Bulls vs Bears, Round 2 on Monday March 11. Who will win? NVDA sees over 10% drop from Friday highs, COIN gapping up. Let's make 300% or more today.

Good morning traders.

What another great trading day Friday! I was looking for a 10x trade and multiple 10x+ opportunities developed. Were you able to plan it, or join the trend? If not, spend the time to review the opportunities Friday provide and ask yourself what do you need to do differently to 1) Recognize the opportunity and 2) trigger action to take advantage of it. Be sure to read the education section to learn I look at things.

After Fridays big sell, and tomorrow’s CPI report today is likely to be choppy but still provide at least a 300%+ gain trade opportunity if not multiple and more.

Let’s get into it.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas each morning, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to THT PRO members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Mar 8 - SMCI 1150p Entry $5 - High after $56.20 ($500 → $5620 potential)

Mar 8 - AMD 220c Entry $0.50 - High after $7.65 ($500 → $7650 potential)

Mar 7 - SPX 5175c Entry $0.50 - High after $2.40 ($500→ $2400 potential)

Mar 6 - SPX 5120c Entry $3.50 - High after $12+ ($3500→ $12000 potential)

Mar 5 - SPX 5070c Entry $0.50 - High after $10.75 ($500 → $10750 potential)

** alerted 0.30 entry wanted. dipped to 0.40. entered at 0.50Mar 5 - SPX 5070p Entry $1 - High after $13.50 ($1000 → $13500 potential)

Mar 4 - SMCI 1200c Entry $33 - High after $61 ($3300 —> $6100 potential)

Mar 1 - SPX 5120c Entry $2 - High after $20 ($2000 —> $20000 potential)

Feb 29 - SPX 5095c Entry 0.50 - High after $10 ($500 —> $10000 potential)

Feb 29 - SPX 5100c Entry 0.30 - High after $5+ ($300 —> $5000 potential)

Feb 27 - TSLA 195p Entry 0.90 - High after $2.30+ ($900 —> $2300 potential)

Feb 26 - SPX 5070p Entry 0.20 - High after $2. ($200 —> $2000 potential)

Feb 23 - NVDA 800p Entry 2.50 - High after $25.11 ($3000 → $25110 potential)

**Dipped to 2.57 (had to chase entry 3)

Feb 23 - NVDA 820c Entry 2.25 (swing from Thursday) - High after $25.00 ($2250 → $25000 potential)

Feb 22 - SPX 4090c Entry $2.50 - High after $9.20 ($2500 → $9200 potential)

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

For live alerts and market commentary click the button below.

Friday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

I missed a lot of opportunity on Friday, because I didn’t sleep the night before (I worked all night on content for Edge Trade Planner) and I was operating on instinct and muscle memory. In the first hour of the day I had more than hit my goals for the day. So I was taking a mental break and missed the 10:30 perfect short entry (those were my exits).

Muscle memory and action kicked in once I recognized what market was doing and I alerted a 10 bagger on SMCI. The most exciting part from Friday’s action was seeing member’s planning trades that payed out nice!

SPY/SPX

Perfectly give a little dip on open and ripped. On Friday I wrote iwanted SPY 518 and we got exactly that.

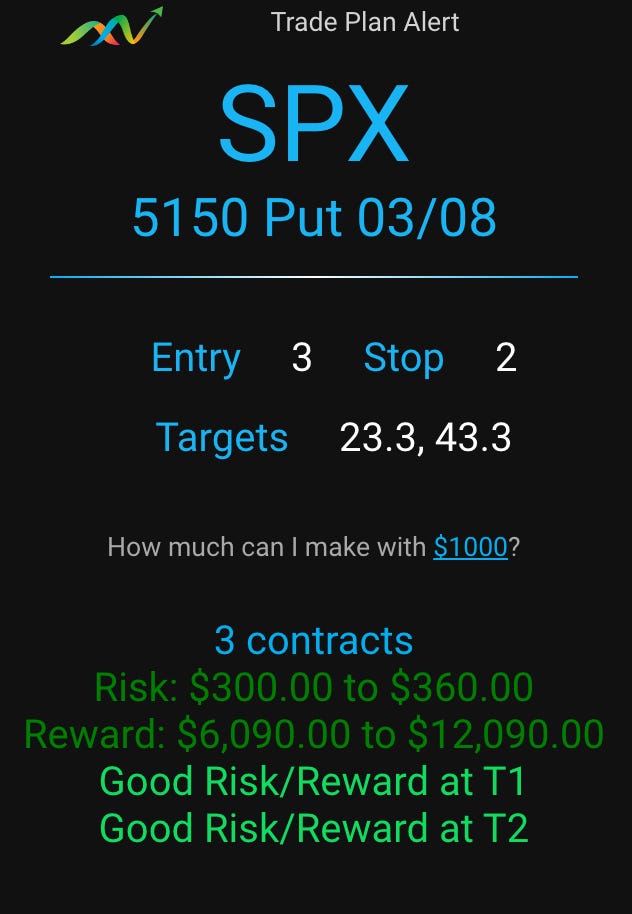

I alerted I wanted 5200c for 0.50 but took a starter for 1.50 that hit 4.50 for sells and I got stopped at 3 I think on the balance. It was a very clean short setup at 10:30, but in my head I was thinking to get short around 11am. You can see how 518 rejected, and then the peachline rejected and at 11am vwap broke. Using Edge Trade Planner a quick plan was made and all target were met.

In fact that is exactly what new member RK did. his plan had $15 for T3. Congrats RK!

There are two modes for choosing targeting bias in the planner. One is focused on extracting consistent gains, and another is focused extracting gains when levels are met.

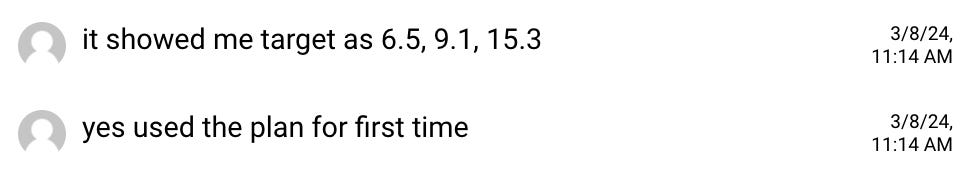

The contracts reached $32.50. On big reversal days using target based can be very lucrative. What I sometimes do is check the ‘expected move’ based prices, and then update the target prices of the “Exit by R” targets. My first goal is to protect capital so in the above example I would keep 6.5, then change T2 to be $15.3 and then make T3 be 23. I’m not worried about getting maximum gain. I want consistent repeatable gains. and lets be honest if you buy at 3 and sell at 23. Isn’t that a great trade?

Back to the action notice how we reached 517-518 sell zone you then target 2 levels below giving us 511 for the best case target. Use this process and the levels I share to bank. It works crazy well!

AMD

All week I had been expecting AMD to ripp 220+ but it consolidated all week. When I saw the way SMCI and NVDA was gapping and the premarket move on AMD as soon as I saw AMD push, I knew 220was coming. so I quickly alerted.

AMD was 0.50. I took profits along the way, way with last bits being stopped out at $7.

This payout was unexpected, but it was a preprogrammed trade in my mind for when I saw the price action align for upside.

NVDA

This was a big miss for me because I was ecstatic from all my morning bull gains. When that happens I know I need to breath and reset. Friday I wrote

NVDA popped to 967 and dropped.

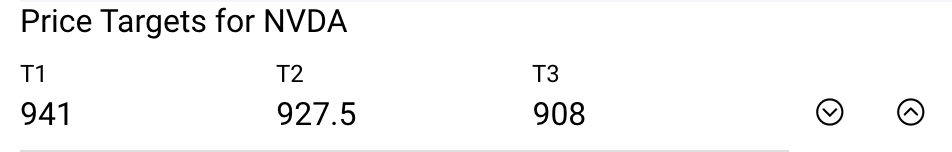

This is the plan Edge would have made for you if you chose to short after seeing 965 reject and using these price targets (in edge you can use the arrows on right to quickly change the targets based on my levels.

NVDA did the drop I was looking for earlier than expected. i was waiting for 1000 so was being too patient to really get focused for the 50 or 100x trade potential it created.

By the time I was mentally reset, AMD and NVDA had reversed downward hard so I put my attention on SMCI and alerted SMCI 1150p for $5 targeting $30-50 for exit.

Summary Review of Market Price Action

Friday could be a blow off top with selling into fomo buyers. at least that is what the price action looks like to me. The next 2 or 3 days will confirm.

Educational Lessons

From the price action review you should have learned the following:

Wait for the levels to plan trades

Use /plan in Edge Trade Planner to quickly create trade plans.

How to target levels after the opening action.

You don’t need to catch. the entrie move. It’s a fools errand.

Be focused on extracting consistent gains, and then let trend reach larger gains on smaller sizes.

Trade Ideas - Plan for Monday Mar 11

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

With CPI coming tomorrow, we could see some choppy rangy action. I’m expecting some gap down, today and then maybe a push and then chop around once range is established. More in the details for each stock below.

Overall I’m probably going to keep today light maybe 1 or 2 trades and be done. I need to work on the videos/training content for Edge. (I’m so inspired when I see members overcome their challenges using it)

I’m watching the following today: SPY, NVDA, SMCI