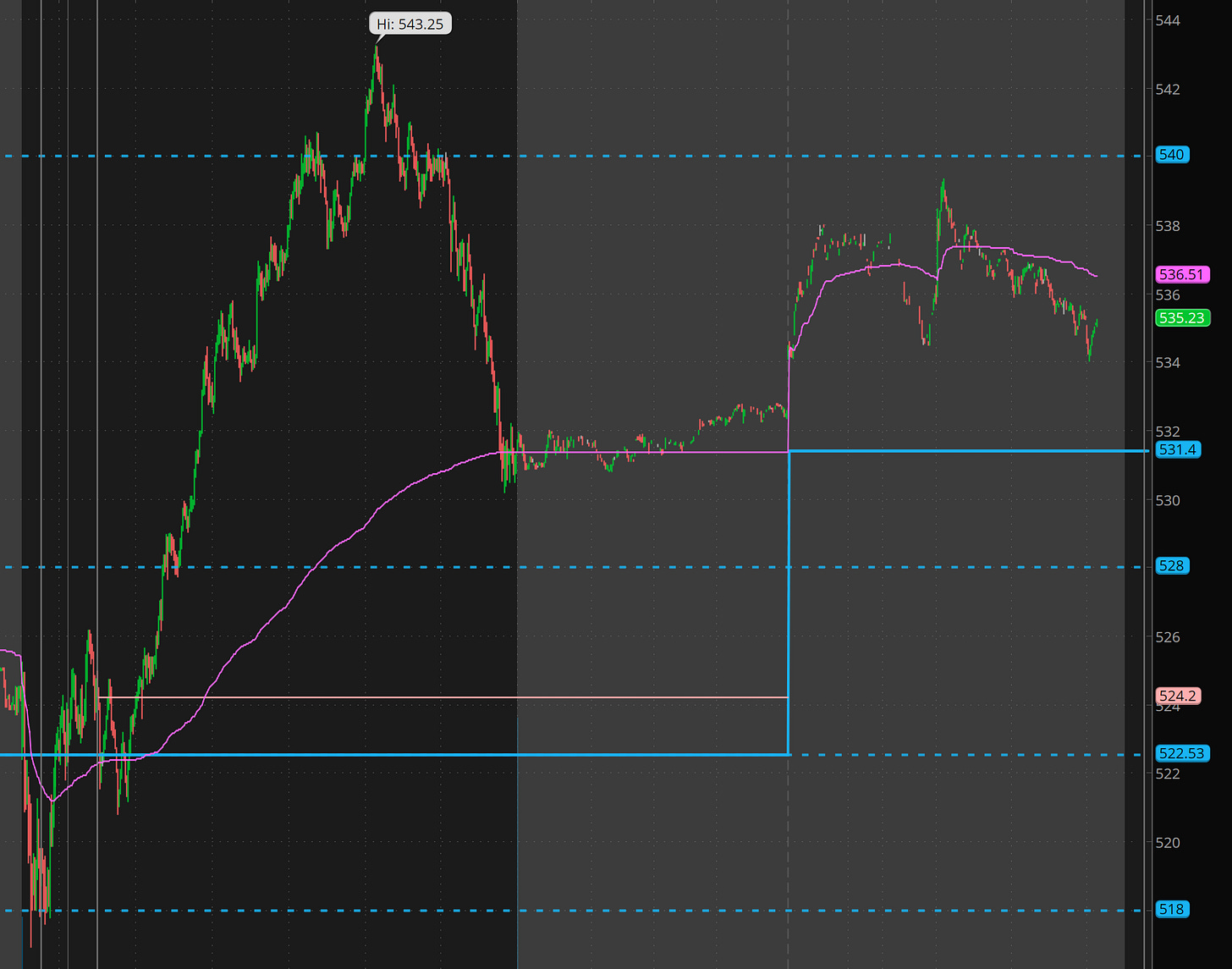

NVDA

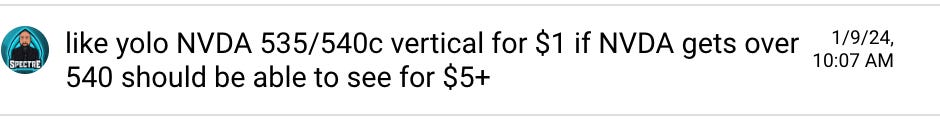

Decided to take verticals on this. NVDA 535/540c. Why? Because If we consolidated today instead of ripping, the premium wouldn’t get me. We nailed the entry!

Notice how we had a 2 level move from 522 (our entry at vwap) after the first hour and the push right to 540! The levels are magic!

The vertical went from $1 to $3. 200% gainer

NFLX

This wasn’t on the watchlist, but I figured with market strength it will do a gap fill.

so 485c was the plan

So these went from 2.20 at time of alert to 5.50 for over 100% gainer

BA

Ok. so I was right and wrong on this. Right for short from Monday up near 235 but wrong on follow through selling for breaking 220.

I got short on 220p thinking we would flush into it, but because of the gap down had to keep stops tight. so we got it at 1.80 and stopped 1.50. No need to be stubborn.

If you took 230p and swung from Monday. the puts went from 2.60 to 6+ as a swing trade.

So overall, market is still in BTFD mode and working on breakouts and grinds higher overall. Even BA imho, should be sub 220 given the news, but BTFD keeps saving it.

Plan for Wed Jan 10

I’m going to take it easy today. after awesome clean moves I’m worried about chop.

SPY

Over all SPY is setting up to break over 475 and head toward 477+. but we may get some profit taking / de-risking action ahead of CPI tomorrow morning.

Stick to process and price action trade setups. if we clear 475, back test 475 and clear 475.40, I will expect a move toward 477 to develop.

I’m be watching for dip and rip off SPY 473/473.50 for 475 clearance. so SPX 4780c for $1 as a yolo may payout.

NVDA

i don’t plan to touch unless I see a double bottom after first hour.

COIN

not on watchlist but keep watch on the side since it broke 148. Given lack of news, may flush out sub 140.

Good luck today!

PS. I need your help, a bunch of people are asking for access to edge and alerts and more education. Please send me a message. I want to get a survey of how I can best help you but I need to hear what from you.