CPI dip and rip, FOMC on deck, AMD/AVGO rally is NVDA next? My plan for trading Wed Dec 13.

Trade Review/Education

Yesterday, the open was a little bit tricky. Per the premarket prep video, I started watching for a long around 461 and that I was expecting roughly a 3 pt range, so 461 to 464. We got exactly that.

We dipped just under 461 and I alerted with a plan to lock in at 3R and 10R.

so at 6 and 10. My goal on this first trade was to get a gap fill and then wait and see what happens after lunch. In retrospect. I should have sold 50% at 3R, and got down to 20% since at 10R ($10), and left 20% of the day with stops at entry.

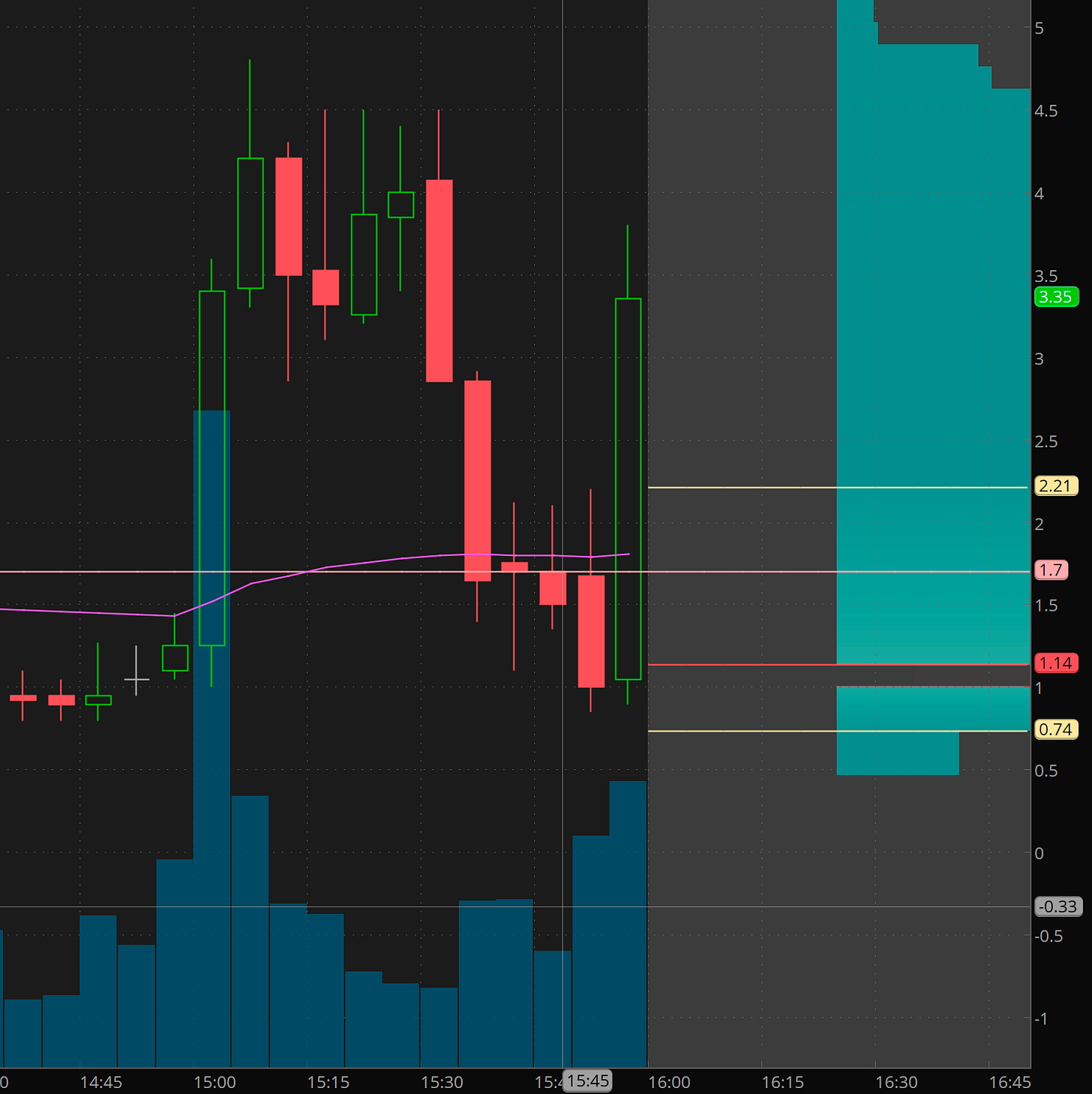

Over lunch we based and a long trade setup.

Using my levels, I targeted 4644 to be reached by the close and scooped some 4640c for $1 and tried to fill size at 0.40 but no luck.

However $1—>$4 is a great trade!

So that was the SPY trades.

Also took AAPL 197.50/200 vertical as a yolo for 0.20. Let’s see if we get a nutty move after FOMC.

That brings us to AMD.

I missed the swing long on this so what do we do? We hawk for a short.

AMD faded perfectly to the 136 watchlist level

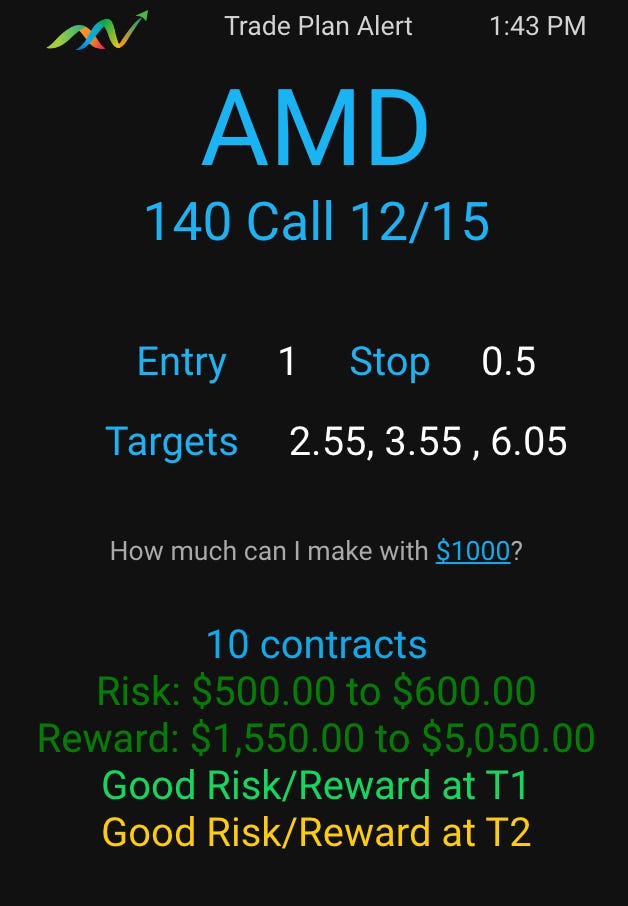

which then gave me a great risk/reward entry to flip long. IF AMD clears 140, we could see 144-150+ this week.

Planning is everything. I wanted 0.50, the contracts had hit a high of 2.70+ so I was being a real cheap bastard for this yolo. As the day continued, the contracts dropped but were near $1 at 136 so I make long plan.

By the close these had spiked up 60% and I locked in 3/4 with a plan to add on dips today.

In case you are wondering, this is the Edge generated plan for the swing.

Let’s see if works.

So overall yesterday plans worked. I tried a couple of shorts as well that got quickly stopped.

Plan for Wed Dec 13

If we gap up and rip on the open, I will look for a gap up reversal scalp ahead of FOMC. Overall I want to be out 80-100% of my positions before the meeting. I’m thinking we could grind/rally into noon and then maybe we see some derisking/selling ahead of the 2pm announcements.

Overall the process doesn’t change. Look for dips and failed breakdowns on key support levels to get long and ride for 1 to 2 levels and taking profit at 3R, 10R and ride the rest until before FOMC.

I have a history of getting punched in the gut trading the immediate action after FOMC, so I will be away from screens between 2pm and 2:40p. I will then evaluate the price action and look for a trade to ride into the close.

Key levels to watch for:

SPY over 466 could take us to 470s

SPY break of 462 could take us to 460 and then 458.

I would not be surprised if today’s price action after FOMC is a clearing/reset day and that whatever happens today, we do the opposite tomorrow.

AAPL, over 197 can see 200+

AMD dip and rip over 138, could take us to 144.

MSFT gapping up nicely, watching for gap fill and then 377.50c.

As always, be patient. Plan your trades, let the trades come to you and then execute your plans.

If you need help planning and documenting your trades, let me know.