Are you riding this wild bull market? Will PPI push SPY to new highs? Plan for Friday Feb 16

SMCI over 1000! what's next? My 50 bagger risky trade plan.

Good morning traders.

Yesterday’s I wrote how over 501, I liked SPY long and over 502.60 I think this could rip. That is developing. 503.50 is all time highs and we are gapping into 503s.

The bears are losing their window for seasonal selling. PPI may smash the rally or support it today. So excited for today. There should be 10x opportunities today and possibly 100x+

In today’s blog we’ll cover how I traded yesterday, the price action, the 10x trade in TSLA and my plan for SMCI today. If right, this could be a 50x+ payer assuming the options contracts get cheap enough and I get the play I want.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to my THT PRO and ELITE members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb 15 - TSLA 195c. Entry $1.20 - Hight after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Thursday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SPX was slightly choppy and slowly did the grind higher. I kept missing the entries I wanted for upside and only getting 50 to 100% gainers.

As you can see the levels weren’t really getting tested. first 2 hours was essentially chop/consolidation between levels, and in the afternoon a grind started but that was choppy and messy too. Nothing exciting to really report other than. I make a couple of shots didn’t get the trades I wanted and decided to avoid that action. besides I had my TSLA trade paying me…

TSLA

I don’t think we could have done better on entries. The only improvement, is on high conviction trades cancel my sell orders and round 2 and just ride it out. But selling and taking profit is systematic for me.

Review the chart below for how I traded this. Overall monster trade. I went 5x my usually size on this.

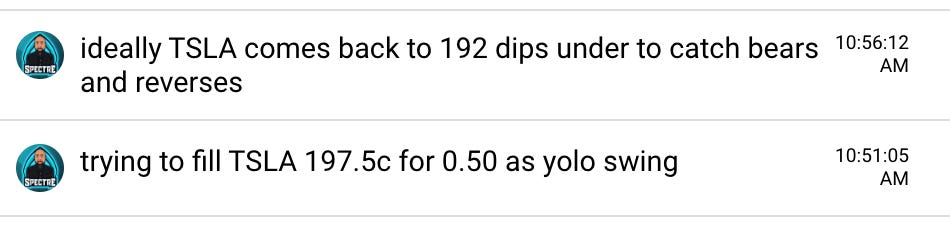

Notice how I shared with you the planning and idea 20 minutes before the dip came. I want you to get the best prices possible and not wait for my alerts for entry. 197.50c only came down to 0.60s so I had to pay more. Same for 200c. but so be it. That just means high demand.

That it’s for review/education today.

(sorry for the shorter blog today, It took me some time to analyze premarket action and write up the ideas for today. Actually I would love the blog to be short every day. Look for one amazing trade that pays over 500% and be done!)

Summary Review of Market Price Action

Overall yesterday did what we thought. Consolidation with an upward bias and range break to upside developed.

This market is getting frothy. many of the really good traders that have been swinging are starting to sell. while a handful are starting to get ultra bullish.

Fear and Greed index is at 77 this morning.

I will keep doing the same. buy dips and occasionally short exhaustion.

Continue to trade the price action targeting 2 level moves up and down using the Two Hour Trading process. I’ll shout out when I think a 4+ level move is coming.

Educational Lessons

From the price action review you should have learned the following:

On strong trending names, be prepared to reload and be more patient. The contracts sometimes call all the way back to your original entry for Round 2!

consider option strikes at the target price for fast move and SELL into the IV spike that comes.

Set sell orders systematically as soon as you enter the trade. Reward that habit/muscle building. Your account will thank you!

Use the levels I provide as a guide.

If SPY is trading choppy, skip trading it.

Watch for breakout/back tests in last 30min

Trade Ideas - Plan for Friday Feb 15

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

There is so much opportunity today. The primary stocks I’m watching: TSLA, SMCI, SPY

I’m trying not to get too excited but I think today has the potential for a 50x trade to develop. For now sticking with the usual goal of 3 to 5x.

Our TSLA long is gapping up and close to 10x if you swung from yesterday.

Read on for my thoughts/plan.