Did SPY exhaust at 600? Will it recover trend or breakdown? Musk/Trump feud wrecks TSLA... Trade Ideas for Fri Jun 6

WOW! over 1000% on TSLA and SPX puts. Did you plan it and catch it?

Wow what a day for planning trades. I was even wrong and banked! The price action and decay was a bit trickier, but the process for planning and executing were spot on.

Read the recaps to learn I read the price action, was wrong about the follow through, but was able to flip and get over 1000% gains on runners.

It’s all about being systematic and planning!

SPY / SPX

IDEA: Dips on 595 maybe 594.50 to get long AND break 594.50 and reject 596.

Waiting the first hour was essential. SPY broke 594.50 but held 594. So I wanted to go long, but I was honoring my system and plan. Wait for the first hour to complete.

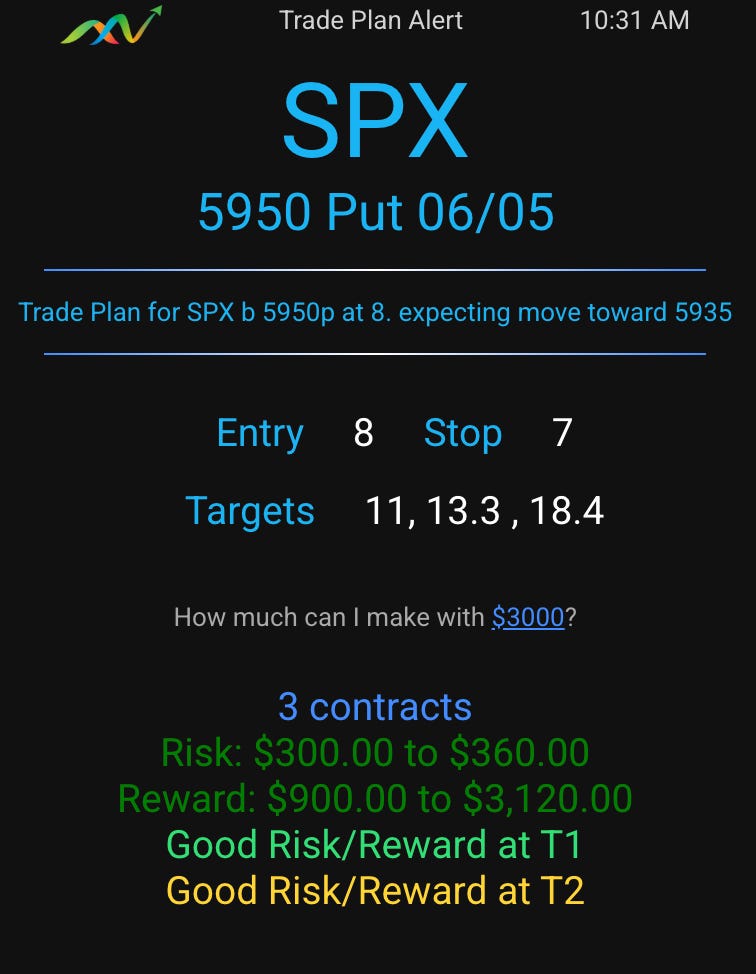

By 10:30 we crossed a little past vwap right the the 596 test level I predicted. So, process wise there was an alignment of expected price action and timing. So I took 5950p for $8 using a super tight stop at 7 believing I nailed the turn.

Into the 594 rested minutes later T1 and T2 hit for exits.

Meanwhile I alerted THT PRO members that I’m also hawking 6000c and 6020c.

We got a double bottom after first hour and 595 reclaim. So I jumped in on 6000c and 6020c. I was basically positioned for downside continuation via 5950 puts and upside continuation on vwap reclaim via the calls.

The runners on SPX puts got stopped while the 6000c and 6020c went on to give 100-200% gains. I sold 50% at $9 on 6000c and stopped another 30% on 598.30 break after almost reaching 600.

My plan was to let it ride or die and die it did, I had profits to pay for if it goes to 0. I was thinking 601 would come.

I also went to go get a massage and run errands mid day as I didn’t plan to trade again until after 2 or 3pm.

It was frustrating as I definitely was considering positioning in puts above 599 in case of a double top fail like we had in premarket. But hey. I want to trade less! And really focusing on that. Anyways, I missed the short entry which sucks because the 5950p on that fail went from 0.80 to 11 in under 60 minutes.

That’s ok. Returning near 2pm, I had to evaluate the afternoon action…

OK so take a look. 599 failed. we dumped to 594.50, then fast rally back to 597 and vwap. the key is to see how 597 was previous support. and was rejecting. If I was back at my desk, This would have been an ideal short….

Then it flushed again this time to 593! Then a quick volume spike over 594. NORMALLY I would take this to be a failed breakdown reversal. BUT I also took it too mean market weakness and we are not backtest under VWAP and the 596 level I mentioned in this blog. Decision time. With TSLA dumping, CRWV, and PLTR well off highs, to me it screamed market switched to risk off.

I planned the targets by counting levels. 592.50 was 2 levels from 595 break and the next level after 594 break.

SO I started in short on 5950p at 3 and average down to 1.80 average… Why? Well if I was right about 592.50 coming I should be able to exit 5950p for $20.. that is 10x! And my bonus target was 591. meaning maybe $30.

Guess what!!! We got exactly that. PLEASE NOTE on these end of day yolos how I lock in 50% to make it risk free! That gives me the patience to hold for massive gain targets.

Finally if you notice every big dip was massively bought and there was a rally so when I saw the double bottom on 591. I got long on 5950c. These did way more than I expect getting to $10 from $1-2 scoops.

TSLA

On Wed TSLA broke 334. i got stopped on my 320p and then it had the gall to gap down and dump.. Frustrating, by my goal was 290-301 given my levels and the price action. So I made a plan. 320 reject get short.

We filled TSLA 310p for around 1.50-3. giving 300%+ opportunity. I then forgot about the position because I was focused on SPX.

I alerted last exit at $30!

What a day!!!! multiple 1000% payers.

There is massive opportunity in this market. Are you taking advantage? Literally have planned and alerted trades that pay over 500%! You will need patience to wait for entries and the exits. But if you have self discipline or trust bracket orders, my process can help you get the results you want.

Thoughts from Thursday price action:

Market is selling near highs

Large Dips continue to get bought

Shorts may have been trapped given how we closed well above 592.50.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Education

How to Join a Strong Trend

The process I typically follow for joining a strong trend are as follows:

All day grinder: join on dips to 20ma

Multi-day grinder:

Join either on support test of morning lows or failed breakdown reversal at key level

Join at VWAP mid day or end of day

Keep it simple. Don’t chase, wait for support levels for great risk/reward entries!

Systematic Profit Taking

How do I take profits? I keep it relatively simple. Depending on the entry and range to the next levels I typically with take profits 50-100% of my profits at 3-10R and then raise stops to above entry with a goal of letting runners take me to the next level or 2 and to then reload if I believe we are consolidating before the next leg.

I then repeat the same process on the reload.

Securing Profits on Options overnight

Sometimes you get this massive paper gains overnight on options but you can’t secure it right? Well if you have a big enough account and a margin account if you have calls you can. What you need to do is buy or sell the stock overnight. and the option turns into a hedge against that position essentially securing your profits.

I’m out of time, but I’ll make a video on this later.

Trade Ideas - Plan for Fri Jun 06

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Ideas

Yesterday’s flush is looking like a failed breakdown reversal in premarket. Will it trend higher or will we chop again today?

Here are the levels and price action I’m looking for today…