Can SPY break 500 today? Plan for Friday Feb 9

Is it too late to join long swings on MARA, COIN, MSTR? Short Squeeze in ARM.

Good morning traders. So much to share today.

In todays blog…

SPY is on the verge of testing and/or breaking out over 500.

Crypto swings ripping

ARM short squeeze

Friday Bangers (5-10x+ trade opportunities)

Read on …

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to my THT PRO and ELITE members. (I will open up new memberships in mid Feb)

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Thursday’s Price Action (Education)

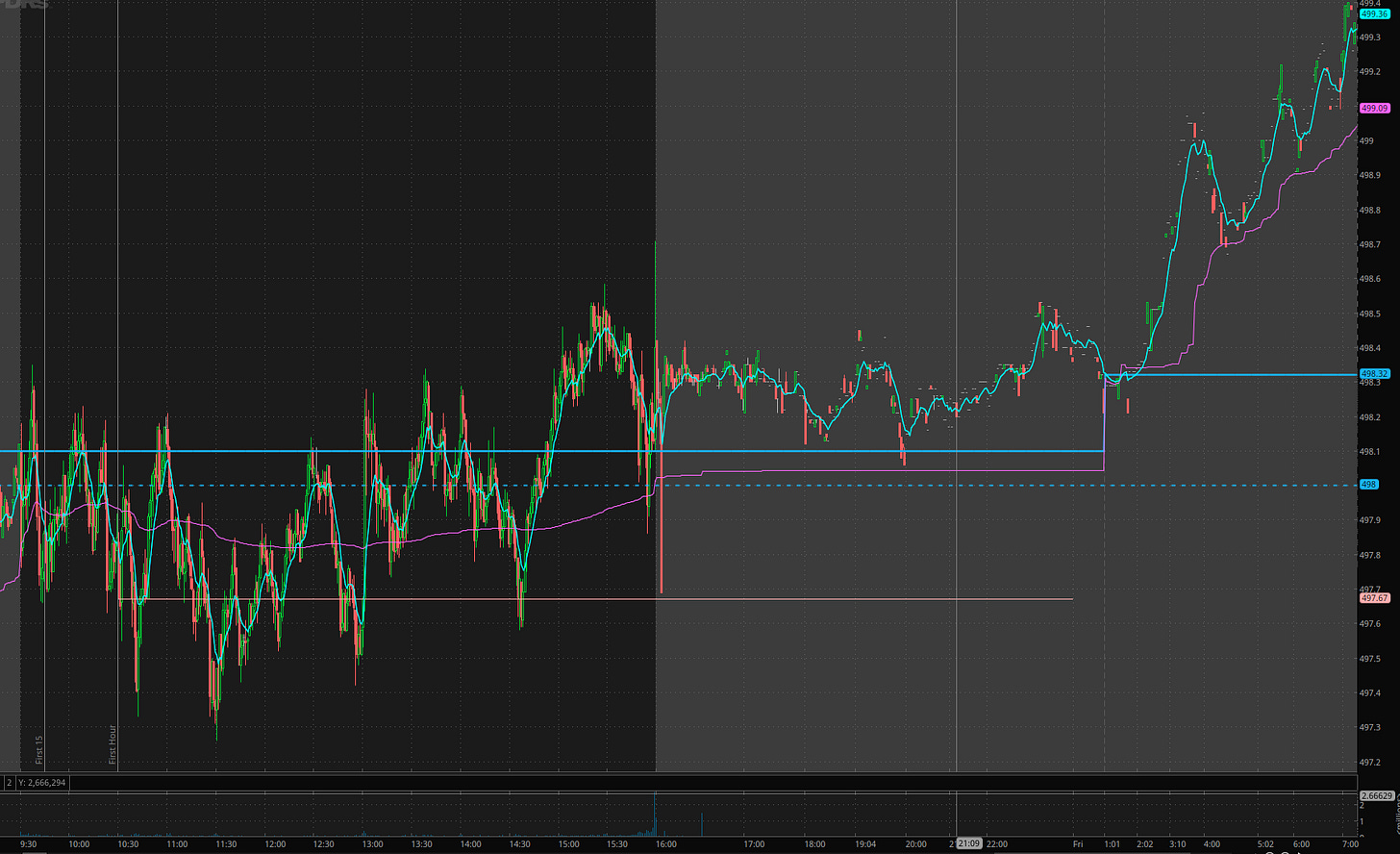

Crypto Ripping: BTC, COIN, MARA, MSTR

On Wednesday I told THT PRO/ELITE members, I wanted to start MARA 21c for March calls and I commented on yesterday’s blog.

Why was this important? A reclaim after a failed breakdown is bullish. We want a swing because this is on the daily chart AND btc had reclaimed the 42.5k level so if 45k was cleared than crypto names are going to go bananas.

What I didn’t expect was it to launch the very next day. But that that is why it was a swing trade.

Here are the charts:

Notice I posted the comment in premarket when btc was around 44k and you can see how it was breaking out of the range. I’m hearing lots of shorts/bears in the crypto world so that could also be fueling some of this push. I was expecting btc to give one more dip sub 30k at minimum before a move over 48k but that was invalidated. That is why failed breakdown moves are so powerful and to pay attention to them!

Is it too late to join long swings on MARA, COIN, MSTR?

Are you feeling fomo? I am, and I’m in it. I wish I had more size on it.

So what’s my plan?

We are gapping up a bit today. I would expect some profit taking on the open today and so will likely take some profits on swing following the gap up in my favor rules.

Ideally a back test on btc to 45k comes in next couple of days, and I can reload there, or if BTC gets a volume break over 48k I can add there.

Overall I don’t think it is too late, but I would use dollar cost averaging rules, and look for dips to begin entry. If I wanted a 20k exposure to crypto names, I would maybe allocate 5k on swings now going into March and January leaps. and then add more on pull backs as long as 42.5k doesn’t break on BTC.

Overall I am targeting BTC to hit 100k+ this year.

Remember btc halving is in April and this could be a run up move into that event

I like to use btc as my guide, but trade COIN, MARA and MSTR options

I think MSTR has been a laggard and will start to get some love. watch dips on 515-520 today if it comes to take 525c as yolo for today.

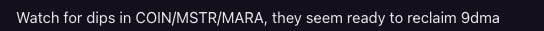

SPY

Super tight 1pt consolidation all day. I made 2 attempts to get positioned long for a high of day breakout but it just couldn’t get the volume to clear. Small loses of 0.50 and 0.20 on the ideas vs $5 to $15 gain opportunity. I have to take the bet. (but I don’t have to keep trying and force it to happen today!)

One thing that is annoying is that moves are mostly happening overnight, and we aren’t getting the dips to buy and the range to get the 5 to 10 baggers we were last month. That is part of the game. I’m not going to change the way I trade or the system I use because of a handful of days that I don’t get paid.

What balances this out is how I keep an eye on alternative plays/stocks/options while waiting for SPX to give me the trade setups I want.

Yesterday I wrote I wanted 5010c for today at $2, (wanting to really get a dip to scoop, it only came down to 4.50 and now near $9 and could hit $34-40 today if SPY breaks out over 500)

The same that applied on Wednesday applied yesterday regarding overnight swing setup. You can see how 497.50 turned into support and one could have started a swing long.

One overnight swing trade setup I like for during a BTFD market like we are in, is on consolidation days, take swing longs late in the day off the major support level. Sometimes you will get a nice gap up to take profit on the next morning.

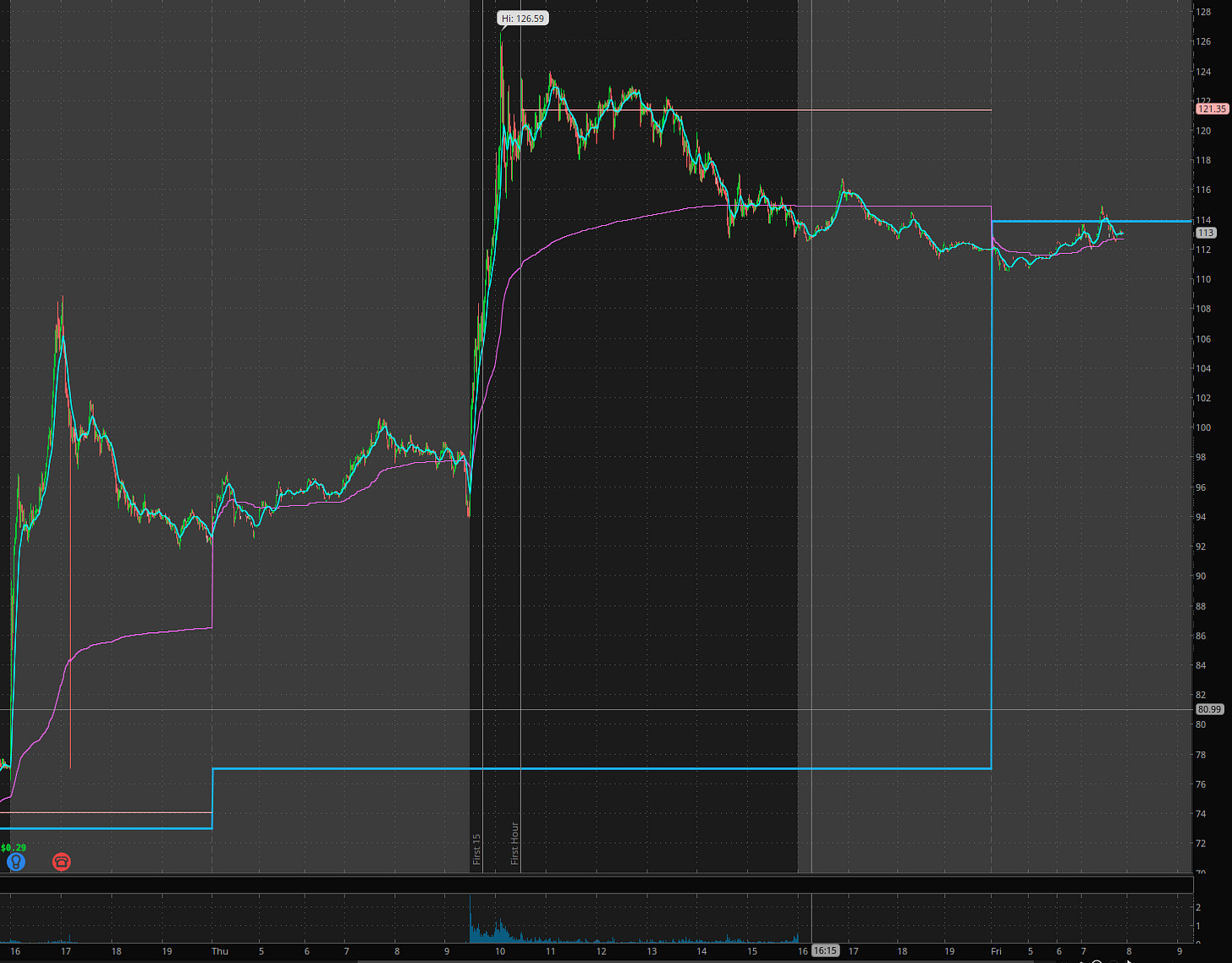

ARM

So the short borrows was limited and Softbank owns 90% off the float which is locked up until March. What does that mean? It’s a recipe for a short squeeze.

This wasn’t on my watchlist, but a friend mentioned it to be before the open and I did a quick game plan. 92 breaks go short 95 holds and 98 clears get long. for squeeze past 110 into 120+

So alerted taking 110c for $5 and that ARM should see 120+. that mean we can sell for $20+. Because it was an e/r play and first 15 minutes, where reversal can happen quick, I sold 50% for $10-12. I told THT PRO/ELITE members I was mostly out after the spike into 126 and that I wanted vwap before considering a reload.

Summary Review of Market Price Action

Many names started running yesterday including SHOP and AMZN. Great play in ARM and I was essentially done for the day. SPY wasn’t giving me what I want and I was able to get long on dips on crypto names yesterday. Nothing else todo. That what I want to stress for why Two Hour Trading. Make your money on great risk/reward plays as oppose to having to be right about anyone stock. The goal is to extract money out of the market consistently, not to be right.

The BTFD theme continues and some smaller names are starting to b/o so look for those plays as well.

Bottom line. If you look back, every dip in market has been bought since December. Bears keep trying to be first in on the reversal short and keep getting crushed.

Educational Lessons

From the price action review you should have learned the following:

Take advantage of anomalies and short squeeze trades

Don’t over trade. stop out if it doesn’t work and move on.

Use the levels I provide as a guide!

buy support for a swing trade on consolidation days for possible gap up

Friday Bangers (5-10x+ trade opportunities)

Given the gap p today, on a bunch of names, I’m expecting contracts to be juiced and its hard to get a read. I don’t see any clean trades for this.

I like META 475c for 0.50 or less. but would prefer 472.50c for 0.75 more targetting a move back into 480+

Trade Ideas - Plan for Friday Feb 8

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

We have a few opportunities today. I’m focused on ARM, COIN, MSTR, SPY, SHOP.