CPI Bear Trap again? Do the Bulls get a Valentine's day gift? Plan for Wednesday Feb 14

500%+ gain trades delivered again with a 2000% potential trade at the close

Good morning traders.

Yesterday’s flush came as expected. The price action was headache free and if anything we got an extra leg down right to one my levels. Its amazing how precise the levels can be!

Then something “strange” happened in the last 30 minutes and its getting follow through this morning.

In today’s blogs lets we’ll cover how I traded yesterday, the price action, and if bulls get a v-day gift today.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

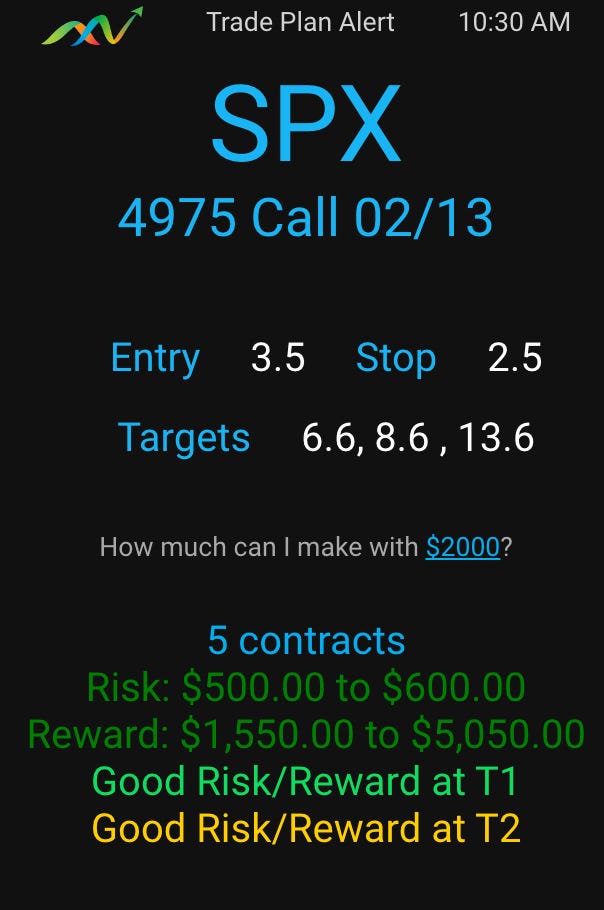

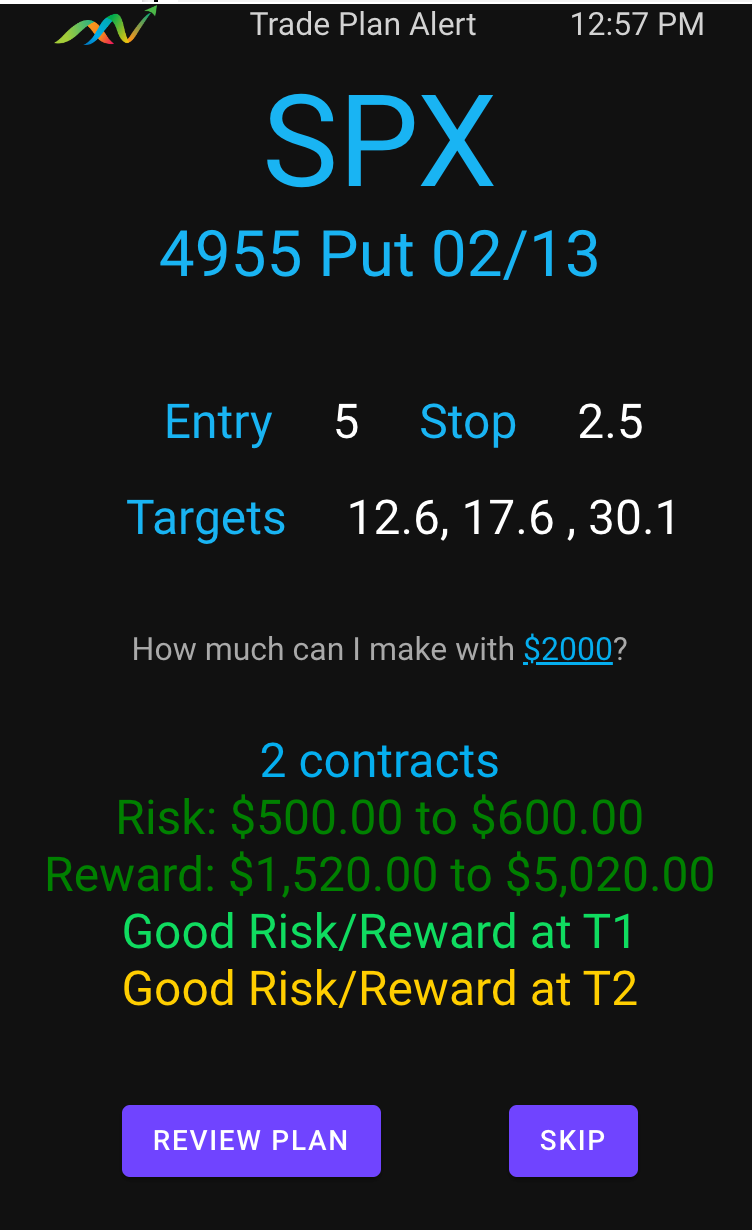

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to my THT PRO and ELITE members. (I will open up new memberships in mid Feb)

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Tuesday’s Price Action (Education)

CPI gap down and flush

Typically after CPI we would get a faker move or two in premarket but yesterday something strange was afoot. To begin with we started with a gap down break of 500. This had me already have a bearish stance. After the news came out typically there would be large fast moves in both direction. This time there wasn’t.

I took puts in premarket on SPX at interactive brokers for a quick gain into the flush sub 495. and then I decided to wait.

I was very bearish but from past experience I knew we should get some sort of bounce and exhaustion and likely get the sell off to new lows after lunch.

But before that, I planned a scalp long. We waited for the price action/signal and then got our move.

I shared this plan:

Unfortunately SPY could not get to my target at SPY 496.50 which also happened to be where I wanted to get short. The trade still worked in that I was able to sell for 5.50-6 and got stopped at 4-4.5 on the runners. It was the right trade to do, but reading price action and recognizing bids were not showing up helped get ready for the short I was expecting.

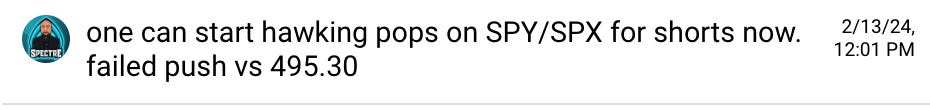

I saw the failed breakout signal and alerted to members to look for a pop back on 495.30 for the short.

And what happened? We got the push right to 495.30 and a failed push. That is where we get short. I was getting for so missed that entry but I knew where this was headed. I was targeting 492 and 490.60 for downside using the levels I share each morning.

So I then shared this plan to THT PRO and THT ELITE members.

This time all sell targets were met. $5→ $30 is 500%! and if basing it on the risk 1000%. $25 gain on $2.50 risk. If you think the contract is too expensive, consider using the contract at the target and be sure to sell into the spike in price.

At this point I’m a two hour trader and I’m done for the day. I knew there was likely to be a trading coming at the close, but one of the commitments I made was to be an example to the community and spend less than 2 hours a day trading.

SPY last 30 minutes

Then the strange action happened (well not really that strange) and I didn’t trade this trade because I was away from desk. My algo didn’t alert me to the trade signal so I spent a few hours last night working on how to have identified this 10-15min before it happens but wasn’t successful (yet).

We had an over extend move to a major support level and that triggered BTFD imho and then a short squeeze that has carried over into this morning.

If you caught the double bottom on SPY. That setup was immense. The SPX 4935c using my process for targeting entry and moves went from 0.60 to $15!

I am bummed about missing it but not bummed because I executed my planned trade!

NVDA

I tried shorting this and only got 4 to 7.50 on the contracts. I wanted to get positioned for possible day 3 selling on this overbought name, but it recovered strongly. NVDA is poised for its rally ahead of e/r next week.

Summary Review of Market Price Action

Overall yesterday was the first sign of weakness we have had in awhile. It does feel different from recent sells. However there still be strong BTFD moves at key support levels like we got yesterday.

A number of names dipped below their 9 ma on the daily and this often a warning signal. However in the last few months, every dip under has been met with strong buying.

At some point the dip buy will fail. Its ok to lose when that happens, because one should get excited about the short opportunity developing.

The next few days should let us know if there is a pause to BTFD or not. In the meantime we continue to trade the price action targeting 2 level moves up and down using the Two Hour Trading process.

Educational Lessons

From the price action review you should have learned the following:

after a large move there is often a retracement, take advantage of that to get contracts cheaper and plan the next leg trade.

consider option strikes at the target price for fast move and SELL into the IV spike that comes. If you don’t they can easily goto 0 but in the meantime give 7-10x Reward to Risk. (why I took 180c on ARM and 5015p on SPX)

Set sell orders systematically as soon as you enter the trade. Reward that habit/muscle building. Your account will thank you!

Use the levels I provide as a guide.

Looking for a reversal on big move days during last 30 minutes.

Trade Ideas - Plan for Wed Feb 14

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

OK so what’s up with this gap up? Well it’s a continuation of the BTFD and short squeeze. It’s almost on Auto pilot. 490.50 major level bounce, over 492.50 triggers squeeze. and over 495 on SPY triggers move to the 496.50 level originally wanted for a short.

So what’s next? Do the bulls get a v-day gift?

Read on for my thoughts/plan