Dodge the SPY Volatility Trap Today. Trade Ideas for Fri Aug 29

Turn market maker traps into profits with today's key levels and ideas.

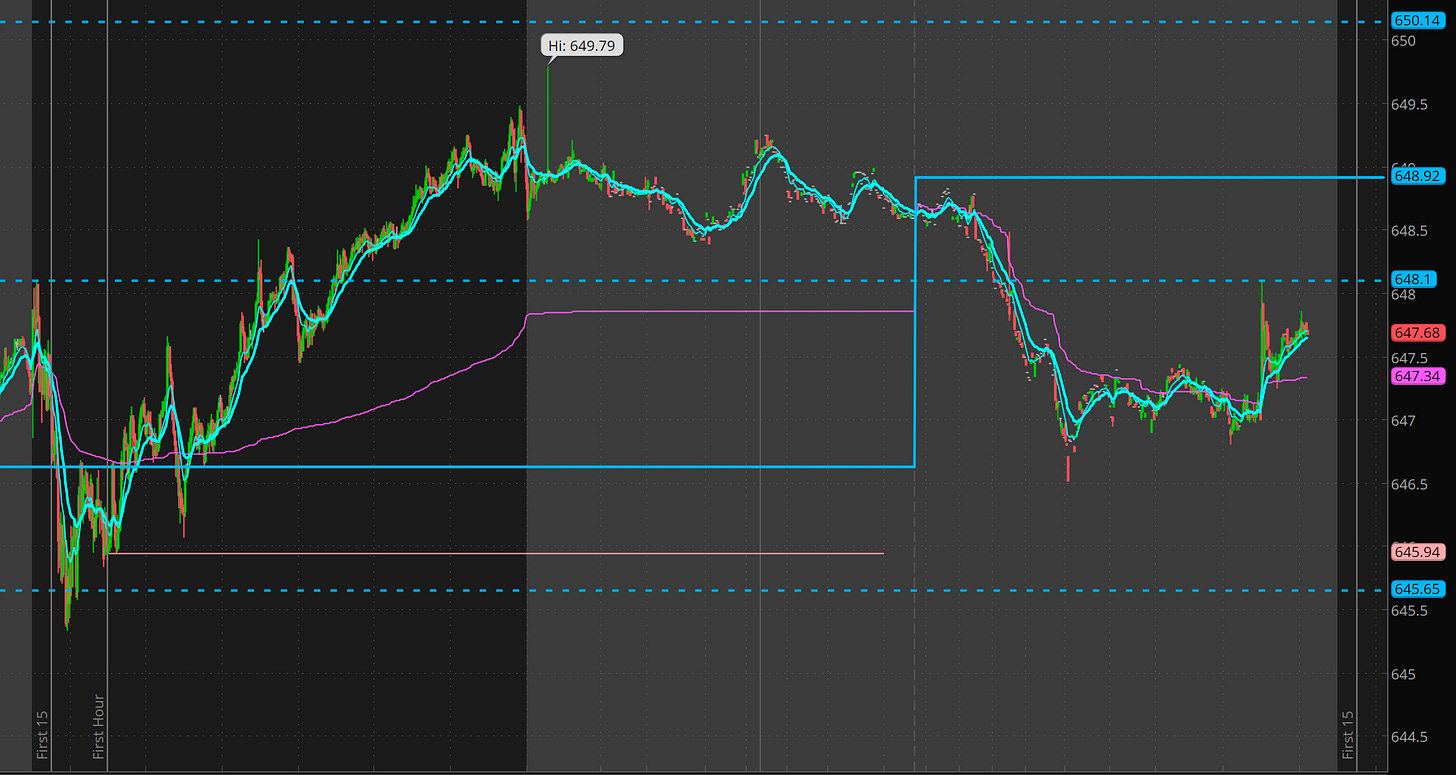

Hey there, fellow market adventurers! As we gear up for August 29, 2025, SPY is showing some intriguing premarket action, trading in a tight range with hints of consolidation after yesterday's wild ride. The latest premarket close sits at 647.28, just below the pivot at 647.91, suggesting a neutral-to-bullish bias if we hold above key supports like 646.02—think of it like your portfolio trying to climb a hill but slipping on banana peels (those failed breakouts we love).

Over the last 5 days, we've seen multi-day highs around 649.51 and lows at 635.97, with volume spikes indicating strong interest at levels like 648.15 (frequent reversals) and 643.66 (bouncy support). Overall bias? Cautiously optimistic, but watch for failed breakdowns below 646.02 or breakouts above 650.47 to spark reversals. Let's protect that capital and nail those status-boosting wins!

Checkout yesterday’s recap below followed by the key levels and ideas for today.

There is massive opportunity in this market. Are you taking advantage? Literally have planned and alerted trades that pay over 300-1000%! You will need patience to wait for entries and the exits. But if you have self discipline or trust bracket orders, my process can help you get the results you want.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education

How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows or failed breakdown reversal at key level

Join at VWAP mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Securing Profits on Options overnight

Sometimes you get this massive paper gains overnight on options but you can’t secure it right? Well if you have a big enough account and a margin account if you have calls you can. What you need to do is buy or sell the stock overnight. and the option turns into a hedge against that position essentially securing your profits.

Trade Ideas - Plan for Fri Aug 29

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Key Events Today

10:00am - consumer sentiment final

Not expecting anything to trigger moves. Perfect for technical plays!

Key Levels and Their Significance

656.81 - Extended resistance from multi-day highs; 65% probability for failed breakout shorts based on low-volume fades, ideal for swing traders late-day; data shows quick drops on 1-minute rejections.

652.36 - Upper barrier with volume spikes >2x average; 68% chance for reversal on tests, suited for scalpers mid-session; aligns with historical peaks for added edge.

650.47 - Strong overhead from price action bounces; 70% hold rate, great for all traders at open; frequent wicks signal traps, active throughout.

648.15 - High Priority: Derived resistance near premarket (0.14% above), with data-driven reversals and spikes; 75% probability for short entries, versatile for intraday; clear chart rejections make it a go-to.

647.91 - Pivot level aligning with premarket close (0.1% above); 80% bounce probability from frequent holds, perfect for hustlers seeking quick wins; high relevance at open.

646.02 - High Priority: Key support within 0.2% of premarket, frequent reversals and volume clusters; 78% edge for long reversals, scalper-friendly early; data flags strong upticks on touches.

643.66 - Deeper support from multi-day action and bounces; 72% probability for failed breakdowns, swing focus post-open; Fibonacci alignment adds conviction.

639.01 - Bottom support with historical lows and spikes >2x; 70% chance for extreme reversals, patient traders late-day if develops; sharp bounces noted in data.

Intraday Trade Ideas for 2025-08-29

Become the trader who turns market traps into triumphs others envy!