Danger ahead! or time to Rally? SPY and QQQ gapping down again. AI names continue rally. Banks consolidating after e/r. Plan for making 100-300% gains on Wed Jan 17

SAVE wrecked on JBLU deal blocked by judge.

More consolidation yesterday but hint of weakness.

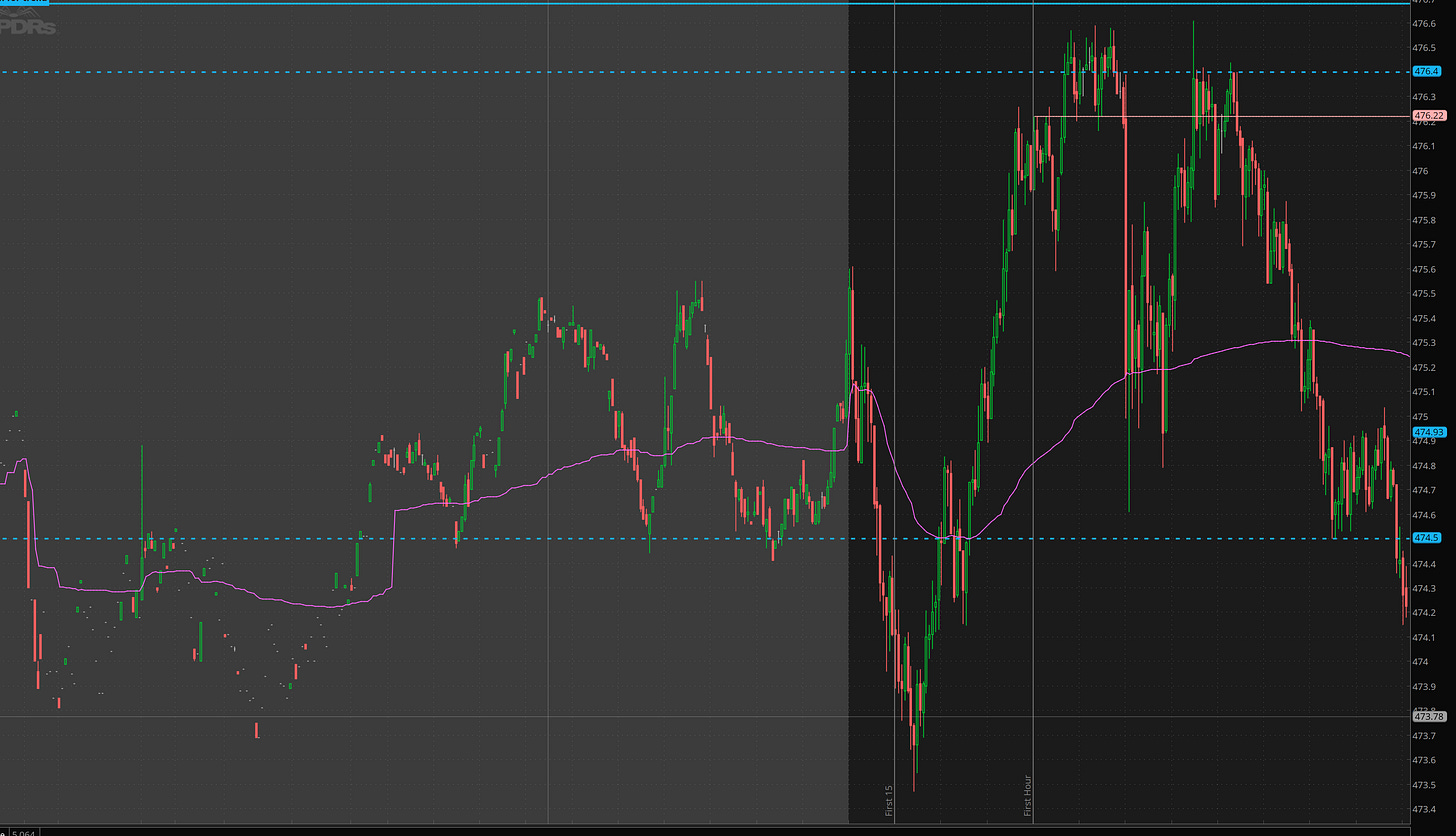

Price Action Review

SPY

The morning action provided a clean failed break down reversal from premarket levels to almost filling the gap.

The SPX 4770c gave a nice move. moving from 5 to 15.

I was focused on TSLA so missed this trade.

Overall. the price action on SPY was consolidation. 473.50 level wasn’t breached however the r/g line was rejected multiple times. That is ok and expected. Yesterday’s action essential was chop and gave us a 3rd red day.

I’m looking for today to give some direction.

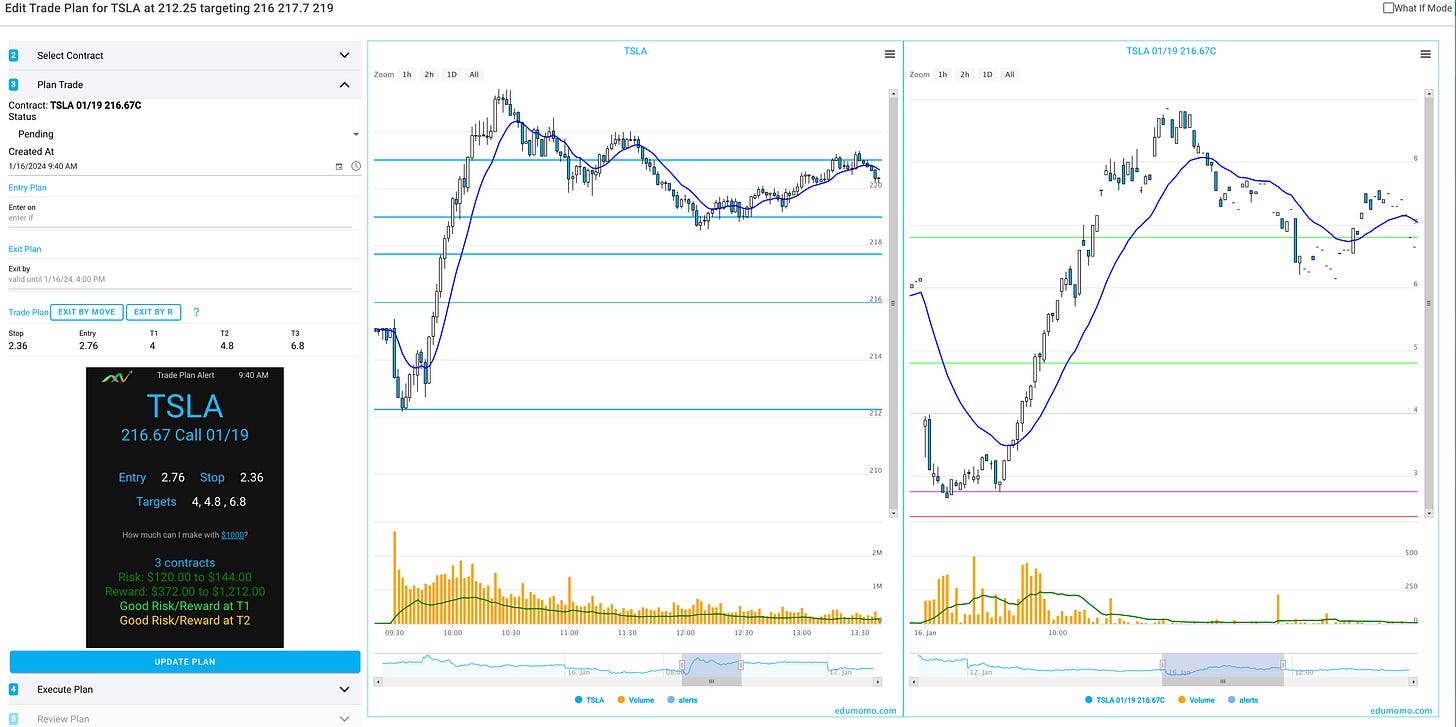

TSLA

Per the idea yesterday and given Musk’s remarks the stock gapped down. I took a small short in case it completely dumped out of the gate but got quickly stopped out. Following process and rules, immediately flippled long on the 212 hold idea targetting 219. It actually moved all the way into 222. I sold too soon but I got the trade I planned. I’ll repeat that. I sold too soon but I got the trade I planned. Plan your trades, execute you to your plans and be happy. Adjust your rules as needed for the next trade, but don’t open yourself to second guessing and chasing.

Here is what the Trade Plan you and price action you could have created in Edge Trade Planner.

The cool thing to notice is the risk/reward off 212 area. Imagine $120 risk for $1200+ gain (especially if you held for 222).

NVDA

NVDA was strong! cleared premarket high, dipped on vwap 15 minutes after open then then nonstop run right to the 468 target level. If you took that trade, remember that is a 4 level gap up. Be sure to lock gains!

Plan for Jan 17

Overall I’m looking at premarket’s weakness as a signal we may get more downside. However I’m also a fan of 3 red days and then 5 green day sequences. This means he price action after first 30min to 60min will be a clue to see how the day plays out

SPY

Bulls need to reclaim 475 with a gusto to bring back the 480+ move everyone has been anticipating. With SPY back under 9dma in premarket, and UVXY pushing, looking like we could see a big roll over after recent rally. Not seeing the BTFD action I’m use to.

Plan 1: more selling thesis: reject 474.50 and break 472 should be 470 or less.

Plan 2: gap down reversal with weak open/rg: dip 472-472.50 and clear 474.50/475 and have 474.50 turn into support for a grind toward 477.

NVDA

I think NVDA could be close to exhaustion. every day I’ll be looking for a gap up reversal

Plan 1: look for exhaustion at levels above

Plan 2: Dips on 561.50 that hold consider long

Plan 3: Break of 561.50 go short

REMINDER: Until we get a range break up or down, I’m assuming choppy consolidation. So be sure to secure profits at key levels or key multiples of risk.

Morning Actions/Todo

You can use this as a template to make sure you stay on task and are prepared to take action ahead of time.

Update Watchlist in TWS with contracts I’m interested in

set alerts notifications so I don’t have to watch charts:

TSLA 212, 219

SPY 470, 472.50, 475, 477

NVDA 475, 480

Copy Levels Code from Edge into ThinkorSwim.

Set Edge to $5k Capital and $2k Risk for sizing and capital management

** Hint. When alerts are triggered, it is a great time to plan trades in Edge.

Be sure to like and share the blog post. I spend an hour each morning putting this blog together.