Did NVDA save and power-up the bulls? Will SPY hold the gap up? Plan for Thursday Feb 22

Good morning traders. Sorry for the delay in getting this out. This morning’s action had me having to rethink and analyze a few things.

I had my worst red day in February yesterday. Why? I broke the rules. I was impatient. I didn’t wait for my goto setups. I meditated on this for a bit yesterday on why did this happen?

NVDA gave it’s report as expected, and has triggered a large gap up in SPY. Why?

In today’s blog I’ll cover yesterday’s price action, the psychology that triggered my bad behavior (my trades yesterday), thoughts on SMCI and NVDA, and trade ideas for today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to my THT PRO and ELITE members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Wednesday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

PANW

PANW reported yesterday and dumped. I wanted 280-282 test to get short with a target of 260, the 200dma and then want to get long there.

The early action ended up giving a double top at 277 and then multiple tests of vwap all day, until finally break down and flushing to that 260 target. We planned our trade, and entered near vwap but the problem was the contracts were too juiced and they decayed. I got stopped but I was confident 260 was coming and if it broke there was chance of massive flush to 245-250 so I wanted to be positioned. I ended up with a 3.20 average on 260p which got to $6 for almost 100%. I stopped out at 5.50. Decent gains, but not after wearing on my patience all morning.

SPY

I waited for FOMC minutes, but the action was multiple fake outs after which triggered some losses for me. I follow my process for looking for failed moves and then reversal and join that. It usually serves me well. But here was the issue. My patience was worn thin after waiting all day for a trade. I had waited for my levels to be tested and they weren’t. We were stuck in a range all day. So when we finally got price action I recognized I jumped in and with size. Unfortunately I was early and the market played its faker games.

So why was I so impatient? It was because I had created pressure for myself. Way too much pressure for myself to perform because I wanted a 100k day and I wanted to provide great trades for members.

The challenge is I was waiting all day long and I’ve been on a hot streak so, I ended up winging it instead of following proces. (still happens to me)

What would have prevented the bad trades and then let me capture 10x? 1 simple rule. NO trade entries unless a major level is tested. Skip the trade if you don’t get it.

If you look at the price action after FOMC you can see how it first did a failed dip, then ripped, then failed, then dipped again giving a nice short into 494 and then that failed again.

Since I had 3 losses I had to follow rules and stop trading. And that’s where I took my eye of the ball to mentally reset.

I started to type that I like 5000c for today at 5.50 when marketed reversed and ripped. Given the likelihood of NVDA positive results and the move back over 495, this met the larger criteria of a failed breakdown and so I swung small 5000 calls and took 5020 SPX calls after NVDA’s results after hours.

So let’s talk process. All of the headache and chop was unnecessary. If I was a bit more patient, and waited for Edge Trade Planner, it found the trades for us.

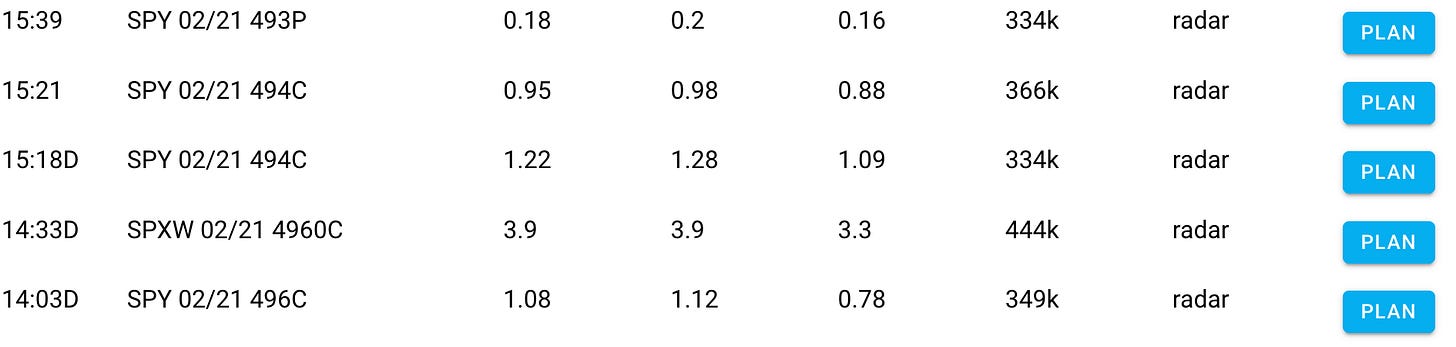

These are the only signals related to SPY/SPX my scanner found after FOMC minutes came. You can see there was call buying at 2 and 2:30, even though market was dipping. Then as SPY got to the the 494.20 level more SPY 494 call buying came in!

So if you combine the interest in the 4960c with the timing of waiting for the level at 494.20 and the multiple buy signals then. Here is the the trade plan fully generated by Edge Trade Planner when given 4974(day high) and 4984 (level above).

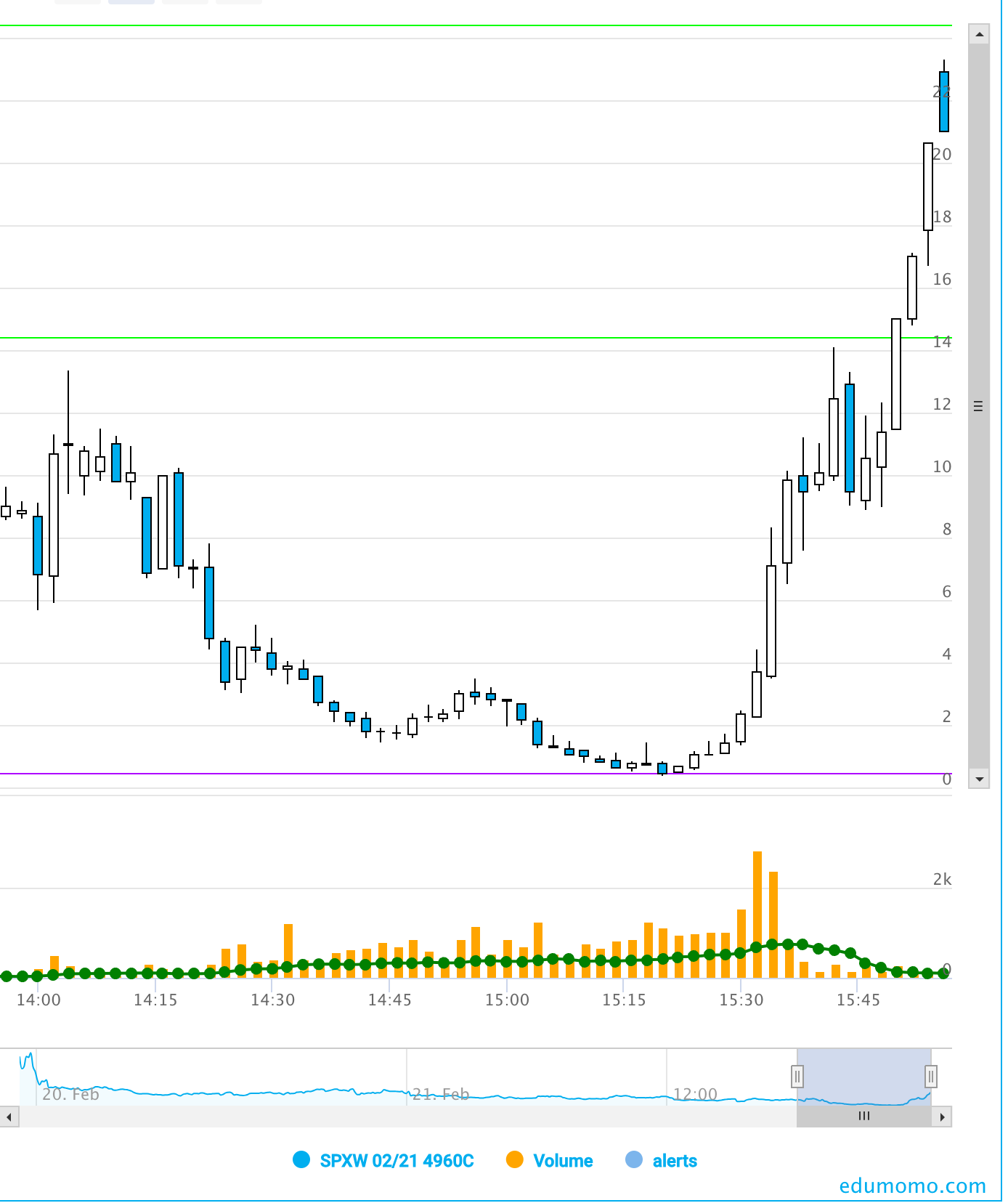

And here is what happened!

Isn’t that insane? That would have been a 30x+ trade!

Even if you took all 5 alerts risking 100%. 1 would have lost, 1 would have broken even and 3 did 200 to 500%!

Do I care about losing yesterday. I’m annoyed. Am I excited about the future? Absolutely! This is why I am devoting so much energy to developing Edge and the algo behind it. I fully believe Edge can help identify and plan 10x trades regularly (and do it more consistently than me)

Summary Review of Market Price Action

Overall choppy consolidation at major support leading to a failed breakdown reversal and technical reclaim of bullish trend.

Educational Lessons

From the price action review you should have learned the following:

Wait fo the levels to plan trades

Combine the alerts in edge with the levels

Use Edge Trade Planner to calculate sell targets

DO NOT PRESSURE yourself to perform. focus strictly on, does this price action meet ALL of my criteria for a trade or not.

Don’t let one bad day of execution ruin your next day. Review why it happened and acknowledge it, don’t let it control you.

Trade Ideas - Plan for Thursday Feb 22

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Market is gapping up big thanks to NVDA. NVDA may have saved the bulls. Overnight price action is a repeat of what we have been getting for last 3 months after every major red day or two. Shorts load up , BTFD comes out of nowhere, and then they get squeezed and we are at new highs.

The primary stocks I’m watching: SPY, SMCI, NVDA

Yesterday I wrote, bears rule for next 4 weeks, unless 500.50 is reclaimed. That happened overnight! one of the nice things about being a day trader is I don’t have to worry about overnight risk and swing trading for weeks. I can have a bias but be wrong and flip and make money in either direction. The key is to capture gains off 1 to 2 levels of moves consistently.

PS. I alerted in premarket upon reaching 504s I exited my overnight SPX calls. (IB lets you trade SPX options in premarket/after hours)

Read on for my thoughts/plan for today.