Did market just pull a bait and switch into yesterday's close? My plan for Tuesday Mar 5.

Good morning traders.

What a reversal into yesterday’s close:

TSLA non stop selling and under 185.

NVDA pushed to 876 yesterday after noon and dipped as low as 832 in premarket

SMCI ran to 1155 yesterday and reversed into 1010 in premarket

Fear and Greed Index continues to sit at 79.

With the market roaring most of yesterday and then suddenly selling off late afternoon it begs the question. Did bulls get lulled into a bait and switch? Do we head lower into mid march?

Read on for my review of Monday’s action and my plan for today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

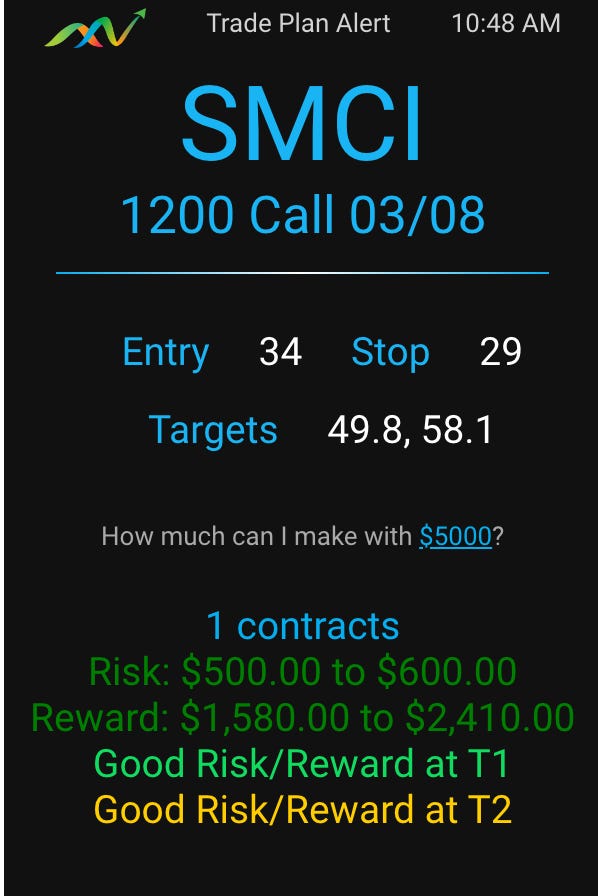

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Friday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPY / SPX

I wanted a back test of 510 before SPY pushed higher, but SPY chose to continue its rally ultimately turning into a failed breakout reversal.

My upside target was off by 0.20 otherwise I likely would have caught the reversal flush i last 30-45 minutes for 10-30x gains.

The push was getting a but too extended and I expect 510s on SPY to be tested this morning. One thing for planning is notice the volume selling and then back test of 513.30. That is where I would enter short.

Why did I miss this trade? I had set alerts for 514.40 level and the price action ahead of the selling beginning didn’t match any of my criteria to have my algo alert me to the opportunity. I’m ok with missing it, it gave me a reason to work on the algo more yesterday to look to precursor signals, but could not identify any tell tales.

It’s OK. I had my major planned trade pay me yesterday and I stuck to my plans. I performed my job and got the gains. I had not anticipated a reversal like yesterday coming at the close. In my mind, I was looking for gap up push fail Tuesday or Wednesday to develop. I was wrong, but I used my time efficiently and I didn’t overtrade. My job is not to catch every move. It is to identify and plan good trades. Focus on the trades you can anticipate and plan.

SMCI

With the SPY inclusion, a squeeze /rally was all but assured, The question for the open was how much dip before rally?

I wanted 1000 to come to get long but instead after initial push we got dips on vwap thta held. I anticipated that $1200c after hitting 55 would dip into 30-35 to give us a long entry and alerted that to THT PRO members. One of the things I strive for is to give ideas/planning before it happens so one doesn’t have to wait for me to alert.

The option scanner caught interesting bids on 1200c at 33-35. So that turned into additional confirmation bias for my entry idea. This eventually led to this overall plan.

High of day turned out to not much past $60 so this was an excellent plan in my books. Well planned entry and exits. Mission Accomplished. I was was very satisfied with the trade.

NVDA

I made 1 or 2 small short attempts too early in the day for small losses. I had set an alert at 880 for a short, unfortunately we got to 876 only and I wasn’t watching screens in late afternoon.

Summary Review of Market Price Action

The action all morning was bullish and likely lured FOMO buyers in with that late afternoon push. However that volume was used to exit positions it seems which triggered heavy selling and the gap downs this morning. If you recalll, I had mentioned with AAPL breaking 180 and TSLA back under 200, those were signals for possible market weakness coming.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

Use /plan in Edge Trade Planner to quickly create trade plans.

Use Edge Trade Planner’s scanner to find trades.

It ok if you dont catch every move. watch screens all day will lead to more losses than gains for most people.

Trade Ideas - Plan for Tuesday Mar 5

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

SMCI and NVDA dipped much in premarket but have recovered to yesterday’s close.

Non-stop selling in AAPL and TSLA, will BTFD come or will selling continue?

Or plan to short AAPL 175 puts is working nicely and AAPL in premarket is close to 172.50 initial targets.

I’ll be focused on AAPL, NVDA, SMCI, and SPY again today.

Will the market get a rug pull today?

Overall I’m on the fence for getting very bearish or not. We are in extreme greed, and the action in tot he close was like a rug pull, but AAPL and TSLA have dipped to levels where they may catch a bid. Meanwhile NVDA has recovered most of it’s premarket dip.

The answer is I don’t know and I will be watching for trend/volume throughout the day to get a feel for how the afternoon and the rest of the week may play out. As always I’ll be using the levels as a guide and o give me an edge for entering and exits trades.

Read on for my thoughts/plan for today.