Do we make new all time highs today on SPY? My plan for Thursday Mar 7.

NVDA at 900+ now what?, TSLA more selling?

Good morning traders.

What another great trading day yesterday! Yesterday I wrote I wanted to get short on CRWD for profit taking and it gave us 5x. I also wrote I want to get long on SPY 508.50 and that gave us a 3x play and if you swung we are at 511.50 in premarket and poised for possible new highs today or tomorrow.

Were you able to take advantage the setups and levels? A big reason for why I write the blog each morning is for you to learn how I use my levels and plan my trades.

Be sure to read today’s price action section to learn how you too can bank using price action.

With market gapping up, Powell speaking again at starting at 9:40am, and Initial jobless claims coming at 8:30am, the board is set for volatility and profit making opportunity.

Let’s get started…

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

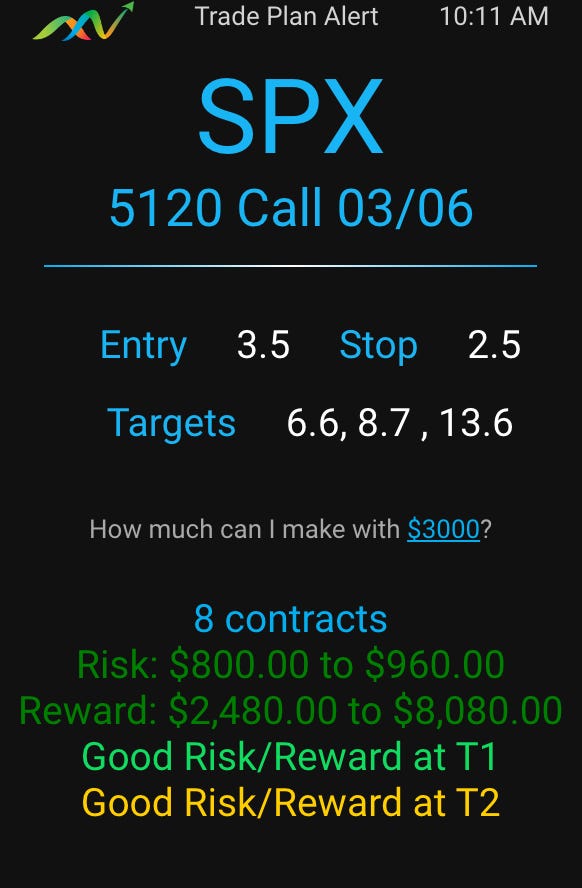

Mar 6 - SPX 5120c Entry $3.50 - High after $12+ ($3500→ $12000 potential)

Mar 5 - SPX 5070c Entry $0.50 - High after $10.75 ($500 → $10750 potential)

** alerted 0.30 entry wanted. dipped to 0.40. entered at 0.50Mar 5 - SPX 5070p Entry $1 - High after $13.50 ($1000 → $13500 potential)

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Wednesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY / SPX

As I wrote before I wanted SPY to dip to 508.50 to get long.

Given the market gap up I wanted some gap fill before pushing higher. and a expected a little overshoot on a dip past the 508.80 level into 508.50 for a failed break down reversal setup there.

You can see how we dipped to 508.50 then push up and the dipped and held 508.80 and then turned higher. That was the entry plan and now we assume we move 2 to 3 levels above from that so our upside targets are 511 and 513.

Here is the plan I made. Not bad to risk $800 to make $2400+. T1 and T2 targets were met. and T3 was missed by $1.60.

The afternoon action turned choppy and I was ablt to scalp both ways for a doubles and also ended up losing some another trade within the chop. At that point I deceided to call it a day. I’ve seen funky price action like that I believed it was designed to catch fomo buyers and burn premium. No thank you. I’ll take. my wins for the day.

CRWD

I expected selling after a pop on the open to lead us to 337-345. However given the way the action on open was, I had to shift my target down to the next 2 levels down which made it 337 and 324. Let’s get into how I look at it.

Instead of getting a push up into the level above and then targeting 2 levels down which gives us 345 and 337 as likely targets we started selling out of the gate. so I then assume 345 is going to break and target the 2 levels below so that is 337 and 324. It’s that simple. Don’t over complicate things, the levels I share work more often than they do not. My levels come from a combination of math and intuition.

Having faith in the levels and targets can yield wild results. But if you don’t hold full size, you can still walk away with great returns. One of my whale trading friends took this exact trade idea and made 200k+ but was upset because if he held full size to the 324 target he would have made $1m!

I got into my CRWD short trade about $1 to $1.50 higher than I should have, but the weakness in TSLA caught my eye and my energy was devoted t that.

TSLA

G

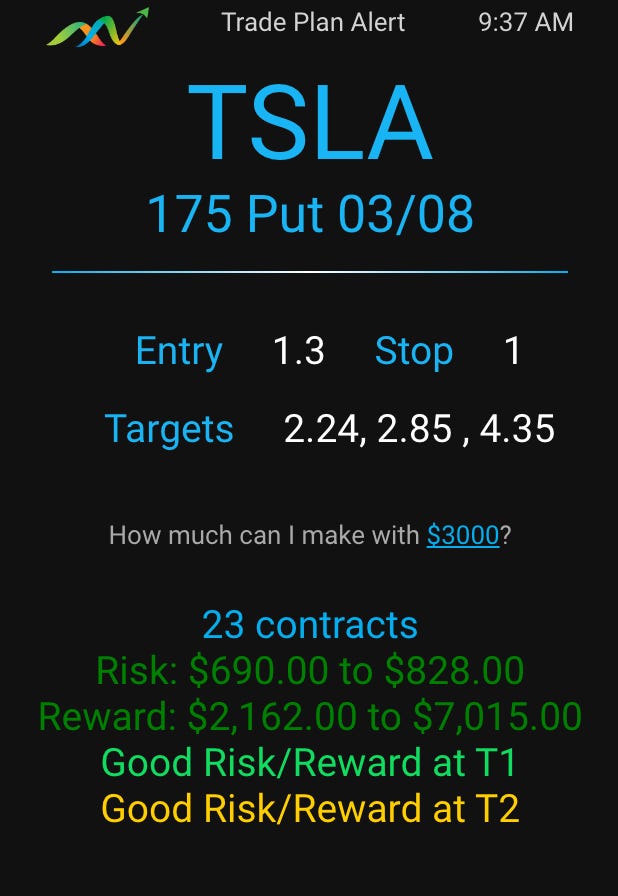

Notice the premarket action beig so weak, so I made the plan that if we get to the solid blue line at the open I will go short targeting 174 or less.

I shared the plan above as soon as I got in. Hitting $4 when TSLA got to 174. So what do I do? I modify the 4.35 sell order to $4 as soon as the level hits. That is good enough!

Solid trades and entries in the morning.

Summary Review of Market Price Action

TSLA continues to act weak and is setting up for 160-165 into next week imho. meanwhile SPY continues to follow the algo pattern which implies new highs will be establish today or tomorrow. However the late afternoon chop yesterday has me cautious and worried a sell program will come out of nowhere soon.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

Use /plan in Edge Trade Planner to quickly create trade plans.

How to target levels after the opening action.

Trade Ideas - Plan for Thursday Mar 7

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

SPY is gapping up again, so is NVDA. I’m going to need to be patient today for entries and may not get a trade until late afternoon. I will likely wait for after 10:30am before opening trades today.

I’ll be watching SPY, TSLA, NVDA today. And possibly CRWD/AMD tool.