Day 2 consolidation complete. Is the SPY bull charged up to go? Plan for Wednesday Feb 7.

Is it time to short NVDA SMCI AMD?

Perfect read yesterday expecting SPY to take a breather and trade in a small range. 492 appears to have formed a strong base. This is normal and healthy behavior. It’s why I have the bull with a charging cable.

I still think 495 could be a toppy spot for a yank this month so I’ve got bull and bear plans. Since I didn’t trade today, the Education component will be on how to read price action and use the levels and then we will get into what I’m watching today.

Can we keep the 300%+ win streak going?

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to my THT PRO and ELITE members. (I will open up new memberships in mid Feb)

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22k potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Tuesday’s Price Action (Education)

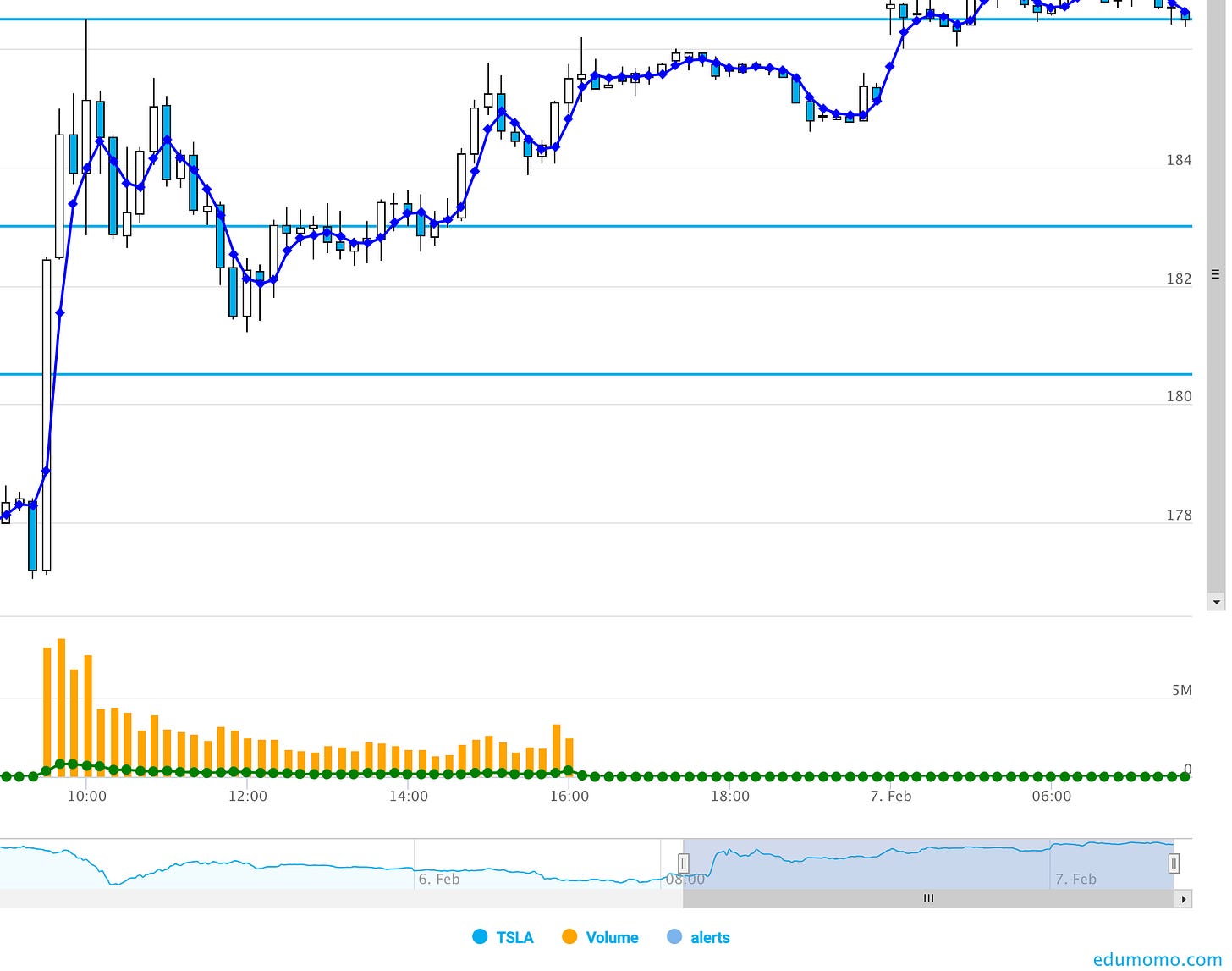

SPY moved as expected, but NVDA and SMCI yanked hard and fast, but recovered well. TSLA reclaimed 180 but limited range.

SPY

gave a mini-pop and then found support at 492, moving around 492.50 all day. This is what I mean by basing. So next time you see me write that I’m looking for that, don’t get stuck on TODAY has to be the move. It may not come, but you can focus on looking for that support to be established and on enter long on that level each time it is tested and sell into any spike or push that comes.

What you don’t want to do is chase break downs or break out on an expected consolidation or basing day. These are great days to even consider avoid trading! I checked back and the 4950c. only gave 25-50% gain opportunities.

One swing trade setup one can do during a BTFD market like we are in, is on consolidation days, take swing longs late in the day off the major support level. Sometimes you will get a nice gap up to take profit on the next morning.

Remember knowing when not to trade is just as important. I feel lucky I took the day off when it comes to SPY.

NVDA

Wow, by premarket, it had done. yank and came back to test 702.

If I was trading, I likely would have got short on 685 break/backtest. The price action you want to recognize is the lower high on 702 vs 710, AND the quick and volume break under 690. At that point once 685 broke, we assume a sell program is in play.

Nice flush into 660s.

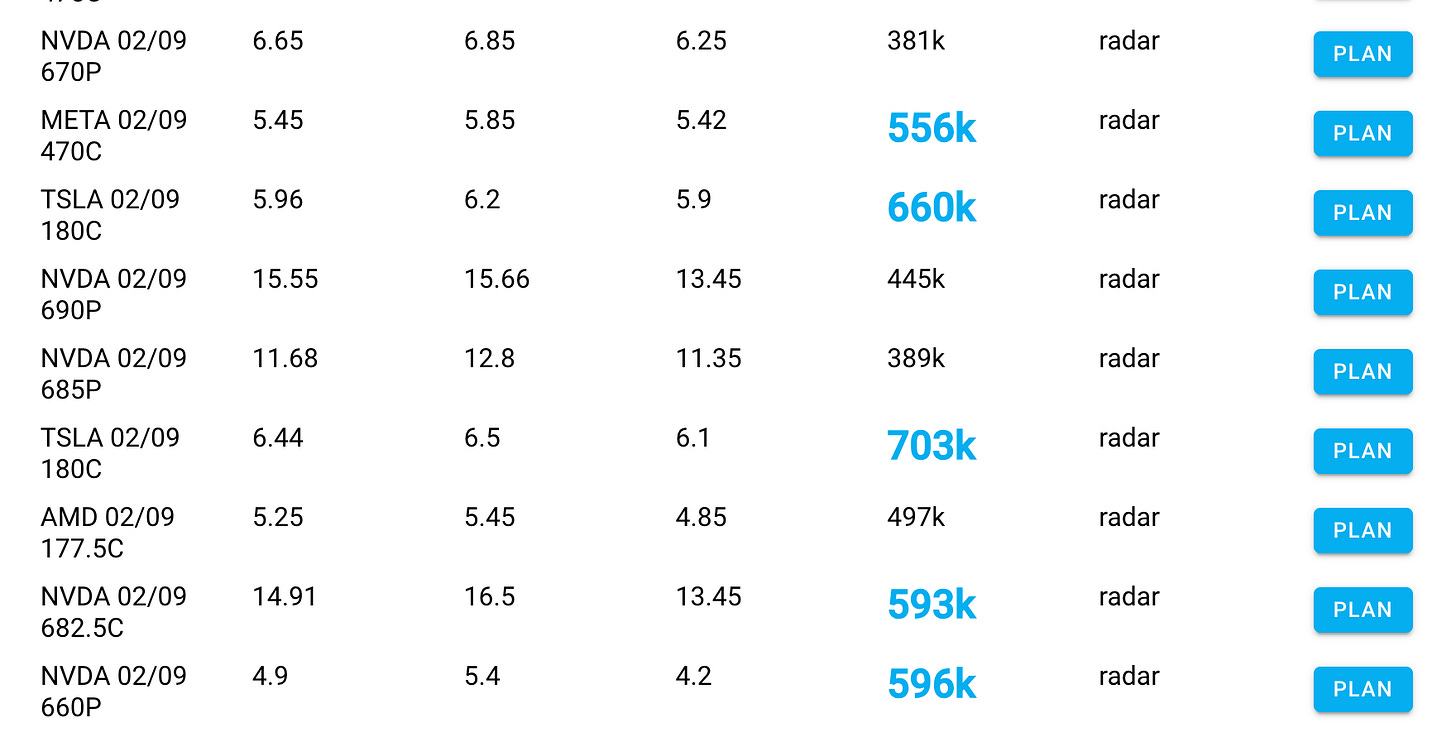

We also had clues. Edge’s Scanner identified heavy put buying in first 15minutes.

TSLA

The scanner above also shows heavy 180c buying with a fast 2 level move to 185

Summary Review of Market Price Action

Overall good consolidation day but there is a chance on weakness in NVDA, SMCI, and AMD showing. If and when the overall market exhausts, these will be the first I will likely hammer on for a short. The question in my mind is will these lead or lag any corrective pull back.

Bottom line. If you look back, every dip in market has been bought since December. Bears keep trying to be first in on the reversal short and keep getting crushed.

Educational Lessons

From the price action review you should have learned the following:

OK to not trade everyday, especially on consolidation days

Pay attention to lower highs in premarket, especially gap ups.

Use the levels I provide as a guide!

buy support for a swing trade on consolidation days for possible gap up

Is it time to short NVDA SMCI AMD?

I’m definitely considering it, but I still want 700+

I’m amazed how at how well SMCI recovered yesterday and so this makes me think these AI chip rally names have at least a little more breathing room. The way I expect to see an exhaustion to develop is when we get a volume sell day and then lower highs on volume days. Or we can get a news catalyst, such as NVDA and/or SMCI doing secondary offerings.

Verdict: Short into strength on gap ups, and take profit quickly until sentiment changes or a news catalyst comes.

In theory SMCI could outrun %wise vs NVDA. Check their market caps vs Revenue to get my meaning.

Trade Ideas - Plan for Wednesday Feb 7

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

We have a few opportunities today. I’m focused on SPY UBER NVDA CNVA and BABA.