Are you ready for the bears to take over Wall Street? Did SPY reject 500? Plan for Tuesday Feb 20

50-100x SMCI trade prediction comes true!

Good morning traders.

Last Friday I wrote:

“The bears are losing their window for seasonal selling. PPI may smash the rally or support it today. So excited for today. There should be 10x opportunities today and possibly 100x+”

And that is exactly what we got! Were you prepared? Did you take advantage of the opportunities? If you didn’t don’t worry about it, there will be more. Be it tomorrow or 3 months from now. The important thing is to learn the process and techniques I share in the review or leave a comment/send me a message asking for a workshop or online course and I’ll devote some time to it if there are enough of you. I want all of you to be prepared to take advantage of the life changing opportunities options can provide.

In today’s blog I’ll cover the SMCI trade plan, my own screw up trading it, and the price action on SPX and the impact of last week’s hot inflation data. I’ll also cover how I plan to profit if the bears do take over Wall Street.

Introduction (for New Readers)

Welcome to my blog on Two Hour Trading, your daily source for market insights and trading opportunities. In this blog, I will provide you with a comprehensive analysis of the market, educational lessons, and trade ideas to help you stay ahead in your trading journey and best of all doing it less than two hours a day.

What Subscribers Get

Subscribers to this blog will receive daily updates on market analysis, educational content, and up to three trade ideas, all based on real-life examples and my personal approach to trading.

NOTE: screenshots from chat are from Edge Trade Planner. A platform available to my THT PRO and ELITE members. Join Us for live commentary and planning. Note my goal is to actively trade less than 2 hours a day finding 1 to 4 great trades a day.

What is Two Hour Trading?

It’s my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to setup. Key benefits:

High Quality trades with great reward vs risk

Avoid Overtrading and losses from it

Trading to Win vs Trading to Not Lose

Stacking the deck in your favor

2024 Alert Leaderboard

(I’ve decided to include a leaderboard so you can see what potential the 2 Hour Trading System has)

The following is based on entry alerts.

Feb 16 - SMCI 1000p Entry $11 - High after $195 ($1100 → $19500 potential)

Feb 15 - TSLA 195c. Entry $1.20 - High after 5.95 ($1200 → $5950 potential)

Feb 14 - NVDA 720p. Entry $4.5 - High after $12 ($4500 → $12000 potential)

Feb 13 - SPX 4955p. Entry $5 - High after $34 ($5000 → $34000 potential)

Feb 12 - ARM 180c. Entry $1.20 - High after $14.10 ($1200 → $14000 potential)

Feb08 - ARM 100c. Entry $5 - High after $27.50. ($5000 → $27500 potential)

Feb07 - TSLA 185c. Entry $2.53 - Hight after $5.60 ($2530 —> $5600 potential)

Feb05 - SPX 4940c. Entry $3 - High after $16.60 ($3000 → $16,600 potential)

Feb02 - AMD 180c. Entry 0.15 - High after $1 ($1500 —> $10000 potential)

Jan 29 - SPX 4910c. Entry $1 - High after $20 ($1000 —> $20000 potential)

Jan 26 - NFLX 570c. Entry $0.50 - High after $9.85 ($500 → $9850 potential)

Jan 25 - TSLA 185p. Entry $1.5 - High after $6.3 ($1500 → $6300 potential)

Jan 24 - SPX 4890p Entry $1.50 - High after $22 ($1500 → $22000 potential)

Jan 24 - SPX 4880p Entry $0.50 - High after $12 ($500 → $6000 potential)

Jan 17 - SPX 4740c Entry $0.20 - High after $2.80 ($200→ $2800 potential)

Jan 17 - SPX 4740c Entry $1.20 - High after $12 ($1200→ $12000 potential)

**Past Performance is not indicative of future results

Friday’s Price Action (Education)

You don't try to make $100,000 ...You don’t start by saying, I’m going to make the biggest most profitable trade and turn $1000 into $100,000 and fix all my bad trades before.

You say, I’m going to plan and execute 1 trade as perfectly as I can today. You do that every single day, and soon you'll have a $100,000 and likely much more!

SMCI

So let’s talk about the move and price action that aligned to be what I refer to as a 4 times a year event. A situation that creates a 'probable” 50-100x event. You are probably wondering how did I suddenly choose Friday to be the day to short SMCI?

Many years ago I started off learning how to trade penny stocks and shorting parabolic moves. I was great at spotting peak euphoria but stopped because it became difficult to get shares to short and I wasn’t a fan of the pump and dump crowd. I first looked at SMCI at 600 and my friends kept wanting to short and I said its not ready. Last week it suddenly ripped to 900s. Now I’m getting interested because of all the gap ups. I actually tried a short on Thursday, because it had a big exhaustive move and I lost $3/contract. It’s ok. Now I’m getting excited because I’ll catch the next pop and make $50-150/contract.

Thursday’s SMCI price action

Notice all the heavy red candles, that is someone dumping into the bidders. That reveals there are sellers.

I also saw tweets last week where people are declaring they are putting their entire life saving into NVDA and SMCI. That is the start of Euphoria and over excitement. Long term they are probably going to be fine, but i the short term big money is up 3-5x in a month. It’s a no brainer to take profit.

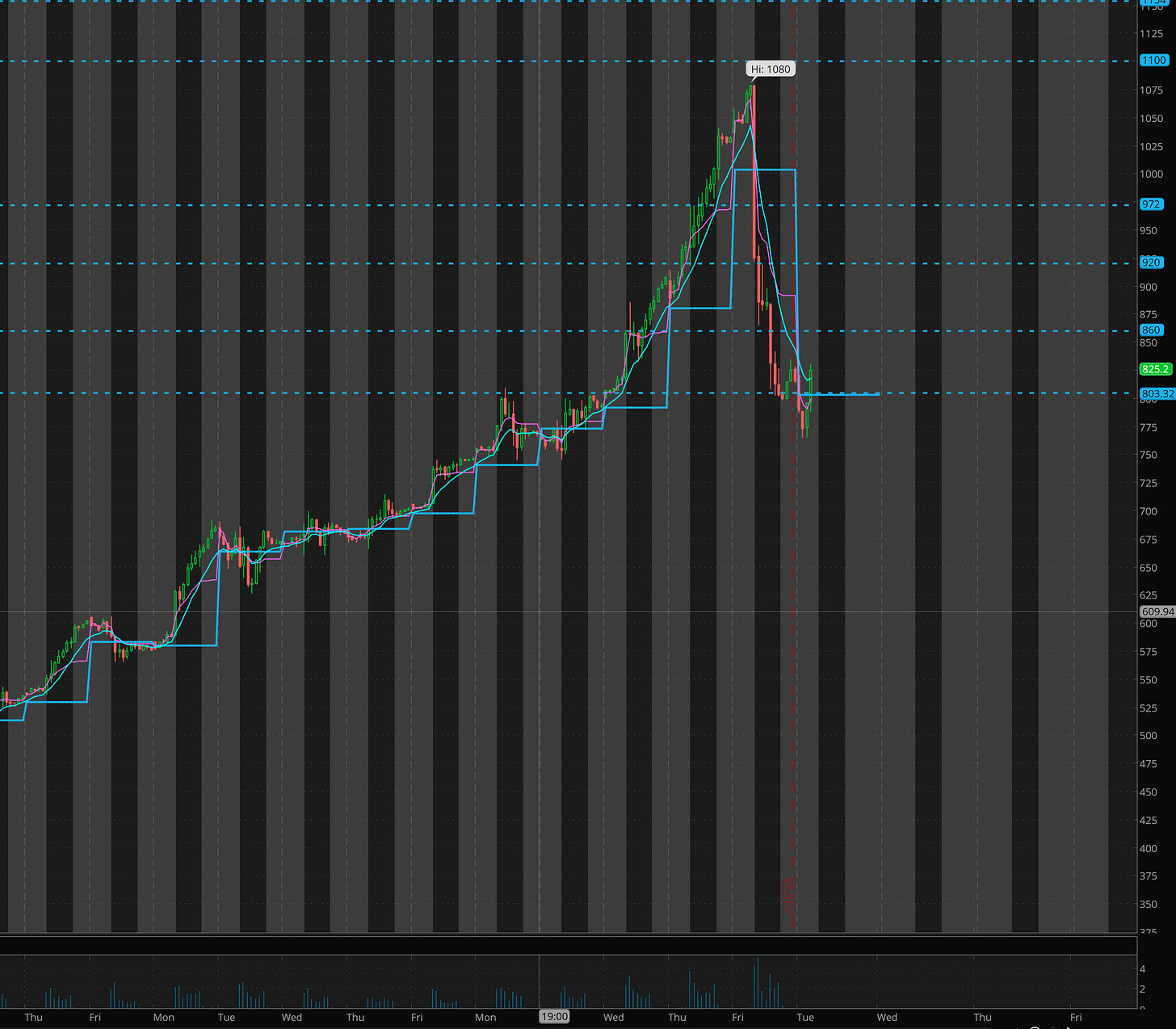

SMCI hourly chart

So on Friday above are the levels I had. We got a big gap.

I actually had expected market makers to squeeze everyone who started short at the open into 1154. That is where I wanted to load up and then target 4 levels down as my Gift from the Universe play. This would have been 860. Instead we got a double top push into 1080 and a failed breakout followed by a close under vwap. I was being hard headed wanting 1100+ for the short entry but that is when muscle memory kicked in and said I’m suppose to go short here. I then alerted taking 1000p at $11 (I was was trying to fill for $1 so it was the contract I already had up). If I followed the procedure I wrote up I would have taken 930c but I was distracted with helping a member sign up and wasn’t properly prepared. (I thought I had another hour before the short would begin).

Anyways, given the 1080 top, count 4 levels down and that is how I got my 805 target for the day. Why 4 levels and not 2? Because 920 broke hard and fast is it should I wanted that to be retested for load up short to take us to that 805 target.

If you missed the first opportunity, many times, on this exhaustion type of move, there is a second drop and great money to be made there too. I was trying to get the 900p for $1 but SMCI couldn’t get even get over 900. So then I switched focus to SMCI 850p for $1 and started in at $3 and also took some 800p for 0.50 since I knew that would likely get juiced on a drop.

On the round 2 move SMCI 850 got to 44+ and 800p got to 8+, oh and those 1000p they got to $195. I got 2 10x trades and 1 16x.

What about the 50 and 100x trades? Well this is where I screwed up and didn’t follow the procedure I spelled out in Friday’s blog. I should have been in 930p (150pt below the peak)

If I had… those went from $1 to $70 on the first drop and to $120 on the second drop.

Lessons Learned:

Make sure you add the contracts to your watchlist before market opens (every time)

Don’t be overly confident on timing (after 10:30 for selling to begin vs 09:45)

Don’t let anything distract you on days you predict 50 to 100x plays.

Scale in vs trying to go full size at cheapest price

Member kills it

Congrats to Boro for getting 56x!!!!

What next for SMCI? I’ll cover that in the paid section of the newsletter.

SPY

PPI flushed SPY in premarket and it tried to recover but it failed at 502.6 and flushed end of day. With the break of 500 again and specifically 499.50, I’m now in the bear camp. The bulls needed to hold 500.50 to keep the accelerated grind going.

With 2 hot inflation numbers and selling reactions, I’ll be watching pops now to get short unless 500.50/501 is reclaimed.

Summary Review of Market Price Action

Overall Friday was amazing. I could have had my first $1m trade day, but that will just have to happen another day.

Fear and Greed index is at 71 (so we have dropped a from Extreme Greed to Greed) and likely get a dip into neutral in coming weeks if not lower.

Overall imho the market is show signs of exhaustion and that the bears could take control for a corrective move.

Educational Lessons

From the price action review you should have learned the following:

Use the levels to plan targets

I still get things wrong and its OK

Review your trades and define what to do better next time.

Get PISSED! I’m pissed I got multiple 10 baggers and not the 100 bagger.

Simulate going through the day again and doing things differently

In my particular case it was choosing a different contract and scaling in

I wont miss the next one!

Don’t give up if you missed the first leg, start planning for the second leg!

Trade Ideas - Plan for Tuesday Feb 20

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Market is gapping down. The primary stocks I’m watching: SMCI, SPY, TSLA

Practice extra patience because of gap down and wait for the pops to get short.

Read on for my thoughts/plan.